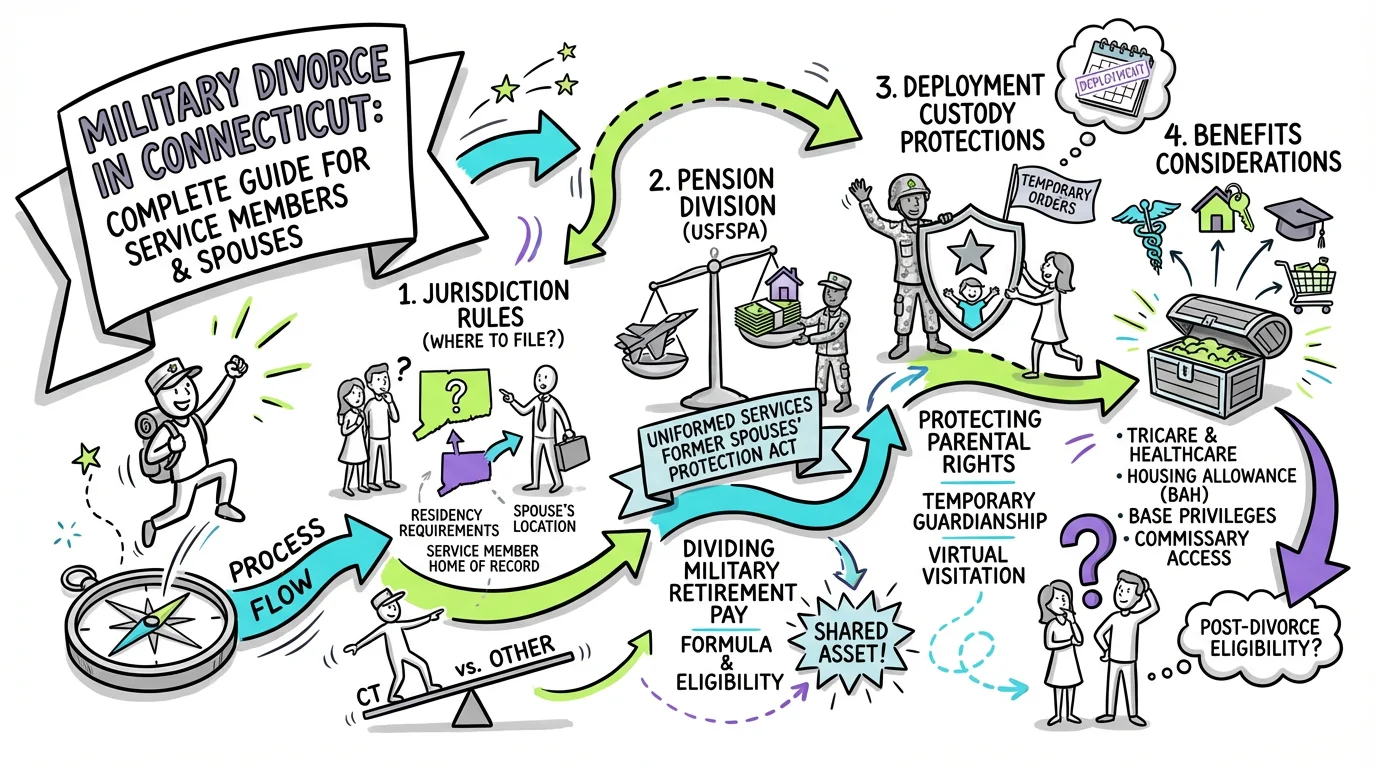

Military Divorce in Connecticut: Complete Guide for Service Members and Spouses

Learn how military divorce works in Connecticut, including jurisdiction rules, pension division, deployment custody protections, and benefits considerations for service members and spouses.

Military divorce in Connecticut follows the same basic legal framework as civilian divorce but involves additional federal laws, unique jurisdictional considerations, and special protections for deployed service members. Service members and military spouses must navigate the Servicemembers Civil Relief Act (SCRA), the Uniformed Services Former Spouses' Protection Act (USFSPA), and Connecticut-specific deployment custody protections under C.G.S. § 46b-56e to ensure their rights are protected throughout the process.

