How to Fill Out Financial Affidavit Short Form (JD-FM-006-SHORT)

Complete step-by-step instructions for filling out Financial Affidavit Short Form (jd-fm-006-short). Learn what information you need, how to complete each field, and avoid common mistakes when filing this Connecticut divorce form.

Need help with your divorce? We can help you untangle everything.

Get Started Today

Overview

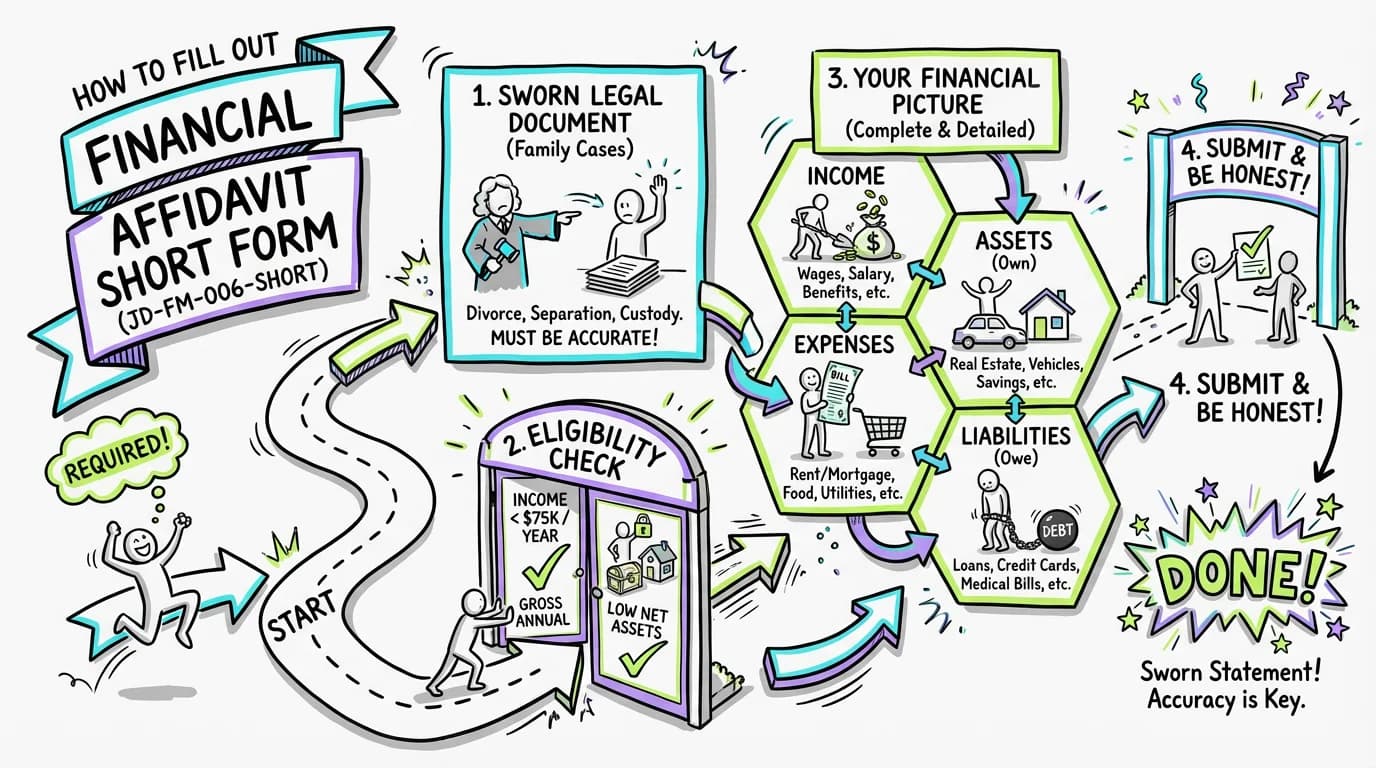

The Financial Affidavit Short Form (JD-FM-006-SHORT) is a sworn legal document required by the Connecticut Superior Court in most family law cases, including divorce, legal separation, and custody matters. You must use this form to provide a complete and accurate picture of your financial situation, including all your income, expenses, assets (what you own), and liabilities (what you owe). This form is specifically for individuals whose gross annual income is less than $75,000 AND whose total net assets are also less than $75,000. If you exceed either of these limits, you must use the Financial Affidavit Long Form (JD-FM-6-LONG).

