How Is Property Divided in a Connecticut Divorce? Understanding C.G.S. 46b-81

A comprehensive guide to Connecticut's property division laws under C.G.S. 46b-81. Explains the 12 factors courts consider when dividing marital assets, debts, and property in divorce cases.

Need help with your divorce? We can help you untangle everything.

Get Started Today

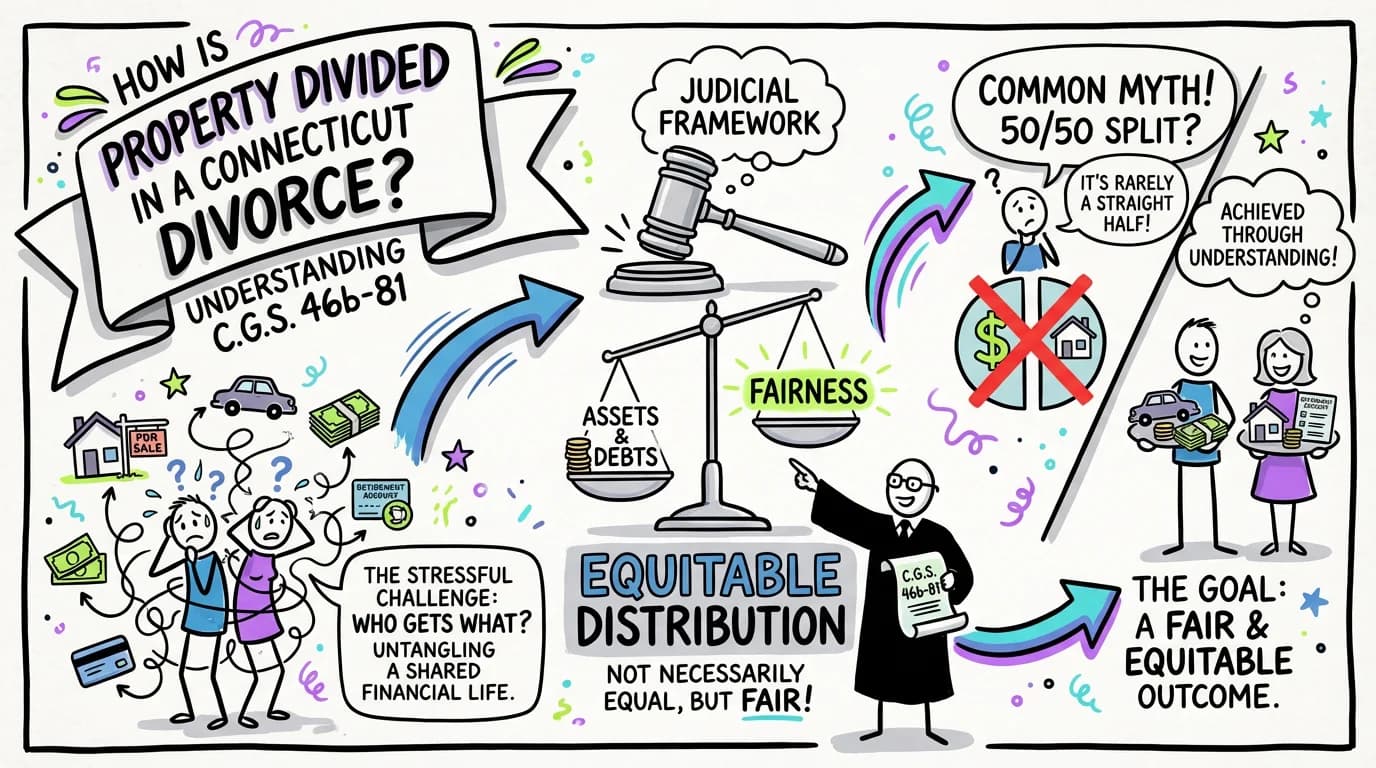

For anyone facing a divorce in Connecticut, the question of "who gets what" is often the most stressful and contentious part of the process. You've spent years, perhaps decades, building a life together, acquiring assets, and taking on debts. Untangling this shared financial life can feel overwhelming. The key to navigating this challenge is to understand the legal framework that Connecticut judges use: equitable distribution.

Many people mistakenly believe that all property will be split 50/50. This is not the case in Connecticut. Instead, the law provides a detailed roadmap for judges to achieve a fair division, which may or may not be an equal one. That roadmap is found in Connecticut General Statutes (C.G.S.) § 46b-81.

This comprehensive article will provide a deep dive into how property division works in a Connecticut divorce. We will move beyond the basics to give you a clear, authoritative understanding of the law. You will learn:

- The crucial difference between "equitable distribution" and "equal division."

- Why Connecticut's "all-property" rule is so important and what it means for your assets.

