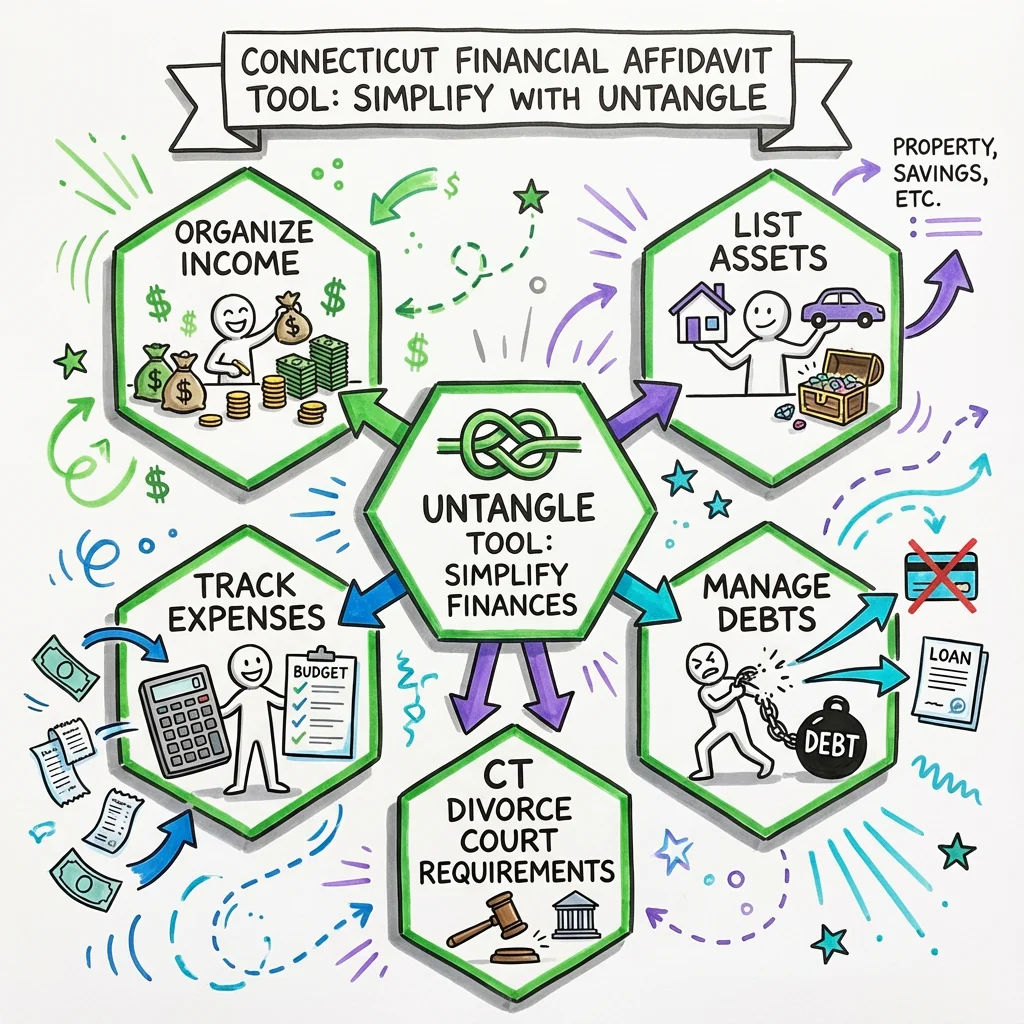

Connecticut Financial Affidavit Tool: Simplify Your Divorce Finances with Untangle

Learn how Untangle's financial affidavit tool helps you organize income, expenses, assets, and debts for Connecticut divorce court requirements.

Untangle's Financial Affidavit Tool helps you organize and prepare the financial information required for Connecticut divorce proceedings by guiding you through income, expenses, assets, and liabilities in a step-by-step format that aligns with court requirements. Instead of facing a confusing government form with dozens of line items, you can input your financial details through an intuitive interface that automatically calculates totals and ensures you don't miss critical information.