This document is one of the most critical in your divorce case. The information you provide is given under oath and is used by the court, your spouse, and the attorneys to make crucial decisions about child support, alimony (spousal support), and the division of property and debts. Accuracy and honesty are paramount; any willful misrepresentation can lead to severe legal penalties, including sanctions and potential criminal charges, as stated in Connecticut Practice Book §§ 25-30 and 25a-15.

Requirements

Before you begin filling out this form, gather the following documents and information to ensure accuracy. You will need to report all figures as weekly amounts, so having these documents ready will make the required calculations easier.

- Income Verification:

- Pay stubs for the last 13 weeks (or as many as you have, up to a year).

- Your most recently filed federal and state tax returns (W-2s, 1099s, and full returns).

- Documentation of any other income: Social Security, disability, unemployment, worker's compensation, or public assistance benefits.

- Records of any child support or alimony you receive from a previous relationship.

- Expense Records:

- Monthly bills for all household expenses: mortgage/rent, utilities, phone, internet, etc.

- Bank and credit card statements to track spending on groceries, gas, and other variable costs.

- Auto loan or lease statements.

- Insurance bills (health, auto, life, home).

- Records of child-related expenses like daycare, lessons, and medical bills.

- Asset Documentation:

- Recent statements for all bank accounts (checking, savings).

- Statements for retirement accounts (401k, IRA, pension).

- Statements for investment accounts (stocks, bonds, mutual funds).

- Deeds for real estate and recent mortgage statements or property tax assessments to estimate value.

- Vehicle titles and loan statements; you can use Kelley Blue Book (kbb.com) to estimate vehicle value.

- Liability (Debt) Documentation:

- Recent statements for all credit cards.

- Statements for all other loans (personal, student, medical).

- Copies of any court orders requiring you to pay child support or alimony.

Step-by-Step Instructions

Case Information and Certification (Page 1)

This top section of the form identifies your case, you, and your role in the case. Read the instructions and certification carefully before you begin.

For the Judicial District of

Enter the name of the Judicial District where your case is filed (e.g., Stamford/Norwalk, Hartford, New Haven). This is on your original divorce complaint.

Example: Hartford

At (Address of Court)

Enter the full street address of the courthouse for the Judicial District you listed.

Example: 95 Washington Street, Hartford, CT 06106

Docket number

Enter your case docket number. It will be in the format 'XX-FA-YY-NNNNNNNNN-S'. If you are filing this with your initial complaint, the clerk will assign this number; you can leave it blank.

Example: HHD-FA-24-6012345-S

Name of case

Enter the case name exactly as it appears on other court documents (e.g., 'Jane Doe v. John Doe').

Example: Jane Doe v. John Doe

Name of affiant (Person submitting this form)

Enter your full legal name. You are the 'affiant' because you are swearing that the information is true.

Example: Jane Doe

Plaintiff/Defendant Checkbox

Check the box that indicates your role in the case. The 'Plaintiff' is the person who started the divorce. The 'Defendant' is the person responding to the divorce filing.

Tips:

- Double-check the income and asset limits in the 'Instructions' box. If your gross annual income is $75,000 or more, or your net assets are $75,000 or more, you MUST use the Long Form (JD-FM-6-LONG).

- The 'Certification' is a sworn statement. By signing the form later, you are attesting under penalty of perjury that everything is true. Take this seriously.

Section I. Income (Page 1)

This section details all your income from every source. All figures MUST be converted to a weekly amount. The form provides formulas for this conversion. Use your pay stubs and other income documents to be precise.

Paid:

Check the box that corresponds to how often you are paid (Weekly, Bi-weekly, Monthly, etc.). This helps the court understand your pay cycle.

(a) Employer, Address, Base Pay

For each job you have, list the employer's name, address, and your weekly base pay. Check 'Salary' or 'Wages'. To calculate weekly pay: if paid bi-weekly, divide by 2; if paid monthly, multiply by 12 and then divide by 52.

