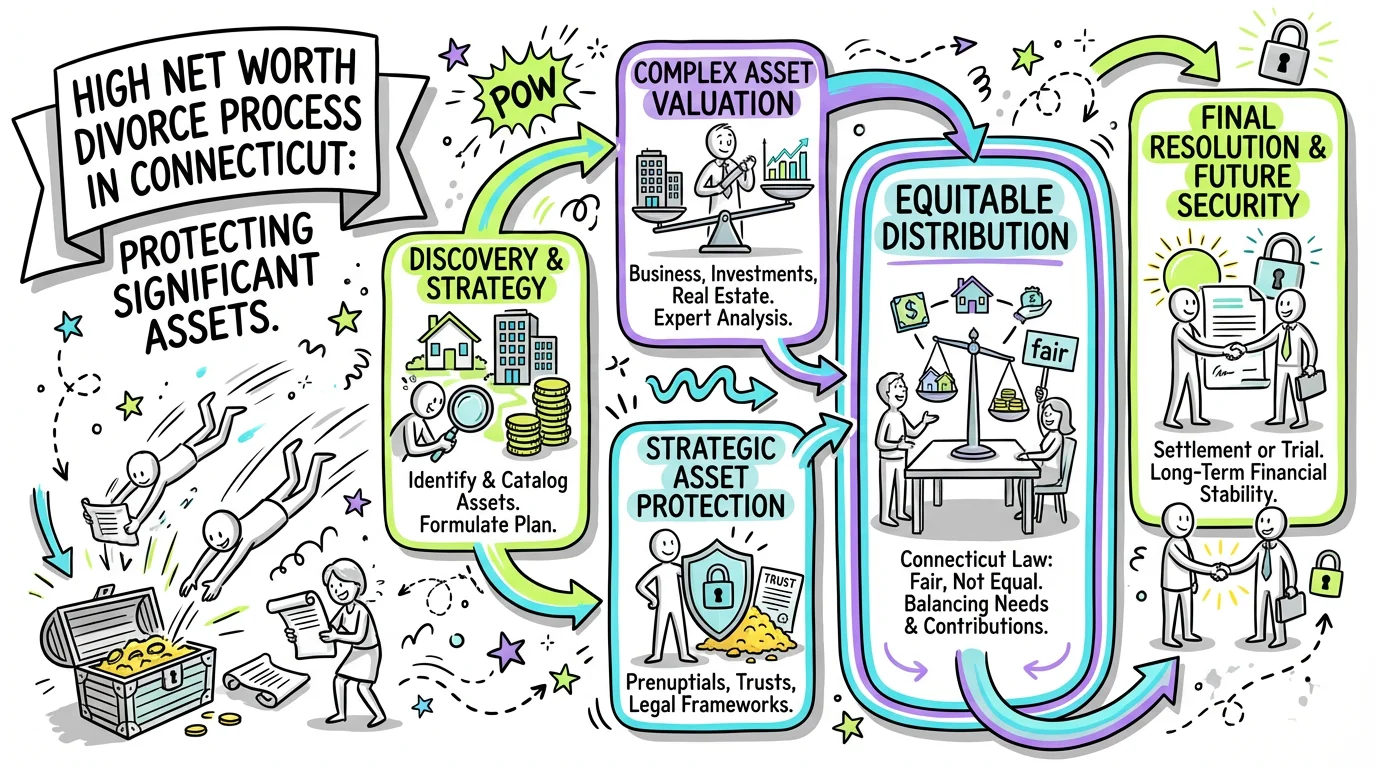

High Net Worth Divorce Process in Connecticut: Protecting Significant Assets

Learn how Connecticut's high net worth divorce process works, including asset protection strategies, business valuation, and equitable distribution for complex estates.

A high net worth divorce in Connecticut involves the same legal framework as any dissolution but requires significantly more complex financial analysis, expert valuations, and strategic planning to protect substantial assets. Under C.G.S. § 46b-81, Connecticut courts have broad authority to assign "all or any part of the estate" of either spouse, making asset protection and proper valuation critical from the very first day of your case. Whether you're protecting a family business, investment portfolios, real estate holdings, or deferred compensation, understanding this process is essential to safeguarding your financial future.

Understanding Connecticut's Equitable Distribution Framework

Connecticut is an equitable distribution state, meaning the court divides marital property based on fairness—not necessarily a 50/50 split. What makes Connecticut unique is that courts can consider all property owned by either spouse, regardless of when or how it was acquired. This includes inheritances, premarital assets, and business interests that might be considered separate property in other states.

