How to Fill Out Financial Affidavit Long Form (JD-FM-006-LONG)

Complete step-by-step instructions for filling out Financial Affidavit Long Form (jd-fm-006-long). Learn what information you need, how to complete each field, and avoid common mistakes when filing this Connecticut divorce form.

Need help with your divorce? We can help you untangle everything.

Get Started Today

Overview

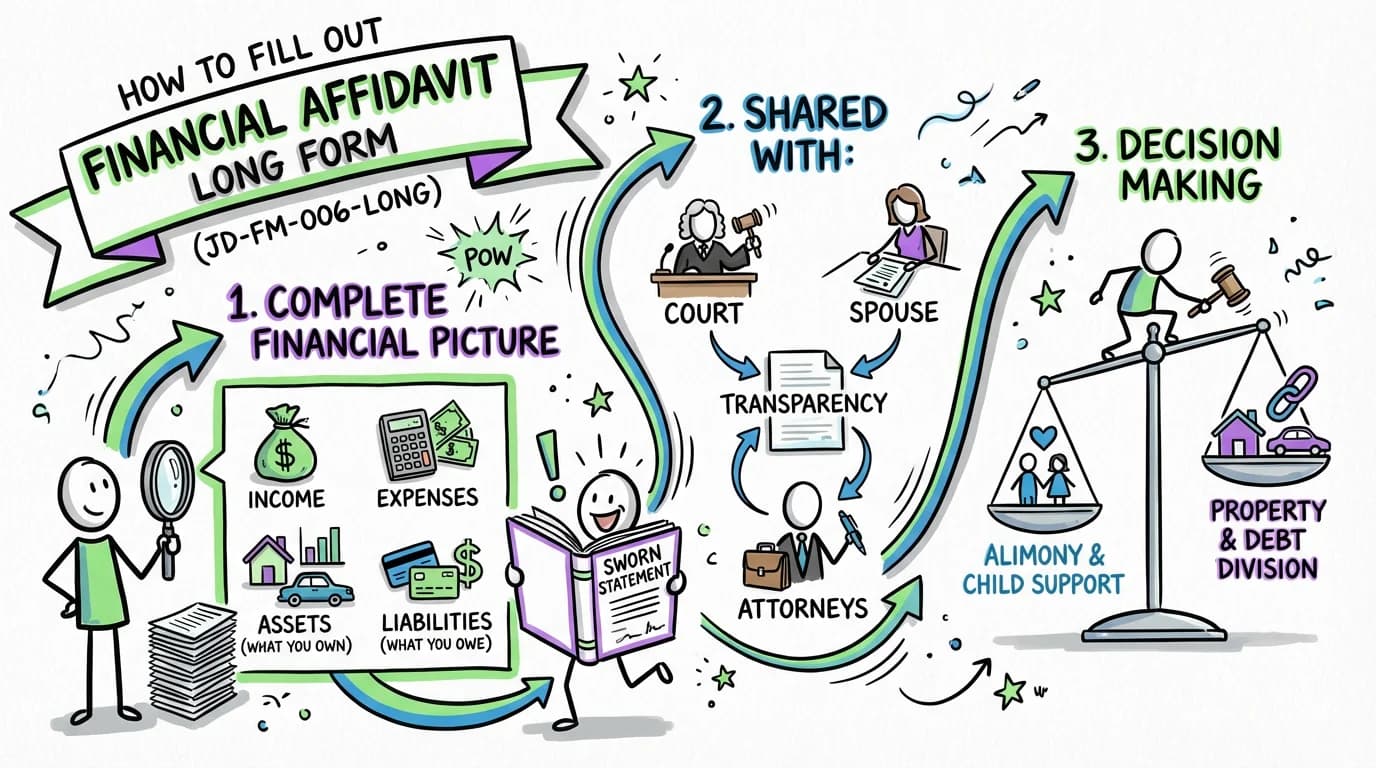

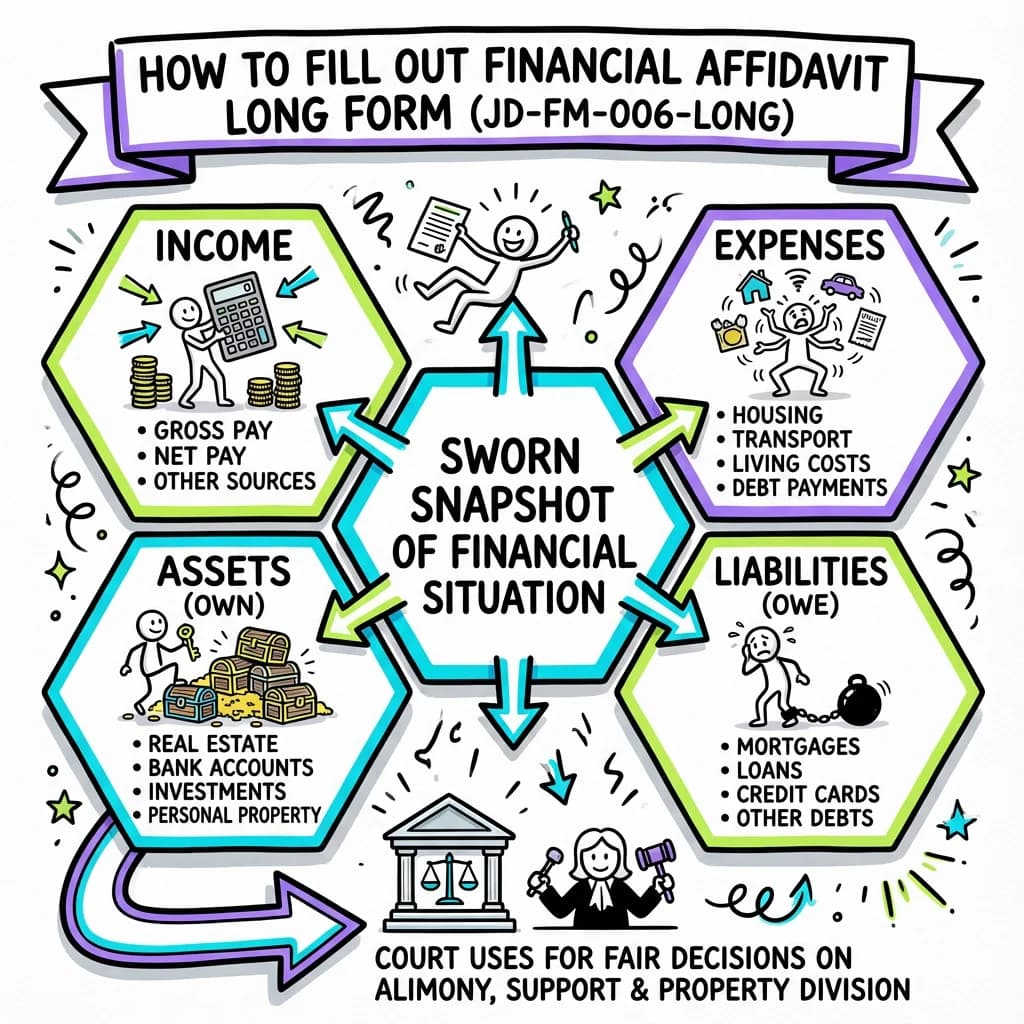

The Financial Affidavit Long Form (JD-FM-006-LONG) is one of the most critical documents in a Connecticut divorce, legal separation, or custody case. It provides the court, your spouse, and the attorneys with a complete and sworn picture of your financial situation. This includes your income, expenses, assets (what you own), and liabilities (what you owe). The court uses this information to make fair and equitable decisions regarding alimony, child support, and the division of property and debts.

This 'Long Form' version is mandatory if your gross annual income is more than $75,000, or if your total net assets are more than $75,000. If both are below this threshold, you may be able to use the Financial Affidavit Short Form (JD-FM-6-SHORT). Because you are signing this document under penalty of perjury, accuracy and honesty are paramount. Willful misrepresentation can lead to serious legal consequences, including sanctions and criminal charges. Take your time, be thorough, and gather all necessary documents before you begin.

Requirements

To complete this form accurately, you will need to gather several financial documents. Having these on hand will make the process smoother and ensure your figures are correct.

-

Income Verification:

- Pay stubs for the last 13 weeks (3 months). If your pay fluctuates, you'll need these to calculate an average.

- Your most recently filed federal and state tax returns (all pages and schedules).

- W-2s, 1099s, and K-1 forms.

- Documentation of any other income, such as Social Security, disability, unemployment, or pension benefits.

-

Expense Records:

- Utility bills (electric, gas, water, internet, phone).