Example: Employer: ABC Company, Address: 123 Main St, Anytown, CT, Base Pay: $800.00

Warning: Do not include overtime here; it has its own line.

Total of base pay from salary and wages of all jobs

Add the weekly base pay from all jobs listed in part (a) and enter the total here.

Other Income Sources

Enter the average weekly amount for each applicable income source. Use your financial records. If a category doesn't apply, leave it blank or enter '0'. For (p) Other, specify the source.

Example: (b) Overtime: $50.00, (e) Social Security: $250.00

Warning: You must include all income, even cash tips, side jobs, or money from relatives. Hiding income can have severe consequences.

(q) Total Gross Weekly Income...

Add the 'Total of base pay' to all the amounts you entered on lines (b) through (p). This is your total weekly income before any deductions.

Hours worked per week

Enter the total number of hours you typically work each week.

Gross yearly income from prior tax year

Find the 'gross income' line on your most recent tax return (e.g., Line 9 on Form 1040) and enter that amount here. Do not attach the tax return unless requested.

Tips:

- The most common mistake is not converting all income to a weekly figure. Use the formulas provided on the form: Monthly x 12 / 52; Bi-weekly / 2; Annually / 52.

- If your income is irregular (like commission or freelance work), calculate an average based on the last 13 weeks or the entire year-to-date. Use the explanation box to describe how you calculated it.

Section I. Income (continued) & Section II. Weekly Expenses (Page 2)

This page continues with your income by detailing deductions from your pay. Then, it moves to your weekly living expenses that are not automatically deducted from your paycheck.

Mandatory Deductions (Job 1, Job 2, Job 3)

In the columns for each job, list the weekly amount for each mandatory deduction taken from your paycheck. Find these on your pay stub. If you are paid bi-weekly, divide the deduction amount by 2. For (1) and (3), list the number of exemptions you claim.

Example: Job 1, (1) Federal income tax: $75.00 (claiming 1 exemption)

Warning: Do not include voluntary deductions like 401k contributions or charitable giving. Only list required deductions.

Net Weekly Income

Subtract your 'Total Mandatory Deductions' [Item I.2.(8)] from your 'Total Gross Weekly Income' [Item I.1.(q)]. This is your weekly take-home pay.

Weekly Expenses Not Deducted From Pay

List your average weekly cost for each expense category. You must convert all monthly, bi-weekly, or annual bills to a weekly amount using the formulas provided. If you do not pay an expense (e.g., your spouse pays it, or a roommate covers it), place an 'x' in the box next to that item.

Example: Rent or Mortgage: $1600/month * 12 / 52 = $369.23 per week.

Warning: Be thorough. Use bank and credit card statements to get an accurate picture of your spending. Underestimating expenses can negatively impact support calculations.

Total Weekly Expenses Not Deducted From Pay

Add up all the weekly expenses you listed in this section and enter the total at the bottom.

Tips:

- For variable expenses like 'Groceries' or 'Gas/Oil', review your bank/credit card statements for the last 3 months, find the monthly average, and then convert it to a weekly amount.

- The checkbox for expenses you don't pay is important. It tells the court that while the household has this expense, you are not the one currently covering it.

Section III. Liabilities (Debts) (Pages 2-3)

This section is for listing all your debts, such as credit cards, personal loans, student loans, and medical debt. Do not list expenses you already included in Section II (like a car payment). Do not list your primary mortgage balance here, as that goes in the Assets section.

Creditor Name /Type of Debt

List the name of the company you owe money to and the type of debt.

Example: Chase / Credit Card

Balance Due

Enter the total amount you currently owe on that debt.

Example: $2,500.00

Date Debt Incurred/Revolving

Enter the date the debt was taken out. For revolving debt like a credit card, you can write 'Revolving'.

Example: Revolving

Ownership (Sole/Joint)

Check 'Sole' if the debt is in your name only. Check 'Joint' if the debt is shared with your spouse or someone else.

Weekly Payment

Enter the weekly amount you pay towards this debt. If you pay monthly, divide the payment by 4.33.

Example: $25.00

(A). Total Liabilities (Total Balance Due on Debts)

On page 3, add up the 'Balance Due' for all debts listed and enter the total here.