- A detailed, factor-by-factor breakdown of the 12 criteria in C.G.S. § 46b-81 that judges must consider.

- Practical examples of how these factors are applied in real-world scenarios.

- Actionable steps you can take to prepare for property division and protect your financial future.

By the end of this guide, you will have the knowledge to set realistic expectations, gather the right evidence, and engage more effectively in settlement negotiations or, if necessary, trial.

The Foundation: What is "Equitable Distribution" in Connecticut?

Connecticut is an equitable distribution state. This is the single most important concept to grasp when considering CT divorce property division.

- Equitable Does Not Mean Equal: The goal of the court is not to cut every asset down the middle. "Equitable" means what the court determines is fair and just under the specific circumstances of your marriage. A 60/40, 70/30, or even a different split is possible if the facts of the case warrant it. The judge has broad discretion to craft an outcome they believe is fair.

- It is Not a Community Property State: Some states, like California and Texas, are "community property" states. In those states, assets acquired during the marriage are generally considered owned 50/50 by both spouses and are divided equally. Connecticut law is fundamentally different. The focus is on fairness, not a rigid mathematical formula.

The entire process of equitable distribution is guided by the factors laid out in a single, powerful statute: C.G.S. § 46b-81. A judge cannot simply invent their own rules; they are legally required to consider each of the statutory factors when making their decision.

What Property is on the Table? Connecticut's Broad "All-Property" Rule

Before a judge can divide property, they must first determine what property is subject to division. Here, Connecticut has one of the broadest definitions in the country. It is considered an "all-property" state.

This means that the "marital pot" available for division includes virtually everything owned by either or both spouses at the time of the divorce, regardless of how or when it was acquired.

This includes:

- Property acquired before the marriage (pre-marital assets).

- Property acquired during the marriage through joint efforts.

- Property acquired during the marriage by one spouse alone, such as an inheritance or a gift from a third party.

This is a critical point that often surprises people. An inheritance you received from your grandmother or a home you owned for ten years before you got married is not automatically protected. While the court will certainly consider the source of these assets (as we'll see in the factors below), they are still legally on the table for division.

The marital estate that a judge can divide includes both assets and liabilities:

Common Assets:

- Real estate (the marital home, vacation properties, rental properties)

- Bank accounts (checking, savings, money market)

- Retirement accounts (401(k)s, 403(b)s, IRAs, pensions)

- Investments (stocks, bonds, mutual funds)

- Business interests (ownership in an LLC, S-Corp, or partnership)

- Vehicles, boats, and other valuable personal property

- Life insurance cash value

- Stock options and deferred compensation

Common Liabilities:

- Mortgages and home equity lines of credit

- Credit card debt

- Student loans

- Car loans

- Personal loans

The first step in any divorce is to create a complete and honest inventory of all these assets and debts. This is done on the official Financial Affidavit (Form JD-FM-6), a sworn statement that forms the financial foundation of your case.

The Judge's Playbook: A Detailed Breakdown of the C.G.S. § 46b-81 Factors

Now we arrive at the heart of the matter. When deciding how assets are divided in a CT divorce, a judge must weigh and balance the following 12 factors. No single factor is more important than another; their significance depends entirely on the unique facts of your case.

1. The Length of the Marriage

- What it means: The duration of the marriage, measured from the wedding date to the date of dissolution.

- How it's applied: This is a foundational factor. In a very short-term marriage (e.g., 2 years), a judge is more likely to try and "unwind" the finances, returning each party to their pre-marital financial position, especially if there are no children. In a long-term marriage (e.g., 25 years), the court is more likely to view the parties as a true economic partnership and divide the assets more evenly, regardless of who earned the money or whose name is on the title.

- Example: A spouse who brought a significant pre-marital investment account into a 3-year marriage is more likely to retain the bulk of that asset than a spouse who did the same in a 30-year marriage where the other spouse relied on that asset's existence for their shared financial security.

2. The Causes for the Dissolution

- What it means: The reasons the marriage broke down. This is where "fault" can enter the property division equation.

- How it's applied: While Connecticut is a "no-fault" state for the purpose of granting a divorce, fault can absolutely impact the financial outcome. If one spouse's behavior (like adultery, substance abuse, or domestic violence) led to the breakdown and harmed the marital finances, the court can assign them a smaller share of the assets. The key is often the financial impact.

- Example: If a spouse had an affair and spent $100,000 of marital savings on gifts, trips, and an apartment for their affair partner, a judge could award the innocent spouse an additional $100,000 from the remaining assets to compensate for this "dissipation of assets."

3. The Age of the Parties

- What it means: The chronological age of each spouse.

- How it's applied: Age is often considered in conjunction with health and employability. A younger couple in their 30s has a long time horizon to rebuild financially after a divorce. A couple divorcing in their late 50s or 60s has a much shorter runway to retirement. The court will be more protective of the assets allocated to an older spouse who has less time to recover from a financial setback.

