Military Divorce Rules in Connecticut: A Complete Guide for Service Members and Spouses

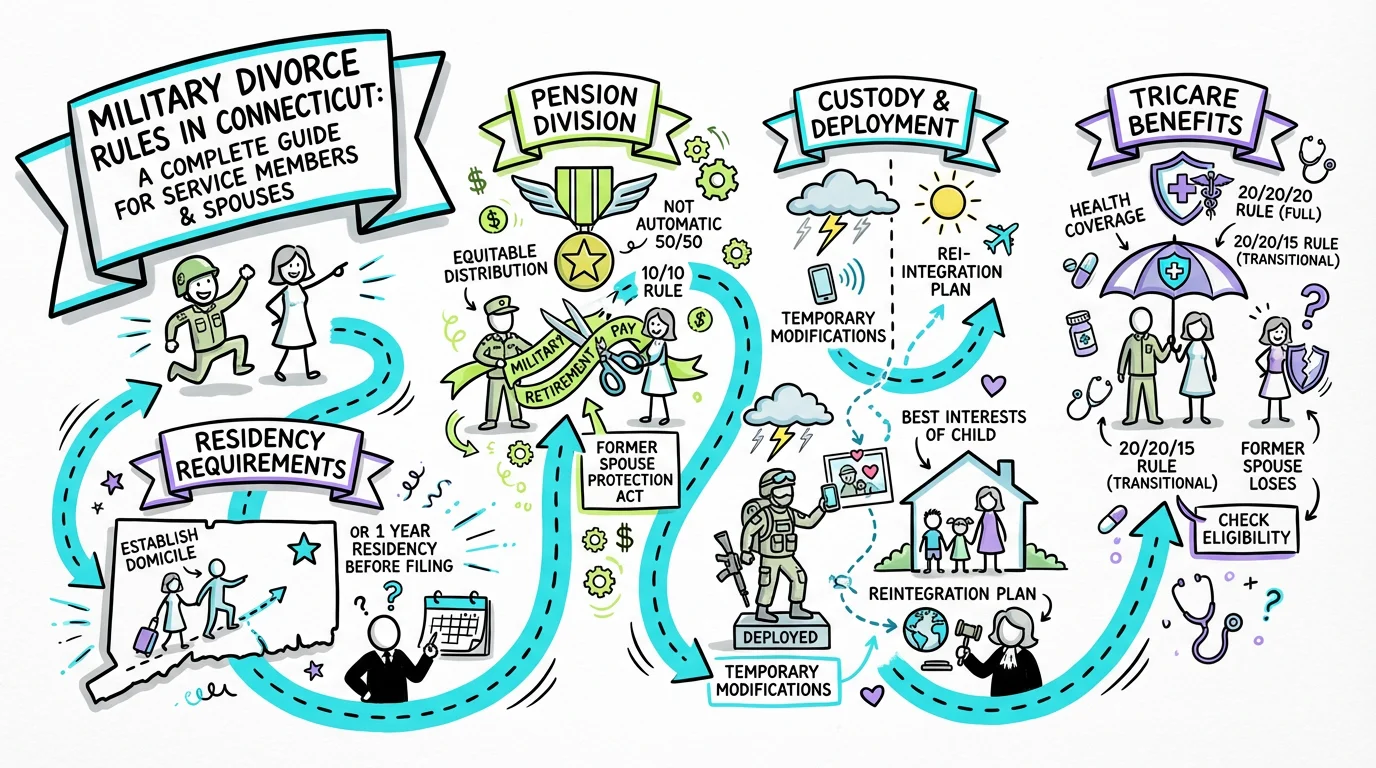

Learn Connecticut military divorce rules including residency requirements, pension division, custody during deployment, and TRICARE benefits for service members and spouses.

Military divorce rules in Connecticut combine state family laws with federal regulations like the Uniformed Services Former Spouses' Protection Act (USFSPA) and the Servicemembers Civil Relief Act (SCRA). Key differences include residency waivers for deployed troops, specific formulas for dividing military pensions, protections against default judgments during active duty, and custody orders designed to accommodate deployment schedules. Understanding these overlapping rules is essential for protecting your rights and benefits during a military divorce.

