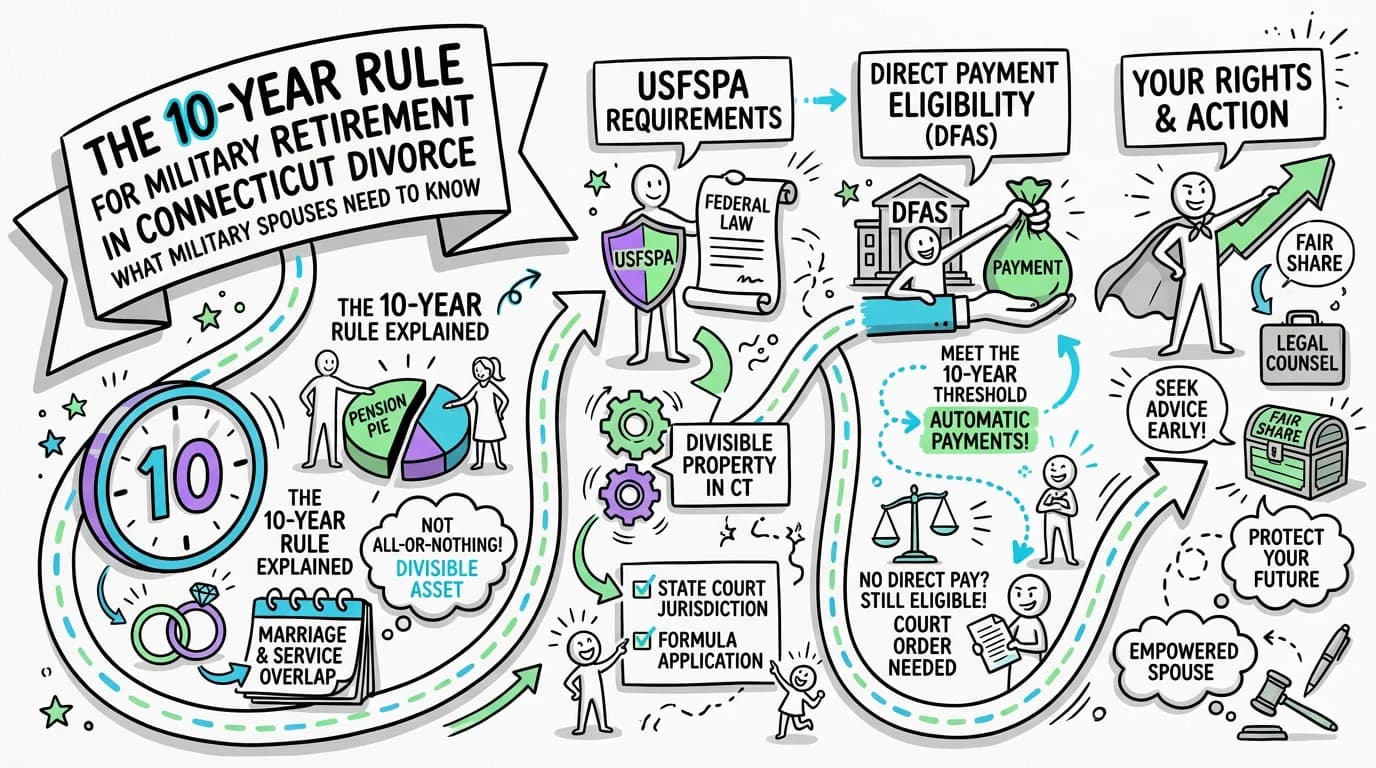

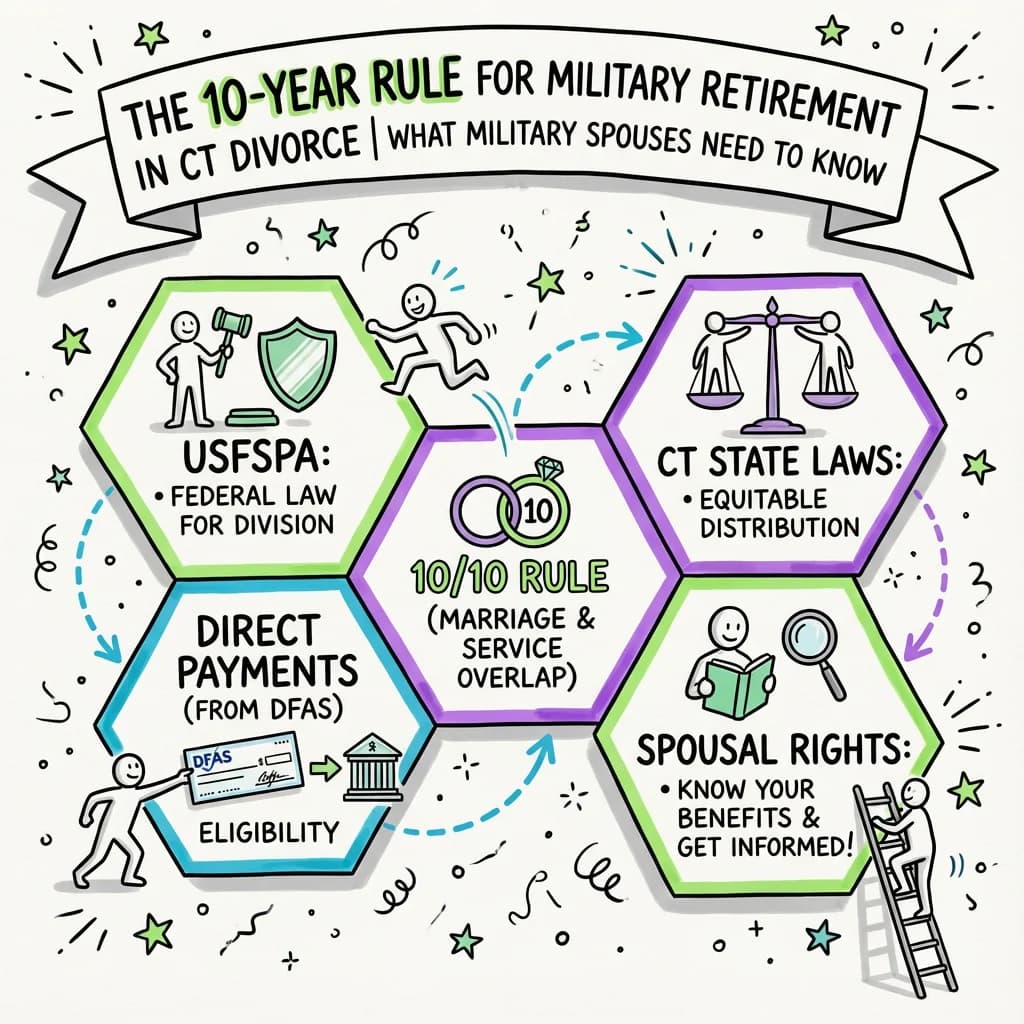

The 10-Year Rule for Military Retirement in Connecticut Divorce | What Military Spouses Need to Know

Learn how the 10-year rule affects military retirement division in Connecticut divorce. Understand USFSPA requirements, direct payment eligibility, and your rights as a military spouse.

Need help with your divorce? We can help you untangle everything.

Get Started Today

How the 10-Year Rule Impacts Military Retirement in Connecticut Divorce

The 10-year rule is a federal requirement under the Uniformed Services Former Spouses' Protection Act (USFSPA) that determines whether a former military spouse can receive their share of military retirement pay directly from the Defense Finance and Accounting Service (DFAS). To qualify for direct payment, the marriage must have overlapped with at least 10 years of creditable military service. However—and this is crucial—the 10-year rule does not determine whether you're entitled to a share of the retirement. It only affects how you receive payment. Connecticut courts can divide military retirement as marital property regardless of how long you were married.

Understanding the Federal Framework for Military Divorce

Military divorces involve a unique intersection of federal and state law that can confuse even experienced attorneys. The USFSPA, enacted in 1982, gave state courts the authority to treat military retirement pay as divisible property in divorce proceedings. Before this law, military members could retire after decades of marriage and their spouse would receive nothing from the pension.

