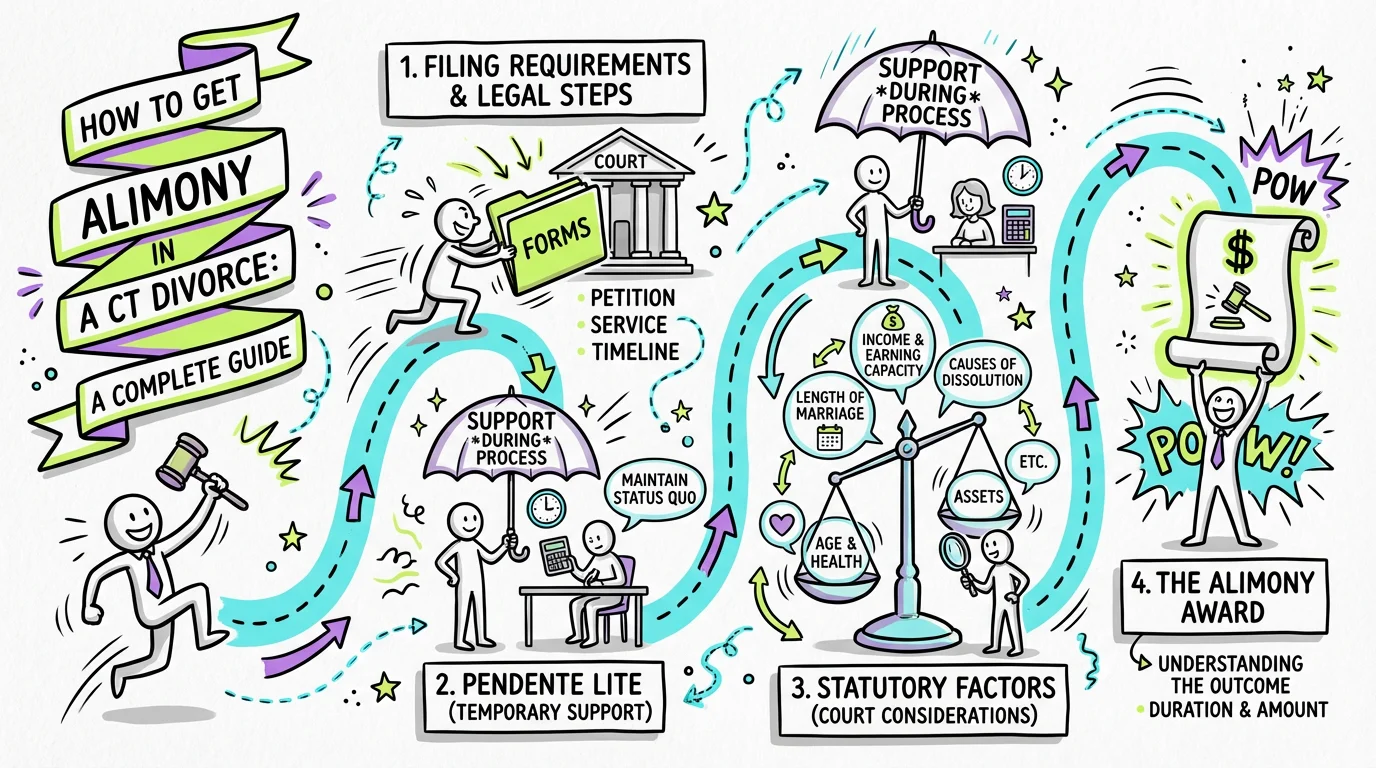

How to Get Alimony in a Connecticut Divorce: A Complete Guide

Learn how to get alimony in a Connecticut divorce. Understand statutory factors, filing requirements, pendente lite support, and what courts consider for spousal support awards.

To get alimony (also called spousal support) in a Connecticut divorce, you must request it through the court by filing a motion and demonstrating your financial need relative to your spouse's ability to pay. Connecticut courts consider multiple statutory factors including the length of your marriage, your earning capacity, your contributions as a homemaker, and your age and health. As a stay-at-home spouse, you may have strong grounds for alimony because you sacrificed career development to support your family—but you'll need to document your financial situation thoroughly and understand what the court evaluates when making these decisions.

