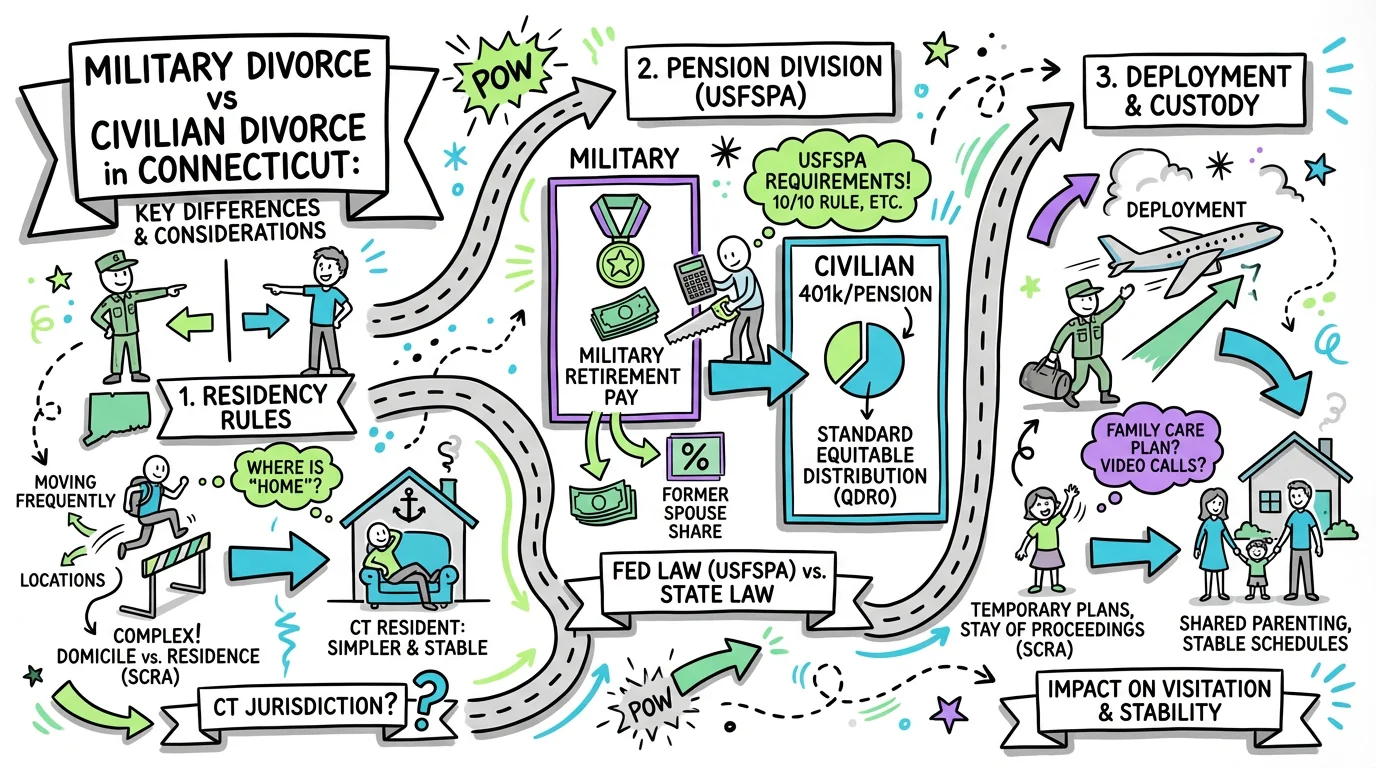

Military Divorce vs Civilian Divorce in Connecticut: Key Differences and Considerations

Learn how military divorce differs from civilian divorce in Connecticut, including residency rules, pension division, deployment custody issues, and USFSPA requirements.

Military divorce in Connecticut follows the same basic legal framework as civilian divorce but adds several critical layers of complexity, including federal laws like the Uniformed Services Former Spouses' Protection Act (USFSPA), special residency options, military pension division rules, and deployment-related custody protections under C.G.S. § 46b-56e. Understanding these differences is essential for military families navigating dissolution because mistakes in areas like pension division or service of process can have permanent financial and legal consequences.