- Bank and credit card statements to track spending on groceries, transportation, personal care, etc.

- Receipts for child care, children's activities, and medical expenses.

-

Asset Documentation:

- Recent statements for all bank accounts (checking, savings, money market).

- Mortgage statements and a recent property tax bill or appraisal for any real estate.

- Kelley Blue Book (kbb.com) or similar valuation for vehicles.

- Recent statements for all retirement accounts (401k, IRA, pensions).

- Recent statements for investment and brokerage accounts.

- Life insurance policies showing any cash surrender value.

-

Debt Documentation:

- Statements for all credit cards.

- Statements for all loans (auto, student, personal).

- Information on any other debts, such as tax liabilities or money owed to individuals.

Step-by-Step Instructions

Case Information and Certification (Top of Page 1)

This section identifies your case for the court. It's crucial to fill this out completely and accurately so the clerk can file it in the correct case file.

For the Judicial District of

Enter the name of the Judicial District where your case was filed (e.g., 'Stamford/Norwalk', 'Hartford', 'New Haven'). This is on your original divorce complaint.

At (Address of Court)

Enter the full street address of the courthouse for the Judicial District you listed.

Name of case

Enter the case name exactly as it appears on other court documents (e.g., 'Jane Doe v. John Doe').

Docket number

Enter the docket number assigned to your case by the court. This number is on all correspondence from the court.

Name of affiant (Person submitting this form)

Enter your full legal name. You are the 'affiant'.

Plaintiff / Defendant

Check the box that indicates your role in the case. If you started the divorce, you are the Plaintiff. If your spouse started it, you are the Defendant.

Certification

Read this statement carefully. You will sign the form at the end (on page 6), but this initial certification confirms you understand the penalty for providing false information.

Warning: Lying on this form is perjury, a serious offense. The court relies on this document to be truthful and complete.

Tips:

- Double-check your docket number. An incorrect number can cause your document to be misfiled.

- If you are unsure of the Judicial District or courthouse address, look at your original summons or complaint form (JD-FM-159).

I. Income

This section details all sources of your income. All figures must be converted to a WEEKLY amount. The form provides a conversion box to help you. Be thorough and list income from every source.

Paid:

Check the box that describes how often you receive your primary paycheck (Weekly, Bi-weekly, Monthly, Semi-monthly, Annually).

If income is not paid weekly, adjust...

Use this box to convert all your income and expense figures to a weekly amount. For example, if you are paid $2,000 bi-weekly, your weekly income is $1,000 ($2,000 ÷ 2). If you are paid $5,000 monthly, your weekly income is $1,153.85 (($5,000 x 12) ÷ 52).

Warning: The most common mistake is failing to convert all figures to weekly amounts. The entire form is based on weekly numbers.

(a) Employer(s)

List each of your jobs. For each, provide the employer's name and address. Check 'Salary' or 'Wages' and enter the WEEKLY base pay amount in the corresponding dollar field. Use your pay stubs and the conversion box to calculate this.

Example: If your annual salary is $80,000, your weekly base pay is $1,538.46 ($80,000 ÷ 52).

Total of base pay from salary and wages of all jobs

Add the weekly base pay from all jobs listed above and enter the total here.

(b) Overtime, (c) Self-employment, etc.

Go through each line item from (b) to (y) and enter the average WEEKLY amount for any other income you receive. Use your tax returns, 1099s, and bank statements to find these amounts and average them over 13 weeks or 52 weeks for consistency.

Warning: You must include everything: bonuses, commissions, rental income, alimony from a previous marriage, and even regular financial contributions from family members.

(z) Total Gross Weekly Income/Monies and Benefits From All Sources

Add your 'Total of base pay' to all other income sources (lines b through y) to get your total gross weekly income. This is your total income before any taxes or deductions.

Tips:

- If your income fluctuates (e.g., you work overtime or are a server), calculate the average weekly amount over the last 13 weeks.

- For 'Self-employment' income, report your gross receipts minus ordinary and necessary business expenses, then convert to a weekly average.

I. Income (Continued) - Deductions and Net Income

This section calculates your net weekly income by subtracting mandatory and other deductions from your gross weekly income.

2) Mandatory Deductions

List your average WEEKLY mandatory deductions from your paycheck. These are non-voluntary deductions like taxes, mandatory retirement, health insurance premiums, and union dues. Use your pay stub to find these amounts and convert them to a weekly average. If you have multiple jobs, fill in the columns for each.

