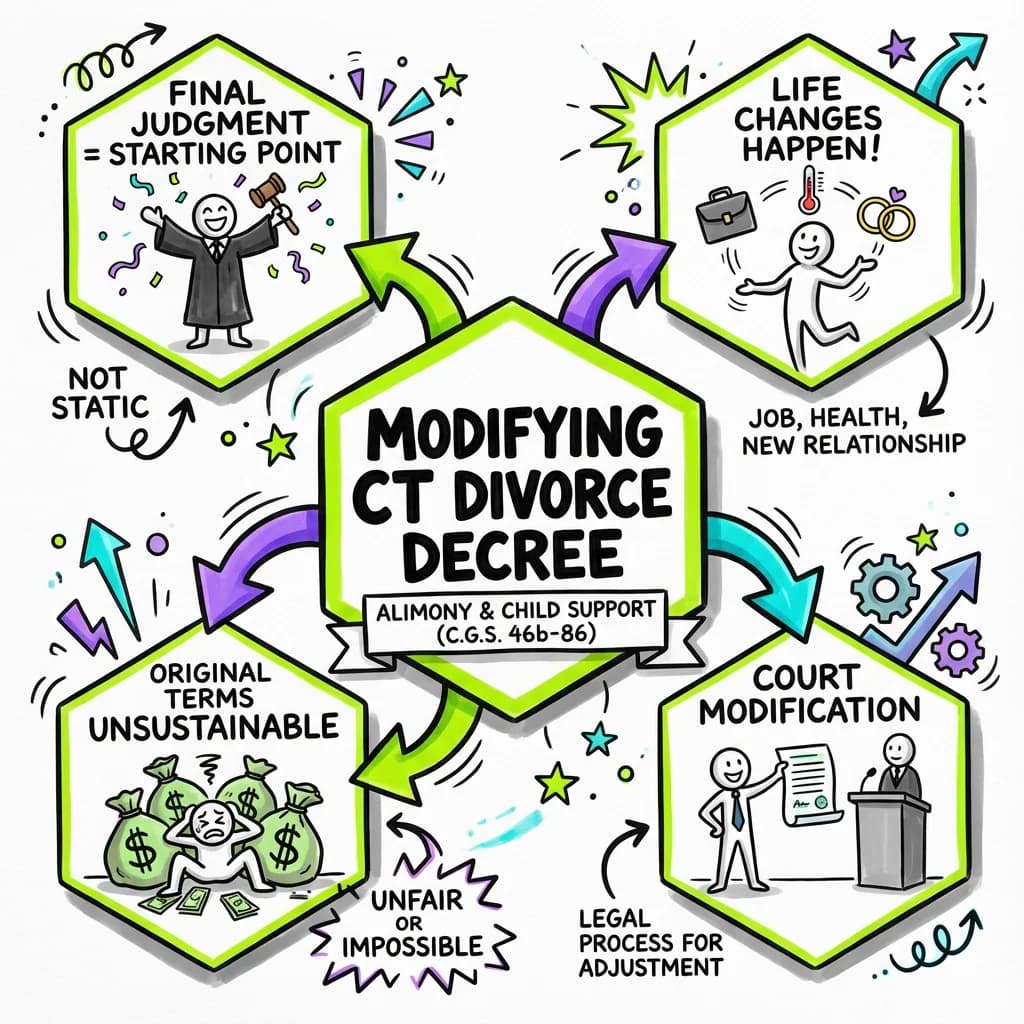

Modifying a Connecticut Divorce Decree: Alimony and Child Support (C.G.S. 46b-86)

Guide to modifying Connecticut divorce decrees under C.G.S. 46b-86. Learn the 'substantial change in circumstances' standard for alimony and child support modifications.

Need help with your divorce? We can help you untangle everything.

Get Started Today

Your divorce is final. The judge has signed the decree, and you have a set of court orders governing your new reality. For many, this final judgment feels like the end of a long and difficult journey. But life is not static. In the months and years that follow, circumstances can—and often do—change dramatically. A promotion, a job loss, a serious illness, or a new relationship can make the original terms of your divorce decree for alimony or child support unsustainable or unfair.

Fortunately, Connecticut law recognizes that life moves on. The final orders in your divorce are not necessarily set in stone. Under a specific legal framework, you can ask the court to change, or "modify," these orders. This process is known as a post-judgment modification.

