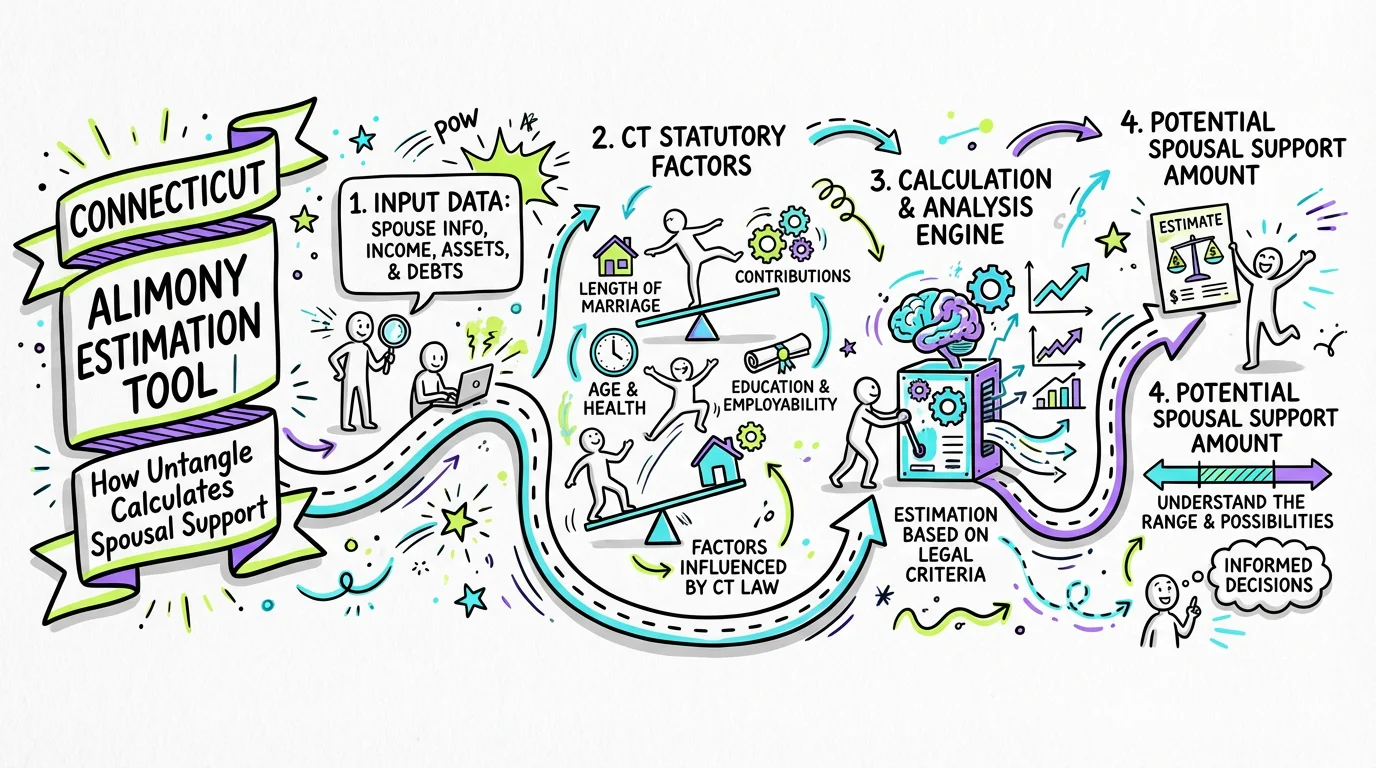

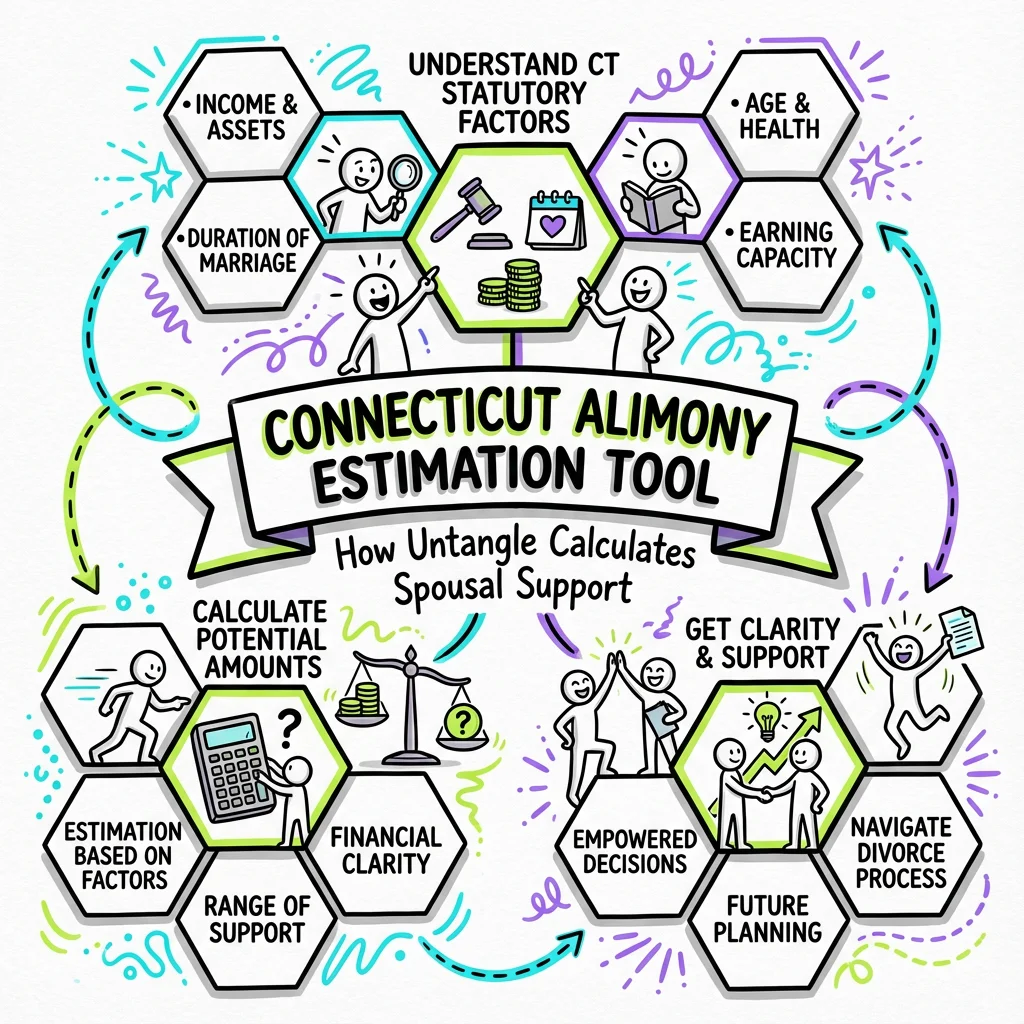

Connecticut Alimony Estimation Tool | How Untangle Calculates Spousal Support

Learn how Untangle's alimony estimation tool helps Connecticut spouses understand potential spousal support amounts based on CT statutory factors.

Untangle's alimony estimation tool helps Connecticut spouses—especially those who have been financially dependent during marriage—understand what spousal support they might receive based on the statutory factors courts actually use. The tool analyzes your specific financial situation, marriage length, and other key variables to provide a personalized estimate that helps you plan for your financial future during and after divorce.

How Connecticut Courts Determine Alimony

Connecticut does not use a fixed formula for calculating alimony, which is why having an estimation tool that considers all relevant factors is so valuable. Under C.G.S. § 46b-82, judges must weigh multiple considerations when determining whether to award alimony and in what amount. This discretionary approach means that two marriages with similar incomes could result in very different support awards based on other circumstances.

The statute specifically directs courts to consider the length of the marriage, the causes for dissolution, the age, health, station, occupation, amount and sources of income, earning capacity, vocational skills, education, employability, estate, and needs of each party. For stay-at-home spouses, the court also evaluates the extent to which one party's earning capacity, assets, or financial ability was affected by foregoing or delaying education, training, employment, or career opportunities during the marriage.

This comprehensive approach recognizes that a spouse who put their career on hold to support the family made real economic sacrifices that should be addressed through spousal support. Connecticut courts have consistently held that both spouses should share equitably in the economic resources accumulated during the marriage.

What Untangle's Alimony Estimation Tool Analyzes

Untangle's Alimony calculator processes the same factors Connecticut judges consider, giving you a realistic preview of potential support scenarios. The tool collects information about both spouses' incomes, the length of your marriage, your educational background, work history, and current employability to generate estimates that reflect how Connecticut courts typically approach these cases.

Income and Earning Capacity Assessment

The tool examines current income sources for both spouses, including wages, bonuses, investment income, and any other regular earnings. For the higher-earning spouse, this establishes the ability to pay support. For the financially dependent spouse, this helps identify the income gap that alimony might bridge.

