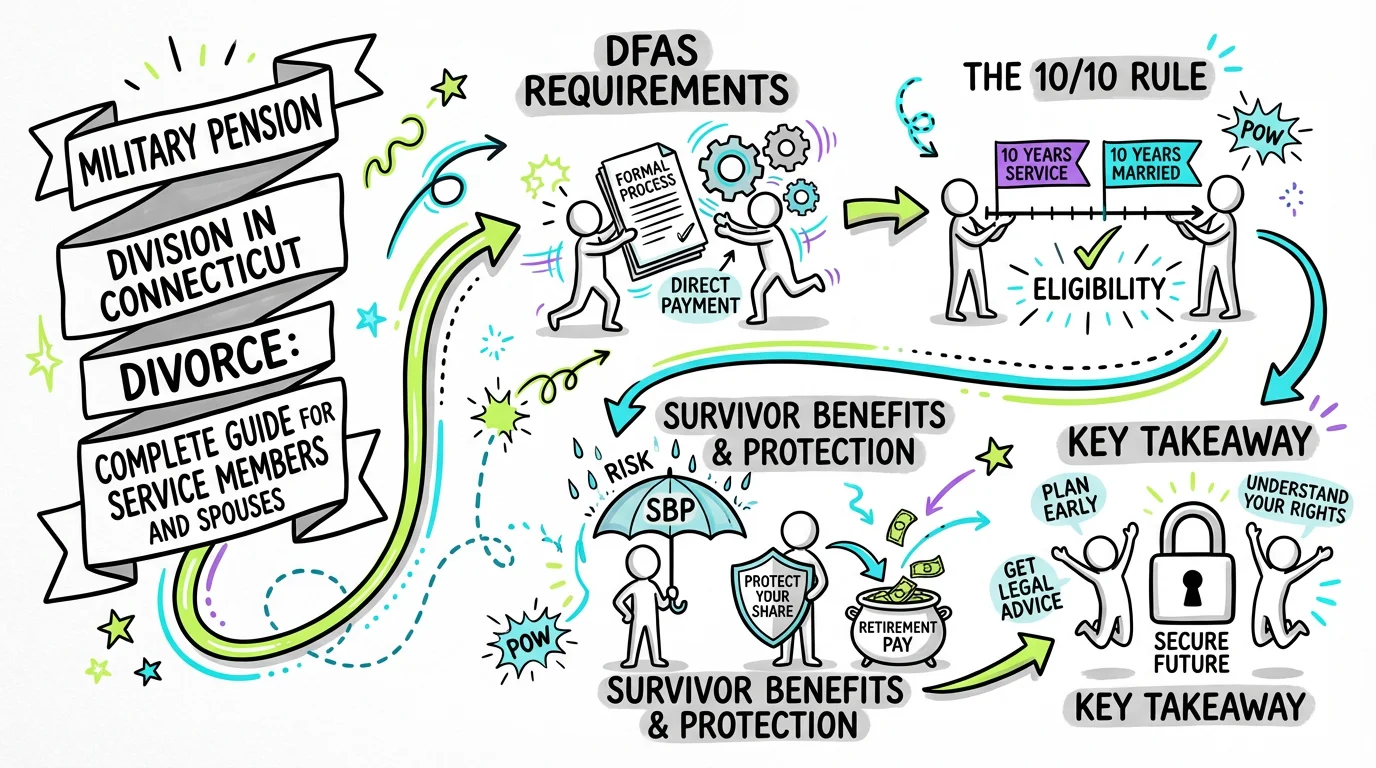

Military Pension Division in Connecticut Divorce: Complete Guide for Service Members and Spouses

Learn how military pensions are divided in Connecticut divorce, including DFAS requirements, the 10/10 rule, survivor benefits, and protecting your share of retirement pay.

Military pensions are divisible marital property in Connecticut divorce cases, but dividing them requires navigating both state law and federal regulations that apply exclusively to military benefits. Under Connecticut General Statutes § 46b-81, courts have broad authority to assign "all or any part of the estate of the other spouse," which includes military retirement benefits earned during the marriage. However, the federal Uniformed Services Former Spouses' Protection Act (USFSPA) governs how and when the Defense Finance and Accounting Service (DFAS) will directly pay a former spouse, creating a complex intersection of state and federal law that military families must carefully navigate.