Connecticut Residency Requirements for Military Personnel

Connecticut provides special residency protections for service members who were Connecticut residents before joining the military. Under C.G.S. § 46b-44(d), any person serving with the armed forces who was a resident of Connecticut at the time of entry is deemed to have continuously resided in the state during their entire period of service. This means a soldier stationed in Texas or deployed overseas can still file for divorce in Connecticut if they lived here before enlisting.

This provision is particularly valuable because Connecticut courts have extensive experience with military divorces and the state's equitable distribution laws may be more favorable than those in other jurisdictions. The "deemed continuous residency" applies to all branches defined in C.G.S. § 27-103, including the Army, Navy, Marine Corps, Coast Guard, Air Force, Space Force, and reserve components including the Connecticut National Guard. Merchant marine members receive the same protection.

For the non-military spouse, standard residency rules apply—at least one spouse must have resided in Connecticut for 12 months immediately before filing, or one spouse must have been a Connecticut resident at the time of the marriage and returned with the intention to remain permanently. Tools like Untangle's AI consultation can help you determine whether Connecticut is the proper jurisdiction for your military divorce.

The Servicemembers Civil Relief Act (SCRA) and Your Divorce

The federal Servicemembers Civil Relief Act provides crucial protections that can significantly impact the timing and process of a military divorce in Connecticut. Under the SCRA, an active-duty service member may request a stay (postponement) of civil proceedings, including divorce, if military service materially affects their ability to participate. Courts must grant at least a 90-day stay upon request, and additional stays may be granted.

This protection prevents default judgments from being entered against deployed service members who cannot appear in court. If your spouse is on active duty and fails to respond to divorce papers, Connecticut Practice Book § 25-28 requires courts to issue "such order of notice as seems reasonable" when a party is absent or their whereabouts are unknown. The court cannot simply proceed without ensuring the service member received actual notice and had a fair opportunity to respond.

For the non-military spouse, SCRA protections can mean significant delays in finalizing your divorce. However, service members can waive these protections in writing if they choose to proceed. Having realistic expectations about timelines is important—what might be a 6-month process for civilians could extend to 12-18 months or longer when one spouse is deployed. Untangle's case management tools help you track where you are in the process and what to expect at each stage.

Dividing Military Pensions Under Federal and State Law

Military retirement benefits are often the most valuable marital asset in a military divorce, and their division involves both federal and state law. The Uniformed Services Former Spouses' Protection Act (USFSPA) permits state courts to treat military retired pay as divisible property. Connecticut's equitable distribution statute, C.G.S. § 46b-81, authorizes courts to "assign to either spouse all or any part of the estate of the other spouse," which includes the military pension.

The standard formula for dividing military retirement is the "marital share" method: the court multiplies the total pension by a fraction (months of marriage during military service divided by total months of military service) and then divides that marital portion equitably between the spouses. The Defense Finance and Accounting Service (DFAS) will make direct payments to a former spouse only if the marriage lasted at least 10 years overlapping with 10 years of creditable military service—known as the "10/10 rule." If you don't meet this threshold, you can still receive your share, but your ex-spouse must make the payments directly rather than DFAS.

It's critical to understand that the Survivor Benefit Plan (SBP) is separate from the pension itself. As illustrated in Mecartney v. Mecartney, Connecticut courts take seriously the obligation to maintain life insurance or survivor benefits for a former spouse when ordered. In that case, the Appellate Court addressed contempt issues where a spouse failed to maintain the defendant as beneficiary of required life insurance coverage. Your divorce agreement should specifically address SBP coverage and what happens if it lapses. Using Untangle's asset inventory feature ensures you capture all military benefits that need to be addressed in your settlement.

Child Custody and Deployment Orders

Connecticut has enacted specific protections for military parents facing deployment that affect custody arrangements. C.G.S. § 46b-56e addresses orders of custody or visitation for children of deploying parents and defines key terms including "armed forces" (all branches plus reserves and National Guard performing duty under Title 32) and "deploy" (military service for combat, contingency, or peacekeeping operations, or remote tours exceeding 90 days).

When a parent receives deployment orders, the court may issue temporary custody modifications without treating the deployment as a permanent change in circumstances. This is crucial because it prevents a deployment from being used against a military parent to permanently alter custody arrangements. The temporary order remains in effect during deployment, and custody generally reverts to the pre-deployment arrangement when the service member returns.

