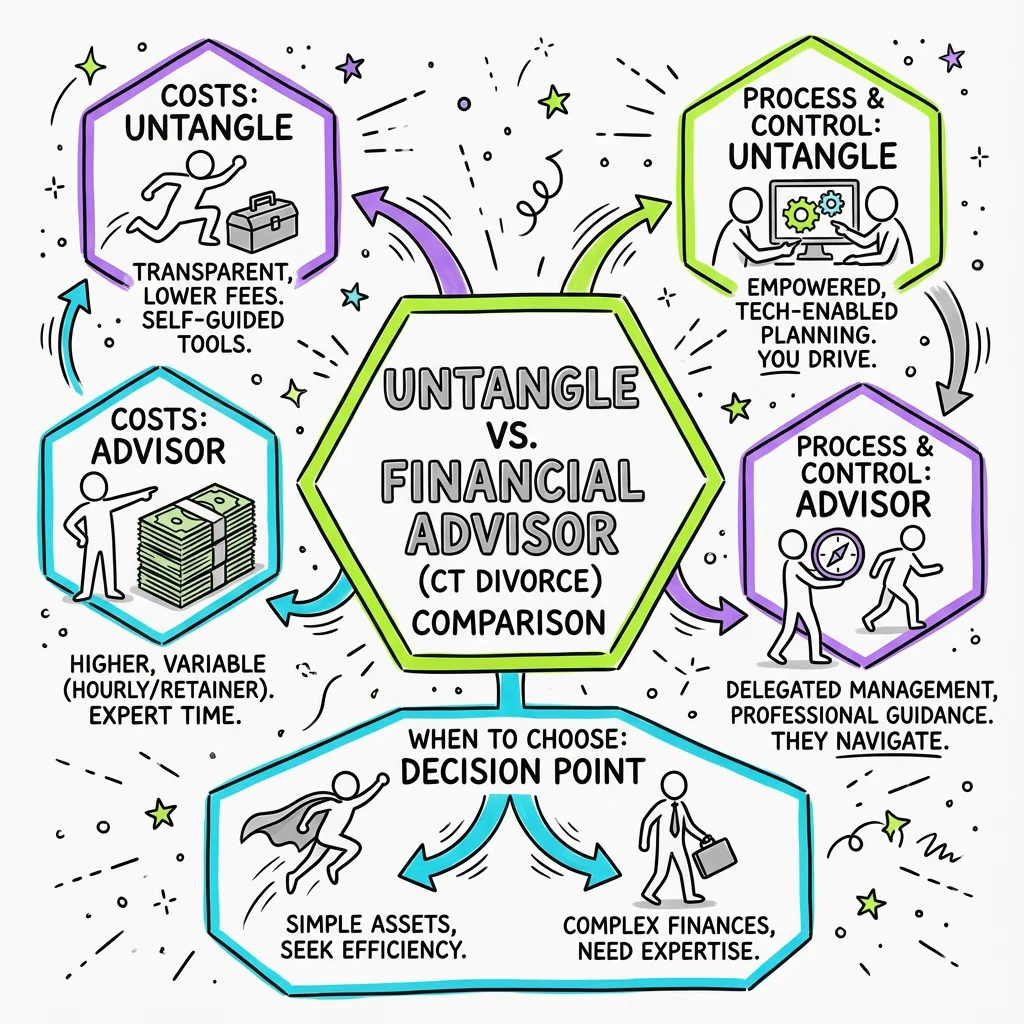

Untangle vs. Hiring a Financial Advisor for Divorce in Connecticut: A Complete Comparison

Compare Untangle's divorce planning tools with hiring a financial advisor for your Connecticut divorce. Learn costs, benefits, and when each option makes sense.

For most Connecticut divorces, Untangle provides the financial clarity you need at a fraction of the cost of a traditional financial advisor—typically saving thousands of dollars while offering the same core insights into asset division, expense tracking, and future financial projections. However, if you have complex assets like business ownership, stock options, or significant retirement accounts requiring expert valuation, a Certified Divorce Financial Analyst (CDFA) may be worth the investment. The good news is these options aren't mutually exclusive: many people use Untangle for day-to-day financial organization and bring in a specialist only for specific valuation questions.

