TRICARE and Military Benefits After Connecticut Divorce: What Spouses Need to Know

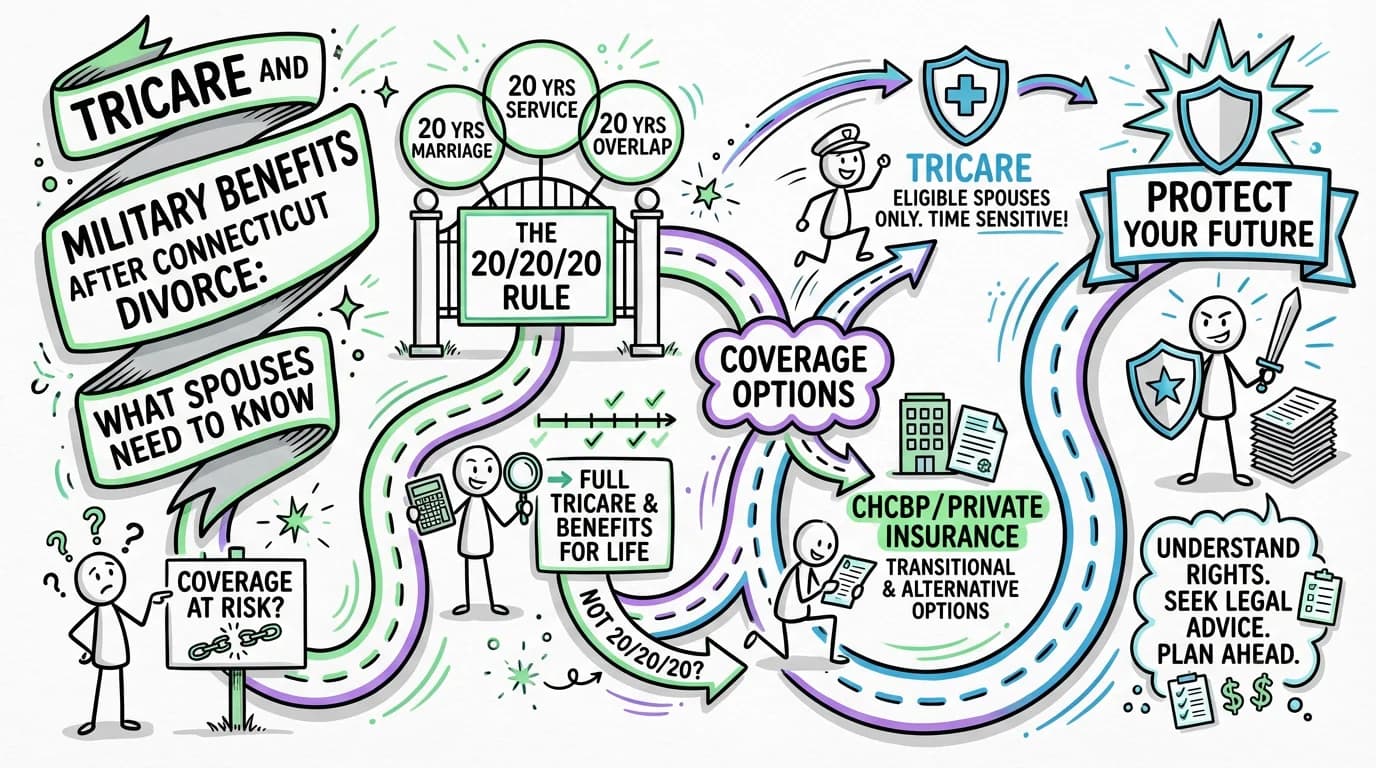

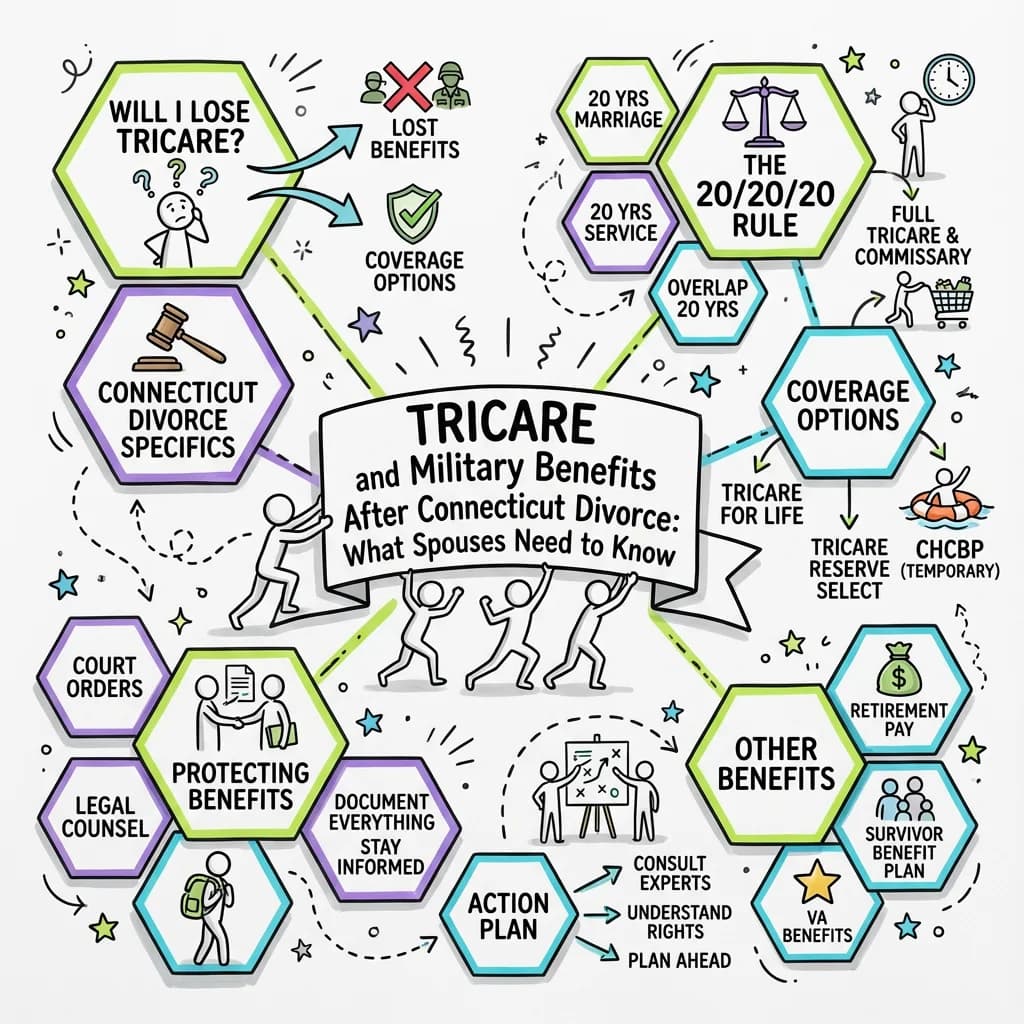

Learn whether you'll lose TRICARE and military benefits after a Connecticut divorce. Understand the 20/20/20 rule, coverage options, and how to protect your benefits.

Need help with your divorce? We can help you untangle everything.

Get Started Today

TRICARE and Military Benefits After Connecticut Divorce: What Spouses Need to Know

Whether you lose TRICARE and military benefits after a Connecticut divorce depends primarily on the length of your marriage, your spouse's military service, and the overlap between the two. Under the federal "20/20/20 rule," former military spouses who were married for at least 20 years to a service member who served at least 20 years, with at least 20 years of overlap between the marriage and service, retain full TRICARE benefits for life. If you don't meet this threshold, you may still qualify for limited benefits under the "20/20/15 rule" or need to explore alternative coverage options.

Understanding Military Benefits in Connecticut Divorce

Military divorces in Connecticut involve a unique intersection of federal law and state divorce proceedings. While Connecticut courts have authority under C.G.S. § 46b-81 to divide marital property, including military retirement benefits, TRICARE eligibility is governed exclusively by federal law—meaning a Connecticut judge cannot order continued TRICARE coverage as part of your divorce decree.

