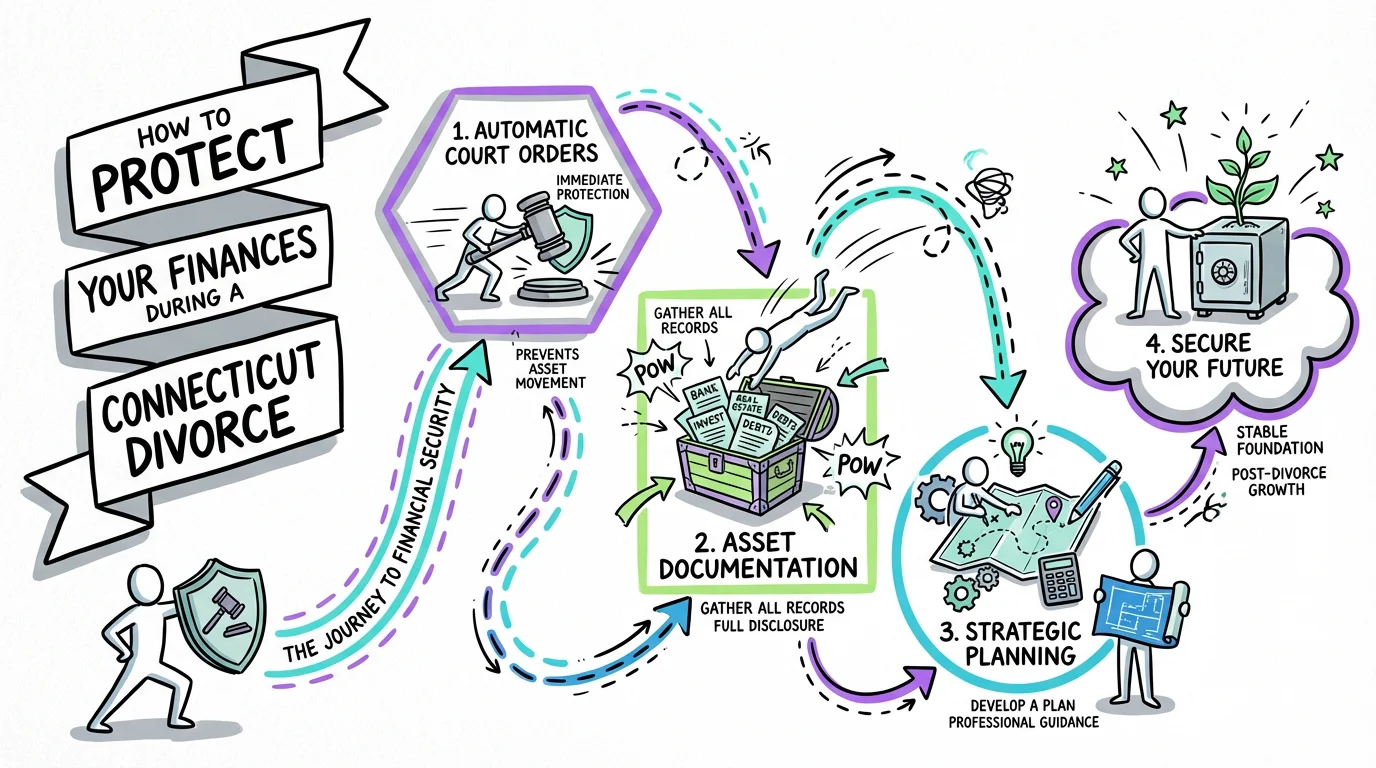

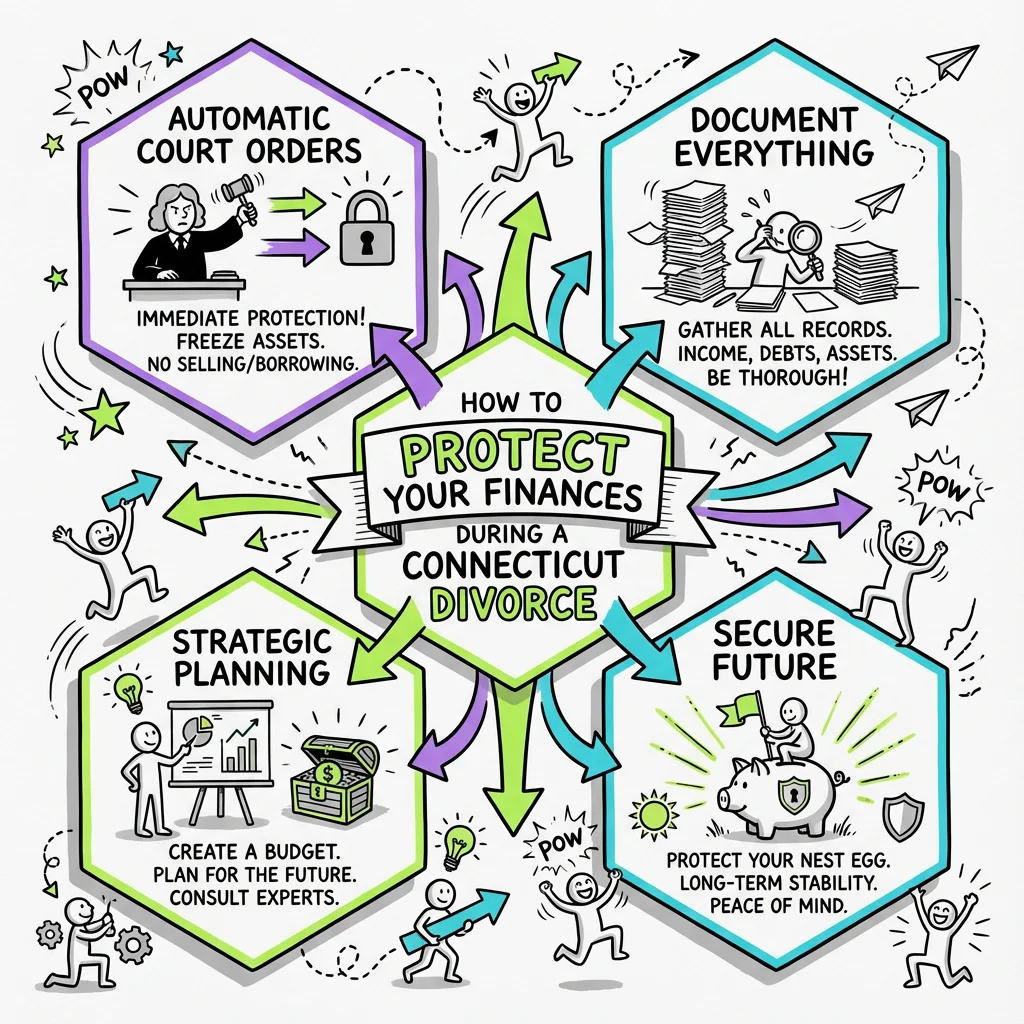

How to Protect Your Finances During a Connecticut Divorce

Learn how to protect your finances during a Connecticut divorce with automatic court orders, asset documentation, and strategic planning to secure your financial future.

Connecticut law provides several automatic protections for your finances the moment a divorce is filed, including court orders that prevent either spouse from hiding, selling, or wasting marital assets. To fully protect your financial interests during a CT divorce, you should immediately document all assets and debts, understand the automatic restraining orders that go into effect, complete accurate financial affidavits, and consider whether additional court-ordered protections are necessary. Taking proactive steps early in the process can prevent financial surprises and help ensure an equitable outcome.

Understanding Connecticut's Automatic Financial Protections

One of the most important safeguards Connecticut offers divorcing spouses is a set of automatic orders that take effect as soon as divorce papers are served. Under Practice Book Rule § 25-5, both parties are immediately prohibited from selling, transferring, encumbering, concealing, assigning, removing, or disposing of any property—except for normal living expenses or with written consent of the other party. These orders apply equally to both spouses and remain in place until the court modifies or terminates them.

The automatic orders also protect insurance coverage, requiring both parties to maintain all existing health, life, automobile, homeowner's, and other insurance policies in full force. Neither spouse can change beneficiaries or allow coverage to lapse. This protection is crucial because losing insurance during divorce can create significant financial vulnerability, especially for a spouse who relies on the other's employer-sponsored health plan.

Violating these automatic orders can result in contempt of court, which carries serious consequences including fines and potential jail time. If you suspect your spouse is hiding assets or violating these protections, you have the right to bring the matter before the court immediately. Tools like Untangle's Smart bank statement analysis can help you organize and track financial documents, making it easier to identify discrepancies that might indicate hidden assets.

Documenting Your Complete Financial Picture

Creating a comprehensive inventory of all marital and individual assets is one of the most important steps you can take to protect yourself financially. Tools like Untangle's Complete asset inventory can simplify this daunting task, helping you meticulously list real estate, vehicles, accounts, and other valuable property. Under Practice Book Rule § 25-32, both parties must exchange extensive financial documentation within 60 days of a request, including three years of tax returns, 24 months of bank statements, retirement account statements, and documentation for all real estate and business interests. The sooner you begin gathering these documents, the better prepared you'll be.