The court evaluates multiple statutory factors when making property assignments, including the length of the marriage, each spouse's age and health, occupation and employability, sources of income, vocational skills, and the opportunity for future acquisition of assets. For high net worth couples, the court pays particular attention to the contribution of each spouse to the acquisition, preservation, or appreciation of assets—including the contributions of a spouse as homemaker.

This broad judicial discretion means that protecting your wealth requires comprehensive documentation of asset origins, careful tracing of separate property, and compelling evidence about each spouse's contributions. Tools like Untangle's Complete asset inventory can help you systematically categorize and document your holdings, creating a clear picture of your financial landscape that will be essential throughout your case.

The High Net Worth Case Management Track

High-asset divorces in Connecticut are typically assigned to Track C under the Pathways case management system, which is reserved for complex cases requiring extensive discovery and expert involvement. This designation recognizes that cases with significant assets need more court resources, longer timelines, and specialized handling.

Under Practice Book § 25-50A, within 30-60 days of filing, both parties meet with a family relations counselor who evaluates the complexity of your case. When substantial assets, business interests, or intricate compensation structures are involved, the counselor recommends Track C, triggering a comprehensive scheduling order that accounts for the additional time needed for valuations, depositions, and negotiations.

Track C cases often take 18 to 36 months to resolve, compared to 6-12 months for simpler divorces. This extended timeline isn't bureaucratic delay—it's recognition that rushing complex asset division leads to unfair outcomes and post-judgment litigation. Your scheduling order will establish deadlines for expert disclosures, discovery completion, and trial dates, giving you a roadmap for the entire process.

Mandatory Financial Disclosure Requirements

Connecticut's disclosure requirements are particularly rigorous, and high net worth cases face heightened scrutiny. Practice Book § 25-32 mandates automatic exchange of extensive financial documentation within 60 days of a proper request, creating a comprehensive picture of both spouses' financial situations.

Required Documentation

| Document Category | Timeframe Covered | Purpose |

|---|---|---|

| Federal & State Tax Returns | Last 3 years | Income verification, asset identification |

| W-2s, 1099s, K-1s | Last 3 years + current | Compensation and investment income |

| Financial Account Statements | Past 24 months | Asset values and transaction history |

| Business Financial Statements | Last 3 years | Entity valuation and cash flow |

| Pay Stubs | Current year + last from prior year | Current income verification |

| Retirement Account Statements | Past 24 months | Deferred compensation values |

For high net worth individuals, this disclosure extends to K-1 schedules from closely held entities, stock option agreements, deferred compensation plans, and any trusts in which you have an interest. The Financial Affidavit Long Form (JD-FM-006-Long) requires detailed reporting of all income, expenses, assets, and liabilities. Ensuring accuracy and completeness is paramount. Tools like Untangle's financial affidavit generation can simplify this process by helping you compile and organize the necessary data for your disclosure forms.

Failure to provide complete disclosure can have severe consequences, including adverse inferences, sanctions, and orders to pay the other party's attorney fees. Conversely, if you suspect your spouse is hiding assets, the extensive discovery rights under Connecticut law give you powerful tools to uncover concealed wealth.

Automatic Court Orders and Asset Protection

The moment a divorce complaint is served, Practice Book § 25-5 automatic orders take effect, freezing certain financial activities to preserve the marital estate. Understanding these restrictions is critical for anyone with significant assets, as violations can result in contempt findings and unfavorable judicial rulings.

Both parties are immediately prohibited from:

- Selling, transferring, encumbering, or disposing of marital property without court permission

- Incurring unreasonable debts or spending beyond normal household expenses

- Changing beneficiaries on life insurance, retirement accounts, or other financial instruments

- Hiding or destroying financial records

For business owners, these orders create particular challenges. You can continue normal business operations, but extraordinary transactions—selling major assets, taking unusual distributions, or restructuring ownership—may violate these orders. If business necessities require actions that might otherwise be prohibited, you'll need to seek court permission through a motion.

The Notice of Automatic Court Orders (JD-FM-158) form outlines these restrictions. Using Untangle's case details management can help you maintain compliance by organizing financial activities and flagging potential issues before they become problems.

Business Valuation and Complex Asset Division

For entrepreneurs and business owners, valuation of closely held entities often represents the most contentious aspect of a high net worth divorce. Connecticut courts recognize multiple valuation methodologies, and the approach selected can dramatically affect the outcome.