Critically, the tool also considers earning capacity—what you could reasonably earn, not just what you currently earn. If you've been out of the workforce caring for children, the tool helps estimate realistic re-entry salaries based on your education and previous experience. Connecticut courts routinely consider earning capacity in their analysis, as confirmed in cases like Ayres v. Ayres, 193 Conn. App. 224, where the court examined income calculations including base pay and performance-based bonuses.

Marriage Duration Impact

Marriage length significantly affects both the amount and duration of alimony in Connecticut. Generally, longer marriages result in longer support periods, sometimes even permanent alimony for marriages lasting 20+ years. Untangle's tool categorizes your marriage duration and adjusts estimates accordingly:

| Marriage Length | Typical Alimony Approach |

|---|---|

| Under 5 years | Short-term or rehabilitative support |

| 5-10 years | Moderate duration support |

| 10-20 years | Longer-term support possible |

| 20+ years | Permanent alimony more common |

The tool provides duration estimates alongside monthly amounts, helping you understand the total financial picture rather than just a monthly number.

Understanding Temporary vs. Permanent Alimony

Connecticut recognizes different types of alimony, and Untangle's tool helps you understand which might apply to your situation. Under C.G.S. § 46b-83, courts can award "alimony pendente lite"—temporary support during the divorce proceedings—to ensure the financially dependent spouse can meet basic needs while the case proceeds.

Pendente Lite (Temporary) Support

Temporary alimony begins shortly after filing and continues until the final divorce decree. This support helps maintain the status quo during litigation, ensuring both spouses can cover living expenses, hire attorneys, and participate fully in the divorce process. The tool can help you estimate what temporary support might look like based on current household expenses and income disparity.

For stay-at-home spouses, temporary alimony is often critical for basic survival during the divorce process. You may need to file an application for temporary support accompanied by an affidavit on the court-prescribed form. Tools like Untangle's Financial affidavit generation can help you prepare the financial information needed for these crucial filings.

Final Alimony Awards

The final alimony order comes as part of the divorce decree and may differ significantly from temporary support. Courts consider a broader range of factors for final awards, including the total property division and each spouse's post-divorce financial picture. Unlike temporary support, which focuses primarily on maintaining the status quo, the final alimony award is intertwined with the equitable distribution of assets. A spouse receiving a larger share of liquid assets or the marital home might receive less alimony, while a spouse receiving fewer assets might be awarded more support to balance the outcome.

Additionally, the final decree aims to provide closure and a roadmap for the future. The court may structure alimony with step-downs—where amounts decrease over time—or set specific conditions for termination, such as cohabitation or remarriage. The estimation tool helps you model different scenarios, showing how various property division outcomes might affect your alimony expectations and total financial stability.

The Financial Affidavit: Foundation for Any Estimate

Any alimony estimate—whether from Untangle's tool or in court—depends on accurate financial information. Connecticut Practice Book Rule § 25-30 - Statements To Be Filed requires both parties to file sworn financial statements at least five business days before any hearing on alimony. These statements must follow the Judicial Branch's prescribed format and detail current income, expenses, assets, and liabilities.

The Financial Affidavit Long Form (JD-FM-006-Long) is the official document you'll need to complete. Untangle's estimation tool walks you through the same categories, so completing it doubles as preparation for this mandatory court filing. Getting accurate numbers now means your estimates will closely match what the court sees later. To efficiently gather and organize all the required financial data for your affidavit, features like Untangle's Expense tracking with AI can be incredibly helpful.

What Information You'll Need

To use the alimony estimation tool effectively, gather the following:

- Income documentation for both spouses (pay stubs, tax returns, W-2s)

- Monthly expenses for housing, utilities, food, transportation, healthcare, and childcare

- Asset information including bank accounts, retirement funds, and real estate

- Debt obligations such as mortgages, car loans, credit cards, and student loans

- Employment history and educational credentials for both spouses

Connecticut Practice Book Rule § 25-32 - Mandatory Disclosure and Production requires automatic disclosure of tax returns, pay stubs, and financial account statements during divorce proceedings. Starting to organize these documents early streamlines both your estimation process and your eventual court requirements.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

How to Interpret Your Alimony Estimate

The numbers Untangle provides represent a range of likely outcomes based on how Connecticut courts have handled similar cases. Because alimony remains discretionary, your actual award could fall anywhere within this range—or occasionally outside it if your circumstances include unusual factors.

Understanding the Range

Rather than providing a single number, Untangle's tool typically shows low, middle, and high estimates. The low estimate reflects what you might receive if the court weighs factors less favorably; the high estimate reflects a more favorable interpretation. Most outcomes fall near the middle of the range.