Overview: Why Military Divorce Requires Special Attention

Connecticut courts handle military divorces regularly, but the intersection of state family law and federal military regulations creates unique challenges that don't exist in civilian cases. The servicemember's duty station, deployment schedule, and military benefits all factor into decisions about jurisdiction, timing, and asset division in ways that can significantly impact both spouses.

For military spouses specifically, understanding your rights under federal law is crucial. The USFSPA allows state courts to treat military retired pay as marital property, but specific requirements must be met for direct payment from the Defense Finance and Accounting Service (DFAS). Additionally, military families often face geographical separations that complicate custody arrangements, making Connecticut's deployment custody statute particularly relevant.

Whether you're the servicemember or the military spouse, the stakes in a military divorce extend beyond the divorce itself. Decisions made during the dissolution process can affect Tricare health coverage, commissary privileges, survivor benefit plan elections, and decades of retirement income. Tools like Untangle's AI consultation can help you identify which military-specific issues apply to your situation before you begin the process.

Residency and Jurisdiction: More Options for Military Families

One of the first differences between military and civilian divorce appears in determining where you can file. Under Connecticut law, at least one spouse must establish residency before filing for divorce. C.G.S. § 46b-44 requires that "one of the parties to the marriage has been a resident of this state" for the court to have jurisdiction to enter a final decree.

For military families, residency can be established in multiple ways. A servicemember may claim Connecticut as their state of legal residence (domicile) even if stationed elsewhere, and that connection may satisfy residency requirements. Similarly, a military spouse living in Connecticut—even if their servicemember is stationed in another state—can establish Connecticut residency and file here. This flexibility is important because it gives military families options that civilian couples don't have.

However, having options creates its own complexity. Filing in the wrong state or failing to properly establish jurisdiction can delay your case or result in unenforceable orders—particularly regarding military pension division. Before filing, military families should carefully consider where jurisdiction makes the most strategic sense based on the state's laws regarding property division, spousal support, and child custody. If you're unsure about the best jurisdiction for your case, tools like Untangle's AI legal guidance can provide instant answers based on Connecticut law.

Service of Process and the Servicemembers Civil Relief Act

The Servicemembers Civil Relief Act (SCRA) provides significant protections for active-duty military members facing legal proceedings, including divorce. If a servicemember is on active duty, they may request a stay (postponement) of proceedings if military service materially affects their ability to participate. This protection exists to ensure servicemembers aren't defaulted while deployed or otherwise unable to respond to legal actions.

For military spouses filing for divorce, this means that serving your spouse and obtaining a final judgment may take longer than in a civilian divorce if the servicemember invokes SCRA protections. Courts must verify the defendant's military status before entering a default judgment, and SCRA allows stays of at least 90 days upon request. While this can feel frustrating, these protections serve an important purpose and apply regardless of which spouse initiates the divorce.

That said, many servicemembers choose not to invoke SCRA protections and participate in proceedings normally. If both parties agree to move forward, the process can proceed on a timeline similar to civilian divorce. The key is proper communication and documentation—ensuring proper service of process using forms like the Summons Family Actions (JD-FM-003) and maintaining records of the servicemember's participation or waiver of SCRA rights.

Dividing Military Retirement Pay: USFSPA Requirements

Perhaps the most significant difference between military and civilian divorce involves the division of military retirement benefits. The Uniformed Services Former Spouses' Protection Act (USFSPA) governs how state courts can treat military retired pay in divorce proceedings, and understanding its requirements is essential for protecting your financial future.

Under USFSPA, Connecticut courts may treat disposable military retired pay as marital property subject to equitable distribution. However, for the former spouse to receive direct payments from DFAS (rather than relying on the servicemember to make payments), specific criteria must be met. Most importantly, the court order must meet DFAS requirements in terms of language and specificity, and the division must be expressed as either a fixed dollar amount or a formula/percentage.

The "10/10 Rule" is often misunderstood. This rule provides that a former spouse can receive direct payment from DFAS if the marriage overlapped with at least 10 years of creditable military service. However, even if you don't meet the 10/10 threshold, the pension may still be divided—you simply won't receive direct payments and will need to rely on the servicemember to pay you directly. Connecticut courts, as reflected in property division cases like Kenny v. Kenny, have broad discretion in achieving equitable distribution of marital assets, including retirement benefits.

