What to Do If Your Spouse Is Hiding Assets in a Connecticut Divorce

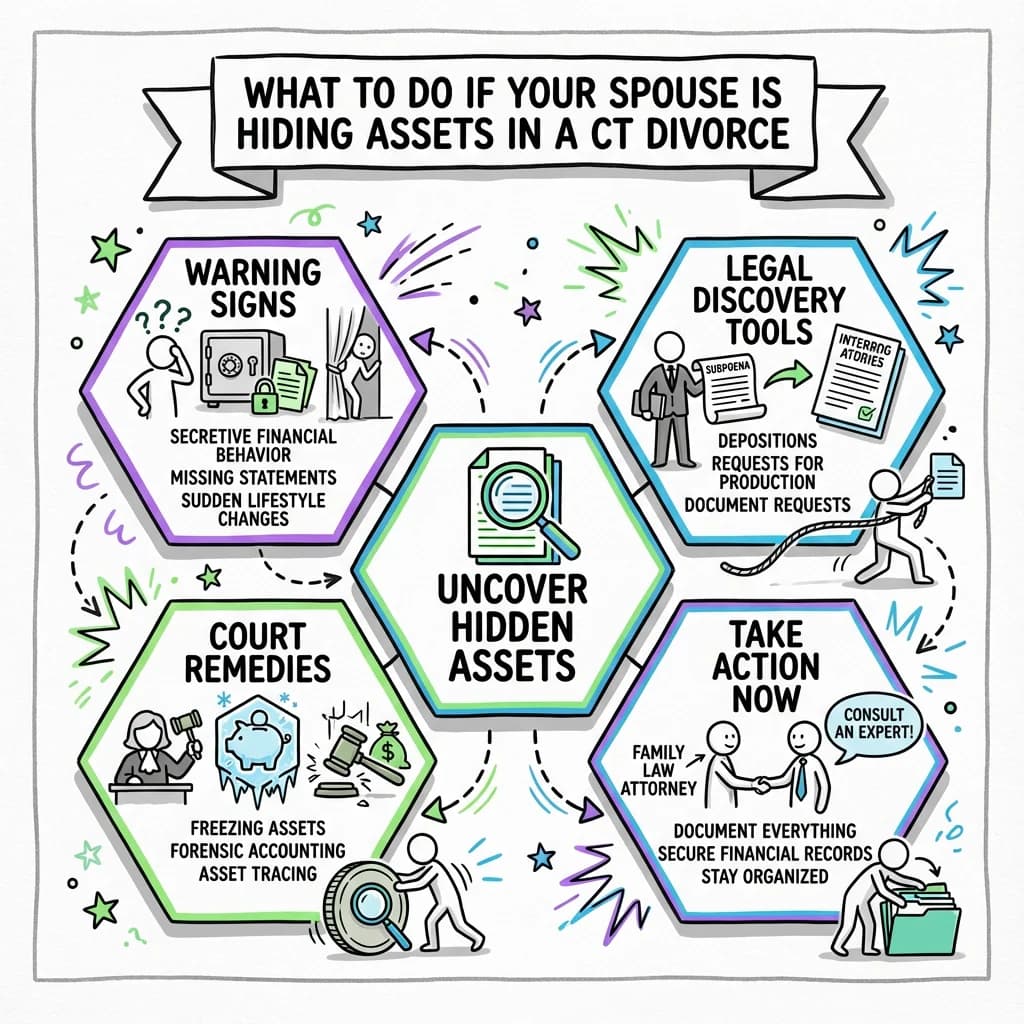

Learn how to uncover hidden assets in a Connecticut divorce. Discover legal discovery tools, court remedies, and warning signs of financial deception.

Need help with your divorce? We can help you untangle everything.

Get Started Today

What to Do If Your Spouse Is Hiding Assets in a Connecticut Divorce

If you suspect your spouse is hiding assets during your Connecticut divorce, you have powerful legal tools at your disposal. Connecticut law requires both parties to provide full financial disclosure through sworn financial affidavits and mandatory document production under Practice Book Rule 25-32. You can use formal discovery methods including interrogatories, subpoenas to banks and employers, and depositions to uncover concealed assets. If your spouse refuses to comply, the court can impose sanctions, draw negative inferences against them, and even award you a larger share of the marital estate under C.G.S. § 46b-81.

The anxiety you're feeling about hidden assets is completely valid—and unfortunately common. Studies suggest that asset concealment occurs in a significant percentage of divorces, and the spouse who managed fewer finances during the marriage is particularly vulnerable. The good news is that Connecticut's family court system takes financial dishonesty seriously, and judges have broad authority to ensure equitable property division even when one spouse attempts to deceive the other.

Understanding Your Right to Full Financial Disclosure in Connecticut

Connecticut divorce law operates on the fundamental principle that both spouses deserve complete transparency about marital finances. This isn't just an expectation—it's a legal requirement with teeth. Under Practice Book Rule 25-30, each party must file a sworn financial statement showing all income, expenses, assets, and liabilities before any hearing involving alimony, support, or property division. Lying on this affidavit constitutes perjury, a serious criminal offense.