Why Financial Affidavits Matter in Connecticut Divorce

The financial affidavit is arguably the most important document in your Connecticut divorce case. Under Practice Book Rule § 25-30 (Statements To Be Filed), every party must file a sworn financial statement showing current income, expenses, assets, and liabilities at least five business days before any hearing involving alimony, child support, or property division. This isn't optional—courts rely on these sworn statements to make fair decisions about your financial future.

Connecticut judges use financial affidavits to determine everything from temporary support during your divorce (called pendente lite orders under C.G.S. § 46b-83) to final property division and alimony awards. Under C.G.S. § 46b-81, courts consider "the length of the marriage, the causes for the annulment, dissolution of the marriage or legal separation, the age, health, station, occupation, amount and sources of income, earning capacity, vocational skills, education, employability, estate, liabilities and needs of each of the parties." Your financial affidavit provides the evidence for nearly every one of these factors.

The stakes are high because inaccurate or incomplete financial affidavits can lead to unfair support orders, improper asset division, or even sanctions from the court. Many people understandably feel overwhelmed when they first see the multi-page government forms, which is exactly why tools that break down the process into manageable steps can be so valuable.

Understanding Connecticut's Two Financial Affidavit Forms

Connecticut uses two different financial affidavit forms depending on your financial circumstances. Choosing the correct form is essential—filing the wrong one can delay your case and require you to start over.

Short Form Financial Affidavit (JD-FM-006-Short)

The Short Form Financial Affidavit (JD-FM-006-Short) is designed for cases where neither party's gross income exceeds $75,000 per year AND total assets (excluding your home) are less than $75,000. This streamlined version covers the basics: weekly income from all sources, weekly expenses, and a simplified list of assets and debts. If you qualify to use this form, your preparation process will be somewhat simpler, though accuracy remains critical.

While simpler, the short form still carries the same legal weight as the long form. It requires you to calculate weekly averages for your income and expenses, which can be tricky if you are paid bi-weekly or have irregular bills. The key is to ensure that the snapshot provided by this form accurately reflects your standard of living, as the court will use these specific weekly figures to calculate support guidelines.

Long Form Financial Affidavit (JD-FM-006-Long)

The Long Form Financial Affidavit (JD-FM-006-Long) is required when either spouse earns more than $75,000 annually or when combined assets exceed $75,000. This comprehensive document requires detailed breakdowns of income (including bonuses, commissions, and investment returns), extensive expense categories, and complete asset and liability schedules. The long form can feel overwhelming because it asks for information many people don't have at their fingertips—like the exact cash value of life insurance policies or the current balance of retirement accounts.

This form includes specific schedules for business income, rental property details, and deferred compensation plans. You will often need to dig deeper into your records to find cost basis information for investments and detailed balances for all liabilities. Because of its complexity, the Long Form is where most discrepancies occur, often leading to contentious cross-examination if the numbers don't add up correctly or match your provided documentation.

| Form Type | Income Threshold | Asset Threshold | Complexity Level |

|---|---|---|---|

| Short Form (JD-FM-006-Short) | Neither party exceeds $75,000/year | Under $75,000 total | Simplified |

| Long Form (JD-FM-006-Long) | Either party exceeds $75,000/year | Over $75,000 total | Comprehensive |

How Untangle's Financial Affidavit Tool Helps

Untangle's step-by-step financial organization features transform what feels like an impossible task into a manageable process. Rather than staring at a blank government form wondering where to start, you answer guided questions that automatically populate the appropriate sections.

Income Organization Made Simple

The tool walks you through every potential income source—not just your salary, but also bonuses, overtime, self-employment income, rental income, dividends, and other categories that are easy to forget. For those with variable income (common for commission-based workers or business owners), the tool helps you calculate appropriate averages that courts will find reasonable. Tools like Untangle's Income source tracking can help you meticulously document every income stream, ensuring nothing is missed.

