Is My Business at Risk in a Connecticut Divorce? What Business Owners Need to Know

Learn how Connecticut courts handle business assets in divorce, including valuation methods, protection strategies, and what business owners should know about property division.

Yes, your business is potentially at risk in a Connecticut divorce. Under C.G.S. § 46b-81, Connecticut courts have broad authority to assign "all or any part of the estate of the other spouse" when dissolving a marriage—and this explicitly includes business interests, regardless of when the business was started or whose name is on the ownership documents. Connecticut is an "equitable distribution" state, meaning the court divides marital property fairly (though not necessarily equally), and your business will likely be considered part of the marital estate subject to division.

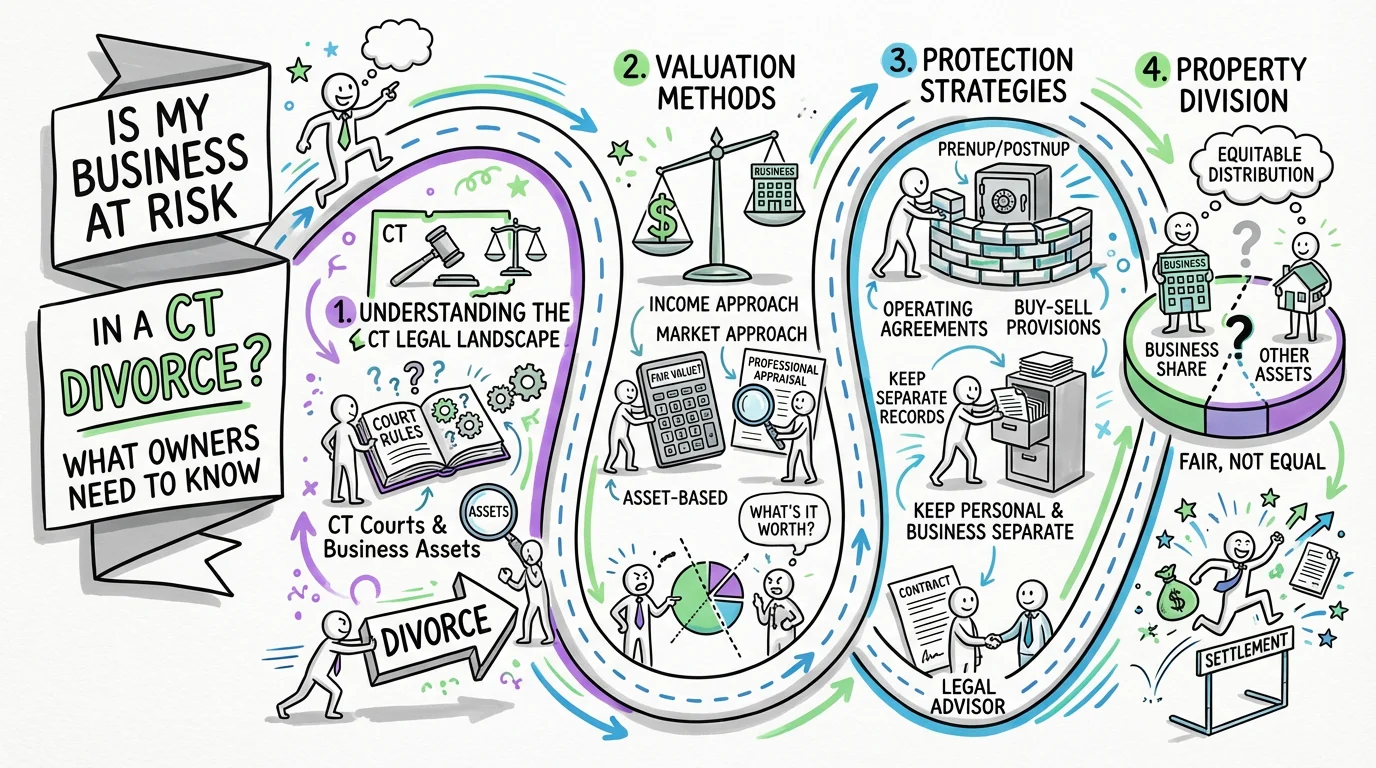

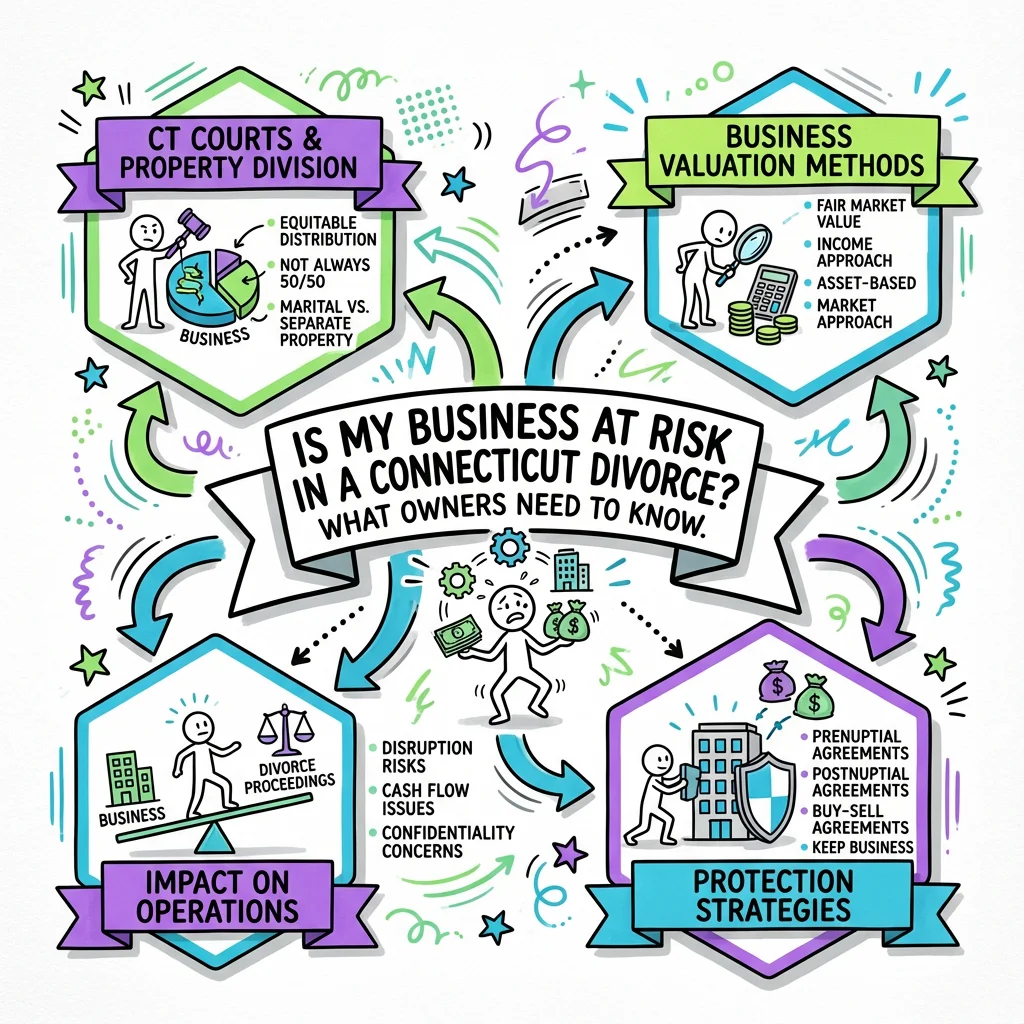

How Connecticut Courts View Business Assets

Connecticut takes an "all property" approach to divorce, which is broader than many other states. Unlike jurisdictions that distinguish between marital and separate property, Connecticut courts can consider virtually any asset either spouse owns—including businesses started before the marriage, inherited interests, or companies built entirely by one spouse's efforts. The court's power under C.G.S. § 46b-81 extends to passing title to property "to either party or to a third person" or ordering the sale of property when deemed necessary.