Connecticut Practice Book § 25-5 includes automatic orders that prohibit either party from permanently removing minor children from Connecticut without written consent or court order. This provision takes on special significance in military divorces where the non-military parent might seek to relocate during a deployment. The automatic orders provide baseline protection while allowing courts to craft deployment-specific arrangements. If you're a military parent concerned about maintaining your parental rights during service, these protections provide important safeguards.

Military Benefits for Former Spouses: TRICARE and Commissary Access

Beyond pension division, military divorce involves other significant benefits that may be at stake. The "20/20/20" rule provides the most comprehensive protection: if you were married for at least 20 years, during which the service member completed at least 20 years of creditable service, and the marriage and service overlapped by at least 20 years, you retain full TRICARE coverage, commissary, and exchange privileges as a former spouse.

A "20/20/15" spouse (15 years of overlap instead of 20) receives only one year of transitional TRICARE coverage after the divorce. Former spouses who don't meet either threshold lose military medical benefits upon divorce, though they may be able to purchase temporary continuation coverage. Understanding your benefit status before finalizing your divorce is essential because these benefits can be worth tens of thousands of dollars over time.

| Benefit Category | 20/20/20 Rule Met | 20/20/15 Rule Met | Neither Rule Met |

|---|---|---|---|

| TRICARE Coverage | Full lifetime | 1 year transitional | None |

| Commissary Access | Yes | No | No |

| Exchange Privileges | Yes | No | No |

| Direct DFAS Payment | Yes (if 10/10 met) | Yes (if 10/10 met) | Must collect from ex |

Try our free CT child support calculator

Calculate your estimated child support using Connecticut's official guidelines formula.

Child Support and Military Income Calculations

Connecticut's Child Support Guidelines specifically address military compensation. Under Conn. Agencies Regs. § 46b-215a-1(11)(A)(vii), "gross income" for child support purposes includes "military personnel fringe benefit payments." This means that Basic Allowance for Housing (BAH), Basic Allowance for Subsistence (BAS), and other military allowances must be included when calculating child support—even though these allowances are not taxed as regular income.

The inclusion of these non-taxable benefits can significantly increase the calculated income of a military parent compared to a civilian with the same base pay. When completing the Child Support Guidelines Worksheet (Form CCSG-001), you must account for all military compensation. Similarly, the Financial Affidavit should reflect total military compensation including allowances.

National Medical Support Notices under C.G.S. § 46b-88 can be used to ensure children are enrolled in TRICARE coverage as part of child support orders. Military children are generally entitled to TRICARE coverage regardless of which parent is ordered to provide health insurance, making this an important consideration in crafting support orders. Untangle's child support calculator helps you run accurate scenarios that include military compensation properly.

Filing for Military Divorce in Connecticut: Step-by-Step Process

The procedural steps for filing a military divorce in Connecticut follow the same general framework as civilian divorces, with additional considerations for service-related issues:

-

Verify jurisdiction and venue: Confirm that Connecticut has proper jurisdiction under C.G.S. § 46b-44, considering the special military residency provisions. File in the judicial district where at least one party resides.

-

Prepare and file initial documents: Complete the Divorce Complaint (Form JD-FM-159), Summons (Form JD-FM-003), and Notice of Automatic Court Orders (Form JD-FM-158).

-

Serve your spouse properly: Service on a deployed service member requires careful attention. You may need to use the service member's official military address or work through the unit's legal assistance office. Keep proof of service.

-

Account for SCRA protections: If your spouse is on active duty, be prepared for potential stays. Check the Department of Defense Manpower Data Center to verify active-duty status.

-

Exchange mandatory financial disclosures: Under Practice Book § 25-32, both parties must exchange tax returns, pay statements, and account statements within 60 days of request. Military Leave and Earnings Statements (LES) are essential documents showing all compensation and deductions.

-

Address military-specific assets: Work with your attorney or mediator to properly value and divide military pensions, ensure SBP coverage, and address continuation of benefits for former spouse and children.

-

Attend case management and complete required programs: Connecticut's Pathways program (Practice Book § 25-50A) assigns cases to tracks based on complexity. Military divorces often end up on Track B or C due to the additional issues involved. Complete required parent education if you have children.

