How to Protect Assets in a Connecticut Divorce: Legal Strategies for High-Asset Couples

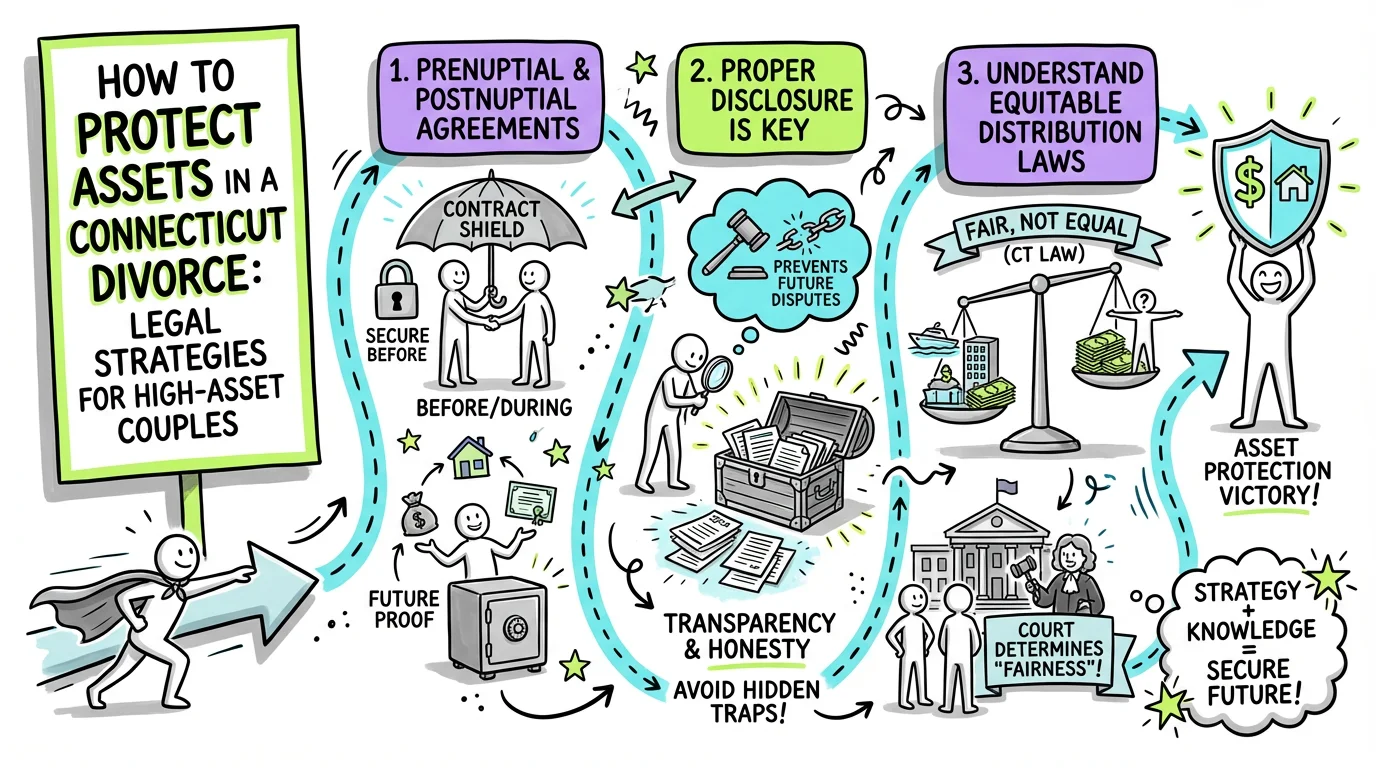

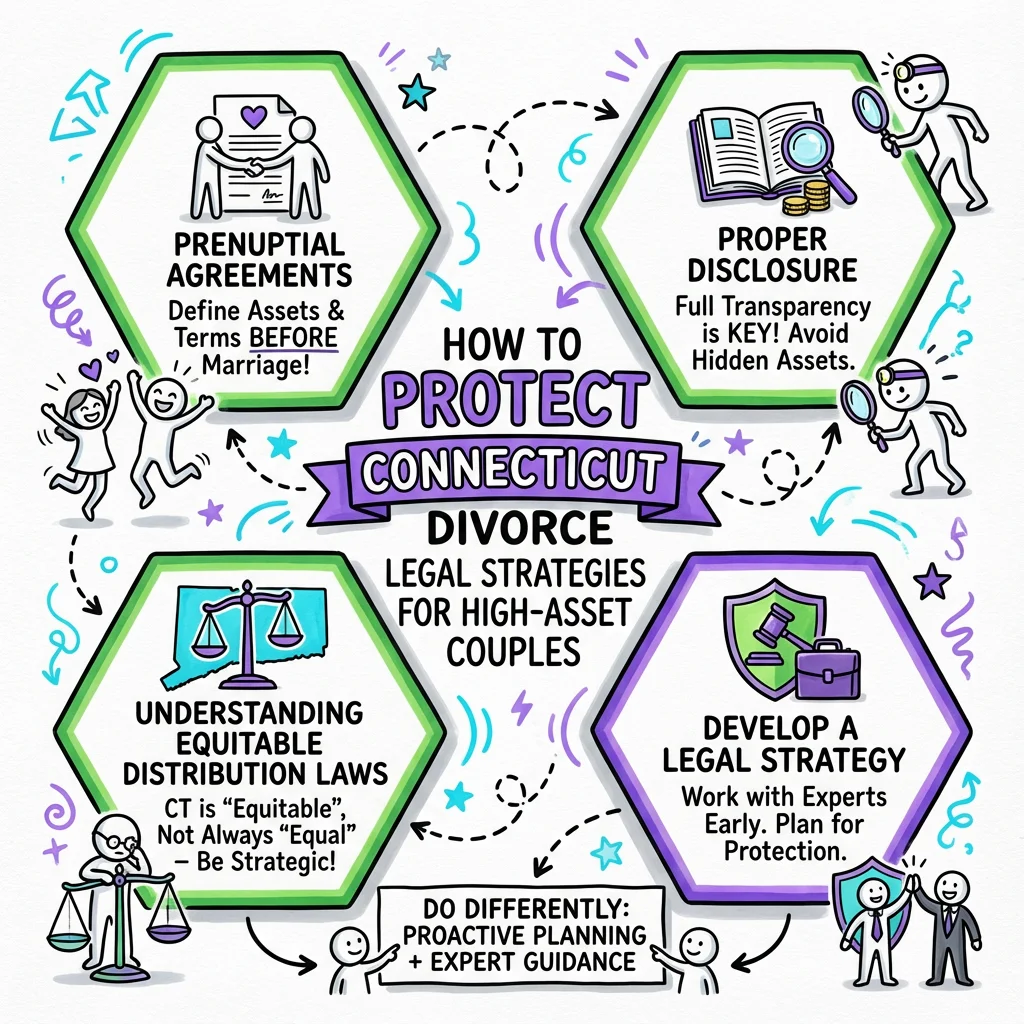

Learn legal strategies to protect assets in a Connecticut divorce, including prenuptial agreements, proper disclosure, and understanding equitable distribution laws.

Protecting assets in a Connecticut divorce requires understanding that CT is an "all-property" equitable distribution state, meaning the court can divide virtually any asset either spouse owns—regardless of when or how it was acquired. The most effective protection strategies include having a valid prenuptial or postnuptial agreement, maintaining meticulous financial records, understanding automatic court orders that prevent asset dissipation, and working with experienced professionals to ensure proper valuation of complex assets like businesses, investments, and real estate holdings.

Understanding Connecticut's Equitable Distribution System

Connecticut's approach to property division is broader than many other states. Under C.G.S. § 46b-81, the Superior Court has the authority to "assign to either spouse all or any part of the estate of the other spouse" when entering a divorce decree. This means that assets you owned before marriage, inherited property, and even gifts from third parties are all potentially subject to division—unlike community property states where such assets might be automatically protected.

The word "equitable" is critical here: it doesn't mean equal. Connecticut courts consider multiple factors when dividing property, including each spouse's contribution to the acquisition of assets, the length of the marriage, the age and health of each party, their occupations and employability, and the causes for the dissolution of the marriage. For high-asset couples, this creates both opportunities and risks. A spouse who built a successful business during the marriage may see a significant portion awarded to the other party, while inherited wealth might be treated differently depending on how it was handled during the marriage.