Connecticut, like all states, follows the USFSPA guidelines when dividing military retirement benefits. Under C.G.S. § 46b-81, Connecticut courts have broad authority to assign "all or any part of the estate of the other spouse" during a divorce proceeding. This includes military retirement benefits that accrued during the marriage. The court considers military retirement a form of deferred compensation earned through years of service—and the portion earned during the marriage is considered marital property subject to equitable distribution.

What makes military divorce particularly complex is that federal law creates the framework, but state law determines the actual division. Connecticut courts apply equitable distribution principles, meaning the division doesn't have to be 50/50 but must be fair based on factors like the length of marriage, each spouse's contributions, and future earning capacity. Tools like Untangle's Asset Analysis can help you understand how military retirement fits into your overall property division picture.

The 10-Year Rule Explained: What It Really Means

The 10-year rule creates three distinct categories that determine how a former spouse receives their court-ordered share of military retirement:

| Marriage/Service Overlap | Direct Payment from DFAS? | How You Receive Payment |

|---|---|---|

| 10+ years overlap | Yes | DFAS pays you directly |

| Less than 10 years overlap | No | Service member pays you |

| No overlap | Typically no division | Retirement earned before marriage usually not divided |

If you meet the 10-year requirement, DFAS will send your portion of the retirement directly to you each month after the service member retires. This provides security and predictability—you don't have to rely on your former spouse to write you a check.