Your documentation should include not just what you own, but what you owe. Compile statements for all credit cards, mortgages, car loans, student loans, and any other debts. Connecticut courts consider the full financial picture when dividing property under C.G.S. § 46b-81, which gives judges broad discretion to assign assets based on factors including the length of marriage, each spouse's contribution to the marriage, and the causes of dissolution. Having complete records protects you from being held responsible for debts you didn't know existed.

Don't overlook less obvious assets that can significantly impact your financial outcome. These include retirement accounts, pension plans, stock options, deferred compensation, frequent flyer miles, cryptocurrency, valuable collections, and business interests. For complex assets like closely-held businesses or trusts, professional valuation may be necessary. The case of Ferri v. Powell-Ferri illustrates how disputed assets like trusts can become central issues in divorce proceedings, making thorough documentation essential from the start.

Filing Accurate Financial Affidavits

Connecticut requires both parties to file sworn financial affidavits before any hearing involving alimony, support, or property division. According to Practice Book Rule § 25-30, you must use the Financial Affidavit Short Form if your net income is under $75,000 per year and total assets are less than $75,000. Otherwise, you'll need the long form that captures more detailed financial information.

These affidavits are sworn statements, meaning you sign under penalty of perjury that the information is true and complete. Intentionally underreporting income or assets can severely damage your credibility with the court and may result in a less favorable outcome—or even criminal charges. Connecticut courts take financial disclosure seriously, and judges have seen every trick for hiding money.

Review your financial affidavit carefully before signing. Common mistakes include forgetting to list retirement accounts, failing to report irregular income like bonuses or commissions, and underestimating expenses. Using Untangle's financial affidavit generation can help ensure you capture all required information accurately and completely, reducing the risk of costly errors or accusations of non-disclosure.

Protecting Your Income and Support Rights

If you're concerned about having enough money to live on during the divorce process, Connecticut law allows you to request temporary alimony and support (called "pendente lite" support) while your case is pending. Under C.G.S. § 46b-83, the court can award alimony and support from the date you file your application, ensuring you have resources to meet basic needs throughout what can be a lengthy process.

The court considers multiple factors when determining temporary support, including each party's income, assets, and expenses, as well as the standard of living established during the marriage. If your spouse was the primary earner, you may be entitled to support that allows you to maintain reasonable stability while the divorce proceeds. This protection exists specifically because the legislature recognized that financial vulnerability shouldn't force anyone into an unfair settlement.

For families with children, Connecticut's Child Support Guidelines provide a formula for calculating appropriate support based on both parents' income and the number of children. The guidelines consider gross income from all sources, including wages, bonuses, commissions, and investment income, as defined in Section 46b-215a-1.(11). Understanding how support is calculated can help you plan your financial future with greater certainty.

Securing Additional Court Protections When Needed

Beyond automatic orders, Connecticut provides additional remedies when standard protections aren't enough. Under C.G.S. § 46b-80, you can pursue prejudgment remedies to secure your financial interests, including placing a lis pendens (legal notice) on real property to prevent its sale without court approval. These remedies are particularly important when you suspect your spouse may try to dispose of assets.

If you need exclusive possession of the family home during the divorce, you can file a motion under Practice Book Rule § 25-25. This motion requires you to describe the property, how long each party has lived there, who currently occupies the home, and why exclusive possession is warranted. Courts grant these motions when there's evidence of domestic violence, extreme conflict, or other circumstances that make shared possession untenable.

The case of Fronsaglia v. Fronsaglia demonstrates how Connecticut courts have broad authority to make property distributions that account for a spouse's misconduct or dissipation of marital assets. If you can document that your spouse wasted marital funds on gambling, affairs, or other improper purposes, the court may compensate you with a larger share of remaining assets. Keeping detailed records of suspicious transactions strengthens your ability to recover these losses.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Steps to Protect Your Finances During Divorce

-

Gather financial documents immediately — Collect bank statements, tax returns, pay stubs, retirement account statements, mortgage documents, and credit card statements before anything can disappear.

-

Open individual bank accounts — Establish accounts in your name only for receiving income and paying necessary expenses, but don't transfer large sums from joint accounts without consent or court approval.

-

Monitor joint accounts and credit — Set up alerts on joint accounts and check your credit report regularly to catch any unauthorized activity early.

-

Create a realistic budget — Calculate your actual monthly expenses to support your request for temporary support and to plan for post-divorce life.

-

Document the value of major assets — Get appraisals for real estate, valuable personal property, and business interests to ensure accurate valuation.