For stay-at-home spouses, several factors often push toward higher awards: significant income disparity, longer marriage duration, health issues that limit employability, and clear evidence of career sacrifice to support the family. Factors that might reduce awards include the dependent spouse's strong earning potential, substantial property division that provides financial security, or misconduct during the marriage.

Planning with Your Estimate

Use your alimony estimate as one piece of your post-divorce financial planning puzzle. When incorporating these estimates into your broader strategy, look beyond the immediate monthly cash flow. Consider tax implications, as alimony is no longer deductible for the payer or taxable to the receiver for federal purposes (for divorces finalized after 2018). This change significantly impacts the real value of every dollar exchanged.

Also, evaluate how alimony interacts with other financial goals, such as retirement savings or funding a child's education. If the estimate falls short of your needs, you may need to prioritize assets that generate income or reduce expenses, like a paid-off home, during the property division negotiations.

- How does this estimate compare to your projected monthly expenses?

- What income gap remains, and how will you fill it?

- If alimony is time-limited, what steps will you take to increase your earning capacity?

- How does the estimate affect your goals for property division?

Tools like Untangle's Case details management help you model these scenarios, showing how different combinations of property division and alimony create different financial futures.

Modifying Alimony After Divorce

Understanding that alimony can be modified provides important context for your estimate. Under C.G.S. § 46b-86, Connecticut courts can modify alimony upon a showing of substantial change in circumstances for either party. This means your initial award isn't necessarily permanent—it can increase if your needs grow or decrease if the paying spouse's ability to pay diminishes.

However, some separation agreements include provisions that limit or preclude modification. The statute specifically notes that modification rights exist "unless and to the extent that the decree precludes modification." When reviewing any proposed settlement, pay careful attention to whether you're waiving future modification rights.

For stay-at-home spouses planning to re-enter the workforce, understanding modification is especially important. As your income increases, the paying spouse might seek to reduce alimony. Conversely, if you face unexpected challenges—health issues, job market changes, or other circumstances—you retain the right to seek increased support absent a waiver in your agreement.

When to Seek Professional Help

While Untangle's alimony estimation tool provides valuable guidance, certain situations call for professional legal advice. Complex financial situations—business ownership, significant assets, or income from multiple sources—may require expert analysis that goes beyond what any estimation tool can provide.

If your spouse has been hiding assets, manipulating income, or otherwise complicating the financial picture, you'll want an attorney who can pursue forensic accounting and aggressive discovery. Similarly, if there's significant disagreement about the facts underlying any estimate, professional help becomes essential.

For stay-at-home spouses feeling overwhelmed by the financial complexity of divorce, remember that Connecticut courts are experienced in protecting economically vulnerable parties. Your legitimate need for support is recognized in the law, and tools like Untangle's Personalized task dashboard can help you understand your rights and prepare to advocate for yourself effectively. The goal is empowering you with knowledge so you can make informed decisions about your future—whether that means negotiating a fair settlement or pursuing your rights in court.

Frequently Asked Questions

How accurate are online alimony calculators for Connecticut divorces?

Online alimony calculators provide helpful estimates, but because Connecticut uses judicial discretion rather than a fixed formula under C.G.S. § 46b-82, actual awards can vary significantly based on your specific circumstances and the judge assigned to your case.

What factors does CT use to calculate alimony payments?

Connecticut courts consider marriage length, each spouse's income and earning capacity, age, health, education, vocational skills, career sacrifices made during marriage, and the overall needs of each party when determining alimony awards.

How much does Untangle's divorce app cost?

Untangle offers a free alimony estimation tool that analyzes your financial situation using the same statutory factors Connecticut judges consider, with additional planning features available through the app.

Can stay-at-home spouses get alimony in Connecticut?

Yes, Connecticut law specifically directs courts to evaluate how a spouse's earning capacity was affected by foregoing education, training, or career opportunities during marriage, which often supports alimony awards for stay-at-home spouses.

How do I estimate my spousal support payments in CT?

You can use Untangle's alimony estimation tool, which processes your marriage length, income disparity, career sacrifices, and other statutory factors to provide a personalized estimate of potential spousal support.

Legal Citations

- • Ayres v. Ayres, 193 Conn. App. 224 View Source

- • Connecticut Practice Book Rule § 25-30 - Statements To Be Filed View Source

- • Financial Affidavit Long Form (JD-FM-006-Long) View Source

- • Connecticut Practice Book Rule § 25-32 - Mandatory Disclosure and Production View Source