This doesn't mean your business will automatically be divided down the middle or sold. Courts consider numerous factors when determining how to handle business assets, including the length of the marriage, each spouse's contribution to the marriage (both economic and non-economic), the causes of the dissolution, and each spouse's opportunity for future asset acquisition. A business you built over decades during a long marriage faces different treatment than one started recently in a short marriage.

The critical reality for Connecticut business owners is that protection requires proactive planning and strategic navigation of the divorce process. Courts have significant discretion in how they handle business interests, and the outcome often depends heavily on how the business is valued, what role (if any) your spouse played in its growth, and how you approach negotiations.

Business Valuation: The Critical Battleground

The value assigned to your business will likely be the most contested financial issue in your divorce. Connecticut courts recognize that business valuation is both an art and a science, and the methodology used can dramatically affect the outcome. In Oudheusden v. Oudheusden, the Connecticut courts addressed how business income from closely held businesses factors into both property division and support calculations—illustrating how complex these determinations become.

Common valuation approaches include the income approach (based on the business's earning capacity), the market approach (comparing to sales of similar businesses), and the asset approach (tallying up the value of business assets minus liabilities). Each method can yield vastly different numbers. For professional practices, courts may also consider "goodwill"—both enterprise goodwill (transferable value tied to the business itself) and personal goodwill (value tied to the owner's individual reputation and relationships).