-

Preserve digital records — Save electronic statements and create backups of financial records in case access is later restricted.

-

Consult financial professionals — Consider working with a forensic accountant if you suspect hidden income or assets, or a financial advisor to understand long-term implications of settlement options.

Comparing Financial Protection Options

| Protection Type | How It Works | When to Use | Court Action Required |

|---|---|---|---|

| Automatic Orders | Prevents asset disposal, maintains insurance | Effective immediately upon service | None—automatic |

| Temporary Support | Provides income during divorce proceedings | When you need financial support to live | Motion required |

| Lis Pendens | Prevents sale of real property | When real estate is at risk | Filing required |

| Exclusive Possession | Grants sole use of family home | Domestic conflict or safety concerns | Motion required |

| Prejudgment Remedies | Secures specific assets or funds | When spouse may dissipate assets | Motion and hearing required |

Planning for Property Division

Connecticut is an "equitable distribution" state, meaning the court divides property fairly—but not necessarily equally. Under C.G.S. § 46b-81, judges consider numerous factors including each spouse's age, health, occupation, earning capacity, and contributions to the marriage (including homemaking and childcare). Understanding these factors helps you advocate effectively for your share.

One often-overlooked aspect of property division is the tax consequences of different assets. A $100,000 retirement account is not equivalent to $100,000 in cash because the retirement funds will be taxed upon withdrawal. Similarly, keeping the family home may seem like a "win," but you'll bear all future maintenance costs, property taxes, and potential capital gains. Working with Untangle's Spouse financial comparison tools can help you compare the true after-tax value of different division scenarios and make informed decisions about property division.

Negotiating a fair settlement requires understanding what you're entitled to and what you need for long-term financial security. Connecticut law allows for creative property division, including having one spouse buy out the other's interest in the home, dividing retirement accounts through qualified domestic relations orders (QDROs), or trading different types of assets to achieve balance. The key is ensuring any agreement genuinely meets your needs before you sign.

When to Seek Professional Help

While many divorcing spouses can manage straightforward financial situations, certain circumstances warrant professional assistance. If your marriage involves significant assets, business ownership, complex investments, or suspected hidden income, working with an experienced divorce attorney is essential. Similarly, if your spouse has historically controlled all finances and you don't fully understand your marital estate, professional guidance can protect you from unknowingly accepting an unfair settlement.

A forensic accountant may be valuable if you suspect your spouse is hiding income or assets. These professionals specialize in tracing funds, analyzing business valuations, and identifying lifestyle inconsistencies that suggest undisclosed resources. While hiring experts adds to divorce costs, the investment often pays for itself through a more equitable outcome.

Even in amicable divorces, having your own attorney review any settlement agreement before you sign is wise. What seems fair in the moment may have long-term consequences you haven't considered. Connecticut courts will review agreements under C.G.S. § 46b-66 to ensure they're fair and equitable, but judges rely on the information parties provide. Protecting your financial future means understanding exactly what you're agreeing to before the divorce is final.

Frequently Asked Questions

Can my spouse drain our bank account during a Connecticut divorce?

No, Connecticut's automatic restraining orders under Practice Book Rule § 25-5 prohibit either spouse from removing, concealing, or disposing of marital assets once divorce papers are served, except for normal living expenses.

What happens if my spouse hides assets during our CT divorce?

Hiding assets violates Connecticut's automatic court orders and can result in contempt of court charges, fines, potential jail time, and an unfavorable ruling when the court divides marital property.

Should I open a separate bank account before filing for divorce in Connecticut?

You may open a separate account for personal expenses, but once divorce papers are served, Connecticut's automatic orders restrict how you can use marital funds, so consult an attorney before making major financial moves.

What documents should I gather to protect my finances before a CT divorce?

Before filing, gather bank statements, tax returns, pay stubs, retirement account statements, property deeds, mortgage documents, credit card statements, and records of all marital assets and debts.

When do Connecticut's automatic financial protections take effect in a divorce?

Connecticut's automatic restraining orders that protect marital assets take effect immediately when divorce papers are served on the other spouse and remain in place until the court modifies or terminates them.

Legal Citations

- • Practice Book Rule § 25-5 View Source

- • Practice Book Rule § 25-32 View Source

- • Ferri v. Powell-Ferri, 213 Conn. App. 841 View Source

- • Practice Book Rule § 25-30 View Source

- • Financial Affidavit Short Form (JD-FM-006) View Source

- • Practice Book Rule § 25-25 View Source

- • Fronsaglia v. Fronsaglia View Source