Understanding Your Financial Obligations in Connecticut Divorce

Connecticut law requires extensive financial disclosure from both parties in any divorce proceeding. Under Practice Book Rule § 25-30, you must file sworn financial statements showing current income, expenses, assets, and liabilities at least five business days before any hearing involving alimony or support. These statements must be updated within 30 days before final judgment. This isn't optional—it's mandatory, and inaccuracies can have serious consequences for your case.

The scope of required disclosure goes even further under Practice Book Rule § 25-32, which mandates automatic exchange of three years of tax returns, W-2s and 1099s, 24 months of statements for all financial accounts, retirement plan summaries, real estate documents, and business records if applicable. Organizing and understanding all this information is where many divorcing spouses feel overwhelmed—and where the right tools or professional help become essential. Tools like Untangle's Smart bank statement analysis can automate the tedious process of categorizing transactions and understanding your spending.

Whether you choose Untangle, a financial advisor, or both, your goal is the same: to understand your complete financial picture so you can advocate effectively for a fair settlement. Connecticut courts consider numerous factors under C.G.S. § 46b-81 when dividing property, including each spouse's contribution to the marriage, earning capacity, age, health, and sources of income. Having your finances organized and clearly understood puts you in the strongest position.

What Untangle Offers for Divorce Financial Planning

Untangle is specifically designed for the divorce process, which means every feature addresses a real challenge you'll face. The platform helps you inventory and categorize all marital assets—bank accounts, retirement funds, real estate, vehicles, and personal property—while tracking which are marital versus separate property. This distinction matters enormously in Connecticut, where courts have broad discretion to divide the "estate of either spouse" under C.G.S. § 46b-81.

Beyond asset tracking, Untangle helps you build realistic post-divorce budgets by analyzing your current spending patterns and projecting future expenses. This is critical because alimony determinations under C.G.S. § 46b-82 depend heavily on each party's actual financial needs and the standard of living established during the marriage. When you can clearly demonstrate your monthly expenses and financial needs, you're better positioned to negotiate appropriate support. The platform's expense tracking tools pull from your actual spending history rather than requiring you to guess at budget categories.

The platform also generates the financial documentation Connecticut courts require. Creating accurate financial affidavits becomes straightforward when your financial data is already organized. For example, Untangle's Financial affidavit generation can help you prepare forms like the Short Form (JD-FM-006) for cases where neither party earns over $75,000 annually. Rather than scrambling to compile bank statements and estimate expenses before deadlines, you'll have everything at your fingertips.

What a Financial Advisor Brings to Divorce

A Certified Divorce Financial Analyst (CDFA) or similar professional offers expertise that goes beyond organization and calculation. Their primary value lies in complex asset valuation—determining the present value of pensions, stock options, deferred compensation, and business interests. In Czarzasty v. Czarzasty, the Connecticut Appellate Court addressed how unvested deferred compensation should be valued and divided, illustrating why expert analysis matters for these sophisticated assets.

Financial advisors also provide tax impact analysis that can significantly affect which assets you should prioritize. A $100,000 401(k) and $100,000 in a brokerage account might look equal on paper, but their after-tax values differ substantially. A CDFA can model various settlement scenarios to show you the long-term financial impact of different asset combinations, helping you avoid deals that look fair but leave you worse off.

Perhaps most valuably, a skilled financial advisor can serve as an expert witness if your case goes to trial. Under Practice Book Rule § 25-33, Connecticut courts may appoint expert witnesses, and parties frequently retain their own financial experts to testify about asset values or income analysis. In high-conflict cases like D.S. v. D.S., where one spouse's partnership interest in a major law firm required careful evaluation, expert financial testimony proved essential to achieving an equitable result.

Cost Comparison: Untangle vs. Financial Advisor

| Service | Typical Cost | Best For |

|---|---|---|

| Untangle | $15-50/month | Most divorces; asset organization; budget planning; financial affidavit preparation |

| CDFA (Limited Scope) | $1,500-3,000 | Specific valuation questions; pension division; one-time consultation |

| CDFA (Full Engagement) | $3,000-10,000+ | Complex estates; business ownership; trial preparation; ongoing support |

| Forensic Accountant | $5,000-25,000+ | Hidden assets; business valuation; income investigation |

The cost differential is significant, but so is understanding what you're paying for. Untangle's monthly subscription covers ongoing access to tools that help you organize documents, track expenses, model scenarios, and prepare court-required financial statements. A financial advisor's hourly rate (typically $150-400 in Connecticut) reflects professional expertise, liability coverage, and the ability to testify in court.