This comprehensive guide will walk you through the legal landscape of modifying alimony and child support in Connecticut. We will delve into the cornerstone of all modifications—the "substantial change in circumstances" standard—and explore the specific rules that apply to each type of support. By the end of this article, you will understand:

- The legal authority for modification under Connecticut General Statutes (C.G.S.) § 46b-86.

- What qualifies as a "substantial change in circumstances."

- The specific process and requirements to modify child support in CT.

- How and when you can terminate alimony in Connecticut, including the detailed rules of the CT alimony cohabitation law.

- The critical steps, evidence, and potential pitfalls involved in filing a Motion for Modification.

The Foundation of Modification: Understanding C.G.S. § 46b-86

The ability to modify a divorce decree is not automatic. You cannot simply go back to court because you dislike the original agreement. The entire legal basis for post-judgment modification of financial orders in Connecticut is found in C.G.S. § 46b-86, "Modification of alimony or support orders and judgments."

This statute sets the fundamental rule: unless the original divorce decree explicitly states that alimony is non-modifiable, the court can alter orders for both alimony and child support upon a showing of a "substantial change in the circumstances of either party."

What is a "Substantial Change in Circumstances" in CT?

This legal phrase is the key that unlocks the door to modification. It is a high bar to meet, and the court will not approve a modification for minor, temporary, or expected life changes. To be considered "substantial," a change must meet two primary criteria:

- It must be significant. The change must have a real and meaningful impact on a party's financial situation or the needs of the child. A 5% dip in overtime pay for one month is likely not substantial; being laid off from a long-term job is.

- It must have been unanticipated. The change could not have been reasonably foreseen or contemplated by the parties at the time the original order was entered. For example, if you knew you were taking a lower-paying job six months after the divorce, that change was anticipated and likely won't be grounds for a modification. However, an unexpected corporate downsizing is a classic example of an unanticipated change.

Examples of what MAY qualify as a substantial change:

- Involuntary loss of employment or a significant, long-term reduction in income.

- A significant and durable increase in the income of either party.

- A serious and costly long-term illness or disability affecting either the parent or the child.

- A change in the child's primary residence or a significant shift in the parenting schedule.

- The recipient of alimony begins cohabitating with a new partner, altering their financial needs (more on this below).

- A parent's retirement, provided it occurs at a reasonable age and was not used as a strategy to avoid support obligations.

Examples of what likely does NOT qualify:

- A minor, temporary fluctuation in income.

- Increased personal expenses due to a voluntary lifestyle change (e.g., buying a more expensive car).

- A change that was already known and accounted for in the original divorce decree.

- Remarriage of the person paying alimony (the payor). While their expenses may increase, their obligation to their former spouse remains.

The burden of proof is on the person filing the motion (the "movant") to demonstrate to the court that this substantial, unanticipated change has occurred.

How to Modify Child Support in CT

Child support orders are almost always modifiable in Connecticut. The state's primary concern is the well-being of the child, and the court retains the authority to ensure support orders reflect the parents' current financial ability and the child's needs.

Common Reasons for Modifying Child Support

The "substantial change in circumstances" standard applies, but it often manifests in specific ways related to children and parental income.

- Change in Income: This is the most common reason. If one parent loses their job, gets a major promotion, or changes careers, it directly impacts the calculation under the Connecticut Child Support and Arrearage Guidelines.

- Change in Parenting Time: If the parenting plan changes significantly—for instance, a child who once lived primarily with Parent A now spends 50% of their time with Parent B—the child support calculation will likely need to be adjusted.

- Change in the Child's Needs: A child developing a chronic medical condition that requires expensive treatment or needing specialized educational support can be a basis for modification.

- Emancipation of a Child: When one of multiple children turns 18 (or 19 if still in high school) and is no longer eligible for support, the overall child support order for the remaining minor children must be recalculated.

The 15% Rule: A Presumptive Substantial Change

Connecticut law provides a helpful shortcut for parents seeking to modify child support in CT. C.G.S. § 46b-86(a) contains a special provision that creates a "rebuttable presumption" of a substantial change in circumstances.

Here's how it works: If you apply the current incomes of both parents to the Connecticut Child Support Guidelines worksheet, and the resulting support amount is at least 15% higher or 15% lower than the existing court order, the law presumes a substantial change has occurred.