Common Valuation Approaches

Business valuations typically employ one or more of these methods:

- Income Approach: Capitalizes expected future earnings or cash flows

- Market Approach: Compares the business to similar companies that have sold

- Asset Approach: Values the company's tangible and intangible assets

The valuation date matters significantly—market fluctuations, business cycles, and timing of the divorce can affect values by millions of dollars. Additionally, courts must determine what discounts apply, such as lack of marketability or minority interest discounts, which can reduce a business's value by 15-35%.

Under Practice Book § 25-33, the court may appoint its own expert witness for valuations, particularly when the parties' experts reach widely divergent conclusions. This court-appointed expert provides an independent assessment, though parties remain free to present their own experts as well. Coordinating with your attorney to select qualified, credible valuation experts is essential to protecting your business interests.

Child Support for High-Income Families

When combined parental net weekly income exceeds $4,000 (approximately $208,000 annually), Connecticut's Child Support Guidelines require case-by-case analysis rather than strict formula application. This creates both opportunity and risk for high-earning parents.

The guidelines establish that the support amount at the $4,000 income level represents the minimum presumptive obligation. The maximum presumptive amount is calculated by multiplying total net income by the percentage applicable at the $4,000 level. Between these bounds, courts exercise discretion based on the children's actual needs and the family's established standard of living.

Factors courts consider in high-income cases include:

- The children's educational needs, including private school tuition

- Extracurricular activities and travel for activities

- Healthcare needs beyond standard insurance

- The lifestyle children enjoyed during the marriage

- Each parent's ability to maintain comparable households

The guidelines at Section 46b-215a-5c also permit deviations based on "substantial assets, including both income-producing and non-income-producing property." This means courts can look beyond income to wealth when setting support obligations. The Child Support Worksheet (CCSG-001) provides the framework for these calculations.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Alimony Considerations in High Net Worth Cases

Connecticut courts have broad discretion in awarding alimony under C.G.S. § 46b-82, and in high net worth cases, these awards can be substantial and long-lasting. The statute requires courts to consider each party's length of marriage, causes of dissolution, age, health, station, occupation, employability, income, vocational skills, and the opportunity for future acquisition of assets.

For significant wealth situations, courts pay particular attention to the "station" factor—essentially, the standard of living established during the marriage. A spouse accustomed to luxury travel, multiple residences, and high-end lifestyle may receive alimony calculated to maintain that standard. This can result in monthly awards far exceeding what the receiving spouse could earn independently.

The court may also order that "security be given" for alimony payments, meaning high-asset payors may be required to maintain life insurance, post bonds, or establish trusts to guarantee future payments. This protection ensures the receiving spouse isn't left vulnerable if the paying spouse's financial circumstances change or they fail to comply with orders.

Strategic planning around alimony—including negotiating property settlements in lieu of periodic payments—can provide certainty and tax advantages for both parties. Untangle's spouse financial comparison can help model different scenarios to find arrangements that work for your specific situation.

Prejudgment Remedies to Protect Assets

If you have legitimate concerns about asset dissipation, Connecticut offers powerful prejudgment remedies under C.G.S. § 46b-80. These tools can freeze assets, prevent transfers, and ensure adequate resources remain available for equitable division.

Available remedies include:

- Attachment: Securing specific assets against transfer

- Garnishment: Capturing funds owed to a spouse before they're paid

- Lis Pendens: Recording notice against real property to prevent sale

- Restraining Orders: Court orders prohibiting specific financial actions

A lis pendens is particularly important in high net worth cases involving real estate. Once recorded, it puts all potential buyers on notice of your claim, effectively preventing your spouse from selling property without addressing your interests. The effect lasts until the court modifies or terminates it.

These remedies require court motions with specific evidence—you cannot simply demand them. Working with experienced counsel to demonstrate the need for asset protection, while avoiding overreach that could antagonize the court, requires careful balance.

Practical Steps for Protecting Your Wealth

Successfully navigating a high net worth divorce requires systematic preparation and strategic action. The following steps provide a roadmap for protecting your interests:

-

Assemble Your Financial Team Early: Engage a family law attorney experienced in complex asset cases, a forensic accountant, business valuation expert, and financial advisor before or immediately upon filing.