Warning: Do not include voluntary deductions like 401k loan repayments or extra savings here. Those go in 'Other Deductions'.

(8) Total Mandatory Deductions

Add lines (1) through (7) in the 'Totals' column to get your total weekly mandatory deductions.

3) Net Weekly Income

Subtract your 'Total Mandatory Deductions' (Item I.2.8) from your 'Total Gross Weekly Income' (Item I.1.z). This is your take-home pay.

4) Other Deductions

List any other pre-tax or post-tax deductions taken from your pay that are not mandatory. This includes voluntary retirement contributions (401k, 403b), Health Savings Account (HSA) contributions, or credit union loan payments. Enter the WEEKLY amount for each.

Tips:

- Your pay stub is the best source for all deduction information. If deductions vary, average them over several pay periods.

- Health insurance premiums deducted from your pay go here under 'Mandatory Deductions'. If you pay for insurance yourself (not via payroll), it will be listed as an expense in Section II.

II. Weekly Expenses Not Deducted From Pay

List all your regular household and personal expenses that you pay for with your net income (i.e., not deducted directly from your paycheck). All amounts must be converted to a WEEKLY figure.

Insert an ('x') in the box if you are not currently paying the expense, or if someone else is paying the expense.

This is very important. For any expense line item that you do not personally pay (e.g., your parents pay your cell phone bill, or you are not currently paying a bill), check the box next to it and leave the dollar amount blank or as $0.

Rent or Mortgage, Property taxes, Condominium Fees, etc.

Enter your WEEKLY housing costs. For monthly rent of $2,000, the weekly cost is $461.54 (($2,000 x 12) ÷ 52). If your taxes and insurance are escrowed with your mortgage, include them in the main mortgage payment line.

Oil, Electricity, Gas, Water, etc.

Enter the average WEEKLY cost for each utility. It's best to average the last few months of bills to get a realistic number, especially for heating/cooling costs that vary by season.

Groceries, Restaurants

Estimate your average WEEKLY spending on food, both for groceries (including household supplies) and for dining out/take-out.

Gas/Oil, Repairs/Maintenance, Auto Loan or Lease, etc.

Enter your WEEKLY transportation costs. Convert your monthly car payment to a weekly amount. Estimate weekly gas, and average out periodic costs like insurance, registration, and maintenance.

Child Support, Child Care, Education, Activities, etc.

Detail all WEEKLY expenses related to your children. If you pay court-ordered child support for children from another relationship, list it here and attach a copy of the court order.

Total Weekly Expenses Not Deducted From Pay

Add up all the weekly expenses you listed in this section and enter the total at the bottom of page 3.

Tips:

- Review your bank and credit card statements for the last 3-6 months to get an accurate picture of your spending habits.

- Don't forget periodic expenses like annual insurance premiums or car registration. Calculate the annual cost and divide by 52 to get the weekly amount.

III. Liabilities (Debts)

This section lists all of your debts, such as credit cards, personal loans, and tax debt. Do not list your primary mortgage or car loan here if you have already listed them in the Assets section.

Creditor Name/Type of Debt

For each debt, list the name of the creditor (e.g., 'Chase Visa', 'Dept. of Education', 'IRS') and the type of debt.

Balance Due

Enter the total current amount you owe for that debt.

Date Debt Incurred/Revolving

Enter the date you took on the debt. For revolving debt like a credit card, you can write 'Revolving'.

Weekly Payment

Enter the amount you pay towards this debt each week. If you pay monthly, convert it to a weekly figure.

Sole / Joint

Check 'Sole' if the debt is in your name only. Check 'Joint' if the debt is co-signed with your spouse or someone else.

(A). Total Liabilities (Total Balance Due on Debts)

Add up all the 'Balance Due' amounts and enter the total here. This is the total amount of debt you have.

(B). Total Weekly Liabilities Expense

Add up all the 'Weekly Payment' amounts. This total will be used in the final summary on page 6.

Tips:

- The form specifically states not to include mortgage or other loan balances that are accounted for in the 'Assets' section. A mortgage balance is subtracted from the home's value in Section IV, so listing it again here would be double-counting the debt.

IV. Assets

This section is an inventory of everything you own. You must be thorough. For each asset, you will determine its total value and the value of your personal interest in it.