This distinction is critical for military spouses planning their post-divorce future. Many former spouses are surprised to learn that healthcare benefits they've relied on for years or even decades can disappear the moment their divorce is finalized. Unlike civilian employer-sponsored health plans that may offer COBRA continuation coverage, TRICARE operates under its own set of rules that don't provide the same safety net.

If you're unsure how these complex federal regulations apply to your case, Untangle’s AI Legal Chat can help you quickly clarify your status and identify which rules govern your specific situation.

The good news is that federal law does provide pathways to continued coverage for qualifying former spouses, and Connecticut's equitable distribution framework allows courts to consider the loss of these benefits when dividing assets and awarding alimony. Understanding both the federal eligibility requirements and your options under Connecticut law is essential for protecting your financial security.

The 20/20/20 Rule: Full TRICARE Benefits for Life

The 20/20/20 rule represents the gold standard for former military spouse benefits. To qualify, you must meet all three of these requirements:

- 20 years of marriage to the service member

- 20 years of creditable military service by your spouse (for retirement purposes)

- 20 years of overlap between the marriage and the military service

If you meet all three criteria, you retain full TRICARE coverage as if you were still married to the service member. This includes TRICARE Prime, TRICARE Select, and access to military treatment facilities. You'll also retain commissary and exchange privileges and remain eligible for these benefits for life—unless you remarry before age 55.

The overlap requirement is where many former spouses fall short. For example, if you were married for 22 years but your spouse only served 18 of those years in the military (having joined after you married), you wouldn't qualify under the 20/20/20 rule. Similarly, if your spouse served 25 years but you were only married during 19 of those years, you'd miss the threshold by just one year.

Tracking military benefits during divorce proceedings can be complex. Tools like Untangle's financial organization features can help you gather and organize the documentation needed to verify your eligibility, including marriage certificates, service records, and retirement point statements.

The 20/20/15 Rule: Transitional Benefits

If you don't quite meet the 20/20/20 requirements but came close, you may qualify for transitional benefits under the 20/20/15 rule:

- 20 years of marriage to the service member

- 20 years of creditable military service by your spouse

- 15-19 years of overlap between the marriage and the military service

Under this rule, you receive one year of transitional TRICARE coverage beginning on the date of your divorce. This provides a crucial bridge period to find alternative health insurance, whether through an employer, the healthcare marketplace, or other options.

The transitional benefit is particularly valuable because it gives you time to plan without an immediate gap in coverage. However, one year passes quickly when you're also adjusting to post-divorce life, so it's essential to start exploring your long-term healthcare options as soon as your divorce proceedings begin—not after they conclude.

Former spouses who qualify under the 20/20/15 rule also retain commissary, exchange, and MWR (Morale, Welfare, and Recreation) privileges during the one-year transitional period, though these benefits end when TRICARE coverage expires.

What Happens If You Don't Qualify for Either Rule

If your marriage doesn't meet the requirements for either the 20/20/20 or 20/20/15 rule, your TRICARE coverage ends on the day your divorce is finalized. This can feel devastating, especially if you've been a military spouse for many years and have relied on TRICARE for your family's healthcare needs.

However, you have several important options to consider:

Continued Health Care Benefit Program (CHCBP): This is a premium-based health plan available to former military spouses who lose TRICARE eligibility. You must enroll within 60 days of losing TRICARE coverage. CHCBP provides coverage similar to TRICARE Standard/Select but requires monthly premium payments. While it's more expensive than TRICARE, it offers continuous coverage and accepts pre-existing conditions.

Healthcare Marketplace Plans: Under the Affordable Care Act, you can purchase health insurance through the federal marketplace or Connecticut's Access Health CT. Losing TRICARE due to divorce qualifies as a "life event" that triggers a special enrollment period, giving you 60 days to enroll outside the normal open enrollment window.

Employer-Sponsored Insurance: If you're employed or seeking employment, employer-sponsored health plans may be available. Some divorcing spouses negotiate alimony amounts that account for the cost of replacing TRICARE coverage.

