Need help with your divorce? We can help you untangle everything.

Get Started Today

Overview

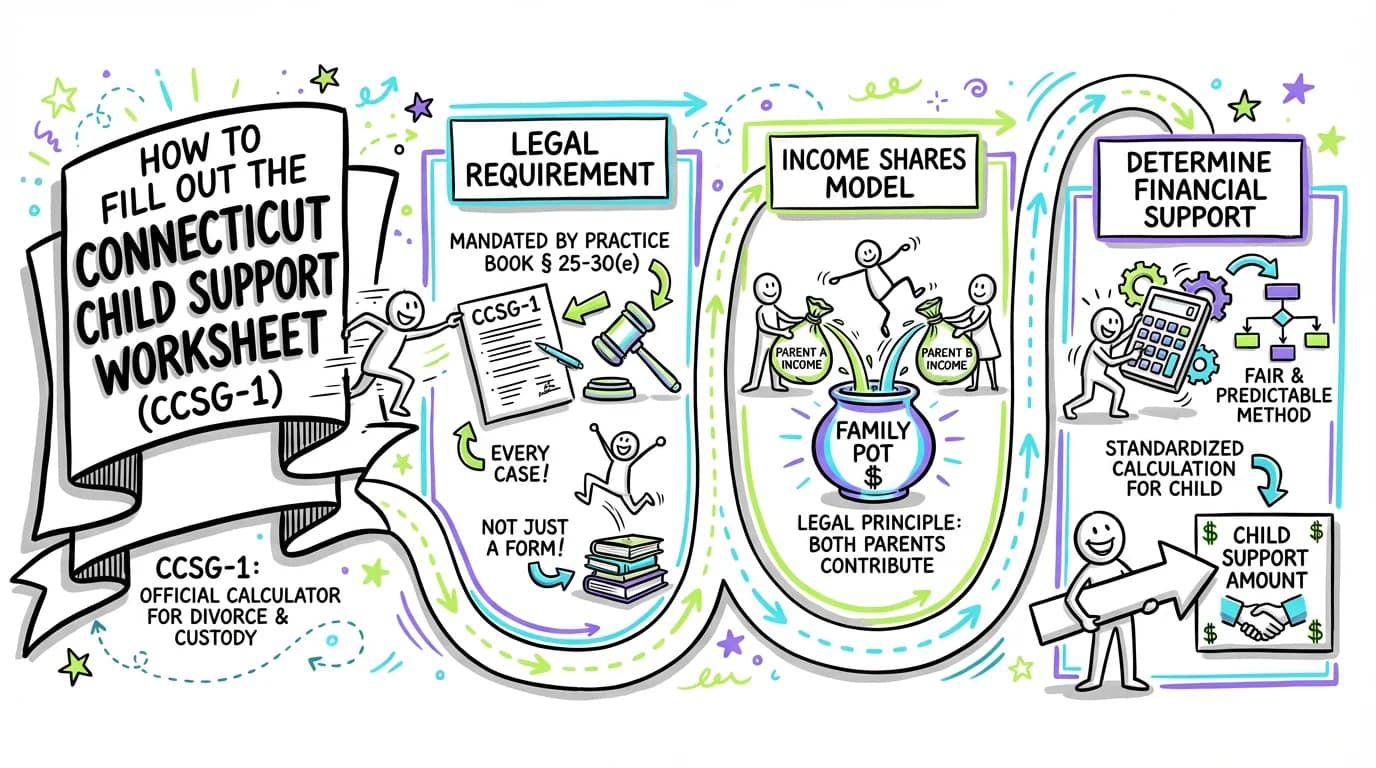

The Connecticut Child Support and Arrearage Guidelines Worksheet (Form CCSG-1) is the official calculator used in every divorce and custody case involving minor children in the state. It is not just a form; it is a legal requirement mandated by Practice Book § 25-30(e). Its purpose is to create a standardized, fair, and predictable method for determining how much financial support a child should receive from their parents.

The worksheet is based on the Income Shares Model, a legal principle outlined in the official Child Support Guidelines preamble. This model presumes that a child should receive the same proportion of parental income they would have received if the family had remained intact. In essence, the worksheet adds both parents' incomes together, determines the amount a family at that level would typically spend on their children, and then divides that obligation proportionally between the parents based on their share of the income.

Completing this form accurately is essential. The final number it produces is called the 'presumptive child support amount,' and a judge will adopt this figure unless there is a very good reason to deviate from it. This guide will walk you through every line of the worksheet, referencing the official guidelines and statutes to ensure you understand not just what to fill in, but why.

Free Calculator: If you want a free tool to calculate child support in Connecticut and automatically fill out the CCSG-1 worksheet, you can use our Connecticut Child Support Calculator.

Try our free CT child support calculator

Calculate your estimated child support using Connecticut's official guidelines formula.

Requirements

Before you can accurately complete the Child Support Worksheet, you must have the following critical documents completed by both you and your spouse:

- Completed Financial Affidavits: A sworn Financial Affidavit (either Form JD-FM-006-SHORT or JD-FM-006-LONG) for both parents. The income and deduction figures on the worksheet come directly from this document.