Understanding Military Divorce Jurisdiction in Connecticut

One of the first questions in any military divorce is where to file. Unlike civilian divorces, military families often have connections to multiple states—where the service member is stationed, where the family maintains legal residence, and where the non-military spouse lives. Connecticut courts can hear your divorce case if you meet the state's residency requirements under C.G.S. § 46b-44, which requires that one party has been a resident of Connecticut for at least twelve months before the divorce decree is entered, or that one spouse was domiciled in Connecticut at the time of the marriage and returned with intent to remain permanently, or that the grounds for divorce occurred after either party moved to Connecticut.

For military families, "residence" can be complicated. A service member stationed at a Connecticut military installation may or may not establish legal residency depending on whether they intend to make Connecticut their permanent home. Many service members maintain legal residence in their home state for tax purposes, even while stationed elsewhere. If the non-military spouse lives in Connecticut and meets the residency requirement, they can file for divorce here regardless of where the service member is stationed. Connecticut courts can also exercise jurisdiction over a non-resident service member for purposes of alimony and support if that person has sufficient contacts with the state, as outlined in C.G.S. § 46b-46.

When one spouse is stationed outside Connecticut or deployed overseas, the court can issue an order of notice under Practice Book § 25-28 to ensure proper service. This rule allows judges to approve alternative methods of notification when the adverse party is absent from the state, ensuring the divorce can proceed even when traditional service is impractical. Tools like Untangle's AI legal guidance can help you understand which jurisdiction options apply to your situation and what documentation you'll need.

The Servicemembers Civil Relief Act (SCRA) Protections

The SCRA provides crucial protections for active-duty service members facing legal proceedings, including divorce. Under the SCRA, a service member can request a stay (postponement) of civil court proceedings if military duty materially affects their ability to appear or prepare their case. This protection recognizes that deployment, training exercises, and military obligations can make it impossible for a service member to participate meaningfully in divorce proceedings.

If you're the non-military spouse, understanding the SCRA is essential because it may affect your timeline. If your spouse requests a stay, the court must grant at least a 90-day postponement, and additional stays may be granted if the service member shows continued inability to participate. However, the SCRA doesn't allow a service member to indefinitely delay divorce proceedings—the protection applies only when military duties genuinely interfere with court participation. Courts will look at factors such as deployment schedules, availability of leave, and whether the service member has taken reasonable steps to participate.

For service members, invoking SCRA protections requires providing the court with a letter from your commanding officer explaining how your current duties prevent you from appearing. If you're deployed to a combat zone or on a ship at sea, this is usually straightforward. If you're simply stationed in another state, courts may be less sympathetic and may require you to participate via video conference or during leave periods. The SCRA also provides protections against default judgments—if you don't respond to divorce papers because of military service, the court cannot enter a default judgment against you without first appointing an attorney to represent your interests.

Dividing Military Pensions and Retirement Benefits

Military retirement pay is often the most significant asset in a military divorce, and Connecticut courts have clear authority to divide it. Under C.G.S. § 46b-81, courts may assign to either spouse all or any part of the other spouse's estate, which includes military retirement benefits. The landmark Connecticut Supreme Court case Bender v. Bender (258 Conn. 733) established that military pensions are marital property subject to equitable distribution, regardless of whether the service member has yet retired.

Connecticut uses equitable distribution, meaning the court divides marital property fairly—not necessarily equally. When dividing military retirement, courts typically apply a formula that considers how much of the military career overlapped with the marriage. The most common approach is the "marital fraction" or "time rule": the court calculates the portion of retirement earned during the marriage divided by total retirement service, then awards the non-military spouse a percentage of that marital portion. For example, if a service member was married for 15 of their 20 years of service, 75% of the retirement would be considered marital property, and the spouse might receive half of that (37.5% of total retirement).

It's important to understand that the Defense Finance and Accounting Service (DFAS) will only make direct payments to a former spouse if the marriage lasted at least 10 years overlapping with 10 years of creditable military service (the "10/10 rule"). If your marriage doesn't meet this threshold, the former military spouse may still owe you a portion of retirement, but you'll need to collect it through other means rather than receiving direct DFAS payments. Using Untangle's complete asset inventory can help you accurately value military retirement benefits and see how different division scenarios might affect your financial future.

Special Considerations for Military Benefits

Beyond retirement pay, military divorce involves several other benefits that require careful attention. Healthcare coverage through TRICARE is often a significant concern for military spouses who have relied on this benefit throughout the marriage. Under the "20/20/20 rule," a former spouse can retain full TRICARE benefits if the marriage lasted at least 20 years, the service member had at least 20 years of creditable service, and there was at least a 20-year overlap between the marriage and the military career. Former spouses who meet the "20/20/15" criteria (15 years of overlap instead of 20) may qualify for one year of transitional TRICARE coverage.