This does not guarantee a modification, as the other party can present evidence to "rebut" the presumption. However, it provides a clear, mathematical benchmark that strongly supports the request to modify.

Example:

- Tom pays Sarah $200 per week in child support based on their incomes at the time of divorce.

- Two years later, Tom is laid off and finds a new job paying significantly less. Sarah has received a promotion.

- They run their new numbers through the official Child Support Worksheet, and the new recommended support amount is $150 per week.

- The difference is $50, which is a 25% reduction from the original $200 order. Because this is more than 15%, Tom has a presumptive basis for filing a Motion for Modification.

The Modification Process for Child Support

- File a Motion for Modification (Form JD-FM-174): This official court form is used to formally request that the court change the existing order. You will state the date of the original order and explain the substantial change in circumstances that has occurred.

- Obtain a Hearing Date: The court clerk will assign a date for you to appear before a judge or family support magistrate.

- Serve the Other Party: You must provide official legal notice to your ex-spouse. This is typically done by having a State Marshal serve them with a copy of the motion and the notice of the hearing date. This step is crucial.

- File Updated Financial Affidavits: Both parties will be required to complete and file a new Financial Affidavit (Form JD-FM-6-SHORT or JD-FM-6-LONG). This document is the single most important piece of evidence in a financial modification case. It provides the court with a complete and current snapshot of your income, expenses, assets, and debts.

- Attend the Court Hearing: At the hearing, you will present your case to the judge. You must be prepared to explain the change in circumstances and support your claims with evidence, such as termination letters, pay stubs, tax returns, and your new Financial Affidavit. The judge will listen to both sides and make a decision.

Critical Point: Retroactivity

A common and costly mistake is waiting too long to file for a modification. In Connecticut, a modification of child support (or alimony) is generally only retroactive to the date of service—the day the State Marshal officially hands the motion papers to the other party.

If you lose your job in January but don't file your motion until June, the court can only modify your support obligation back to June. You would still be legally responsible for the full, higher support amount from January through May, and those arrears would not be erased. Time is of the essence.

Modifying or Terminating Alimony in Connecticut

Modifying alimony can be more complex than modifying child support. The first and most important step is to carefully read your original Divorce Decree or Separation Agreement.

Is Your Alimony Order Modifiable?

Unlike child support, parties can agree to make alimony non-modifiable. If your decree contains clear and unambiguous language such as, "The term and amount of alimony shall be non-modifiable by either party," the court loses its jurisdiction to change it. In this case, even a catastrophic job loss or illness will not allow the court to alter the alimony order.

If the decree is silent on the issue of modifiability or explicitly states that it is modifiable, then C.G.S. § 46b-86 applies, and you can seek a modification based on a substantial change in circumstances.

Grounds for Modifying Modifiable Alimony

The same "substantial change" standard applies. Common reasons to modify alimony include:

- A significant, involuntary decrease in the paying spouse's income.

- A significant increase in the recipient spouse's income or earning capacity.

- The retirement of the paying spouse at a customary retirement age.

- A serious health crisis impacting either party's ability to work or support themselves.

The Special Case: The CT Alimony Cohabitation Law

One of the most frequently asked questions involves how a new partner impacts alimony. If your ex-spouse is living with someone new, does that automatically terminate alimony in Connecticut?

The answer is no, but it may be grounds for a modification. This scenario is governed by a specific part of the statute, C.G.S. § 46b-86(b). This is often referred to as the CT alimony cohabitation law.

The law states that a court may suspend, reduce, or terminate alimony if the recipient is cohabitating—living with another person. However, simply living together is not enough. The person filing the motion must prove that the cohabitation has caused a "change of circumstances so as to alter the financial needs of that party."

In plain English, you must show that your ex-spouse's new living arrangement has reduced their financial needs because the new partner is contributing to their support.

The Financial Impact Test:

The court will look for evidence of financial entanglement. The key question is: Is the alimony recipient's financial situation better because of their new partner?

- Evidence for Modification: The new partner pays for half the rent/mortgage, covers the utility bills, buys the groceries, or pays for vacations. These contributions directly reduce the recipient's expenses, meaning they have less "need" for the same level of alimony.

- Evidence Against Modification: The recipient and their new partner live as mere roommates. They keep their finances completely separate, each pays their own precise share of the bills, and there is no commingling of funds or financial support. In this scenario, a court may find that the recipient's financial needs have not been altered, and a modification may be denied.

