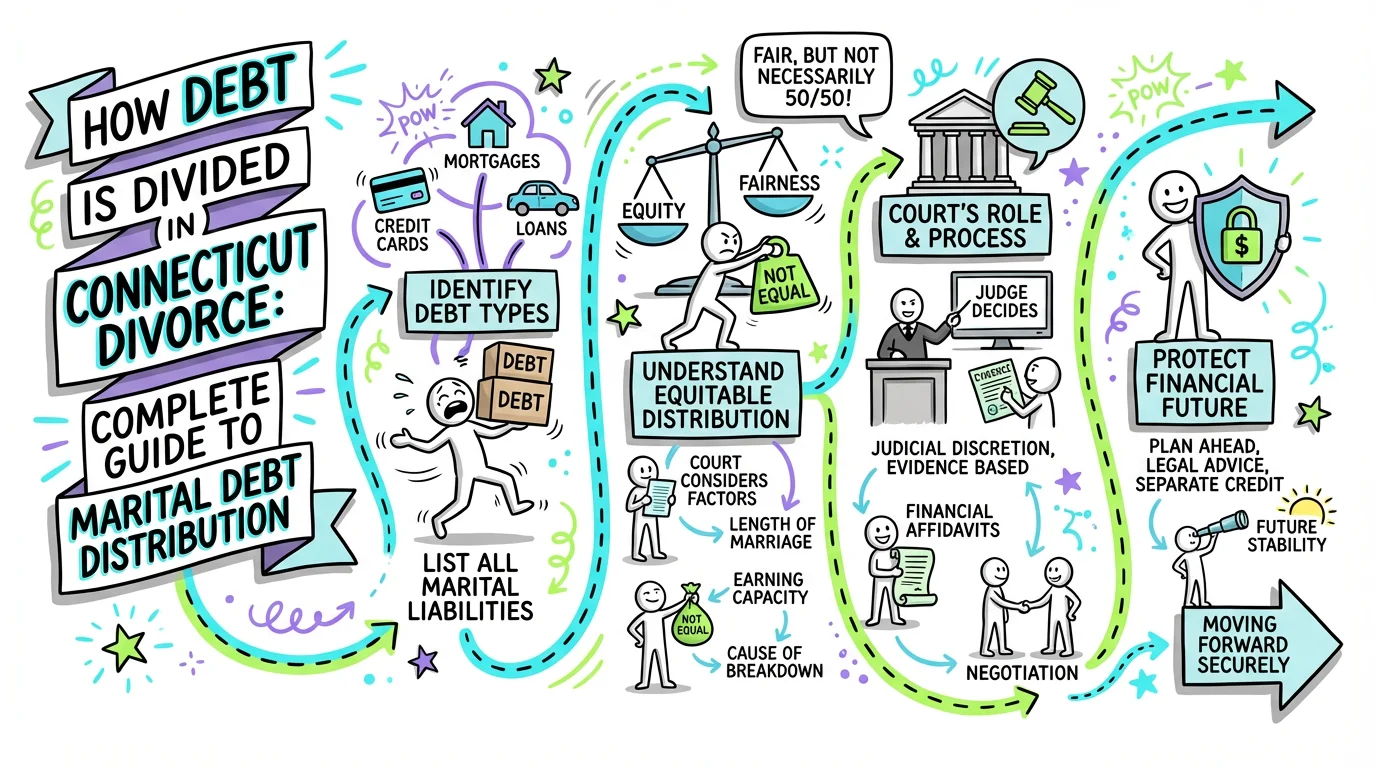

How Debt Is Divided in Connecticut Divorce: Complete Guide to Marital Debt Distribution

Learn how Connecticut courts divide debt in divorce, including credit cards, mortgages, and loans. Understand equitable distribution and protect your financial future.

In Connecticut, debt is divided according to "equitable distribution" principles, meaning the court divides marital debt fairly—but not necessarily equally—between spouses. Under C.G.S. § 46b-81, Connecticut courts have broad authority to assign "all or any part of the estate" of either spouse, which includes both assets and liabilities. The court considers factors like each spouse's earning capacity, the length of the marriage, who incurred the debt, and what the debt was used for when determining how to divide financial obligations.

Understanding Connecticut's Approach to Debt Division

If you're worried about being stuck with your spouse's debt or losing financial stability after divorce, you're not alone. Debt division is one of the most anxiety-inducing aspects of divorce, especially when you're unsure whether you'll be held responsible for credit cards, loans, or other obligations your spouse accumulated during the marriage.

Connecticut is an "all-property" state, which means the court can consider and divide all assets and debts owned by either spouse, regardless of whose name is on the account or when the debt was incurred. This differs from community property states where only debts acquired during marriage are divided. The practical impact is significant: even debt your spouse brought into the marriage or accumulated in their name alone may be factored into the overall financial picture.

The court's goal is to reach a fair outcome that considers each spouse's future financial needs and contributions during the marriage. This means the division might not be 50/50—one spouse might receive more assets but also take on more debt, or the higher-earning spouse might be assigned a larger portion of marital debt because they have greater capacity to pay it off.