Understanding Alimony in Connecticut

Connecticut law gives judges broad discretion to award alimony to either spouse during and after a divorce. Under C.G.S. § 46b-82, the court may order one party to pay alimony to the other "in addition to or in lieu of" property division. This means alimony isn't automatic—it's a separate consideration from how your assets get divided, and the court weighs it based on your specific circumstances.

For stay-at-home spouses, alimony serves a critical purpose: it helps bridge the financial gap created when one partner focused on homemaking and childcare while the other built a career. Connecticut courts recognize this contribution. The statute specifically lists "the contribution of each of the parties in the acquisition, preservation or appreciation in value of their respective estates" as a factor, which includes non-financial contributions like maintaining the household and raising children.

The process begins with understanding that you have rights. Even if your name isn't on the primary income sources, your role in the marriage has economic value. Connecticut's approach acknowledges that marriage is a partnership, and alimony helps ensure both partners can transition to post-divorce life with some financial stability.

The Statutory Factors Courts Consider

When deciding whether to award alimony and how much to grant, Connecticut judges must consider a comprehensive list of factors outlined in C.G.S. § 46b-82. Understanding these factors helps you build a stronger case and know what documentation you'll need.

Financial Factors

The court examines the length of the marriage, causes of the divorce (though Connecticut is a no-fault state, conduct can still be relevant), and the age, health, station, occupation, amount and sources of income, earning capacity, vocational skills, education, employability, estate and needs of each party. For a stay-at-home spouse, earning capacity is particularly important—if you've been out of the workforce for years, your ability to become self-supporting may be limited, at least initially.

The court also looks at property division. Under C.G.S. § 46b-81, judges can divide marital assets, and they consider how this division affects each spouse's financial situation. Sometimes a larger property award reduces the need for ongoing alimony, while other times property alone isn't enough to address the income disparity between spouses.

Non-Financial Contributions

Connecticut explicitly recognizes homemaker contributions. The statute requires courts to consider "the contribution of each of the parties in the acquisition, preservation or appreciation in value of their respective estates." If you managed the household, raised children, supported your spouse's career advancement, or gave up your own career opportunities, these contributions matter legally.

Additionally, the court weighs the opportunity for future acquisition of capital assets and income. A spouse who has been working and building a career has very different prospects than one who has been out of the workforce. This factor often works in favor of stay-at-home spouses who need time and support to re-enter the job market.

Types of Alimony Available in Connecticut

Connecticut doesn't rigidly categorize alimony types by statute, but courts typically structure awards in several ways depending on your circumstances. Understanding these options helps you advocate for what makes sense for your situation.

| Type | Duration | Purpose | Best For |

|---|---|---|---|

| Rehabilitative | Limited (often 3-5 years) | Support while gaining skills/education | Spouses who can become self-supporting |

| Transitional | Short-term | Bridge immediate post-divorce period | Adjusting to single-income household |

| Permanent/Indefinite | Until death, remarriage, or modification | Long-term support | Long marriages, older spouses, health issues |

| Lump Sum | One-time payment | Clean break, property-like | When ongoing payments are impractical |

For stay-at-home spouses after long marriages, permanent or rehabilitative alimony is most common. The court wants to see a realistic plan for your financial future—whether that means returning to work after retraining or acknowledging that circumstances make self-sufficiency unlikely. Tools like Untangle's alimony calculator can help you model different scenarios and understand what level of support you might need.

Pendente Lite Alimony: Getting Support During the Divorce

You don't have to wait until your divorce is finalized to receive financial support. Under C.G.S. § 46b-83, the court can award alimony pendente lite (during the litigation) "from the date of the filing of an application therefor." This is crucial for stay-at-home spouses who may otherwise have no income during what can be a lengthy divorce process.