Given the complexity of military pension division, using tools like Untangle's financial comparison features to track your marriage length relative to military service and understand potential pension values can help ensure you don't leave money on the table—or agree to terms that can't be enforced.

Deployment and Custody: Connecticut's Protective Statute

Connecticut has enacted specific protections for military parents facing deployment. Under C.G.S. § 46b-56e, courts must address custody and visitation issues related to a deploying parent's military service. The statute defines "armed forces" broadly to include all branches plus the Connecticut National Guard performing federal duty, and "deploy" covers combat operations, contingency operations, peacekeeping operations, and remote tours of duty.

This statute allows for temporary custody modifications during deployment without prejudicing the servicemember's rights upon return. Courts can grant custody to a close family member during deployment, establish communication schedules (including video calls) between the deployed parent and child, and create plans for custody to revert to pre-deployment arrangements when the servicemember returns. These provisions recognize that deployment is temporary and shouldn't permanently alter a parent's relationship with their children.

For military families negotiating custody agreements, building deployment contingencies into your parenting plan from the start is advisable. Rather than returning to court each time a deployment occurs, a well-drafted agreement can address how custody will temporarily adjust, who will care for children during deployment, and how the servicemember can maintain their relationship with children while away. The Request for Relief from Judgment - Parent Education Program (JD-FM-149) form may be relevant if you need to modify existing orders.

Try our free CT child support calculator

Calculate your estimated child support using Connecticut's official guidelines formula.

Child Support Calculations: Including Military Benefits

Connecticut's Child Support and Arrearage Guidelines apply to military and civilian families alike, but the calculation of gross income differs for military members. Under the guidelines at § 46b-215a-1(11)(A)(vii), gross income specifically includes "military personnel fringe benefit payments."

This means that in addition to base pay, military allowances and benefits may factor into child support calculations. Basic Allowance for Housing (BAH), Basic Allowance for Subsistence (BAS), and other non-taxable military benefits can be considered income for child support purposes. This often results in higher child support calculations than the servicemember might expect based on their base pay alone.

When completing the Child Support Worksheet (CCSG-001) and Financial Affidavit (JD-FM-006), military families must accurately report all sources of military income. Courts also consider the practical realities of military life—as seen in cases like Bolat v. Bolat, where courts addressed support obligations in the context of changing family circumstances. Underreporting income or omitting allowances can result in motions to modify and potential contempt findings down the road.

Military Divorce vs Civilian Divorce: Key Comparison

| Issue | Civilian Divorce | Military Divorce |

|---|---|---|

| Residency | Must establish CT residency | Multiple options: servicemember domicile, spouse residence, or station state |

| Service of Process | Standard rules apply | SCRA may allow servicemember to request stays |

| Timeline | No special delays unless contested | Potential delays if SCRA invoked; deployment can affect proceedings |

| Pension Division | State law governs (ERISA for private pensions) | USFSPA governs; DFAS requirements for direct payment |

| Health Insurance | COBRA continuation (limited duration) | Potential continued Tricare based on marriage length and service overlap |

| Custody Modifications | Standard modification rules | Deployment-specific provisions under C.G.S. § 46b-56e |

| Income for Support | All income sources | Includes military allowances (BAH, BAS, etc.) |

| Survivor Benefits | Life insurance/estate planning | Survivor Benefit Plan (SBP) elections critical |

Protecting Military Benefits: Tricare and Beyond

For military spouses, health insurance through Tricare is often a significant concern in divorce. Your eligibility for continued Tricare benefits after divorce depends on the "20/20/20" or "20/20/15" rules, which consider the length of the marriage, the servicemember's creditable service, and the overlap between the two.

If you were married for at least 20 years, your spouse served at least 20 years, and there was at least 20 years of overlap between the marriage and service (20/20/20 rule), you retain full Tricare benefits after divorce. The 20/20/15 rule provides one year of transitional Tricare coverage if you meet the first two requirements but only have 15-19 years of overlap. Understanding where you fall can significantly impact your divorce negotiation strategy.