Many people don't realize that Connecticut courts look at "gross income" differently than what appears on your paycheck. The tool helps you understand which deductions count and which don't, preventing common errors that can make you look like you're hiding income—or accidentally understating what you earn.

Expense Tracking That Catches Everything

Perhaps the most anxiety-inducing part of the financial affidavit is listing your weekly expenses. Untangle's expense tracking features prompt you for categories you might forget: car maintenance, medical co-pays, clothing, personal care items, and more. Underreporting expenses can hurt you in support calculations, while overreporting can damage your credibility with the court.

The tool also helps you convert monthly or annual expenses into the weekly amounts the form requires. This sounds simple, but converting a $1,200 annual car insurance payment into a weekly figure while also remembering to include quarterly property taxes requires careful math that's easy to get wrong when you're stressed.

Asset and Debt Inventory

Under Connecticut's equitable distribution laws, courts can assign "all or any part of the estate of the other spouse" when dividing property (C.G.S. § 46b-81). This means every asset matters—including retirement accounts you haven't touched in years, the value of your vehicle, and even personal property with significant value. Untangle's asset tracking tools help you create a comprehensive inventory that protects your interests. And to ensure all your obligations are accounted for, Untangle's debt tracking features help you list every outstanding balance.

The same thorough approach applies to debts. Credit cards, mortgages, car loans, student loans, personal loans, and medical debt all need to be listed. Missing a debt can create problems later if the court's orders don't account for obligations you're legally responsible for paying.

What Information You'll Need to Gather

Before using any financial affidavit tool, gathering your financial documents will make the process smoother and more accurate. Tools like Untangle's Smart bank statement analysis can help automate the tedious process of categorizing transactions and calculating averages from your bank records. Practice Book Rule § 25-32 (Mandatory Disclosure and Production) requires automatic disclosure of extensive financial documentation anyway, so this preparation serves double duty.

Income Documentation Checklist

- Pay stubs - Current year plus the last pay stub from the prior year

- Tax returns - Federal and state returns for the past three years, including all schedules

- W-2s and 1099s - For the past three years

- Business records - If self-employed, profit and loss statements and K-1 forms

- Other income proof - Social Security statements, pension information, rental income records

Asset Documentation Checklist

- Bank statements - All accounts for the past 24 months

- Investment account statements - Brokerage accounts, retirement accounts (401k, IRA, pension)

- Real estate documents - Deeds, mortgage statements, recent appraisals or tax assessments

- Vehicle information - Titles, registration, loan statements, current values

- Insurance policies - Life insurance with cash value, annuities

- Business valuations - If you own a business, any formal or informal valuations

Debt Documentation Checklist

- Mortgage statements - Including any home equity lines of credit

- Credit card statements - Current balances for all cards

- Loan documents - Auto loans, student loans, personal loans

- Tax obligations - Any owed taxes to IRS or state

- Other debts - Medical bills, judgments, family loans

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Common Financial Affidavit Mistakes to Avoid

Errors on financial affidavits can have serious consequences. Courts have modified judgments and imposed sanctions when parties submit inaccurate information. The case of Zakko v. Kasir, 223 Conn. App. 205 demonstrates how financial disputes can lead to years of litigation when original affidavits don't accurately reflect the parties' circumstances.

Underestimating Income

Some people unconsciously minimize their income because they're worried about paying more support. This backfires badly when opposing counsel subpoenas tax returns and bank statements that tell a different story. Be thorough and honest—include all income sources, even irregular ones.

Forgetting Hidden Assets

Retirement accounts, stock options, deferred compensation, and life insurance cash values are frequently overlooked. These assets are often significant and absolutely count toward the marital estate. The court will eventually discover them through mandatory disclosure requirements, so omitting them only damages your credibility.

Overstating Expenses

While you want to ensure all legitimate expenses are captured, inflating numbers or including expenses that aren't really yours destroys trust with the court. Judges review hundreds of these forms and can spot unrealistic claims. Be accurate, and let the numbers speak for themselves.