If you don't meet the 10-year requirement, you're still entitled to your court-ordered share of the retirement. The difference is that the service member receives the full payment and must then pay you your portion. This creates enforcement challenges if your former spouse refuses to pay or pays late. You'd need to return to court to enforce the order, which costs time and money.

Many military spouses mistakenly believe that falling short of the 10-year mark means they lose all rights to the retirement. This misconception can lead to accepting unfavorable settlement terms. If you are unsure how your specific marriage dates align with your spouse's service history, Untangle’s AI legal assistant can help you clarify your situation and the federal requirements in seconds.

How Connecticut Courts Calculate Military Retirement Division

Connecticut courts typically use a formula to determine what portion of military retirement is marital property. The most common approach is the "time rule" or "coverture fraction," which calculates the marital share based on the overlap between the marriage and military service.

The Coverture Fraction Formula:

- Numerator: Months of military service during the marriage

- Denominator: Total months of military service at retirement

- Result: Multiply this fraction by the retirement benefit, then typically divide by 2 for each spouse's share

For example, if a service member served 20 years (240 months), and 15 years (180 months) overlapped with the marriage, the coverture fraction would be 180/240 = 75%. If the court awards an equal split, the former spouse would receive 37.5% of the total retirement benefit.

Connecticut's Practice Book Rule 25-30 requires both parties to file sworn financial statements before any hearing involving property division. This includes documenting the military retirement benefit, its estimated value, and the timeline of service during the marriage. Getting these numbers right is critical—errors in calculating military retirement can cost tens of thousands of dollars over a lifetime.

Using Untangle's Financial Affidavit tools can help ensure you accurately capture all retirement information in your court filings, reducing the risk of costly mistakes.

The Survivor Benefit Plan: Protecting Your Future

One often-overlooked aspect of military retirement division is the Survivor Benefit Plan (SBP). Without SBP coverage, your share of military retirement ends when the service member dies—even if you're only 50 years old with decades of life ahead.

The SBP is essentially life insurance for your retirement share. The service member pays a premium (typically 6.5% of the covered amount), and if they die before you, you continue receiving a portion of the retirement benefit. Connecticut courts can order a service member to maintain SBP coverage as part of the divorce decree.

Key SBP considerations:

- You must request SBP coverage within one year of the divorce

- The cost can be factored into the overall property division

- Failing to secure SBP coverage cannot be undone later

- The benefit is typically 55% of the covered amount

This is one area where military spouses often fail to protect themselves. In the emotional rush to finalize a divorce, SBP coverage gets overlooked—and by the time you realize the oversight, the deadline has passed. Make sure your divorce agreement specifically addresses SBP coverage and who pays the premiums.

Practical Steps for Military Spouses in Connecticut

Navigating a military divorce requires careful attention to both federal requirements and Connecticut state law. Here's a step-by-step approach to protecting your interests:

-

Gather military service documentation - Obtain Leave and Earnings Statements (LES), service records showing dates of service, and any retirement estimates. You'll need these to calculate the coverture fraction accurately.

-

Calculate your marriage/service overlap - Document the exact dates of your marriage and compare them to the service member's military service dates. This determines whether you qualify for direct DFAS payment.

-

Complete Connecticut's required financial disclosures - Under Practice Book Rule 25-32, you must exchange tax returns, pay stubs, and financial account statements. Include all military retirement documentation in this exchange.

-

Request a military retirement estimate - The service member can request an estimate from their branch's retirement services. This helps value the benefit for property division purposes.

-

Address SBP coverage explicitly - Don't assume it will be included. Make SBP coverage a specific item in your settlement agreement or request it from the court.

-

Obtain a properly drafted court order - Military retirement division requires specific language that DFAS will accept. Generic divorce language often gets rejected, requiring costly amendments.

-

Submit your claim to DFAS - After the divorce is final, you must submit the court order to DFAS along with their required application forms. There's no automatic enrollment.

Organizing all this documentation can feel overwhelming during an already stressful time. Untangle's document organization features can help you keep track of military records, financial statements, and court filings in one secure location.

Special Residency Considerations for Military Families

Military families often face unique challenges meeting Connecticut's residency requirements for divorce. Under C.G.S. § 46b-44, at least one spouse must have been a Connecticut resident for 12 months before a divorce decree can be entered (with some exceptions for marriages performed in Connecticut or if one spouse is a current resident at the time of filing).

For military families stationed in Connecticut, residency can be complicated. Military members often maintain legal residency in another state for tax purposes while physically living in Connecticut. The non-military spouse may have established Connecticut residency, which could allow the divorce to proceed in Connecticut courts.