Types of Debt Subject to Division

Marital Debt vs. Separate Debt

While Connecticut courts can technically divide any debt, they typically distinguish between marital debt (incurred for family purposes during the marriage) and separate debt (incurred before marriage or for purely individual purposes). Marital debt usually includes mortgages on family homes, car loans for family vehicles, credit card debt for household expenses, medical bills, and educational loans that benefited the family.

Separate debt might include student loans from before marriage, gambling debts, or credit card charges for an affair. However, even "separate" debt can be assigned to either spouse if the court finds it equitable. In Fronsaglia v. Fronsaglia, the Connecticut Appellate Court upheld a trial court's decision to assign the majority of marital debt to one spouse, demonstrating that courts have wide latitude in making these determinations based on the specific circumstances of each case.

Common Types of Debt in Divorce

| Debt Type | Typical Treatment | Key Considerations |

|---|---|---|

| Mortgage | Often divided with home sale or refinance | Whoever keeps the home usually assumes the mortgage |

| Credit Cards | Divided based on who benefited and ability to pay | Joint cards may require both parties to negotiate with creditors |

| Auto Loans | Usually assigned to spouse keeping the vehicle | Refinancing may be required to remove other spouse's liability |

| Student Loans | Often assigned to spouse who incurred them | May be shared if degree benefited family income |

| Medical Debt | Typically shared if incurred during marriage | Children's medical expenses usually shared |

| Tax Debt | Generally shared liability | IRS can pursue either spouse regardless of divorce decree |

Factors Courts Consider When Dividing Debt

Connecticut courts apply the same statutory factors used for dividing assets when allocating debt. Under C.G.S. § 46b-81, these include the length of the marriage, the causes for the dissolution (including fault), each spouse's age, health, station, occupation, employability, and the opportunity for future acquisition of capital assets and income.

The court also examines each spouse's contribution to the acquisition of the marital estate, including contributions as a homemaker. This factor is particularly important for debt division—if one spouse ran up credit card debt while the other spouse worked to support the family, the court will consider who benefited from those expenditures. Similarly, if one spouse sacrificed career advancement to raise children while the other earned advanced degrees (and student loans), the court may consider how the debt served the family unit.

Financial misconduct can also influence debt allocation. If one spouse dissipated marital assets through reckless spending, gambling, or hiding assets, the court may assign them a greater share of the debt as a form of equitable adjustment. This is why complete financial disclosure is so critical—and why tracking all debt-related information throughout your marriage and divorce process matters enormously. Tools like Untangle's Debt and liability tracking can help you catalog and track all debts as you prepare for divorce proceedings.

The Financial Disclosure Process

Required Documentation

Connecticut requires comprehensive financial disclosure before any divorce can be finalized. Under Practice Book § 25-30, each party must file a sworn financial statement showing current income, expenses, assets, and liabilities at least five business days before any hearing involving financial matters. You'll need to update this statement within 30 days before final judgment.

The Financial Affidavit is a critical document that lists all your debts, including creditor names, account numbers, current balances, and monthly payments. If your gross income is under $75,000 and you have less than $75,000 in total assets, you can use the Short Form Financial Affidavit (Form JD-FM-006). Otherwise, you'll need the Long Form version.

Mandatory Document Exchange

Practice Book § 25-32 requires automatic disclosure of extensive financial documentation within 60 days of a request. For debt-related matters, you must exchange 24 months of statements for all financial accounts, three years of credit card statements for each account, and documentation of all debts including mortgages, loans, and credit lines. This comprehensive disclosure helps both parties and the court understand the full debt picture.

Gathering and organizing this information can feel overwhelming, especially when you're already emotionally drained from the divorce process. Untangle's Financial affidavit generation can help you systematically collect and categorize the financial records you'll need, ensuring you don't miss critical debt documentation for your official filings.

Protecting Yourself During the Divorce Process

Automatic Court Orders

The moment a divorce case is filed in Connecticut, automatic orders take effect under Practice Book § 25-5. These orders prohibit both parties from incurring unreasonable debts, including borrowing against property, guaranteeing loans for others, or using credit cards or cash advances except for reasonable and customary living expenses. Violating these orders can result in serious consequences, including being held responsible for improperly incurred debt.

These protections exist because courts recognize that spouses sometimes try to run up debt before divorce, either to punish the other spouse or to extract cash from marital assets. If you suspect your spouse is violating automatic orders by accumulating unnecessary debt, document everything and bring it to your attorney's attention immediately.

Creditor Considerations

One crucial point that catches many people off guard: divorce decrees don't bind creditors. If you and your spouse have joint debt and the court orders your spouse to pay it, the creditor can still come after you if your spouse defaults. Your divorce agreement may give you legal recourse against your spouse, but it won't stop collection calls or damage to your credit.

This is why it's often advisable to pay off joint debts before finalizing divorce, refinance to remove one spouse's name, or build indemnification language into your settlement agreement. The agreement should specify consequences if one spouse fails to pay assigned debts, such as responsibility for any resulting legal fees or credit damage.