-

Document Everything: Gather all financial records, including tax returns, account statements, business records, and compensation documentation. Untangle's Smart bank statement analysis can provide organized, accessible recordkeeping for your holdings.

-

Understand Your Business Structure: If you own a business, analyze ownership documents, operating agreements, and any buy-sell provisions that might affect valuation or division.

-

Identify Separate Property: Trace inheritances, premarital assets, and gifts to establish their separate character and any commingling that may have occurred.

-

Analyze Lifestyle Spending: Document the family's standard of living through credit card statements, bank records, and receipts to establish baselines for support calculations.

-

Review Estate Planning Documents: Understand how wills, trusts, and beneficiary designations interact with divorce proceedings.

-

Secure Digital Information: Ensure you have independent access to important accounts and records, while respecting automatic orders against destruction or concealment.

Timeline and Cost Expectations

High net worth divorces in Connecticut typically involve significant time and expense. Understanding these realities helps you plan appropriately.

| Phase | Typical Duration | Key Activities |

|---|---|---|

| Initial Filing & Response | 1-2 months | Complaint, automatic orders, preliminary motions |

| Discovery | 6-12 months | Document exchange, depositions, interrogatories |

| Expert Work | 4-8 months (overlapping) | Business valuations, forensic accounting, lifestyle analysis |

| Negotiation/Mediation | 2-4 months | Settlement conferences, mediation sessions |

| Trial Preparation | 2-3 months | Witness preparation, exhibit assembly, briefs |

| Trial | 1-3 weeks (if needed) | Testimony, argument, decision |

Attorney fees for high net worth divorces commonly range from $50,000 to $500,000 or more, depending on case complexity and whether trial is necessary. Expert witness fees add substantially to these costs. Under C.G.S. § 46b-62, courts may order one spouse to contribute to the other's attorney fees based on their respective financial abilities.

When to Engage Professional Help

While understanding the process is valuable, high net worth divorce is not a DIY endeavor. The stakes are simply too high, and the legal complexities too significant, to navigate without experienced guidance.

Seek professional help immediately if your situation involves business ownership, stock options or deferred compensation, multiple real estate holdings, concerns about hidden assets, international assets, or complex trust structures. An experienced Connecticut family law attorney can coordinate your team of experts and develop strategy tailored to your specific circumstances.

Even during initial exploration, tools like Untangle's free AI consultation can help you organize your thoughts, identify key issues, and prepare for productive conversations with legal counsel. Having a clear picture of your assets and concerns makes your professional consultations more efficient and effective.

Frequently Asked Questions

What is considered a high net worth divorce in Connecticut?

While there's no official threshold, Connecticut divorces are generally considered high net worth when the marital estate exceeds $1 million in combined assets, including real estate, investments, business interests, and retirement accounts.

How long does a high net worth divorce take in CT?

High net worth divorces in Connecticut typically take 12 to 24 months or longer due to complex asset valuations, business appraisals, and the discovery process required to properly identify and divide substantial marital estates.

How do you find hidden assets in a Connecticut divorce?

Hidden assets can be uncovered through formal discovery methods including subpoenas for financial records, depositions, forensic accountants analyzing tax returns and bank statements, and lifestyle analysis comparing spending to reported income.

Can I keep my divorce private in Connecticut if I have significant assets?

Connecticut courts may grant motions to seal certain financial documents and allow parties to use confidential settlement agreements, though complete privacy is difficult since divorce filings are generally part of the public record.

What experts are needed for a high net worth divorce in Connecticut?

High net worth divorces often require forensic accountants, business valuation experts, real estate appraisers, pension analysts, and sometimes lifestyle analysts to properly value and divide complex marital assets.

Legal Citations

- • C.G.S. § 46b-81 - Assignment of property and transfer of title View Source

- • C.G.S. § 46b-82 - Alimony View Source

- • C.G.S. § 46b-80 - Prejudgment remedies View Source

- • C.G.S. § 46b-62 - Orders for payment of attorney's fees View Source

- • Practice Book § 25-5 - Automatic Orders upon Service of Complaint View Source

- • Practice Book § 25-32 - Mandatory Disclosure and Production View Source

- • Practice Book § 25-33 - Judicial Appointment of Expert Witnesses View Source

- • Practice Book § 25-50A - Case Management under Pathways View Source

- • Financial Affidavit Long Form (JD-FM-006-Long) View Source

- • Notice of Automatic Court Orders (JD-FM-158) View Source

- • Child Support Worksheet (CCSG-001) View Source