To request pendente lite support, you'll file a motion accompanied by a sworn financial affidavit. The court can act relatively quickly on these requests because the goal is to maintain stability while the full divorce proceedings unfold. Practice Book Rule § 25-24 confirms that any party may move pendente lite for alimony, support, or other relief.

The automatic orders that take effect when divorce papers are served (Practice Book § 25-5) also provide some protection. These orders prevent either spouse from dissipating assets, canceling insurance, or making major financial changes without agreement or court approval. This helps ensure the family's resources remain available while support arrangements are being determined.

Step-by-Step Process to Request Alimony

Getting alimony requires following Connecticut's procedural requirements carefully. Here's what you need to do:

-

File for divorce or respond to your spouse's filing - Alimony is addressed within divorce proceedings. You'll need an active case to request support.

-

Complete your Financial Affidavit - This is mandatory. Practice Book Rule § 25-30 requires each party to file a sworn statement showing income, expenses, assets, and liabilities at least five business days before any alimony hearing. Use the Financial Affidavit Long Form (JD-FM-006) and be thorough—this document drives the court's understanding of your financial situation. To simplify this crucial task and ensure accuracy, Untangle's financial affidavit generation can help automatically populate this document based on your financial data.

-

Gather mandatory disclosure documents - Under Practice Book Rule § 25-32, you must exchange tax returns (last three years), W-2s, pay stubs, bank statements (24 months), and other financial records. Even as a stay-at-home spouse without income, you'll need to provide documentation of accounts in your name and any other financial information.

-

File a motion for alimony pendente lite - If you need immediate support, file this motion as soon as possible after the case begins. Include your financial affidavit and explain why you need support now.

-

Request attorney's fees if needed - Under C.G.S. § 46b-62, the court can order your spouse to pay your legal fees based on your respective financial abilities. This helps level the playing field when one spouse controls the money.

-

Prepare for the hearing - Be ready to explain your financial needs, your contributions to the marriage, and your plans for the future. The judge will want to understand why you need support and for how long.

Using Untangle's personalized task dashboard can help you keep track of the extensive paperwork required and ensure you don't miss critical filing deadlines.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

What Courts Look for in Alimony Decisions

Connecticut case law provides insight into how judges actually apply the statutory factors. In Emrich v. Emrich (233 Conn. App. 324), the appellate court emphasized that trial courts must properly consider all the criteria in C.G.S. § 46b-82 when making alimony decisions. This means a judge can't ignore relevant factors—they must weigh the complete picture.

The Fogel v. Fogel (212 Conn. App. 784) case illustrates how alimony terms in separation agreements are interpreted. When the agreement specified alimony based on "income from employment," the court had to determine exactly what that meant when circumstances changed. This highlights the importance of clear language in any alimony agreement and understanding how modifications work.

Courts also recognize that circumstances change. Alimony orders can typically be modified if there's a substantial change in circumstances—such as significant income changes, health issues, or other major life events. However, some agreements include non-modifiable provisions, so understanding the terms of any settlement is essential.

Proving Your Case: Documentation That Matters

Strong documentation strengthens your alimony request significantly. Here's what to gather:

- Employment history and earnings records - Show what you earned before leaving the workforce and document the gap in your employment history

- Education and training records - Demonstrate your qualifications and what additional training might be needed to re-enter your field

- Contributions to spouse's career - Document how your homemaking enabled your spouse's professional advancement (relocations, entertaining clients, managing the household during demanding work periods)

- Health records (if relevant) - Any conditions affecting your ability to work

- Childcare and household responsibilities - Detail your daily contributions to the family

- Future needs analysis - Realistic budget showing what you need to live independently. Accurately projecting your monthly expenses is key to proving your needs, and Untangle's expense tracking with AI can help you build a realistic budget to present to the court.

Common Challenges for Stay-at-Home Spouses

Seeking alimony when you've been financially dependent comes with unique challenges. First, you may not have access to all the family's financial information. The mandatory disclosure rules help address this, but you need to know what to ask for. Request complete records and don't accept incomplete responses.