For a straightforward divorce with W-2 income, defined contribution retirement accounts, and clear asset ownership, Untangle provides everything most people need. When you add complexity—a family business, restricted stock units, carried interest, or suspicion that your spouse is hiding assets—professional expertise becomes increasingly valuable.

When Untangle Is the Right Choice

Untangle makes the most sense when your financial situation is relatively straightforward but you need help organizing and understanding it. This describes the majority of Connecticut divorces. If both spouses earn regular W-2 income, own a home with a mortgage, have standard retirement accounts (401(k)s, IRAs), and maintain typical bank and investment accounts, you likely don't need expensive professional analysis.

The platform excels at ongoing financial management throughout the divorce process, which can take many months. Connecticut's Pathways case management system under Practice Book Rule § 25-50A categorizes cases by complexity, with even simpler cases taking several months to resolve. During this time, you need to track expenses, comply with automatic court orders under Practice Book Rule § 25-5 (which prohibit dissipating assets), and prepare multiple financial disclosures. Tools like Untangle's Complete asset inventory can help you stay compliant and prepared by keeping all your financial data organized.

Untangle is also ideal if you're focused on reaching a negotiated settlement rather than litigating. Under C.G.S. § 46b-66, Connecticut courts review and incorporate settlement agreements into divorce decrees, but you need to understand your finances thoroughly to negotiate effectively. The platform helps you model different settlement scenarios—what if you keep the house? What if you accept more alimony in exchange for less property?—so you can make informed decisions at the negotiating table.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

When You Should Hire a Financial Advisor

Consider professional financial help if your divorce involves any of these complexities:

- Business ownership or self-employment income - Valuing a business requires expertise in multiple methodologies (asset-based, income-based, market-based) and understanding of goodwill, accounts receivable, and future earnings potential

- Stock options, RSUs, or deferred compensation - These assets require careful analysis of vesting schedules, tax implications, and present value calculations, as addressed in Czarzasty v. Czarzasty

- Pension plans requiring QDRO - Dividing defined benefit pensions involves complex actuarial calculations and legal requirements

- Suspected hidden assets or income - A forensic accountant can trace funds, analyze lifestyle inconsistencies, and uncover concealed wealth

- High-net-worth estates - When significant wealth is at stake, professional analysis can pay for itself many times over

The other clear indicator is if your case is headed for trial. Connecticut judges appreciate—and sometimes require—expert testimony on complex financial matters. If you're in a Track C case under the Pathways system (reserved for the most complex matters), professional financial support becomes increasingly important.

A Hybrid Approach: Using Both Strategically

Many Connecticut residents find the best value in combining Untangle's affordable ongoing tools with targeted professional consultations. This approach gives you the best of both worlds: daily financial organization and clarity from the platform, plus expert analysis for specific questions that require professional judgment.

Here's how this hybrid approach might work in practice: Untangle's asset inventory tools can help you compile and categorize all marital property. Run expense reports to understand your actual cost of living. Generate draft financial affidavits from your organized data. Then, if you have a pension that needs to be divided or stock options that need valuation, consult with a CDFA for just that specific analysis. You'll pay for perhaps 3-5 hours of professional time instead of a full engagement.

This strategy works particularly well for preliminary financial analysis before mediation or settlement conferences. You arrive prepared with comprehensive financial data from Untangle, and you've already consulted an expert about the one or two complex issues in your case. You understand both the big picture and the nuanced details, putting you in the strongest possible negotiating position.

Protecting Your Financial Interests During the Process

Regardless of which resources you use, Connecticut's automatic orders under Practice Book Rule § 25-5 impose strict requirements from the moment divorce papers are served. Neither spouse may transfer, encumber, conceal, or dispose of property without written consent or court permission. Violating these orders can result in contempt charges and adverse inferences about your character.

Tools like Untangle's Case details management help you document compliance with these orders and monitor your spouse's compliance as well. If assets disappear or accounts are depleted contrary to court orders, having clear records of balances at the time of filing becomes crucial. C.G.S. § 46b-80 provides prejudgment remedies to secure financial interests, but you need to identify problems quickly to take action.