- Example: A 62-year-old spouse who is nearing retirement may be awarded a larger share of the liquid assets or retirement funds to ensure their security, while the 63-year-old spouse with a stable, high-paying job may receive a smaller share of those specific assets.

4. The Health of the Parties

- What it means: The physical and mental health of each spouse.

- How it's applied: A serious health condition can significantly impact a person's ability to work, their income-earning potential, and their future medical expenses. A judge will consider these needs when dividing property.

- Example: If one spouse has a chronic illness that requires expensive ongoing medical care and limits their ability to work full-time, the court may award them a larger portion of the marital assets, or perhaps the marital home, to provide stability and help cover future needs.

5. The Station of the Parties

- What it means: The lifestyle, social standing, and economic status the couple enjoyed during the marriage.

- How it's applied: The court aims to prevent a drastic, unfair drop in the standard of living for one spouse, especially after a long marriage. This factor is closely tied to the division of assets and the award of alimony. The goal is not to guarantee the same lifestyle forever, but to allow for a reasonable transition.

- Example: In a high-net-worth divorce where the couple enjoyed a lavish lifestyle, the court will divide assets in a way that allows both parties to maintain a reasonably comfortable, albeit separate, life, rather than leaving one spouse in luxury and the other in poverty.

6. The Occupation of the Parties

- What it means: Each spouse's profession or line of work.

- How it's applied: This factor looks at the stability and nature of each person's job. A tenured professor has a very different occupational outlook than a freelance artist or a construction worker whose income is seasonal. The court considers the security and demands of each occupation.

- Example: A spouse with a secure government job with a guaranteed pension may receive a smaller share of the 401(k) assets, while the other spouse, a self-employed consultant with a fluctuating income, might be awarded a larger share of the liquid investment accounts to provide a buffer during lean months.

7. The Amount and Sources of Income

- What it means: How much money each spouse earns and where it comes from (salary, bonuses, commissions, investment income, etc.).

- How it's applied: This is a straightforward but critical factor. A significant disparity in income will heavily influence the division. The court will look to balance this disparity through the property award and/or alimony.

- Example: If Spouse A earns $300,000 per year and Spouse B earns $50,000 per year, the court is highly likely to award Spouse B a greater than 50% share of the marital assets to help close that economic gap.

8. The Vocational Skills of the Parties

- What it means: Each spouse's education, training, and marketable job skills.

- How it's applied: This factor assesses a spouse's ability to support themselves. A spouse with an advanced degree and a current professional license is in a very different position than a spouse who has been out of the workforce for 20 years to raise children and has no recent job training.

- Example: A 45-year-old spouse who left a nursing career to be a stay-at-home parent may be awarded assets specifically to pay for retraining and recertification courses to re-enter the workforce, in addition to a larger share of the overall estate.

9. The Employability of the Parties

- What it means: The realistic ability of each spouse to find and maintain a job. This is related to skills but also includes factors like age, health, and the current job market.

- How it's applied: This is a forward-looking assessment. A spouse may have excellent vocational skills on paper, but if they are also 60 years old and in poor health, their actual employability is low. The court considers the practical reality of their job prospects.

- Example: A spouse who is the primary caregiver for a child with special needs may have limited employability due to the demands of that care. The court would likely award this spouse a greater share of the assets to compensate for their reduced ability to earn income.

10. The Estate, Liabilities, and Needs of Each of the Parties

- What it means: A holistic look at each person's complete financial picture—what they will own, what they will owe, and what they will need to live after the divorce.

- How it's applied: This is a catch-all factor that allows the judge to consider the net effect of the entire financial settlement. The court looks at the proposed division of assets and debts and asks, "Is this a viable financial future for each person?" It considers needs like housing, transportation, and daily living expenses.

- Example: The court might award the marital home to the custodial parent not just because of the children, but because their "need" for stable housing is greater, and the other spouse has sufficient income to secure new housing easily. The associated mortgage (liability) would also be assigned accordingly.

11. The Opportunity of Each for Future Acquisition of Capital Assets and Income

- What it means: Each spouse's future potential to earn money and acquire assets.

- How it's applied: This is perhaps the most forward-looking factor. The court considers things like expected inheritances, career trajectory, and investment potential.

- Example: A 40-year-old spouse who is a partner at a law firm has a very high opportunity for future acquisition of income and assets. Their 40-year-old spouse who is a public school teacher has a much more modest and fixed future potential. The court will use the current property division to balance this future disparity, likely awarding the teacher a larger share of the current assets.

12. The Contribution of Each of the Parties in the Acquisition, Preservation or Appreciation in Value of Their Respective Estates

- What it means: This acknowledges all contributions to the marriage, both financial and non-financial.