Understanding Military Pensions as Marital Property in Connecticut

Connecticut courts consistently treat military pensions as property subject to equitable distribution rather than as income for alimony purposes. This distinction is crucial because it affects how the pension's value is calculated and divided. In the landmark case Dinunzio v. Dinunzio, the Connecticut Appellate Court reversed a trial court decision that had improperly treated a military pension as income, emphasizing that military retirement benefits must be classified as divisible marital property.

The "marital portion" of a military pension—the part subject to division—typically includes only the benefits earned during the marriage. If a service member served for 10 years before marriage and 10 years during the marriage, only half the pension would potentially be divisible. Connecticut courts use various methods to calculate this portion, most commonly the "coverture fraction," which divides the months of marriage overlapping with military service by the total months of creditable service.

Understanding this classification matters because it determines what happens to the benefit. As property, the pension's value can be offset against other assets, divided directly, or factored into the overall equitable distribution. Tools like Untangle's spouse financial comparison can help you understand how different division scenarios might affect your overall settlement compared to keeping other assets like real estate.

The 10/10 Rule and Direct Payment from DFAS

The USFSPA's "10/10 rule" creates one of the most misunderstood aspects of military pension division. This rule states that DFAS will only make direct payments to a former spouse if the marriage overlapped with at least 10 years of creditable military service. Critically, this is not a requirement for division—it only determines the payment mechanism. A court can still order a service member to pay a share of the pension even if the marriage lasted only a few years.

If your marriage meets the 10/10 threshold, DFAS can send pension payments directly to the former spouse, making enforcement straightforward. If the marriage was shorter, the service member remains legally obligated to pay the former spouse's share, but enforcement becomes more challenging because you must rely on the service member's compliance or pursue contempt proceedings in state court. This distinction often influences settlement negotiations, as the security of direct payment has tangible value.

Even with direct DFAS payment, the maximum payable to a former spouse is generally 50% of disposable retired pay (or up to 65% when combined with child support or alimony garnishments). "Disposable retired pay" excludes certain amounts like disability pay, which can significantly reduce the divisible amount—a complication that requires careful calculation during the divorce process.

How Connecticut Courts Value and Divide Military Pensions

Connecticut follows equitable distribution principles under C.G.S. § 46b-81, meaning courts divide property fairly but not necessarily equally. When valuing military pensions, courts consider multiple factors including the service member's rank, years of service, and projected retirement date. The Connecticut Supreme Court in Bender v. Bender established important principles for dividing pensions that continue to guide courts today.

Present Value vs. Deferred Distribution

Courts typically use one of two approaches to divide military pensions:

| Method | How It Works | Best For |

|---|---|---|

| Present Value | Pension is valued today; non-military spouse receives equivalent assets now | Cases with sufficient liquid assets; when clean break is preferred |

| Deferred Distribution | Non-military spouse receives percentage of each payment when service member retires | Cases with limited assets; when pension is primary asset |

| Reserved Jurisdiction | Court retains authority to divide later when pension matures | Active duty members far from retirement |

The deferred distribution method is most common because military pensions often represent the largest marital asset, and other assets may be insufficient for an offset. Under this approach, the court order specifies a formula—typically using the coverture fraction—that determines the former spouse's share of each monthly payment.

The Frozen Benefit Rule

Former spouses should be aware of the "frozen benefit rule," mandated by the National Defense Authorization Act (NDAA) of 2017. This federal law requires that the disposable retired pay available for division be determined based on the service member's rank and years of service at the time of the divorce decree, not at the time of actual retirement. This is a significant departure from previous rules where the former spouse often benefited from the service member's career progression post-divorce.

Practically, this means that if a Captain divorces after 15 years of service but retires 10 years later as a Colonel, the former spouse's share is calculated as if the member retired as a Captain with 15 years of service. While Cost of Living Adjustments (COLAs) are typically included in the former spouse's share, the value added by subsequent promotions and longevity raises belongs exclusively to the service member.