Military spouses may also have claims to Survivor Benefit Plan (SBP) coverage, which provides a continuing annuity to a designated beneficiary if the retiree dies. Courts can order a service member to designate their former spouse as an SBP beneficiary, but this must be specifically addressed in the divorce decree and properly submitted to DFAS within one year of the divorce. Failing to secure SBP coverage in the divorce agreement can leave a former spouse without protection if the retiree dies.

The case of Wald v. Cortland-Wald (226 Conn. App. 752) illustrates how military education benefits can also come into play in Connecticut divorces. In that case, the court approved an agreement in which the service member transferred G.I. Bill benefits to the other spouse as part of the divorce settlement. This demonstrates that Connecticut courts will honor negotiated agreements involving military educational benefits, though such transfers must comply with federal regulations governing G.I. Bill transferability.

Connecticut's Child Support Guidelines and Military Income

When calculating child support in a military divorce, Connecticut courts include military-specific income components that civilian courts might not encounter. Under Section 46b-215a-1(11)(A) of Connecticut's Child Support Guidelines, gross income explicitly includes "military personnel fringe benefit payments" and "veterans' benefits." This means that basic allowance for housing (BAH), basic allowance for subsistence (BAS), and other military allowances are counted as income for child support purposes, not just base pay.

| Income Component | Included in CT Child Support Calculation? |

|---|---|

| Base Military Pay | Yes |

| Basic Allowance for Housing (BAH) | Yes - as fringe benefit |

| Basic Allowance for Subsistence (BAS) | Yes - as fringe benefit |

| Hazardous Duty Pay | Yes |

| Flight Pay/Special Duty Pay | Yes |

| VA Disability Benefits | Yes - veterans' benefits included |

| Combat Zone Tax Exclusion | N/A - still counts as income |

| Bonuses and Reenlistment Pay | Yes |

This comprehensive approach to income calculation ensures that child support reflects the true financial picture of military families, who often receive significant compensation through non-taxable allowances. The Untangle child support calculator can help you input all income sources, including military allowances, to estimate your likely support obligation.

Try our free CT child support calculator

Calculate your estimated child support using Connecticut's official guidelines formula.

Deployment and Custody Protections Under Connecticut Law

Connecticut law provides specific protections for military parents facing deployment through C.G.S. § 46b-56e. This statute recognizes that deployment shouldn't permanently disrupt custody arrangements or damage the relationship between a service member and their children. The law defines "armed forces" broadly to include all branches of the U.S. military, reserve components, and the Connecticut National Guard performing federal duty.

Under this statute, when a parent receives deployment orders, several protections kick in. The court can enter temporary custody modifications that account for the deployment period, with the understanding that pre-deployment custody arrangements will resume when the service member returns. The law allows deployed parents to designate a family member to exercise custodial time on their behalf during deployment, maintaining the children's relationships with that side of the family. Additionally, courts cannot treat a parent's deployment or potential future deployment as the sole basis for modifying a permanent custody order.

These protections are essential because, without them, a non-military parent could use deployment as an opportunity to establish a new custody status quo. By the time the service member returned, the children might be settled in a new arrangement, making it difficult to restore the original custody plan. Connecticut's law prevents this by treating deployment modifications as explicitly temporary. If you're facing a deployment-related custody situation, Untangle's parenting plan builder can help you document your current arrangements and plan for temporary modifications that protect your parental relationship.

Filing for Military Divorce: Step-by-Step Process

Filing for military divorce in Connecticut follows the same basic procedural steps as civilian divorce, with some additional considerations:

-

Confirm jurisdiction - Determine whether Connecticut courts have jurisdiction based on residency requirements under C.G.S. § 46b-44. Remember that the military spouse's duty station may differ from their legal residence.

-

Gather military-specific documents - In addition to standard financial documents required under Practice Book § 25-32, collect Leave and Earnings Statements (LES), deployment orders, retirement point statements, and documentation of all military benefits.

-

File the divorce complaint - Use Form JD-FM-159 (Divorce Complaint) along with Form JD-FM-003 (Summons for Family Actions) and Form JD-FM-158 (Notice of Automatic Court Orders).

-

Serve your spouse properly - If your spouse is stationed elsewhere or deployed, work with the court to arrange appropriate service. Military legal assistance offices can often help facilitate service on base.

-

Complete financial disclosures - Both parties must exchange financial affidavits. Use Form JD-FM-006 (Short Form) if neither party's income exceeds $75,000 and assets are under $75,000.