What makes Connecticut particularly challenging for asset protection is that courts have wide discretion. A judge might award 50/50, 60/40, or even more lopsided divisions based on the specific circumstances. This uncertainty is precisely why proactive planning—ideally before divorce becomes imminent—is so valuable. Tools like Untangle's Complete asset inventory can help you organize and track all marital property from the start, ensuring nothing is overlooked during this critical process.

The Power of Prenuptial and Postnuptial Agreements

The single most effective way to protect assets in a Connecticut divorce is through a properly executed prenuptial or postnuptial agreement. These contracts allow couples to define in advance how property will be divided, potentially removing certain assets from the equitable distribution process entirely. Connecticut Practice Book Rule § 25-2A establishes the procedural framework for enforcing these agreements, requiring that a party seeking enforcement must specifically demand it and state the agreement's date in their claim for relief.

For a prenuptial or postnuptial agreement to be enforceable in Connecticut, it must meet several requirements. Both parties must have had the opportunity to consult with independent legal counsel, there must be full financial disclosure from both sides, and the agreement cannot be unconscionable at the time of enforcement. Courts will scrutinize these agreements carefully, particularly when one spouse claims they were pressured into signing or didn't understand the terms. If you already have a prenuptial agreement, now is the time to locate it and review its terms with an attorney.

If you're already facing divorce without a prenuptial agreement, it's not too late to negotiate a postnuptial agreement or a separation agreement that protects your interests. Under C.G.S. § 46b-66, when parties submit a final agreement concerning property disposition, the court will review it to ensure it's fair before incorporating it into the divorce decree. This creates an opportunity for spouses who can communicate effectively to reach their own terms rather than leaving decisions to a judge.

Automatic Orders: Your First Line of Defense

The moment a divorce complaint is served in Connecticut, automatic orders take effect under Practice Book Rule § 25-5 that protect both parties' financial interests. These orders prohibit either spouse from selling, transferring, encumbering, concealing, or disposing of any property—except in the usual course of business or for reasonable living expenses. Violating these orders can result in contempt of court charges and severely damage your credibility with the judge.

For high-asset individuals, these automatic orders serve as both protection and constraint. On the protective side, they prevent your spouse from liquidating joint accounts, transferring business interests, or hiding assets. On the constraining side, you cannot move money around to shield it from division without court permission. Understanding this balance is crucial: any legitimate asset protection strategy must work within these legal boundaries or risk serious consequences.

Connecticut also provides additional prejudgment remedies under C.G.S. § 46b-80 to secure financial interests during the divorce process. These include lis pendens (a notice filed against real property to prevent sale), attachments of assets, and other measures available under Chapter 903a concerning prejudgment remedies. If you have concerns that your spouse might dissipate assets, you can petition the court for these protective measures early in the process.

Complete and Accurate Financial Disclosure

Transparency is paradoxically one of your best asset protection strategies. Practice Book Rule § 25-30 requires each party to file a sworn financial statement showing current income, expenses, assets, and liabilities at least five business days before any hearing on financial matters. This sworn statement—typically the Financial Affidavit Long Form for complex cases—becomes a key document in your divorce.

Attempting to hide assets almost always backfires. Connecticut courts have seen every concealment strategy and have powerful tools to uncover hidden wealth. Under Practice Book Rule § 25-32, mandatory disclosure requires production of three years of tax returns (including K-1s for business entities), W-2s and 1099s, pay stubs, and statements for all financial accounts going back 24 months. The rule also requires disclosure of business financial statements, retirement account statements, and documentation of any asset transfers or major purchases.

Rather than hiding assets, focus on ensuring they're properly characterized and valued. This is where documentation becomes your greatest ally. Keep records showing the source of funds for major purchases, maintain clear separation between inherited assets and marital funds, and document your contributions to the acquisition and growth of family wealth. Tools like Untangle's Smart bank statement analysis can assist in accurately reviewing and categorizing transactions from these accounts, while Untangle's Financial affidavit generation can help you compile and categorize all the financial records you'll need, making the disclosure process smoother while ensuring nothing important is missed.