Because of this rule, divorce decrees must be drafted with specific language defining the "high-3" base pay at the time of divorce. Failure to include the correct data points—such as the service member's high-3 amount and years of service on the date of divorce—can lead to DFAS rejecting the order or miscalculating the benefit, potentially resulting in years of underpayment to the former spouse.

Disability Pay, Survivor Benefits, and Other Complications

Military pension division involves several complicating factors that don't apply to civilian retirement accounts. Understanding these issues upfront can prevent costly surprises later.

VA Disability Offset

One of the most significant issues involves Veterans Administration disability compensation. When a retiree waives a portion of retired pay to receive VA disability benefits (which are tax-free), the former spouse's share decreases because disability pay is not divisible property. This can substantially reduce what a former spouse actually receives, even when the divorce decree awards a specific percentage.

Some service members elect Combat-Related Special Compensation (CRSC) or Concurrent Retirement and Disability Pay (CRDP) after divorce, which can further complicate matters. Careful drafting of the court order can help protect against some of these reductions, but complete protection isn't always possible under current federal law. In some cases, courts may order indemnification, requiring the service member to make up the difference if their disability election reduces the former spouse's awarded share.

Survivor Benefit Plan (SBP)

The Survivor Benefit Plan provides continued payments to a former spouse if the service member dies first—but it requires affirmative election and premium payments. Without SBP coverage, the former spouse's pension share ends at the service member's death. Connecticut courts have authority to order SBP coverage as part of the divorce decree, and this should be explicitly addressed in any military divorce settlement.

The deadline for electing former spouse SBP coverage is one year from the divorce, making timely action essential. Missing this deadline can permanently forfeit valuable survivor protection. The order must clarify who pays the premiums—often deducted directly from the retirement pay—and must be sent to DFAS promptly to be effective.

Drafting the Military Pension Division Order

Proper drafting of the court order dividing a military pension is critical—DFAS rejects thousands of orders annually due to technical deficiencies. Unlike civilian retirement plans that accept Qualified Domestic Relations Orders (QDROs), military pensions require orders that comply with specific DFAS requirements.

Essential Elements for DFAS Acceptance

A proper military pension division order must include:

- The service member's full name and Social Security number - DFAS uses this for identification

- Clear identification of the military branch - Army, Navy, Air Force, Marines, Coast Guard, or Space Force

- Specific award language - Percentage or formula for calculating the former spouse's share

- Treatment of COLAs - Whether cost-of-living adjustments apply to the former spouse's share

- Disability waiver provisions - How to handle potential disability conversions

- SBP election requirements - Coverage specifications and premium responsibility

The Wald v. Cortland-Wald case illustrates how military benefits can be addressed in Connecticut divorce agreements, including creative provisions like transferring G.I. Bill benefits. Working with an attorney experienced in military divorce is strongly recommended given these technical requirements.

Using Untangle's case details management can help you keep track of all the financial disclosures and pension statements needed to properly value and divide military retirement benefits and ensure no required document is lost in the shuffle.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Financial Disclosure Requirements in Connecticut

Connecticut Practice Book Rule § 25-30 requires both parties to file sworn financial statements showing income, expenses, assets, and liabilities. For military pension division, this means the service member must disclose their most recent Leave and Earnings Statement (LES), retirement point statements (for reservists), and any retirement benefit estimates.

Rule § 25-32 mandates automatic disclosure of tax returns, pay stubs, and financial account statements going back 24 months. Military-specific documents that should be exchanged include:

- Military retirement benefit estimates from DFAS or the service's finance center

- Complete service records showing dates of service and creditable time

- Any disability ratings or pending disability claims

- Current LES showing all pay, allowances, and deductions

- SBP election documents if already retired

Gathering these documents early in the process helps ensure accurate valuation. Untangle's financial affidavit generation tools can help you organize this information and prepare the required Financial Affidavit that Connecticut courts require for every dissolution action.