- Recent Pay Stubs and Tax Returns: These are needed to accurately calculate the 'gross weekly income' for each parent.

- Health Insurance Information: The cost of the health, dental, and vision insurance premiums for the children only.

- Childcare Costs: Documentation of the weekly cost of any work-related childcare.

- Parenting Plan: Your proposed parenting schedule, as this can affect the calculation, especially in shared custody situations.

Step-by-Step Instructions

Part I: Net Weekly Income Calculation

This is the engine of the worksheet. It determines each parent's net weekly income, which is the foundation for the entire calculation. All figures must be weekly amounts. Tip: You can use our free Connecticut Child Support Calculator to do these calculations automatically and generate a completed worksheet.

Line 1. Gross weekly income

Enter each parent's average gross weekly income from all sources before any taxes or deductions. This figure comes from the 'Weekly Income' section of the Financial Affidavit. It includes salary, wages, bonuses, commissions, self-employment income, etc. Per § 46b-215a-1(11) of the guidelines, this definition is very broad.

Example: Parent A: $1,500; Parent B: $1,000

Warning: For overtime, the guidelines limit income to 45 total paid hours per week unless a deviation is sought.

Lines 2-5. Income Taxes and FICA

Enter the weekly amounts for federal, state, Social Security, and Medicare taxes. These are 'allowable deductions' defined in § 46b-215a-1(1). These figures should come directly from the 'Weekly Expenses' section of the Financial Affidavit.

Warning: These are not your elective 401(k) contributions; they are mandatory taxes.

Lines 6-11. Other Allowable Deductions

Enter the weekly cost for each parent's health insurance premiums (for themselves), mandatory union dues, court-ordered life/disability insurance, and support for other children not involved in this case.

Example: If Parent A pays $50/week for their own health insurance, enter '50' on Line 6 for Parent A.

Warning: Do not include the cost of health insurance for the children in this case on Line 6; that is handled separately later.

Line 12. Deduction for qualified children

This is a complex calculation for a parent who supports other dependent children living with them. The guidelines provide a multi-step formula in § 46b-215a-2c(d) to determine this deduction. Untangle's calculator can compute this for you.

Warning: Do not simply enter the amount of support you pay for another child here. You must use the specific formula from the guidelines.

Line 14. Net weekly income

Subtract the total deductions (Line 13) from the gross income (Line 1) to find each parent's net weekly income.

Example: If Parent A's gross income is $1,500 and total deductions are $400, their net income is $1,100.

Part II: Current Support Calculation

This section uses the net incomes to find the basic child support obligation from the state's official schedule.

Line 15. Combined net weekly income

Add the net weekly incomes of Parent A (Line 14) and Parent B (Line 14) together.

Example: $1,100 (Parent A) + $700 (Parent B) = $1,800

Line 16. Basic child support obligation

Take the combined income from Line 15 and look it up on the Schedule of Basic Child Support Obligations. Find the column for the number of children in your case. The dollar amount listed is the basic obligation.

Example: For a combined income of $1,800 with two children, the schedule might show a basic obligation of $456.

Warning: Always use the most recent official schedule from the CT Judicial Branch website. This amount changes periodically.

Line 17. Each parent's percentage share of income

Divide each parent's individual net income (Line 14) by the combined net income (Line 15) to get their percentage share.

Example: Parent A: $1,100 / $1,800 = 61%. Parent B: $700 / $1,800 = 39%.

Line 20. Presumptive current support amount

This is each parent's share of the basic obligation. Multiply the basic obligation (Line 16) by each parent's percentage share (Line 17). The amount for the non-custodial parent is typically the presumptive support order.

Example: Parent A: $456 * 61% = $278. Parent B: $456 * 39% = $178.

Warning: This amount can be adjusted for Social Security dependency benefits on Line 19.

Part III & IV: Net Disposable Income & Unreimbursed Medical

These sections calculate each parent's share of additional expenses like medical and childcare costs.

Line 23. Net disposable income

This calculation adjusts each parent's net income by the presumptive child support payment to determine the money they have available for other expenses. For the custodial parent, add the support payment to their net income. For the non-custodial parent, subtract it.

Example: If Parent B is custodial: $700 (net) + $278 (support) = $978. Parent A: $1,100 (net) - $278 (support) = $822.

Line 25. Each parent's percentage share of combined net disposable income

Based on the net disposable incomes from Line 23, calculate each parent's new percentage share. This percentage is used to divide unreimbursed medical expenses and childcare costs.

Example: Parent A: $822 / ($978 + $822) = 46%. Parent B: $978 / ($978 + $822) = 54%.

Part VI & VII: Arrearage and Final Order Summary

These final sections calculate any payments for past-due support and summarize the total weekly obligation.

Line 29. Arrearage payment

If there is past-due child support, a periodic payment on that arrearage is calculated here. The general rule (§ 46b-215a-3a(b)) is 20% of the current support order (Line 30).

Example: 20% of $278 (current support) = $56 per week.