Preparing these disclosures accurately is a critical part of your case; Untangle’s financial affidavit tools can help you organize your income, expenses, and debts into the required format while ensuring you don't overlook common line items.

Beyond the sworn affidavit, Practice Book Rule 25-32 establishes mandatory disclosure requirements that automatically apply to every Connecticut divorce. Within 60 days of a request, your spouse must provide three years of federal and state tax returns (including K-1s for any business interests), W-2s and 1099s, current pay stubs, 24 months of statements for all financial accounts, recent statements for retirement accounts, and documentation for any closely held business interests.

The automatic orders that take effect when a divorce is filed under Practice Book Rule 25-5 also protect you. These orders prohibit both parties from selling, transferring, or dissipating marital assets during the divorce proceedings. Violations of these automatic orders can result in contempt findings and significant penalties.

Warning Signs Your Spouse May Be Hiding Assets

Recognizing the red flags of asset concealment is the first step toward protecting yourself. While some behaviors might have innocent explanations, a pattern of the following warning signs warrants investigation. Being aware of these indicators can help you gather information and alert your attorney early in the process.

Financial behavior changes to watch for:

- Sudden "business losses" or unexplained drops in income

- New mailing addresses for financial statements you don't recognize

- Cash withdrawals that can't be explained

- Overpaying the IRS or creditors (to receive refunds after the divorce)

- Complaints about money problems that don't match your lifestyle

- Reluctance to discuss finances or deflection when you ask questions

- New or unfamiliar account statements arriving at the house

- Transfers to family members or "loans" to friends

- Cryptocurrency purchases or digital asset activity

- Expensive purchases that later "depreciate" or disappear

Tools like Untangle's financial organization features can help you compile and track all financial documents you've gathered, creating a clear picture of what you know and what's missing. Having this organized baseline makes it easier to spot discrepancies when your spouse's disclosures arrive.

Legal Discovery Tools Available in Connecticut Divorces

Connecticut provides robust discovery mechanisms specifically designed to uncover hidden assets. These formal legal processes allow you to demand information, documents, and testimony from your spouse and third parties.

Interrogatories and Requests for Production

Interrogatories are written questions your spouse must answer under oath. You can ask detailed questions about every bank account they've ever held, any transfers made in recent years, business interests, and assets they may have gifted or placed in trusts.

In Connecticut, while there are standard production requests and interrogatories that are routinely exchanged, your attorney can also draft custom interrogatories tailored to your specific suspicions. For instance, if you suspect hidden crypto assets, specific questions regarding digital wallets, exchange keys, and mining equipment can be included to force a direct response on the record. Any dishonesty here serves as evidence of perjury.

Subpoenas to Third Parties

One of the most powerful tools for uncovering hidden assets is the subpoena—a court order requiring third parties to produce documents or testimony. You can subpoena records directly from banks, brokerage firms, employers, accountants, and business partners. This bypasses your spouse entirely, making it much harder to conceal assets.

Because privacy laws protect financial data, issuing subpoenas often requires specific legal protocols, including notifying your spouse that their records are being sought. Once served, however, the financial institution must compile the records and send them directly to your legal team. This "source data" is often far more reliable than the curated documents your spouse might choose to hand over voluntarily.

Depositions

A deposition allows your attorney to question your spouse under oath, with a court reporter recording every word. Unlike written interrogatories, depositions happen in real-time, making it difficult for your spouse to craft evasive answers.

Depositions also serve a critical strategic purpose: assessing your spouse's credibility. If they appear evasive, unable to recall details, or contradict documents during the deposition, a transcript of that testimony becomes a powerful tool for cross-examination at trial. It locks them into a story that can be dismantled later if new evidence emerges.

What Happens When Your Spouse Won't Comply with Discovery

Connecticut courts take discovery violations seriously, and Practice Book Rule 25-32A provides a clear pathway for addressing noncompliance through Motions to Compel and Sanctions. The court can order your spouse to pay your attorney’s fees or even award you a larger portion of the marital estate if they find your spouse has acted in bad faith.

If the noncompliance continues, you can file a Motion for Sanctions. The court has the discretion to prohibit the non-compliant spouse from introducing evidence related to the undisclosed assets—essentially silencing their defense on those issues. In extreme cases, the court may even strike their pleadings entirely, placing them in default and allowing the case to proceed as if they were not participating.

Hiring Experts to Uncover Hidden Assets

Sometimes standard discovery isn't enough, particularly when dealing with complex finances or business ownership. Connecticut courts regularly allow parties to retain expert witnesses who can trace assets and value businesses.

| Expert Type | What They Uncover | Typical Cost Range |

|---|---|---|

| Forensic Accountant | Hidden income, fraudulent transfers, lifestyle vs. reported income | $5,000 - $25,000+ |

| Business Valuator | True business value, manipulation of financials | $3,000 - $15,000+ |

| Private Investigator | Hidden assets, lifestyle inconsistencies, undisclosed property | $2,000 - $10,000+ |

While these experts come with a price tag, their cost is often justified by the assets they recover. A forensic accountant, for example, can often identify "lifestyle discrepancies"—where spending patterns don't match reported income—that a layperson might miss. Determining whether to hire an expert is a cost-benefit analysis you should conduct with your attorney, ensuring the potential recovery outweighs the expense.