Reaching a Settlement Agreement

Most Connecticut divorces settle through negotiation rather than trial. Under C.G.S. § 46b-66, parties can submit a final agreement to the court covering property and debt division. The court will review the agreement to ensure it's fair and entered into voluntarily, but generally respects agreements reached by the parties.

Negotiating debt division requires understanding both the legal principles and your practical financial situation. Consider your post-divorce budget, your ability to qualify for refinancing, and your risk tolerance for depending on your spouse to pay assigned debts. Sometimes accepting a smaller share of assets in exchange for less debt exposure makes more sense than fighting for every dollar of property while remaining liable for joint obligations.

Connecticut's Pathways case management system, outlined in Practice Book § 25-50A, helps structure the resolution process. Cases are assigned to different tracks based on complexity, with Track A for simpler cases likely to settle quickly and Track C for complex cases requiring more court intervention. Understanding which track applies to your case helps set realistic expectations for how long debt division negotiations might take.

Untangle's AI legal guidance can help you evaluate different debt division scenarios, so you can understand the long-term financial impact of various settlement options before you commit to an agreement.

Step-by-Step: Preparing for Debt Division

-

Create a comprehensive debt inventory - List every debt including creditor, balance, interest rate, monthly payment, whose name is on the account, and what the debt was used for. Include mortgages, car loans, credit cards, student loans, personal loans, medical debt, and tax obligations. To streamline this crucial step, Untangle's Smart bank statement analysis can help you meticulously catalog all your obligations by identifying recurring payments and hidden liabilities.

-

Gather supporting documentation - Collect 24 months of statements for each debt account, as required by Connecticut's mandatory disclosure rules. Note any unusual charges or balance increases.

-

Identify joint vs. individual accounts - Determine which debts have both spouses' names and which are individual. Joint accounts create ongoing liability regardless of divorce orders.

-

Calculate your debt-to-income ratio - Understanding your ability to service debt post-divorce helps you negotiate realistic terms and argue for fair allocation based on earning capacity.

-

Research refinancing options - For mortgages and car loans, determine whether you can qualify to refinance in your name alone if you want to keep the asset. Get pre-approval if possible.

-

Consider tax implications - Some debt payments have tax consequences. Mortgage interest may be deductible, while forgiven debt can create taxable income. Consult a tax professional.

-

Draft proposed allocation scenarios - Prepare multiple options showing different ways debt could be divided, along with offsetting asset allocations, to facilitate productive negotiations.

When to Seek Professional Help

While many couples can negotiate debt division on their own, certain situations call for professional assistance. If your marital estate includes substantial debt, business obligations, or complex financial instruments, consulting a divorce attorney or financial advisor is essential. Similarly, if you suspect your spouse is hiding debt, has dissipated assets, or is violating automatic orders, you need legal help to protect yourself.

Even in simpler cases, having your settlement agreement reviewed by an attorney before signing is wise. The consequences of agreeing to unfair debt allocation can follow you for years through damaged credit, collection actions, and reduced financial flexibility. An experienced Connecticut family law attorney can identify potential problems and help you negotiate protective language.

If you're in the early stages of considering divorce and trying to understand how debt division might affect you, start by organizing your financial information and educating yourself on the process. Untangle's Complete asset inventory can help you build a clear picture of your marital debts and understand what to expect, giving you confidence as you move forward—whether toward negotiation, mediation, or court.

Frequently Asked Questions

Am I responsible for my spouse's credit card debt after divorce in Connecticut?

In Connecticut, you may be responsible for your spouse's credit card debt even if your name isn't on the account, because courts can assign marital debt to either spouse based on factors like earning capacity and who benefited from the purchases.

How is student loan debt divided in a CT divorce?

Student loan debt in a Connecticut divorce is typically assigned to the spouse who incurred it and received the education, though courts may consider whether the other spouse contributed to household expenses while one partner attended school.

What happens to joint debt like a mortgage when you get divorced in Connecticut?

Joint mortgage debt in a Connecticut divorce is usually addressed by selling the home and splitting proceeds, having one spouse refinance to remove the other's name, or offsetting the debt obligation with other marital assets.

Can I be held liable for debt my spouse hid from me during our marriage?

Connecticut courts may still assign hidden marital debt to either spouse, but if your spouse concealed debt or spent recklessly, the court can factor that misconduct into the equitable distribution decision.

Does it matter whose name is on the debt in a Connecticut divorce?

While whose name is on the debt matters to creditors, Connecticut courts can assign any marital debt to either spouse regardless of whose name appears on the account, based on what's equitable given the circumstances.

Legal Citations

- • Connecticut Practice Book § 25-5 - Automatic Orders upon Service of Complaint View Source

- • Connecticut Practice Book § 25-30 - Statements To Be Filed View Source

- • Connecticut Practice Book § 25-32 - Mandatory Disclosure and Production View Source

- • Connecticut Practice Book § 25-50A - Case Management under Pathways View Source

- • Fronsaglia v. Fronsaglia View Source

- • Financial Affidavit Short Form (JD-FM-006) View Source