Medicaid: Depending on your income level post-divorce, you may qualify for Connecticut's Medicaid program (HUSKY Health), which provides comprehensive coverage at low or no cost.

Military Retirement Pay Division in Connecticut

While TRICARE eligibility is governed by federal law, the division of military retirement pay falls under Connecticut's equitable distribution framework. Under C.G.S. § 46b-81, Connecticut courts can assign "all or any part of the estate of the other spouse" at the time of divorce, and military retirement benefits are considered marital property subject to division.

The Uniformed Services Former Spouses' Protection Act (USFSPA) allows state courts to treat disposable military retirement pay as marital property. However, the federal law caps direct payments from the Defense Finance and Accounting Service (DFAS) to a former spouse at 50% of disposable retirement pay.

| Aspect | Federal Law Governs | Connecticut Law Governs |

|---|---|---|

| TRICARE eligibility | ✓ | |

| Military retirement division | ✓ | |

| Direct DFAS payment limits | ✓ | |

| Alimony awards | ✓ | |

| Property division factors | ✓ | |

| Child support | ✓ |

Connecticut courts consider multiple factors when dividing military retirement, including the length of the marriage, each spouse's contribution to the marriage, and the circumstances leading to the divorce. Using Untangle's asset tracking tools can help you document your spouse's military retirement benefits and understand what portion may be considered marital property.

Special Considerations for Connecticut Military Families

Connecticut has enacted specific protections for military families going through divorce, recognizing the unique challenges service members and their spouses face. C.G.S. § 46b-56e addresses custody and visitation orders for deploying parents, defining "Armed forces" to include "the United States Army, Navy, Marine Corps, Coast Guard, Air Force and Space Force and any reserve component thereof, including the Connecticut National Guard."

This statute provides important protections for military families by preventing deployment from being used against a service member in custody determinations and allowing for temporary custody modifications during deployment periods. For military spouses concerned about maintaining relationships with their children during their ex-spouse's deployments, this statute provides a framework for addressing those concerns.

Connecticut's automatic court orders under Practice Book Rule 25-5 also apply to military families, preventing either party from permanently removing children from Connecticut without written consent or court order. These protections are particularly important when one spouse is an active-duty service member who may receive orders to relocate.

Protecting Your Benefits: Steps to Take During Divorce

Taking proactive steps early in your divorce can help protect your benefits and ensure you have documentation to prove your eligibility:

-

Gather your documentation immediately. Collect marriage certificates, your spouse's DD-214 (discharge papers) or current service records, and any documents showing creditable service years. You'll need these to verify your eligibility under the 20/20/20 or 20/20/15 rules.

-

Calculate your overlap period carefully. Determine the exact dates of your marriage and your spouse's military service to calculate whether you meet the overlap requirements. Even one day can make a difference in eligibility.

-

Complete required financial disclosures thoroughly. Under Practice Book Rule 25-32, both parties must exchange tax returns, pay stubs, and financial statements. Military-specific income like BAH (Basic Allowance for Housing) and BAS (Basic Allowance for Subsistence) should be included in these disclosures.

-

File your financial affidavit accurately. Connecticut requires sworn financial statements under Practice Book Rule 25-30, filed at least five business days before hearings. Untangle's financial affidavit preparation tools can help ensure all military pay and benefits are properly documented.

-

Consider healthcare costs in settlement negotiations. If you won't qualify for continued TRICARE, factor the cost of replacement health insurance into alimony discussions. Under C.G.S. § 46b-82, courts consider each party's needs and the standard of living established during the marriage.

-

Apply for CHCBP within 60 days if needed. If you don't qualify for continued TRICARE and want to enroll in the Continued Health Care Benefit Program, you must apply within 60 days of your divorce being finalized. Don't miss this deadline.

-

Request a military pension division order. If you're entitled to a portion of your spouse's military retirement, work with your attorney to prepare a proper court order that DFAS will accept for direct payment.