-

Address SCRA considerations - If the service member needs a stay due to military duties, file the appropriate documentation. If you're the non-military spouse, be prepared for potential delays.

-

Negotiate or litigate military-specific issues - Work through division of retirement pay, SBP designation, healthcare benefits, and any deployment-related custody arrangements.

-

Obtain and submit the final decree - Ensure the divorce decree contains specific language required by DFAS for direct payment of retirement benefits to a former spouse.

Timeline and Cost Considerations for Military Divorce

Military divorces often take longer than civilian divorces due to deployment schedules, SCRA stays, and the complexity of dividing military benefits. However, if both parties cooperate and the service member is available to participate, an uncontested military divorce can proceed on Connecticut's standard timeline.

| Factor | Impact on Timeline |

|---|---|

| Uncontested, both parties available | 90 days minimum (CT waiting period) |

| SCRA stay requested | Add 90+ days per stay |

| Active deployment | May extend significantly |

| Complex pension division | Add 2-4 months for valuation |

| Contested custody issues | Add 6-12 months |

| Need for military pension expert | Add 1-2 months |

Costs vary depending on complexity. An uncontested military divorce where both parties agree on all issues might cost $1,500-$5,000 in attorney's fees. Contested cases involving military pension valuation experts, custody disputes, and multiple hearings can easily exceed $20,000-$50,000. Using Untangle's case details management can help you organize your case, understand your options, and potentially reduce the time and expense of working with attorneys by arriving at meetings better prepared.

When to Seek Professional Help

While many aspects of military divorce can be handled with proper preparation and resources, certain situations warrant professional legal assistance. You should consult with an attorney experienced in military divorce if you're dealing with a military pension that will be a significant asset in the divorce, particularly if you need to calculate the marital portion or ensure proper DFAS language in your decree. Complex cases involving disputes over disability pay versus retirement pay (which has different rules for division), contested custody when deployment is a factor, or questions about SCRA protections also benefit from professional guidance.

Military legal assistance offices on base can provide free consultations and basic guidance, though they typically cannot represent either party in a contested divorce. Connecticut's attorney referral services can connect you with civilian attorneys who specialize in military family law. For couples who can agree on major issues, mediation with a mediator knowledgeable about military benefits can be a cost-effective alternative to litigation.

Remember that decisions made in your divorce will affect your financial security and family relationships for years to come. Military benefits like retirement pay and SBP coverage represent decades of service, and errors in how these are addressed in your divorce can be extremely difficult to correct after the fact. Taking the time to understand your rights and options—whether through professional consultation or thorough self-education—is an investment in your future stability.

Frequently Asked Questions

How long does a military divorce take in Connecticut?

A military divorce in Connecticut typically takes 3-12 months, though the Servicemembers Civil Relief Act (SCRA) can extend this timeline if the service member is deployed or requests a stay of proceedings.

Can I file for divorce in CT if my military spouse is stationed in another state?

Yes, you can file for divorce in Connecticut if you meet the state's 12-month residency requirement, regardless of where your military spouse is currently stationed.

How are military retirement benefits divided in a Connecticut divorce?

Military retirement benefits are divided according to the Uniformed Services Former Spouses' Protection Act (USFSPA), which allows Connecticut courts to treat military pensions as marital property subject to equitable distribution.

What rights does a military spouse have during divorce in Connecticut?

Military spouses in Connecticut have the right to a share of military retirement pay, continued healthcare coverage under certain conditions, and protections under state and federal laws governing military benefits division.

Does deployment affect child custody decisions in a CT military divorce?

Yes, Connecticut law under C.G.S. § 46b-56e provides specific protections for deployed parents, preventing permanent custody modifications based solely on a parent's military deployment.

Legal Citations

- • C.G.S. § 46b-44 View Source

- • C.G.S. § 46b-46 View Source

- • C.G.S. § 46b-56e View Source

- • C.G.S. § 46b-81 View Source

- • Practice Book § 25-28 View Source

- • Practice Book § 25-32 View Source

- • Section 46b-215a-1(11)(A) of Connecticut's Child Support Guidelines View Source

- • Bender v. Bender, 258 Conn. 733 View Source

- • Wald v. Cortland-Wald, 226 Conn. App. 752 View Source

- • Form JD-FM-159 View Source

- • Form JD-FM-003 View Source

- • Form JD-FM-006 View Source

- • Form JD-FM-158 View Source