Modification of Orders for Changing Military Circumstances

Military life involves frequent changes—new duty stations, deployments, promotions, and separations from service. Practice Book § 25-26 governs modifications of custody, alimony, and support orders, requiring a showing of substantial change in circumstances. For military families, PCS (Permanent Change of Station) orders, deployment, or transition to civilian life can all constitute such changes.

In Wald v. Cortland-Wald, the Connecticut Appellate Court addressed a dissolution agreement where the parties agreed that the plaintiff would transfer twelve months of G.I. Bill benefits to the defendant. This case illustrates how military benefits beyond traditional pension and healthcare can be incorporated into divorce agreements—and the importance of addressing these unique military assets explicitly.

When requesting modifications, you must file the appropriate motion and serve the other party. If you're a military parent whose circumstances have changed, acting promptly is important. Connecticut courts can issue temporary orders addressing custody and visitation during deployment under C.G.S. § 46b-56e without that deployment counting as the kind of permanent change that would support a permanent custody modification.

When to Get Professional Help with Your Military Divorce

While Connecticut allows self-represented parties to file for divorce, military divorces involve complexities that often warrant professional assistance. The intersection of federal military law and Connecticut family law creates traps for the unwary—from missing the 10/10 threshold for direct payment by a matter of months, to failing to preserve SBP coverage, to improperly calculating support with military allowances.

Consider consulting with an attorney experienced in military divorce if any of the following apply: you have more than 10 years of marriage overlapping with military service, significant retirement benefits are at stake, there's a pension from another military branch in a prior marriage, one spouse may not cooperate with the process, there are custody disputes involving potential relocation, or either party is currently deployed. Many military installations offer free legal assistance through JAG offices that can provide at least initial guidance.

Untangle's task dashboard can help you organize your military divorce documents, understand the process, and prepare for productive conversations with attorneys or mediators. While we don't replace legal advice, our tools help you approach your military divorce with clarity about your assets, timelines, and options—so you can make informed decisions about your future.

Frequently Asked Questions

How does the SCRA protect military members during a Connecticut divorce?

The Servicemembers Civil Relief Act (SCRA) protects active-duty military members from default judgments by requiring courts to stay proceedings and ensure proper notice before entering any divorce orders against a deployed or active-duty service member.

Can I file for divorce in Connecticut if my military spouse is stationed in another state?

Yes, Connecticut allows divorce filings if either spouse meets the 12-month residency requirement, and service members who lived in Connecticut before enlisting are deemed continuous residents regardless of where they're currently stationed.

How do you serve divorce papers to a deployed military spouse?

Divorce papers can be served to a deployed spouse through their military unit's legal office, by certified mail to their APO/FPO address, or through a military-approved process server, though additional time must be allowed under SCRA protections.

How is a military pension divided in a Connecticut divorce?

Military pensions in Connecticut are divided according to the Uniformed Services Former Spouses' Protection Act (USFSPA), which allows state courts to treat military retirement pay as marital property subject to equitable distribution.

What happens to child custody in CT when a military parent gets deployed?

Under C.G.S. § 46b-56e, Connecticut courts can create temporary custody modifications during deployment and must restore the original custody arrangement when the service member returns, protecting military parents from permanent custody changes due to military service.

Legal Citations

- • Conn. Agencies Regs. § 46b-215a-1(11)(A)(vii) - Military personnel fringe benefit payments included in gross income View Source

- • Connecticut Practice Book § 25-5 - Automatic Orders upon Service of Complaint View Source

- • Connecticut Practice Book § 25-26 - Modification of Custody, Alimony or Support View Source

- • Connecticut Practice Book § 25-28 - Order of Notice View Source

- • Connecticut Practice Book § 25-32 - Mandatory Disclosure and Production View Source

- • Connecticut Practice Book § 25-50A - Case Management under Pathways View Source

- • Wald v. Cortland-Wald, 226 Conn. App. 752 View Source

- • Mecartney v. Mecartney, 206 Conn. App. 243 View Source

- • Form JD-FM-159 - Divorce Complaint View Source

- • Form JD-FM-003 - Summons Family Actions View Source

- • Form JD-FM-158 - Notice of Automatic Court Orders View Source

- • Form JD-FM-006 - Financial Affidavit Short Form View Source

- • Form CCSG-001 - Worksheet for Child Support and Arrearage Guidelines View Source