Protecting Business Interests

For entrepreneurs and business owners, a divorce can threaten not just personal wealth but the very enterprise you've built. Connecticut courts will consider the value of a business as part of the marital estate, even if you owned it before the marriage and your spouse never worked there. The key questions become: what is the business worth, and how much of that value is marital property?

Business valuation in divorce is complex and often contentious. The three main approaches—asset-based, income-based, and market-based—can produce dramatically different results. Personal goodwill (value tied to your individual skills and relationships) may be treated differently than enterprise goodwill (value that would transfer with a sale). Expert testimony from forensic accountants and business appraisers is typically essential in high-value cases.

Protection strategies for business owners include structuring the business properly from the start (keeping it in a separate entity, avoiding commingling personal and business funds), maintaining accurate books and records, and considering buy-sell agreements that establish how ownership interests are handled during life changes including divorce. If you have partners or co-owners, their interests must also be considered—a court order transferring business interests to your ex-spouse could create significant complications for your business relationships.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Key Factors Courts Consider in Property Division

| Factor | How It Affects High-Asset Cases |

|---|---|

| Length of marriage | Longer marriages typically lead to more equal divisions; shorter marriages may protect pre-marital wealth |

| Contribution to acquisition | Non-financial contributions (homemaking, child-rearing) are recognized alongside financial contributions |

| Age, health, employability | A spouse with limited earning capacity may receive more assets |

| Earning capacity | High earners may retain more assets but face larger alimony obligations |

| Causes for dissolution | Fault (adultery, abuse) can influence property division in Connecticut |

| Pre-marital assets | May be considered but aren't automatically protected |

| Liabilities | Debt allocation follows similar equitable principles |

| Future needs | Courts consider each party's post-divorce financial prospects |

Understanding these factors helps you anticipate how a court might rule and prepare your case accordingly. For instance, if you brought significant assets into the marriage and kept them separate, documenting that separation becomes crucial. If the marriage was relatively short, emphasizing the pre-marital nature of assets may be more effective. Untangle's AI legal guidance can help you evaluate how these factors might apply to your specific situation.

Practical Steps to Protect Your Assets

-

Gather comprehensive financial documentation - Collect statements for all accounts, tax returns, property deeds, business records, and any documentation showing the source of major assets. Start this process early, as gathering records becomes more difficult once divorce proceedings begin.

-

Create a complete inventory of all assets - List every asset you're aware of, including retirement accounts, investment portfolios, real estate, vehicles, valuable personal property, business interests, intellectual property, and digital assets. Note when and how each was acquired.

-

Understand automatic orders and comply fully - Review Practice Book Rule § 25-5 and ensure you don't inadvertently violate any restrictions. Continue normal bill payments and business operations, but avoid any unusual transfers or liquidations.

-

Obtain professional valuations - For businesses, real estate, and other complex assets, engage qualified appraisers early. Their valuations may be challenged, but having credible expert opinions strengthens your position.

-

Review and organize existing agreements - Locate your prenuptial agreement, any postnuptial agreements, business operating agreements, partnership agreements, and trust documents. Understand what protections may already be in place.

-

Separate inherited and gifted assets - If you've received inheritances or gifts, document that they've been kept separate from marital funds. Commingling—such as depositing an inheritance into a joint account—can convert separate property into marital property.

-

Consult with tax professionals - Asset division has significant tax implications. Understanding the tax basis of assets, the consequences of selling property, and the treatment of retirement account distributions can help you negotiate smarter.

-

Consider the timing of your divorce - Strategic timing around bonus payments, stock vesting schedules, or business cycles can affect the value of assets subject to division.

Protecting Privacy in High-Profile Divorces

High-asset divorces often involve sensitive financial information that both parties prefer to keep confidential. While Connecticut generally follows a presumption of public access to court filings, Practice Book Rule § 25-59A allows for sealing files or limiting disclosure when necessary to protect an overriding interest. However, the rule explicitly states that the parties' agreement alone is not sufficient—there must be a demonstrated need.