Beyond Tricare, the Survivor Benefit Plan (SBP) is another critical consideration. SBP provides a monthly annuity to a surviving beneficiary if the retiree dies before them. Courts can order SBP coverage for a former spouse, but this election must be made properly and reported to DFAS. Failing to secure SBP coverage in your divorce decree could cost you tens of thousands of dollars over your lifetime.

Steps for Navigating Military Divorce in Connecticut

-

Determine jurisdiction - Decide which state's laws work best for your situation, considering Connecticut residency under C.G.S. § 46b-44 versus other options based on duty station or domicile.

-

Gather military-specific financial documents - Collect Leave and Earnings Statements (LES), deployment orders, retirement point statements (for reserve members), and any military orders affecting your situation.

-

Calculate the "marital share" of retirement - Determine the length of marriage, length of service, and overlap to understand both pension division and Tricare eligibility.

-

Complete required court forms - File the Divorce Complaint (JD-FM-159), ensuring proper service on the servicemember and compliance with SCRA requirements.

-

Address deployment in custody plans - If children are involved, build contingencies for deployment into your parenting agreement rather than leaving this to future modification.

-

Ensure pension order meets DFAS requirements - Work with an attorney or use professional resources to draft a military pension division order that DFAS will accept for direct payment.

-

Make SBP elections within deadlines - Survivor Benefit Plan elections must be made within one year of the divorce, and failure to meet this deadline can permanently waive coverage.

Navigating these steps is significantly easier when you have clear information about your specific situation. Untangle's task dashboard helps military families understand which issues apply to them and organize the documentation needed for each stage.

When to Get Professional Help

While some Connecticut divorces can proceed without attorneys, military divorces often benefit from professional guidance due to their complexity. If your case involves significant military retirement benefits, disputed custody with deployment concerns, or disagreement about how federal laws apply to your situation, consulting with an attorney experienced in military family law is advisable.

Certain mistakes in military divorce can't be fixed later. A pension division order that doesn't meet DFAS specifications may need to be amended—assuming your ex-spouse agrees. Missing the SBP election deadline may permanently waive coverage. Courts, including Connecticut courts applying principles from cases like Kenny v. Kenny, have limited ability to reopen property divisions after the fact.

Even if you plan to handle much of your divorce yourself, having a professional review military-specific provisions before your agreement is finalized can prevent costly errors. Untangle's document generation tools can help you understand the basics and prepare organized documentation, but complex military pension divisions and benefit questions may warrant attorney consultation to protect your interests fully.

Frequently Asked Questions

How is a military pension divided in a Connecticut divorce?

Military retired pay can be divided as marital property under the Uniformed Services Former Spouses' Protection Act (USFSPA), with direct payment from DFAS available if the marriage overlapped at least 10 years of military service.

Can a deployed servicemember delay divorce proceedings in CT?

Yes, the Servicemembers Civil Relief Act (SCRA) allows active-duty military members to request a stay of divorce proceedings for at least 90 days if military duties prevent them from appearing in court.

Does a military spouse keep TRICARE after divorce in Connecticut?

A former military spouse may retain full TRICARE coverage under the 20/20/20 rule if the marriage lasted at least 20 years, with 20 years of military service and 20 years of overlap between the two.

Where can I file for military divorce if my spouse is stationed out of state?

Connecticut allows you to file for divorce if either spouse is a CT resident, the servicemember is stationed in CT, or Connecticut was the last shared marital residence.

How does military BAH affect child support calculations in Connecticut?

Basic Allowance for Housing (BAH) is typically included as income when calculating child support in Connecticut military divorces, even though it's technically a non-taxable allowance.

Legal Citations

- • C.G.S. § 46b-44 (Residency requirement) View Source

- • C.G.S. § 46b-56e (Orders of custody or visitation re children of deploying parent) View Source

- • Kenny v. Kenny, 226 Conn. 219 View Source

- • Bolat v. Bolat, 190 A.3d 96 View Source

- • JD-FM-003 Summons Family Actions View Source

- • JD-FM-006 Financial Affidavit Short Form View Source

- • JD-FM-149 Request for Relief from Judgment - Parent Education Program View Source

- • JD-FM-159 Divorce Complaint (Dissolution of Marriage) View Source

- • CCSG-001 Worksheet for Child Support and Arrearage Guidelines View Source