Steps for Dividing a Military Pension in Connecticut Divorce

Navigating military pension division requires careful attention to both state and federal procedures. Following these steps can help ensure you receive (or pay) the correct amount:

- Gather service records and pension estimates - Request a retirement benefit estimate from the appropriate military finance center showing projected retirement pay based on current rank and service

- Calculate the marital portion - Determine what percentage of the pension was earned during the marriage using the coverture fraction

- Decide on division method - Work with your attorney to determine whether present value offset or deferred distribution makes more sense for your situation

- Address survivor benefits - Negotiate SBP coverage and determine who pays the premiums

- Draft DFAS-compliant language - Ensure your divorce decree or separation agreement contains all required elements for DFAS acceptance

- File with DFAS after divorce - Submit the certified court order along with required application forms to DFAS within applicable deadlines

- Monitor for changes - Watch for disability elections or other post-divorce changes that could affect payments

Timeline and Cost Considerations

| Item | Typical Range | Notes |

|---|---|---|

| Pension valuation | $500-$2,000 | May need actuary for present value calculations |

| Attorney fees for military divorce | $5,000-$25,000+ | Complexity varies significantly |

| DFAS processing time | 60-90 days | After receiving compliant order |

| SBP election deadline | 1 year from divorce | Critical deadline—cannot be extended |

| Connecticut divorce timeline | 3-12 months | Depends on contested issues |

The financial and emotional complexity of military divorce often makes it more time-consuming than civilian cases. In addition to standard procedural delays, the Servicemembers Civil Relief Act (SCRA) allows active duty members to stay (pause) court proceedings if their military service, such as a deployment, prevents them from participating. This can extend the timeline significantly, potentially pausing the divorce for the duration of a deployment plus an additional 90 days.

However, for non-deployed members, Connecticut's Practice Book Rule § 25-50A establishes a case management system that helps move cases along. Through scheduled court dates and required status conferences, the court ensures that financial discovery—including the crucial pension valuations—occurs on a set schedule, preventing cases from languishing indefinitely due to inaction.

When to Seek Professional Help

Military pension division is one area where professional guidance is particularly valuable. The intersection of federal military law with Connecticut family law creates unique challenges that can have lifelong financial consequences if handled incorrectly.

Consider consulting with an attorney experienced in military divorce if any of the following apply: the service member has disability ratings or pending disability claims, the service member is still on active duty with years until retirement, significant Thrift Savings Plan (TSP) assets exist alongside the pension, the 10/10 rule doesn't apply and enforcement may be challenging, or disputes exist about the length of marriage or overlapping service.

A family law attorney can also help you understand how military pension division fits into your overall settlement—whether you should negotiate for a larger pension share versus keeping the family home, for example. Tools like Untangle's AI legal consultation can help you prepare for these meetings by identifying the key questions you need to ask about your specific benefits package.

Frequently Asked Questions

What is the 10/10 rule for military pension division in divorce?

The 10/10 rule requires at least 10 years of marriage overlapping with 10 years of military service for DFAS to make direct payments to a former spouse, though the pension can still be divided even if this threshold isn't met.

How is the marital portion of a military pension calculated in CT divorce?

Connecticut courts typically use the coverture fraction, which divides the months of marriage overlapping with military service by the total months of creditable service to determine the divisible portion.

Can my ex-spouse receive direct payments from my military retirement in Connecticut?

Yes, if you meet the 10/10 rule requirements, DFAS can pay your ex-spouse directly up to 50% of your disposable retired pay (or 65% if combined with alimony or child support).

What is the Survivor Benefit Plan (SBP) and is it required in Connecticut military divorce?

The Survivor Benefit Plan provides continued payments to a former spouse if the service member dies first, and Connecticut courts can order coverage as part of the divorce settlement to protect the ex-spouse's share.

Is a military pension considered income or property in a Connecticut divorce?

Connecticut courts treat military pensions as divisible marital property under equitable distribution laws, not as income for alimony purposes, which affects how the pension's value is calculated and divided.

Legal Citations

- • C.G.S. § 46b-81 - Assignment of property and transfer of title View Source

- • Dinunzio v. Dinunzio, 182 A.3d 706 View Source

- • Bender v. Bender, 258 Conn. 733 View Source

- • Wald v. Cortland-Wald, 226 Conn. App. 752 View Source

- • Connecticut Practice Book Rule § 25-30 - Statements To Be Filed View Source

- • Connecticut Practice Book Rule § 25-32 - Mandatory Disclosure and Production View Source

- • Connecticut Practice Book Rule § 25-50A - Case Management under Pathways View Source

- • Financial Affidavit Long Form (JD-FM-006) View Source