To successfully seal financial records, you'll need to show the court that public disclosure would cause harm beyond mere embarrassment or inconvenience. This might include protecting proprietary business information, shielding minor children from public scrutiny, or preventing identity theft. The court must make specific findings and consider narrower alternatives before sealing any documents.

For high-profile individuals, alternative dispute resolution methods like mediation or collaborative divorce can provide more privacy than traditional litigation. These processes keep disputes out of public courtrooms and allow parties to resolve issues confidentially. The final agreement still becomes part of the court record, but the detailed negotiations remain private.

Cost Comparison: Protection Strategies

| Strategy | Approximate Cost | Best For |

|---|---|---|

| Prenuptial Agreement | $2,500 - $10,000+ | Couples before marriage with significant assets |

| Postnuptial Agreement | $3,000 - $15,000+ | Married couples wanting to clarify property rights |

| Business Valuation | $5,000 - $50,000+ | Business owners needing accurate enterprise values |

| Forensic Accounting | $10,000 - $100,000+ | Complex cases with suspected hidden assets |

| Real Estate Appraisal | $500 - $5,000+ | Properties requiring current market value |

| Mediation | $3,000 - $10,000 | Couples who can negotiate cooperatively |

| Collaborative Divorce | $15,000 - $50,000+ | High-asset couples wanting privacy and control |

| Litigation | $25,000 - $500,000+ | Contentious cases requiring court intervention |

These figures vary significantly based on case complexity, geographic location within Connecticut, and the specific professionals involved. Investing in proper planning and professional guidance typically costs far less than trying to recover from mistakes made during the divorce process.

When to Get Professional Help

While understanding your rights and options is valuable, high-asset divorces involve complexities that typically require professional guidance. Consider assembling a team that includes a family law attorney experienced in complex property division, a forensic accountant who can trace assets and identify discrepancies, a business valuator if you own a company, and a financial planner who can model different settlement scenarios.

Red flags that indicate you need immediate professional help include discovering your spouse has moved money to unknown accounts, receiving demands for access to business records, suspecting your spouse is understating income, or facing pressure to sign documents you don't fully understand. In these situations, protecting your interests requires swift, informed action.

Untangle's platform can complement your professional team by helping you stay organized, track important deadlines, and understand the financial implications of different scenarios. Having your information well-organized before meeting with attorneys and accountants can reduce professional fees while ensuring nothing falls through the cracks during this critical transition.

Frequently Asked Questions

What is the difference between separate and marital property in a Connecticut divorce?

Unlike many states, Connecticut is an "all-property" equitable distribution state under C.G.S. § 46b-81, meaning the court can divide virtually any asset either spouse owns—including property acquired before marriage, inheritances, and gifts—though judges may treat these differently based on how assets were handled during the marriage.

Can my spouse hide assets during a Connecticut divorce?

Connecticut has automatic court orders that take effect when divorce papers are filed, which prohibit either spouse from hiding, transferring, or dissipating marital assets, and violations can result in serious legal consequences including contempt of court.

Is a prenup or postnup better for protecting assets in CT?

A prenuptial agreement signed before marriage provides the strongest asset protection in Connecticut, but a postnuptial agreement can still be effective if properly executed and can address assets or circumstances that weren't anticipated at the time of marriage.

How much of my business can my spouse get in a Connecticut divorce?

In Connecticut, a business built during the marriage is subject to equitable distribution and a significant portion could be awarded to your spouse, making proper business valuation and documentation of your contributions essential to protecting your interests.

When should I start protecting my assets before filing for divorce in Connecticut?

Asset protection strategies should ideally be implemented well before any marital problems arise, as actions taken too close to a divorce filing may be scrutinized by the court and could be reversed or held against you.

Legal Citations

- • Practice Book Rule § 25-5 - Automatic Orders upon Service of Complaint View Source

- • Practice Book Rule § 25-30 - Statements To Be Filed View Source

- • Practice Book Rule § 25-32 - Mandatory Disclosure and Production View Source

- • Practice Book Rule § 25-2A - Premarital and Postnuptial Agreements View Source

- • Practice Book Rule § 25-59A - Sealing Files or Limiting Disclosure View Source

- • Financial Affidavit Long Form (JD-FM-006) View Source