Proving this can be challenging and may require formal discovery, such as requesting bank statements or lease agreements, to demonstrate the financial benefit the recipient is receiving.

How to Terminate Alimony in Connecticut

Alimony does not always last forever. It can be terminated in several ways:

- By the Terms of the Decree: Most alimony awards are for a specific duration (e.g., five years). Alimony automatically terminates when the term expires.

- Remarriage of the Recipient: By law, the obligation to pay alimony automatically terminates upon the remarriage of the person receiving it. The paying spouse should file a Motion for Modification to get a court order officially stopping the payments.

- Death of Either Party: The alimony obligation automatically ends if either the payor or the recipient dies.

- By Motion: A party can file a Motion for Modification asking the court to terminate alimony based on a substantial change in circumstances, such as the recipient winning the lottery or the payor becoming permanently disabled and unable to work. A successful motion based on cohabitation can also result in termination.

The Modification Process in Practice: Pitfalls and Best Practices

Whether for child support or alimony, the formal process is key. Informal, "handshake" agreements are a recipe for disaster.

Common Mistakes to Avoid

- Relying on Informal Agreements: You and your ex may agree to a temporary reduction in support. If this agreement is not approved by the court and entered as an official order, it is not legally enforceable. The original order remains in full effect, and you will continue to accrue arrears on the original amount. Always get any changes in writing and approved by a judge.

- Waiting Too Long to File: As mentioned, the retroactivity rule is unforgiving. The moment a substantial change occurs (like a job loss), you should immediately begin the process of filing a motion. Every day you wait is a day you may be overpaying (or being underpaid) with no legal recourse to fix it.

- Filing an Inaccurate or Incomplete Financial Affidavit: The Financial Affidavit is sworn testimony. Intentionally misrepresenting your income or assets is perjury and can result in severe penalties. Even unintentional errors can damage your credibility with the judge and harm your case. Be meticulous and honest.

- Failing to Gather Evidence: You cannot simply walk into court and say, "My income went down." You need to prove it. Gather your pay stubs, termination letter, evidence of your job search, medical bills, or proof of cohabitation. A well-documented case is a strong case.

Summary and Next Steps

Navigating life after divorce requires vigilance. The financial orders that were fair on the day of your divorce may no longer be appropriate years, or even months, later. Connecticut law provides a vital safety valve through the post-judgment modification process under C.G.S. § 46b-86.

Key Takeaways:

- The Standard: Modification requires proving a "substantial change in circumstances" that was not anticipated at the time of the divorce.

- Child Support: Is almost always modifiable. A 15% or greater change in the Guideline calculation creates a presumption for modification.

- Alimony: Is only modifiable if your decree does not explicitly forbid it.

- Cohabitation: Can be grounds to reduce or terminate alimony, but only if you can prove the new living arrangement has lessened your ex-spouse's financial needs.

- Process is Everything: You must file a formal Motion for Modification. Informal agreements are not enforceable, and modifications are only retroactive to the date of service.

If your circumstances have changed and you believe your court orders need to be updated, your first steps should be to:

- Review Your Divorce Decree: Understand exactly what your current orders are and check if your alimony is modifiable.

- Gather Financial Documents: Collect pay stubs, tax returns, and any other evidence that supports your claim of a substantial change.

- Act Promptly: Do not delay. The sooner you file, the sooner a new, fair order can be put in place.

The process of modifying a court order can feel just as daunting as the original divorce. But with a clear understanding of the law and a strategic approach, you can ensure your legal obligations reflect your current reality.

Legal Citations

- • C.G.S. § 46b-56 (Orders re Custody and Support of Children) View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source

- • C.G.S. § 46b-82 (Alimony) View Source

- • C.G.S. § 46b-86 (Modification of Alimony or Support Orders) View Source

Related Articles

How Is Property Divided in a Connecticut Divorce? Understanding C.G.S. 46b-81

Learn more about how is property divided in a connecticut divorce? understanding c.g.s. 46b-81

Calculating Alimony in Connecticut: A Guide to the Factors in C.G.S. 46b-82

Learn more about calculating alimony in connecticut: a guide to the factors in c.g.s. 46b-82

The 17 'Best Interests of the Child' Factors in Connecticut Custody Cases (C.G.S. 46b-56)

Learn more about the 17 'best interests of the child' factors in connecticut custody cases (c.g.s. 46b-56)