Expect both sides to hire forensic accountants or business valuation experts who may reach conclusions hundreds of thousands—or even millions—of dollars apart. The Oudheusden case also raised the issue of "double counting," where the Appellate Court examined whether business income was improperly counted for both property division and spousal support purposes. This highlights why proper business valuation requires sophisticated analysis. Tools like Untangle's asset disclosure features can help you compile and track the extensive financial records needed for accurate valuation.

Mandatory Disclosure Requirements for Business Owners

Connecticut's discovery rules are extensive, and business owners face particularly demanding disclosure obligations. Practice Book § 25-32 requires automatic exchange of comprehensive financial documents within 60 days of a request, including federal and state tax returns for the last three years, K-1 forms for closely held entities, statements for all financial institution accounts (past 24 months), and retirement account statements.

For business owners, this means you'll likely need to produce business tax returns, profit and loss statements, balance sheets, accounts receivable aging reports, and potentially much more. The Financial Affidavit (Form JD-FM-006) requires sworn disclosure of all income sources, including business income, and all assets, including business interests. Underreporting or hiding business assets is not only unethical—it's illegal and can result in severe penalties, including having the court draw adverse inferences against you. To streamline this crucial step and ensure accuracy, tools like Untangle's financial affidavit generation can automatically prepare your CT financial affidavit, reducing errors and saving time.

This disclosure process actually presents an opportunity for well-prepared business owners. Organized, complete, and transparent financial records build credibility with the court and can support your position on valuation. Untangle's case management tools can help you systematically gather and categorize the extensive documentation required, reducing stress and ensuring nothing falls through the cracks during this intensive discovery phase.

Automatic Orders: Protecting the Business During Divorce

Once divorce proceedings begin, Connecticut's automatic orders under Practice Book § 25-5 immediately restrict what you can do with business assets. These orders prohibit both spouses from selling, transferring, encumbering, concealing, or disposing of any property without written consent of the other party or court permission. For business owners, this creates significant operational constraints.

The automatic orders specifically prevent you from "selling, transferring, exchanging, assigning, removing, or in any way disposing of, without the consent of the other party in writing, or an order of a judicial authority, any property" except in the "usual course of business." This "usual course of business" exception is narrower than many business owners assume—it covers routine operations but not major transactions like selling business units, taking on significant new debt, or transferring ownership interests.

Violating these orders can result in contempt charges and severely damage your credibility with the court. If you need to make substantial business decisions during the divorce, you'll need either your spouse's written agreement or court approval. Planning major transactions before filing for divorce carries its own risks, as courts can look back at pre-filing transfers and potentially unwind them if they appear designed to defeat the other spouse's interests.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Strategies to Protect Your Business Interest

While no strategy guarantees complete protection, several approaches can help minimize the impact of divorce on your business:

Prenuptial and Postnuptial Agreements

The most effective protection is established before divorce becomes a possibility. Connecticut recognizes both premarital and postnuptial agreements under Practice Book § 25-2A, which can specify how business interests will be treated in divorce. If you have such an agreement, it must be formally raised early in the proceedings—a party seeking enforcement must "specifically demand enforcement" in their claim for relief. If your spouse is challenging the agreement, they must file a reply within 60 days stating the grounds for avoidance.

Negotiated Settlements

Under C.G.S. § 46b-66, Connecticut courts encourage parties to reach their own agreements on property division. A negotiated settlement allows you to craft creative solutions that keep the business intact—such as offsetting your spouse's share of business value with other assets like real estate, retirement accounts, or a structured buyout over time. Courts will review any agreement to ensure it's fair, but generally respect the parties' autonomy to structure their own division.

Buyout Arrangements

If your spouse is entitled to a share of business value, structuring a buyout paid over time from business profits may be preferable to selling the business or bringing your spouse in as an unwilling partner. This requires careful negotiation and typically involves trade-offs in other areas of the settlement.

| Protection Strategy | Timing | Effectiveness | Considerations |

|---|---|---|---|

| Prenuptial Agreement | Before marriage | Highest | Must meet enforceability requirements |

| Postnuptial Agreement | During marriage | High | Requires spouse's voluntary agreement |

| Negotiated Settlement | During divorce | Moderate-High | Depends on available offsetting assets |

| Buyout Arrangement | During divorce | Moderate | May require ongoing payments |

| Trust Structures | Before divorce | Variable | Court can still consider trust assets |

How Business Income Affects Alimony and Support

Your business doesn't just affect property division—it also plays a central role in determining alimony. Under C.G.S. § 46b-82, courts consider "the income, estate, and earning capacity" of each spouse when awarding alimony. For business owners, this often means intense scrutiny of both the income you actually take from the business and the income the business could provide.