Second, your spouse may argue you can work and earn income even if you haven't been employed. Be prepared to explain realistically what you can earn given your skills, the job market, and any childcare responsibilities. Vocational experts can sometimes testify about your earning capacity if this becomes contested.

Third, emotions run high in divorce, and financial negotiations can become contentious. Having accurate financial information and understanding the legal standards helps you negotiate from a position of knowledge rather than fear. This is where working with professionals—whether attorneys or financial advisors—becomes valuable.

Timeline and Cost Expectations

The duration of your alimony case depends largely on the complexity of your finances and the level of conflict between you and your spouse. While every divorce is unique, understanding the typical progression of events can help you plan for the months ahead.

| Stage | Typical Timeline | What Happens |

|---|---|---|

| Filing to pendente lite hearing | 2-6 weeks | Temporary support established |

| Discovery period | 60+ days | Financial documents exchanged |

| Negotiation/mediation | Varies widely | Attempt to reach agreement |

| Trial (if needed) | 6-18 months from filing | Court decides contested issues |

| Final judgment | End of case | Permanent alimony terms set |

Costs vary dramatically based on whether your case is contested or uncontested. Attorney fees in Connecticut divorce cases typically range from a few thousand dollars for simple uncontested matters to $15,000-$50,000+ for contested cases requiring trial. Remember that C.G.S. § 46b-62 allows the court to order your spouse to contribute to your attorney's fees based on your respective financial abilities.

When to Get Professional Help

While understanding the alimony process empowers you to make informed decisions, most stay-at-home spouses benefit significantly from professional guidance. Consider consulting with a family law attorney if your spouse has significantly greater income or assets, if you've been married more than ten years, if there are complex assets like businesses or investments, or if your spouse is uncooperative with financial disclosure.

An attorney can help you understand what's realistic to expect, ensure your rights are protected, and advocate effectively in court if needed. Many attorneys offer initial consultations to help you understand your options before committing to full representation.

Even before meeting with an attorney, getting organized helps. Understanding your financial situation, knowing what questions to ask, and having your documents in order makes legal consultations more productive. Resources like Untangle's free AI consultation can help you prepare by organizing your financial information and helping you understand the key issues in your case—so when you do work with professionals, you're ready to make the most of that time.

Frequently Asked Questions

What are the eligibility requirements for alimony in Connecticut?

To be eligible for alimony in Connecticut, you must demonstrate financial need relative to your spouse's ability to pay, and the court will evaluate statutory factors including marriage length, earning capacity, age, health, and contributions to the marriage.

How long does alimony last in CT?

Alimony duration in Connecticut varies based on marriage length and circumstances, with shorter marriages typically receiving time-limited support while longer marriages (15+ years) may qualify for indefinite alimony until remarriage, cohabitation, or death.

What types of alimony can you get in a Connecticut divorce?

Connecticut courts can award several types of alimony including temporary (pendente lite) support during divorce proceedings, rehabilitative alimony to help a spouse become self-sufficient, and permanent alimony for long-term marriages.

How do I request alimony in my Connecticut divorce?

To request alimony in Connecticut, you must file a motion with the court, complete financial affidavits documenting your income and expenses, and present evidence supporting your need for spousal support.

Can a stay-at-home spouse get alimony in Connecticut?

Yes, stay-at-home spouses often have strong grounds for alimony in Connecticut because courts recognize that sacrificing career development to maintain the household and raise children is a valuable contribution to the marriage.

Legal Citations

- • Practice Book Rule § 25-24 (Motions) View Source

- • Practice Book Rule § 25-5 (Automatic Orders) View Source

- • Practice Book Rule § 25-30 (Statements To Be Filed) View Source

- • Practice Book Rule § 25-32 (Mandatory Disclosure and Production) View Source

- • Emrich v. Emrich, 233 Conn. App. 324 View Source

- • Fogel v. Fogel, 212 Conn. App. 784 View Source

- • Financial Affidavit Long Form (JD-FM-006) View Source