Before handing boxes of paper to an expert, using automated bank statement analysis can help you flag suspicious transfers or cash withdrawals early, potentially saving you significant billable hours in the long run.

Protecting Yourself with Prejudgment Remedies

Connecticut law provides prejudgment remedies designed to secure your financial interests. Under C.G.S. § 46b-80, you can access protections like the attachment of property or garnishment of accounts to prevent your spouse from dissipating assets before the divorce is finalized. Don't wait until assets have disappeared—acting promptly when you spot warning signs is essential.

To obtain a prejudgment remedy (PJR), your attorney will typically file a motion and the court will schedule a hearing. At this hearing, you must demonstrate "probable cause" that you will prevail in your claim for a financial award. If the judge grants the PJR, a lien can be placed on real estate or a hold placed on bank accounts, effectively freezing the assets to ensure they are still available when the final divorce decree is issued.

How Hidden Assets Affect Property Division

Connecticut is an "equitable distribution" state. Under C.G.S. § 46b-81, the court has broad authority to assign property to either spouse fairly. When a spouse attempts to hide assets, judges have the discretion to credit the innocent spouse with the value of hidden assets or award a larger percentage of known assets to compensate for the concealment.

This authority extends to the concept of "dissipation of assets." If the court finds that your spouse has wasted marital funds—whether through gambling, spending on an affair, or fraudulent transfers—the judge can calculate the total amount dissipated and deduct it directly from that spouse's share of the remaining assets. This ensures you are not financially penalized for their misconduct.

Steps to Take If You Suspect Hidden Assets

Taking systematic action protects your interests and strengthens your position. Here's what you should do:

-

Document everything you currently know - Create a comprehensive inventory of all assets and income sources. Untangle's asset disclosure features can help you organize this information systematically so your attorney has a clear starting point.

-

Gather accessible financial documents - Collect tax returns, bank statements, and loan applications you can legally access.

-

Note behavioral changes - Keep a journal of concerning financial behaviors, including dates and amounts.

-

Consult with an experienced divorce attorney - An attorney can advise on the best discovery strategies for your specific situation.

-

Request mandatory disclosures immediately - Trigger the 60-day disclosure requirement under Practice Book Rule 25-32 as soon as possible.

When to Seek Legal Help

Hidden asset cases almost always require professional legal assistance. Under C.G.S. § 46b-62, Connecticut courts can order the higher-earning spouse to pay reasonable attorney's fees, ensuring access to legal representation isn't determined solely by who controls the money.

The financial anxiety you're experiencing is a natural response to uncertainty. Knowledge is power, and Connecticut law provides meaningful protections for spouses facing financial dishonesty. By understanding your rights, gathering information systematically with tools like Untangle, and working with qualified professionals, you can uncover hidden assets and secure a fair outcome in your divorce.

Frequently Asked Questions

How does the discovery process work for uncovering hidden assets in a Connecticut divorce?

In Connecticut, you can use formal discovery methods including interrogatories, subpoenas to banks and employers, requests for production of documents, and depositions to legally compel your spouse to disclose financial information and uncover concealed assets.

What are the penalties for lying on a financial affidavit in a CT divorce case?

Lying on a sworn financial affidavit in Connecticut constitutes perjury, which is a criminal offense, and can also result in court sanctions, negative inferences against the dishonest spouse, and a larger share of marital assets being awarded to the other party.

When should I hire a forensic accountant for my divorce in Connecticut?

You should consider hiring a forensic accountant when your spouse owns a business, has complex investments, handles most marital finances, or when you notice unexplained cash withdrawals, lifestyle inconsistencies, or suspect assets are being hidden offshore.

What financial documents must be disclosed during a Connecticut divorce?

Under Practice Book Rule 25-32, Connecticut requires mandatory disclosure of three years of federal and state tax returns, along with documentation of all income, expenses, assets, and liabilities within 60 days of a request.

Can a Connecticut judge award me more assets if my spouse hid money during our divorce?

Yes, under C.G.S. § 46b-81, Connecticut judges have broad authority to award a larger share of the marital estate to the honest spouse when the other party attempts to conceal assets or deceive the court.

Legal Citations

- • C.G.S. § 46b-81 - Assignment of property and transfer of title View Source

- • C.G.S. § 46b-80 - Prejudgment remedies available View Source

- • C.G.S. § 46b-62 - Orders for payment of attorney's fees View Source

- • Practice Book Rule 25-30 - Statements To Be Filed View Source

- • Practice Book Rule 25-32 - Mandatory Disclosure and Production View Source

- • Practice Book Rule 25-32A - Discovery Noncompliance View Source

- • Practice Book Rule 25-31 - Discovery and Depositions View Source

- • Practice Book Rule 25-5 - Automatic Orders upon Service of Complaint View Source

- • Merk-Gould v. Gould, 195 A.3d 458 View Source

- • Reinke v. Sing, 201 A.3d 404 View Source