Courts look beyond your W-2 salary or stated distributions. They examine retained earnings, discretionary expenses paid through the business, and perks like vehicles, travel, or meals. In Oudheusden v. Oudheusden, the trial court found that the defendant's gross annual income of $550,000 was derived from two closely held businesses and awarded substantial alimony based on that income—alimony that was not modifiable in duration or amount.

The Appellate Court in Oudheusden also addressed concerns about "double counting"—using business income both to calculate support obligations and as a component of business value for property division. This is a technical but crucial issue: if your business's value is based on its income-generating capacity, using that same income stream to calculate high alimony could effectively make you pay twice for the same dollars. Sophisticated legal and financial analysis is essential to avoid this outcome.

Steps to Take Now to Protect Your Business

-

Gather comprehensive business records - Compile tax returns, financial statements, operating agreements, buy-sell agreements, and any business valuation reports from the past several years. Untangle's case management features provide a central location to organize these critical documents.

-

Review any existing prenuptial or postnuptial agreement - If you have one, locate it immediately and have an attorney assess its enforceability regarding your business interests.

-

Understand your business structure - How your business is organized (sole proprietorship, LLC, partnership, corporation) affects both valuation and division options. Review your operating agreement or corporate documents for any provisions about divorce or ownership transfers.

-

Identify your spouse's contributions - Courts consider both economic contributions (did your spouse invest money or work in the business?) and non-economic contributions (did your spouse's homemaking enable you to build the business?). Understanding these factors helps predict likely outcomes.

-

Engage qualified professionals early - A business valuation expert and forensic accountant should be consulted before you begin negotiations, not after. Their analysis will shape your entire strategy.

-

Consider business continuity - Think about what the business needs to operate successfully and what arrangements would work if your spouse receives an interest or buyout payments. Your goal should be preserving the business's ability to generate income.

When to Seek Professional Help

If you own a business of any significant value, navigating divorce without experienced legal counsel is extremely risky. Connecticut's broad equitable distribution powers, combined with the complexity of business valuation and the interplay between property division and support, create numerous opportunities for outcomes that could devastate your business and financial future.

You should consult with a divorce attorney who has experience with business valuations immediately upon considering divorce—or upon learning your spouse may be considering it. Look for attorneys who work regularly with forensic accountants and business valuation experts. The cost of proper professional guidance is almost always far less than the cost of unfavorable court rulings or poorly structured settlements.

While preparing for these conversations, Untangle can help you organize your assets and understand the key documents you'll need to share with your legal team. Being prepared with organized records and a clear understanding of your assets helps your attorney work more efficiently—and ultimately helps protect what you've built.

Frequently Asked Questions

How is a business valued in a Connecticut divorce?

Connecticut courts typically use professional business valuators who assess fair market value through methods like income-based, asset-based, or market comparison approaches, considering factors such as revenue, assets, goodwill, and future earning potential.

Can my spouse claim my business if I started it before we got married in CT?

Yes, under Connecticut's "all property" approach, courts can consider businesses started before marriage as part of the marital estate, though the timing and your spouse's contributions will factor into how much, if any, they receive.

Is my LLC protected from divorce in Connecticut?

An LLC structure alone does not protect your business from divorce division in Connecticut, but having a properly drafted operating agreement with buyout provisions or a prenuptial/postnuptial agreement can provide significant protection.

What can I do to protect my business during a Connecticut divorce?

You can protect your business through prenuptial or postnuptial agreements, maintaining separate business finances, documenting your spouse's non-involvement, and working with attorneys experienced in high-asset divorces to negotiate buyout arrangements.

Will a Connecticut court force me to sell my business in a divorce?

While Connecticut courts have the authority under C.G.S. § 46b-81 to order a business sale, they more commonly award the business to the owner-spouse while offsetting the other spouse's share with other marital assets or structured payments.

Legal Citations

- • C.G.S. § 46b-81 - Assignment of Property and Transfer of Title View Source

- • C.G.S. § 46b-82 - Alimony View Source

- • C.G.S. § 46b-66 - Review of Final Agreement View Source

- • Practice Book § 25-5 - Automatic Orders upon Service of Complaint View Source

- • Practice Book § 25-32 - Mandatory Disclosure and Production View Source

- • Practice Book § 25-2A - Premarital and Postnuptial Agreements View Source

- • Oudheusden v. Oudheusden, 338 Conn. 761 View Source

- • Financial Affidavit Long Form (JD-FM-006) View Source