(B). Total Weekly Liabilities Expense

On page 3, add up the 'Weekly Payment' for all debts listed and enter the total here.

Tips:

- Use your most recent statements for accurate balances.

- This section helps the court understand the total debt that needs to be divided between you and your spouse.

Section IV. Assets (Page 3)

This section requires you to list everything you own of value. Be thorough and provide good-faith estimates if exact values are unknown. Pay close attention to the 'Ownership' codes: S = Sole (yours alone), JTS = Joint with Spouse, JTO = Joint with Other.

A. Real Estate (including time share)

List any real estate you own. Provide the address, ownership type, estimated Fair Market Value (use Zillow or a recent appraisal), mortgage balance, and any other liens. The form calculates equity (d = a - (b+c)). For 'Value of Your Interest', enter the full equity if Sole (S), half the equity if Joint with Spouse (JTS), or your proportional share if Joint with Other (JTO).

B. Motor Vehicles

List your vehicles. Provide the year/make/model, ownership, estimated value (use kbb.com), and any loan balance. The form calculates equity (c = a - b). For 'Value of Your Interest', enter the full equity if Sole (S) or half the equity if Joint with Spouse (JTS).

C. Bank Accounts

List all checking, savings, and other bank accounts. Provide the institution name, last 4 digits of the account number, ownership, and current balance. For 'Value of Your Interest', enter the full balance for Sole accounts or half the balance for JTS accounts.

Warning: Do not include accounts owned by your children here; they go in Section V.

D. Stocks, Bonds, Mutual Funds

List any investment accounts. Provide the company name, account number (last 4), beneficiary, and current market value.

E. Insurance

List any life or disability insurance policies that have a cash value. Do not list term life insurance. Provide the insured's name, company, account number, beneficiary, and current cash surrender value.

F. Retirement Plans

List all retirement assets like Pensions, IRAs, 401Ks, etc. Provide the plan type, bank/company name, account number (last 4), beneficiary, and current balance. Check 'Yes' or 'No' for 'Receiving Payments'.

G. Business Interest/Self-Employment

If you own all or part of a business, list its name, the percentage you own, and the estimated value of your share.

Tips:

- Calculating 'Value of Your Interest' is crucial. For jointly owned assets with your spouse (JTS), your interest is typically 50% of the equity or value. The court needs to know your individual share.

- For asset values, use the most recent statement date. For real estate and cars, a good-faith estimate is acceptable, but be prepared to justify it.

Sections IV (cont.), V, VI, Summary, and Certification (Page 4)

This final page concludes the assets section, asks about children's assets and health insurance, provides a summary of your finances, and requires your sworn, notarized signature.

H. Other Assets

List any other assets not covered above, such as valuable jewelry, art, collectibles, or money owed to you. Provide a name/description and an estimated value.

I. Total Net Value All Assets

Add the 'Total Net Value' from each asset category (A through H) and enter the grand total here.

V. Child(ren)'s Assets

List any assets held in your children's names, such as a Uniform Gift to Minor Account (UGMA) or a 529 college savings plan. List who controls the account (the Fiduciary). These are not marital assets.

VI. Health (Medical and/or Dental Insurance)

List the insurance company that provides health/dental coverage and the names of all family members covered by that policy. Also, answer the question about HUSKY Health Insurance coverage.

Summary

Transfer the totals you calculated in previous sections into this summary box. This provides a quick snapshot of your financial situation. Double-check that the numbers match your calculations from Sections I, II, III, and IV.

Certification

DO NOT SIGN THIS YET. You must sign this form in the presence of a Notary Public, Commissioner of the Superior Court, or other authorized officer. Fill in your name, check Plaintiff or Defendant, enter your address and phone number. The official will then watch you sign, date it, and complete their portion.

Warning: A financial affidavit that is not properly signed and notarized will be rejected by the court.

Tips:

- The 'Important' box is a final reminder that you have an affirmative duty to disclose all financial information. If you have something unusual to report, use this space.

- Find a notary at a bank, a town clerk's office, or a UPS Store. Bring a valid photo ID.

- After signing and notarizing, make at least two copies: one for your records and one to provide to your spouse or their attorney.

Common Mistakes to Avoid

- Using Monthly Figures: The form requires all income and expense figures to be converted to a weekly amount. Failing to do this is the most common error and will result in an inaccurate affidavit.