Timeline for Military Benefits After Divorce

Understanding when benefits change can help you plan appropriately:

| Situation | TRICARE Coverage | Other Benefits |

|---|---|---|

| Meet 20/20/20 rule | Lifetime (unless remarry before 55) | Commissary, exchange, MWR for life |

| Meet 20/20/15 rule | 1 year transitional | Commissary, exchange, MWR for 1 year |

| Don't meet either rule | Ends on divorce date | Ends on divorce date |

| Children of service member | Continue until age 21 (or 23 if in college) | Varies by program |

| Enroll in CHCBP | Up to 36 months | Not included |

Children of service members generally retain their TRICARE eligibility regardless of the divorce, typically until age 21 (or 23 if enrolled full-time in college). Under C.G.S. § 46b-84, Connecticut courts can order parents to maintain health insurance coverage for minor children, which may include continuing TRICARE coverage for eligible dependents.

It is critical to note that the timeline for applying for transitional benefits or CHCBP is strict. Missing the 60-day window for CHCBP enrollment after your divorce decree can result in a permanent loss of coverage eligibility. Because the military healthcare system operates independently of state court timelines, delays in updating the Defense Enrollment Eligibility Reporting System (DEERS) with your divorce decree can also cause complications with claims processing.

When to Seek Professional Help

Military divorce involves complex interactions between federal law and Connecticut state law that can significantly impact your financial future. While understanding the basics helps you make informed decisions, certain situations call for professional guidance:

Consider consulting an attorney if:

- You're close to meeting the 20/20/20 or 20/20/15 thresholds and timing your divorce could affect eligibility

- Your spouse disputes the calculation of creditable service years

- You need help understanding how military retirement division interacts with survivor benefit plans

- There are concerns about jurisdiction (where the divorce should be filed)

- You're dealing with disability pay versus retirement pay issues

Consider a financial advisor if:

- You need to calculate the true cost of replacing TRICARE coverage

- You're negotiating alimony and need to factor in healthcare costs

- You want to understand the present value of military retirement benefits

Navigating these decisions doesn't have to be overwhelming. Untangle's guided divorce tools can help you organize your case, understand the key issues, and prepare for conversations with legal and financial professionals. By staying organized and informed, you can protect the benefits you've earned as a military spouse and plan confidently for your post-divorce future.

Frequently Asked Questions

What is the 20/20/20 rule for keeping TRICARE after a military divorce in Connecticut?

The 20/20/20 rule allows former military spouses to keep full TRICARE benefits for life if they were married at least 20 years to a service member who served at least 20 years, with at least 20 years of overlap between the marriage and military service.

Can a Connecticut divorce judge order my military spouse to keep me on TRICARE?

No, Connecticut courts cannot order continued TRICARE coverage in a divorce decree because TRICARE eligibility is governed exclusively by federal law, not state law.

What is the Continued Health Care Benefit Program (CHCBP) for divorced military spouses in CT?

CHCBP is a temporary health insurance option that allows former military spouses who don't qualify for the 20/20/20 rule to purchase continued coverage for up to 36 months after their Connecticut divorce is finalized.

How do I update my military ID and DEERS status after a Connecticut divorce?

After your Connecticut divorce is finalized, you must visit a DEERS office with your divorce decree to update your enrollment status and determine whether you need to surrender or replace your military ID card.

Can a CT court consider lost TRICARE benefits when awarding alimony?

Yes, Connecticut courts can consider the loss of TRICARE and military healthcare benefits under the state's equitable distribution framework when dividing assets and determining alimony awards.

Legal Citations

- • C.G.S. § 46b-81 - Assignment of property and transfer of title View Source

- • C.G.S. § 46b-82 - Alimony View Source

- • C.G.S. § 46b-84 - Parents' obligation for maintenance of minor child View Source

- • C.G.S. § 46b-56e - Orders of custody or visitation re children of deploying parent View Source

- • Practice Book Rule 25-5 - Automatic Orders upon Service of Complaint or Application View Source

- • Practice Book Rule 25-30 - Statements To Be Filed View Source

- • Practice Book Rule 25-32 - Mandatory Disclosure and Production View Source