Mathematical Errors

Simple addition mistakes happen when you're stressed and juggling dozens of numbers. This is where Untangle's automatic calculation features provide peace of mind—the tool handles the math so you can focus on entering accurate information.

Timeline for Filing Your Financial Affidavit

Understanding when your financial affidavit is due helps you plan your preparation time. Connecticut courts are strict about these deadlines.

| Event | Filing Requirement |

|---|---|

| Any support/alimony hearing | At least 5 business days before the hearing |

| Case scheduled for final hearing | Updated affidavit required |

| Within 30 days before judgment | Both parties must file updated sworn statements |

| Post-judgment modifications | New affidavit required with modification motion |

For contested cases, you may need to update your financial affidavit multiple times as your case progresses through the court system. Under Practice Book Rule § 25-50A (Case Management under Pathways), cases are assigned to tracks based on complexity, and more complex cases (Track C) may require more frequent updates over a longer timeframe.

Protecting Your Financial Privacy

Understandably, many people worry about having their detailed financial information become public record. Practice Book Rule § 25-59A (Sealing Files or Limiting Disclosure) addresses this concern, though it sets a high bar for sealing financial documents. Courts presume that filed documents are public, and parties' agreement alone isn't enough to seal records—you must show that sealing is necessary to protect an "overriding interest."

That said, certain sensitive information may qualify for protection. If you have legitimate privacy concerns about specific financial details, discuss sealing options with an attorney. In the meantime, Untangle's secure platform keeps your financial information protected while you're preparing your documents, with privacy controls that let you decide what to share and when.

When to Seek Professional Help

While tools like Untangle's financial affidavit preparation features can handle straightforward situations effectively, some circumstances warrant professional assistance:

- Complex business ownership - If you or your spouse owns a business, professional valuation may be necessary

- Significant assets - High-net-worth divorces often benefit from forensic accountants

- Suspected hidden assets - If you believe your spouse is hiding money, an attorney can subpoena records

- Self-employment complications - Variable income requires careful documentation and presentation

- International assets - Foreign accounts and property add complexity

Even if you ultimately hire professionals, starting with organized financial information saves time and money. Many attorneys appreciate clients who come prepared with their finances already sorted—it allows the attorney to focus on strategy rather than basic data gathering.

Frequently Asked Questions

What documents do I need to complete a Connecticut financial affidavit?

You'll need recent pay stubs, tax returns, bank statements, mortgage statements, credit card bills, and documentation of all income sources, assets, and debts to accurately complete your CT financial affidavit.

When do I have to file my financial affidavit in a Connecticut divorce?

Under Connecticut Practice Book Rule § 25-30, you must file your sworn financial affidavit at least five business days before any hearing involving alimony, child support, or property division.

Is the Untangle financial affidavit tool free to use?

Untangle offers a financial affidavit tool that guides you through organizing your divorce finances step-by-step, though you should check their website for current pricing and available features.

What happens if I make a mistake on my Connecticut divorce financial affidavit?

Inaccurate or incomplete financial affidavits can result in unfair support orders, improper asset division, or court sanctions, so it's critical to review your information carefully before filing.

How does Untangle's financial affidavit tool help with Connecticut divorce requirements?

Untangle's tool walks you through income, expenses, assets, and liabilities in an intuitive interface that automatically calculates totals and aligns with Connecticut court requirements.

Legal Citations

- • Practice Book Rule § 25-30 (Statements To Be Filed) View Source

- • Practice Book Rule § 25-32 (Mandatory Disclosure and Production) View Source

- • Zakko v. Kasir, 223 Conn. App. 205 View Source

- • Practice Book Rule § 25-50A (Case Management under Pathways) View Source

- • Practice Book Rule § 25-59A (Sealing Files or Limiting Disclosure) View Source

- • Short Form Financial Affidavit (JD-FM-006-Short) View Source

- • Long Form Financial Affidavit (JD-FM-006-Long) View Source