Connecticut also has specific protections for deployed service members under C.G.S. § 46b-56e. This statute addresses custody and visitation modifications when a parent is deployed, ensuring that deployment alone cannot be used against a service member in custody decisions. If you're facing a divorce while your spouse is deployed—or if you're the service member—understanding these protections is essential.

Common Mistakes Military Spouses Make

Even with the best intentions, military spouses often make costly errors during divorce proceedings. Being aware of these pitfalls can help you avoid them:

Mistake 1: Accepting a buyout without understanding the math - A lump-sum payment in exchange for waiving retirement rights might seem appealing, but military retirement is a guaranteed, inflation-adjusted income stream for life. Calculate the present value carefully before agreeing to a buyout.

Mistake 2: Ignoring VA disability offsets - Service members can waive a portion of retirement pay to receive VA disability compensation, which is not divisible in divorce. This can significantly reduce your expected share. Make sure your agreement addresses how disability waivers will be handled.

Mistake 3: Using generic court order language - DFAS has specific requirements for the language in court orders. If your order doesn't meet their standards, they'll reject it. Use a Qualified Domestic Relations Order (QDRO) attorney or ensure your lawyer has military divorce experience.

Mistake 4: Missing deadlines - The SBP election deadline is one year from divorce. Missing this deadline means losing this protection permanently.

Mistake 5: Not accounting for cost-of-living adjustments - Military retirement receives annual cost-of-living adjustments (COLAs). Make sure your order specifies that your share includes these adjustments.

When to Seek Professional Help

While many aspects of divorce can be handled independently, military retirement division often requires specialized expertise. Consider working with a professional if:

- The service member has significant years of service and a high rank

- You don't meet the 10-year rule and need enforcement mechanisms

- VA disability compensation is involved

- You're unsure how to value the retirement benefit

- The service member is still on active duty with an uncertain retirement date

- You need to draft a court order that DFAS will accept

Military divorce involves high stakes—a 20-year service member's retirement can be worth hundreds of thousands of dollars over a lifetime. Getting the division wrong can mean losing a substantial portion of what you're entitled to receive.

Even if you're handling most of your divorce independently, Untangle's guided workflows can help you understand what questions to ask and what documents you need to navigate these complex federal rules. For complex military retirement calculations, consulting with a military divorce specialist—even for a one-time review—can provide peace of mind that you haven't overlooked anything critical.

Key Takeaways for Military Spouses

The 10-year rule is just one piece of the military divorce puzzle, but understanding it correctly can save you significant stress and money. Remember:

- The 10-year rule affects payment method, not entitlement

- Connecticut courts can divide military retirement regardless of marriage length

- Direct payment from DFAS provides security and simplifies enforcement

- SBP coverage is essential to protect your benefits after the service member dies

- Proper court order language is crucial for DFAS acceptance

- Military divorce involves both federal law and Connecticut state law

Your military marriage represented shared sacrifices—relocations, deployments, career compromises, and family separations. Understanding your rights to military retirement ensures that those contributions are recognized fairly in your divorce settlement.

Frequently Asked Questions

Can I still get a share of military retirement in a Connecticut divorce if my marriage lasted less than 10 years?

Yes, Connecticut courts can award you a share of military retirement as marital property regardless of marriage length—the 10-year rule only affects whether DFAS sends payments directly to you or through your ex-spouse.

What is the difference between the 10/10 rule and the 20/20/20 rule for military spouses in CT?

The 10/10 rule allows direct DFAS payments of divided retirement pay, while the 20/20/20 rule (20 years of marriage, 20 years of service, with 20 years of overlap) determines eligibility for continued military benefits like TRICARE and commissary access after divorce.

How do Connecticut courts calculate the marital portion of a military pension?

Connecticut courts typically use a coverture fraction that divides the months of marriage during military service by the total months of creditable service, then apply equitable distribution principles to determine each spouse's share.

What court orders do I need to divide military retired pay in Connecticut?

You need a final divorce decree from Connecticut Superior Court that specifically awards a portion of the military retirement, plus a separate Military Retired Pay Division Order that meets DFAS requirements for processing direct payments.

If I don't qualify for direct DFAS payments, how will I receive my share of the military retirement in Connecticut?

Your ex-spouse will receive the full retirement payment from DFAS and must pay your court-ordered share directly to you, which Connecticut courts can enforce through contempt proceedings if payments aren't made.

Legal Citations

- • C.G.S. § 46b-81 View Source

- • Practice Book Rule 25-30 View Source

- • Practice Book Rule 25-32 View Source

- • C.G.S. § 46b-44 View Source

- • C.G.S. § 46b-56e View Source