Beyond compliance, protecting yourself means understanding what you're entitled to receive. Connecticut is an "all-property" state—the court can divide any asset owned by either spouse, regardless of whose name is on the title or when it was acquired. This broad authority under C.G.S. § 46b-81 means you need complete knowledge of all family assets. Whether through Untangle's systematic approach or a financial professional's investigation, make sure nothing falls through the cracks.

Practical Steps for Financial Clarity

- Gather all financial documents - Start with the mandatory disclosure list under Practice Book Rule § 25-32: tax returns, pay stubs, bank statements, retirement account statements, mortgage documents, and credit card statements

- Create a comprehensive asset inventory - List every account, property, vehicle, and valuable item; note current values and which spouse's name appears on each

- Calculate your actual monthly expenses - Review 6-12 months of spending to understand your true cost of living, not what you think you spend

- Identify complex assets requiring expert analysis - Flag business interests, stock options, pensions, or unusual investments for potential professional review

- Build post-divorce budget scenarios - Model your finances living on one income, with and without spousal support, in different housing situations

- Prepare your financial affidavit - Use your organized data to complete the Financial Affidavit Short Form (JD-FM-006) or long form accurately

Untangle's step-by-step guidance walks you through each of these stages, ensuring you don't miss critical information and helping you understand what each document reveals about your financial situation.

When to Seek Additional Professional Help

Even with excellent financial tools and analysis, some situations require professional legal or financial guidance beyond what any platform can provide. If your spouse has significantly more financial sophistication than you, if there's a history of financial control or abuse, or if you suspect dishonesty about income or assets, don't try to navigate alone.

Connecticut courts take financial disclosure seriously, and C.G.S. § 46b-81 gives judges broad discretion to craft equitable solutions. But the court can only work with the information presented. If you're unsure whether you're seeing the complete picture, a financial professional can help verify the numbers while an attorney ensures your rights are protected.

The goal isn't to spend more money than necessary—it's to achieve a fair outcome that protects your financial future. For most people, Untangle provides the organization and clarity needed to accomplish this goal affordably. For complex situations, strategic use of professional expertise ensures nothing is overlooked. Understanding where you fall on this spectrum is the first step toward financial confidence in your Connecticut divorce.

Frequently Asked Questions

Do I need a financial advisor during my Connecticut divorce?

Not necessarily—for most CT divorces, financial planning software like Untangle provides sufficient clarity for asset division and expense tracking, though complex situations involving business ownership or stock options may benefit from a Certified Divorce Financial Analyst.

How much does a Certified Divorce Financial Analyst (CDFA) cost in Connecticut?

CDFAs in Connecticut typically charge $150-$400 per hour or $1,500-$5,000+ for comprehensive divorce financial planning, which is significantly more than software solutions like Untangle.

Can I use both Untangle and a financial advisor for my divorce?

Yes, many Connecticut divorcing spouses use Untangle for day-to-day financial organization and expense tracking while bringing in a CDFA specialist only for specific complex valuation questions.

When should I hire a CDFA instead of using DIY divorce finance tools?

Consider hiring a CDFA when your Connecticut divorce involves complex assets like business ownership, stock options, significant retirement accounts, or other holdings that require expert valuation beyond what software can provide.

What financial documents are required for divorce in Connecticut?

Connecticut Practice Book Rules require sworn financial statements, three years of tax returns, W-2s and 1099s, 24 months of all financial account statements, retirement plan summaries, real estate documents, and business records if applicable.

Legal Citations

- • Practice Book Rule § 25-30 - Statements To Be Filed View Source

- • Practice Book Rule § 25-32 - Mandatory Disclosure and Production View Source

- • Practice Book Rule § 25-33 - Judicial Appointment of Expert Witnesses View Source

- • Practice Book Rule § 25-5 - Automatic Orders upon Service of Complaint View Source

- • Practice Book Rule § 25-50A - Case Management under Pathways View Source

- • C.G.S. § 46b-81 - Assignment of property and transfer of title View Source

- • C.G.S. § 46b-82 - Alimony View Source

- • C.G.S. § 46b-66 - Review of agreements; incorporation into decree View Source

- • C.G.S. § 46b-80 - Prejudgment remedies View Source

- • Czarzasty v. Czarzasty, 922 A.2d 272 (Conn. App. 2007) View Source

- • D.S. v. D.S., 217 Conn. App. 530 View Source

- • Financial Affidavit Short Form (JD-FM-006) View Source