Ownership: S, JTS, JTO

For each asset, you must indicate ownership. 'S' = Sole (yours alone). 'JTS' = Joint with Spouse. 'JTO' = Joint with Other (e.g., a parent or business partner).

A. Real Estate (including time share)

List any property you own. Provide the address, its current Fair Market Value (use Zillow or a recent appraisal for an estimate), the current mortgage balance, and any other liens (like a HELOC). The form calculates equity for you (Value minus debts). Finally, in column 'e. Value of Your Interest', enter the value of your share. If owned JTS, this is typically 50% of the equity.

Example: Home Value (a) = $400,000. Mortgage (b) = $250,000. Equity (d) = $150,000. If owned jointly with spouse (JTS), your 'Value of Interest' (e) is $75,000.

B. Motor Vehicles

List all vehicles. Provide the Year/Make/Model, its current value (use kbb.com), and any loan balance. Calculate the equity and then enter your 'Value of Interest' (typically 50% of the equity if the loan and title are joint).

C. Bank Accounts

List all bank accounts (checking, savings, CDs). Provide the institution name, last 4 digits of the account number, ownership type (S, JTS, JTO), the current balance, and the 'Value of Your Interest'.

D. Stocks, Bonds, Mutual Funds, Bond Funds

List all investment accounts. Provide the company name, account number, beneficiary, and current market value.

E. Insurance (exclude children)

List any life insurance policies that have a cash surrender value. Indicate if it's Disability (D) or Life (L). List the company, beneficiary, and the current cash value. Do not list term life insurance, which has no cash value.

F. Retirement Plans (Pensions on Interest, Individual IRA, 401K, Keogh, etc.)

List all retirement assets. Provide the type of plan, the financial institution, beneficiary, and the current vested balance. Check 'Yes' or 'No' for 'Receiving Payments'.

I. Other Assets

This is a catch-all for valuable personal property. List items like art, antiques, jewelry, firearms, cash on hand, or money owed to you. Provide your best estimate of their current value.

J. Total Net Value All Assets

Add the 'Value of Your Interest' from every asset listed in Sections A through I. This is the total value of all your assets.

Tips:

- Be realistic with 'Fair Market Value'. Use recent statements and online valuation tools. The court expects good-faith estimates.

- Forgetting assets is a serious omission. Go through your records carefully. This includes things like cryptocurrency, vested stock options, and pensions.

V. Child(ren)'s Assets

This section is for assets held for the benefit of your children, which are legally separate from your marital assets.

Include Uniform Gift to Minor Account, Uniform Trust to Minor Account, College Accounts/529 Account, Custodial Account, etc.

List any accounts you have set up for your children, such as a 529 college savings plan or a UTMA/UGMA custodial account. Provide the institution, account number, beneficiary, the person who controls the account (Fiduciary), and the current balance.

Warning: These assets generally belong to the child and are not divisible in the divorce, but they must be disclosed.

Tips:

VI. Health Insurance, Summary, and Certification

The final page covers health insurance, summarizes your entire financial picture, and requires your sworn signature.

VI. Health Insurance (Medical and/or Dental Insurance)

List the company name for any health or dental insurance policies you have and list all individuals (e.g., 'Self, Spouse, Child 1') covered by that policy.

Do you or any member of your family have HUSKY Health Insurance Coverage?

Check 'Yes', 'No', or 'I Don't Know'. If yes, list who is covered.

Important: If you have other financial information that has not yet been disclosed...

Use this space to disclose any other relevant financial information not captured elsewhere on the form. You have an ongoing duty to disclose any changes to your financial situation.

Summary

Transfer the totals from the previous sections into this summary box.

- Total Net Weekly Income: From Section I, item 3.

- Total Weekly Expenses and Liabilities: Add 'Total Weekly Expenses' (Section II) and 'Total Weekly Liabilities Expense' (Section III.B).

- Total Cash Value of Assets: From Section IV, item J.

- Total Liabilities: From Section III, item A.

Certification

Carefully read the certification paragraph. Fill in your name, check Plaintiff or Defendant, enter your residential address and telephone number. Then, sign and date the 'Signed (Affiant)' line in the presence of a Notary Public or Commissioner of the Superior Court.

Warning: Do not sign the form until you are in front of the notary or court official. They must witness your signature.