Line 33b. Unreimbursed medical expenses - each parent's share

Enter the percentages calculated on Line 25 here. This determines how out-of-pocket medical costs are split.

Example: Parent A: 46%; Parent B: 54%.

Line 34b. Child care contribution - each parent's share

Enter the same percentages from Line 25. This determines how work-related childcare costs are split.

Example: Parent A: 46%; Parent B: 54%.

Line 35. Total child support award

This line summarizes the total weekly payment owed by the non-custodial parent. It is the sum of the current support (Line 30), the arrearage payment (Line 31), and any cash medical or childcare contributions.

Part VIII: Deviation Criteria

This final section is used only if you are asking the judge to order a support amount that is different from the presumptive amount calculated by the worksheet. You must check the specific legal reason for your request.

Deviation Criteria Checklist

If your agreed-upon or requested child support amount deviates from the guidelines, you must check the box for the specific reason listed in § 46b-215a-5c. Common reasons include 'Shared physical custody' or 'Extraordinary expenses for care and maintenance of the child'.

Warning: You must provide a factual basis to the judge to justify any deviation. Simply wanting to pay less or receive more is not a valid reason.

Tips:

- Shared physical custody is the most common reason for deviation. If parents have a nearly 50/50 schedule, the court may adjust the support amount to reflect the shared expenses.

- Even if you and your spouse agree to deviate, a judge must still approve it and find that it is in the best interests of the child.

Common Mistakes to Avoid

- Using Gross Income Instead of Net Income: All primary calculations are based on net income after the specific allowable deductions. Using gross income will lead to a vastly incorrect result.

- Incorrectly Calculating Net Income: Including non-allowable deductions (like voluntary 401k contributions or car payments) when calculating net income. Only the deductions listed in § 46b-215a-1(1) are permitted.

- Forgetting Health and Childcare Costs: Failing to include the weekly costs for the child's health insurance premium and work-related childcare will result in an inaccurate and lower support order.

- Misunderstanding Shared Custody: There is no automatic formula for shared custody. It is a deviation criterion that requires a judge's specific finding. You can't just cut the support amount in half for a 50/50 schedule.

- Failing to Attach the Worksheet: The court cannot enter a child support order without a completed worksheet being filed with the court, per Practice Book § 25-30(e).

Related Forms

Financial Affidavit (Long Form)

This is the source document for all income and deduction figures used on the worksheet. It must be completed first.

Learn more about Financial Affidavit (Long Form)

Financial Affidavit (Short Form)

If you qualify, this is the source document for all income and deduction figures used on the worksheet. It must be completed first.

Learn more about Financial Affidavit (Short Form)

Custody Agreement and Parenting Plan

The parenting schedule detailed in this plan is crucial for determining whether a deviation for shared physical custody is appropriate on the worksheet.

Next Steps

After you have completed the Child Support Worksheet:

- Attach to Your Agreement: If you have an uncontested divorce, the completed worksheet must be attached to your final settlement agreement that you submit to the court.

- File Before Your Hearing: If your case is contested, you must file the completed worksheet with the court clerk at least five business days before any hearing where child support will be decided, as required by Practice Book § 25-30.

- Bring Copies to Court: Always bring multiple copies of the completed worksheet to your court hearing: one for the judge, one for your spouse's attorney, and one for yourself.

- Be Prepared to Explain: The judge may ask you questions about the numbers you used. You should be able to explain how you calculated your income and deductions based on your Financial Affidavit.

Frequently Asked Questions

What if I am self-employed or my income changes week to week?

For variable income, the guidelines require you to determine an 'average weekly' amount. This is typically done by averaging your income over a reasonable period, such as the last 13 weeks, 6 months, or even the entire previous year, to arrive at a fair representation of your earnings.

Does my spouse's new partner's income get included on the worksheet?

No. The guidelines (§ 46b-215a-1(11)(B)(vi)) explicitly exclude the income of a new spouse or domestic partner from the gross income calculation. A new partner has no legal duty to support your child.

My ex isn't paying child support. Does this worksheet help?

This worksheet is for calculating the correct support amount. If an order is already in place and your ex isn't paying, you need to file a Motion for Contempt to enforce the existing order. This worksheet would only be used if you are also asking to modify the support amount at the same time.

What if the combined income is over $4,000 per week?

The official schedule only goes up to a combined net weekly income of $4,000. For higher-income families, the guidelines state that child support is determined on a 'case-by-case basis' (§ 46b-215a-2c(a)(2)). The amount at the $4,000 level becomes the presumptive minimum, and the court will look at the specific needs of the children and the family's standard of living to determine a final amount.

Get Help with Your Connecticut Divorce

Feeling overwhelmed by the Child Support Worksheet? You're not alone. The calculations are complex, and a small mistake can have a big impact on your finances. Untangle's Connecticut Child Support Calculator does the math for you. Simply enter your financial information, and we'll automatically generate a completed CCSG-1 worksheet, saving you time, reducing stress, and giving you the confidence that your calculation is accurate and ready for court.

Legal Citations

- • C.G.S. § 25-30 View Source

- • C.G.S. § 46b-215a View Source