- Forgetting Income: Neglecting to list all sources of income, such as overtime, cash from a side job, or financial help from family. All income must be disclosed.

- Incorrectly Calculating 'Value of Your Interest': For assets owned jointly with a spouse (JTS), your interest is 50% of the value/equity, not 100%. This is a critical distinction for property division.

- Using the Wrong Form: Using this short form when your gross annual income or net assets exceed the $75,000 limit. This can cause delays and require you to redo your paperwork on the long form.

- Forgetting to Sign Before a Notary: The signature on the final page is a sworn statement and is not valid unless it is signed in the presence of a notary or other authorized official. Do not sign it beforehand.

- Guessing at Values: While some estimates are necessary (like for a home's value), use real numbers from recent statements for bank accounts, debts, and retirement funds. Wild guesses can undermine your credibility.

Related Forms

Financial Affidavit (Long Version)

If your gross annual income or total net assets are $75,000 or more, you must use this more detailed version of the Financial Affidavit instead of the short form.

Learn more about Financial Affidavit (Long Version)

Divorce Complaint (Dissolution of Marriage)

This is the form used to start the divorce process. Your Financial Affidavit is typically filed along with it or shortly after.

Learn more about Divorce Complaint (Dissolution of Marriage)

Affidavit Concerning Children

If you have minor children, you must file this form along with your Financial Affidavit. It provides the court with information about the children's living situation.

Next Steps

Once you have completed and notarized your Financial Affidavit:

- Make Copies: Make at least two photocopies of the entire, signed document. Keep one for your personal records. The other copy is for your spouse.

- File with the Court: File the original, signed document with the Superior Court Clerk's office in the Judicial District where your case is being heard.

- Serve Your Spouse: You must provide a copy to your spouse or their attorney. This is called 'service'. This ensures both parties have the same financial information.

- Keep it Updated: You have a continuing duty to keep your financial information current. If your financial situation changes significantly during your case (e.g., you get a new job or a large inheritance), you must file an updated Financial Affidavit with the court and provide a copy to your spouse.

Frequently Asked Questions

What if my income is not consistent every week?

If your income fluctuates (e.g., you work on commission, have a seasonal job, or get irregular overtime), you should calculate an average. The form suggests using year-to-date income, but no less than the last 13 weeks. Add up your gross pay for that period and divide by the number of weeks to get your average weekly income. Use the explanation box in Section I to briefly state how you arrived at your figure (e.g., 'Based on 13-week average').

Do I really have to fill this out if my spouse and I agree on everything?

Yes. In Connecticut, the court requires a full and frank financial disclosure from both parties before it can approve any divorce agreement. The judge must review both Financial Affidavits to ensure the agreement is fair and equitable based on the parties' financial circumstances.

What is the difference between 'JTS' and 'JTO' in the Assets section?

'JTS' stands for 'Joint with Spouse,' meaning you own the asset with the person you are divorcing. 'JTO' stands for 'Joint with Other,' meaning you own the asset with someone else, like a parent, sibling, or business partner.

What if I don't know the exact value of an asset, like my furniture or jewelry?

You are required to provide a good-faith estimate of the 'fair market value,' which is what a willing buyer would pay for the item today. For general household furnishings, you can provide a lump-sum estimate unless a specific item is exceptionally valuable. For items like valuable art or jewelry, you may need to get an appraisal if the value is significant or in dispute.

My spouse pays for my cell phone. How do I list that?

In Section II (Weekly Expenses), you would find the 'Telephone/Cell/Internet' line. You would list the weekly cost of the bill, but then you must place an 'x' in the box next to it. This tells the court that this is a household expense, but you are not the one currently paying for it.

Get Help with Your Connecticut Divorce

The Financial Affidavit is a detailed and demanding form, and it's the foundation for all financial outcomes in your divorce. Getting it right is essential. If you're feeling overwhelmed by the calculations or unsure about what to include, Untangle can provide clarity. Our platform offers tools and resources specifically designed to help you navigate Connecticut's divorce forms, ensuring you present your financial situation accurately and confidently.

Legal Citations

- • C.G.S. § 25-30 View Source