Signed (Notary, Commissioner of Superior Court...)

This section is to be completed and signed by the official who is witnessing your signature (notarizing the document).

Tips:

- Most law offices, banks, and some town clerk's offices have a Notary Public. The court clerk's office will also have staff who can witness your signature.

- Always make a copy of the fully signed and notarized form for your own records before filing it with the court.

Common Mistakes to Avoid

- Using Monthly/Bi-Weekly Numbers: The form requires all income and expense figures to be converted to a WEEKLY amount. Failing to do this is the most frequent error.

- Incorrectly Calculating 'Value of Your Interest': Forgetting to divide the equity of a joint asset in half (or by the correct percentage) for the 'Value of Your Interest' column.

- Omitting Income or Assets: Forgetting to list side jobs, small investment accounts, or cash-value life insurance. All assets and income sources must be disclosed.

- Double-Counting Debts: Listing a mortgage or car loan balance in the Section III Liabilities section when it has already been accounted for as a deduction from the asset's value in Section IV.

- Guessing at Expenses: Not taking the time to review bank/credit card statements, leading to inaccurate expense figures that don't reflect reality.

- Signing Before Notarization: Signing the affidavit before you are in the physical presence of a Notary Public or court official. The signature must be witnessed.

Related Forms

Divorce Complaint (Dissolution of Marriage)

This is the form used to start the divorce process. The Financial Affidavit is a required supporting document that must be filed and exchanged with your spouse after the case begins.

Learn more about Divorce Complaint (Dissolution of Marriage)

Affidavit Concerning Children

If you have minor children, you must file this form. It provides the court with information about the children's living situation for the past five years. It is filed alongside the Financial Affidavit.

Learn more about Affidavit Concerning Children

Financial Affidavit (Short Version)

This is an alternative to the Long Version. You can use the Short Version if your gross annual income is less than $75,000 and your net worth is less than $75,000.

Next Steps

Once you have completed and notarized your Financial Affidavit:

- Make Copies: Make at least two copies of the signed, notarized original. One copy is for your records, and one is for your spouse or their attorney.

- Serve Your Spouse: You must provide a copy to your spouse or their attorney. This is part of the financial discovery process. You can do this via mail, in person, or through your attorneys.

- File with the Court: File the original, signed, and notarized Financial Affidavit with the Superior Court Clerk's office at the courthouse where your case is being heard. There is typically no fee for filing this form.

- Update as Needed: You have a continuing duty to keep your financial information current. If your financial situation changes significantly (e.g., you get a new job or a large inheritance), you must file an updated Financial Affidavit with the court and provide a copy to your spouse.

Frequently Asked Questions

What is the difference between the Long Form and the Short Form Financial Affidavit?

The Long Form (JD-FM-006-LONG) is required if your gross annual income is over $75,000 OR your net assets are over $75,000. If both your income and assets are below this threshold, you can use the simpler Short Form (JD-FM-6-SHORT).

What if my income changes from week to week?

The form instructs you to compute your income based on at least the last 13 weeks (about 3 months). Add up your gross income from the last 13 weeks and then divide by 13 to get your average weekly income. This provides a more accurate picture than a single paycheck.

Do I have to list assets I owned before I got married?

Yes. You must disclose all of your assets, regardless of when or how you acquired them. The court will later determine what is considered marital property subject to division and what might be considered separate property, but full disclosure is mandatory.

What do 'JTS' and 'JTO' mean in the Assets section?

'JTS' stands for 'Joint with Spouse,' meaning you own the asset together with the person you are divorcing. 'JTO' stands for 'Joint with Other,' meaning you own the asset with someone else, like a parent, sibling, or business partner.

What if I don't know the exact value of an asset, like my furniture or jewelry?

You are expected to provide a good-faith estimate of the 'fair market value,' which is what a willing buyer would pay for the item today. For household furnishings, you can estimate the 'garage sale' value. For potentially valuable items like antiques or fine jewelry, it may be worth getting a professional appraisal.

Get Help with Your Connecticut Divorce

The Financial Affidavit is a detailed and demanding form, and getting it right is crucial for a fair outcome in your divorce. If you're feeling overwhelmed by the calculations or unsure about what to include, Untangle can help. Our platform offers tools and resources designed to simplify complex forms like this one, helping you organize your finances and navigate the Connecticut divorce process with more confidence.