- How it's applied: This is a crucial factor for stay-at-home parents or spouses who supported their partner's career. Connecticut law explicitly recognizes that managing a household, raising children, and supporting a spouse's career are valuable contributions to the acquisition of marital property. It also considers negative contributions, like gambling away assets.

- Example: A husband is the CEO of a company. The wife left her job to raise their three children, manage the home, and host business-related social events. The court will view her non-monetary contributions as essential to the husband's ability to build his career and acquire the assets. Her contribution will be weighed heavily, and she will be entitled to a significant share of the estate she helped build, even if her name is not on the accounts.

It's a Balancing Act: How Judges Weigh the Factors

Understanding the 12 individual CGS 46b-81 factors is only half the battle. The true art and challenge of equitable distribution in Connecticut lie in how a judge balances them.

There is no mathematical formula. A judge will not create a scorecard and give points for each factor. Instead, they will listen to the testimony, review the evidence (like financial affidavits, appraisals, and bank statements), and craft a narrative of the marriage. They use their discretion to weigh which factors are most relevant and compelling in your specific case.

For instance, in a short-term marriage between two high-earning young professionals, the "length of marriage" (Factor 1) and "contribution" (Factor 12) might be the most important, leading to a division that largely restores their pre-marital finances. In a long-term, single-income marriage where one spouse is in poor health, the "length of marriage" (Factor 1), "health" (Factor 4), "income" (Factor 7), and "opportunity for future acquisition" (Factor 11) will likely dominate, leading to a division that heavily favors the non-working, unhealthy spouse.

Preparing for Property Division: Actionable Steps and Mistakes to Avoid

Knowledge of the law is power. You can use your understanding of these factors to prepare effectively for your settlement negotiations or trial.

Actionable Steps:

- Gather All Financial Documents: Start immediately. Collect at least three years of bank statements, investment account statements, credit card bills, tax returns, pay stubs, and mortgage statements. This is the raw data for your Financial Affidavit.

- Create a Comprehensive Inventory: Make a spreadsheet listing every single asset and debt you and your spouse have, regardless of whose name it's in. Include account numbers, current balances, and any relevant notes.

- Get Professional Appraisals: Do not guess the value of significant assets. Hire qualified professionals to appraise the marital home, any business interests, pensions, or valuable collections. A formal appraisal carries much more weight in court than a Zillow estimate.

- Analyze Your Case Through the 12 Factors: Go through the 12 factors one by one and write down how they apply to your marriage. This exercise will help you and your attorney build your case and identify what evidence you need to support your position.

Common and Costly Mistakes to Avoid:

- Hiding Assets: This is the cardinal sin of divorce. It is illegal, and the penalties are severe. If you are caught hiding assets, a judge can award 100% of that asset to your spouse and sanction you with fines and legal fees. Full and honest disclosure is required.

- Assuming a 50/50 Split: As this article has shown, this is a myth. Basing your negotiation strategy on a guaranteed 50/50 split will lead to frustration and unrealistic expectations.

- Forgetting About Debts: The division of liabilities is just as important as the division of assets. Make sure all debts are identified and a clear plan for their payment is included in the final agreement.

- Ignoring Non-Monetary Contributions: Do not discount your contributions as a homemaker or stay-at-home parent. The law recognizes this as a vital contribution to the marital estate, and you must advocate for its value.

Navigating Your Path Forward with Clarity

Understanding how assets are divided in a CT divorce is the first step toward taking control of your financial future. The process is not arbitrary; it is guided by the principles of equitable distribution and the specific CGS 46b-81 factors. The court's goal is fairness, based on a comprehensive review of your entire marital partnership.

By recognizing that "equitable" does not mean "equal" and by preparing your case with the 12 statutory factors in mind, you can approach settlement discussions with confidence and clarity. You can gather the right documents, make persuasive arguments, and work toward a resolution that is truly fair and allows you to begin your next chapter on solid financial footing.

This process is complex, and the stakes are high. Having the right tools and support can make all the difference.

Legal Citations

- • C.G.S. § 46b-56 (Orders re Custody and Support of Children) View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source

- • C.G.S. § 46b-82 (Alimony) View Source

- • C.G.S. § 46b-86 (Modification of Alimony or Support Orders) View Source

Related Articles

Calculating Alimony in Connecticut: A Guide to the Factors in C.G.S. 46b-82

Learn more about calculating alimony in connecticut: a guide to the factors in c.g.s. 46b-82

Modifying a Connecticut Divorce Decree: Alimony and Child Support (C.G.S. 46b-86)

Learn more about modifying a connecticut divorce decree: alimony and child support (c.g.s. 46b-86)

The 17 'Best Interests of the Child' Factors in Connecticut Custody Cases (C.G.S. 46b-56)

Learn more about the 17 'best interests of the child' factors in connecticut custody cases (c.g.s. 46b-56)