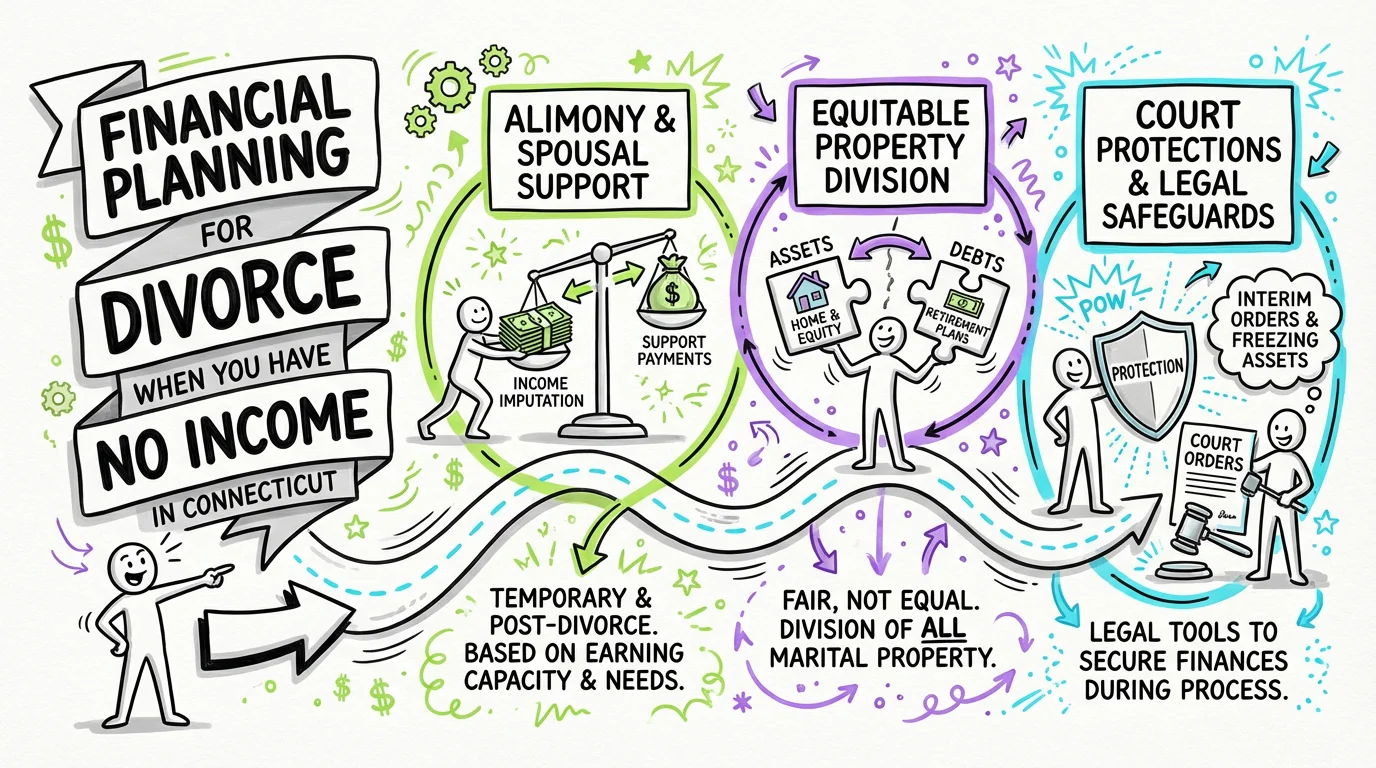

Financial Planning for Divorce When You Have No Income in Connecticut

Learn how stay-at-home spouses in Connecticut can navigate divorce financial planning with no income, including alimony, property division, and court protections.

Connecticut divorce law provides specific financial protections for spouses with no income, primarily through alimony pendente lite (temporary support), equitable distribution of assets, and fee-shifting for legal costs. Under C.G.S. § 46b-81 and § 46b-82, courts must value a stay-at-home spouse's non-monetary contributions—such as homemaking and childcare—equally with financial contributions when dividing property and awarding alimony. These statutes ensure you can participate fairly in the divorce process and transition to financial independence regardless of your current income.

Understanding Your Financial Protections as a Non-Working Spouse

Connecticut operates under an "equitable distribution" model, which means courts divide marital property fairly—not necessarily 50/50—based on each spouse's circumstances, contributions, and needs. This is particularly important for stay-at-home spouses who may have sacrificed career advancement to raise children or support their partner's career growth.

Under C.G.S. § 46b-81, the court considers factors including the length of marriage, causes for the dissolution, age, health, station, occupation, amount and sources of income, vocational skills, employability, estate, liabilities, and needs of each party. Critically, the statute also considers "the contribution of each of the parties in the acquisition, preservation or appreciation in value of their respective estates"—which explicitly includes services as a homemaker. This means your years of domestic work, childcare, and household management have quantifiable value in property division.

The court also evaluates "the opportunity of each for future acquisition of capital assets and income." If you left the workforce to raise children or support your spouse's career, Connecticut courts recognize this sacrifice and factor it into both property division and alimony awards. Tools like the Spouse financial comparison feature can help you understand your complete financial picture before entering negotiations.

Temporary Support During Divorce Proceedings

One of your most immediate protections is the ability to request alimony pendente lite—temporary support during the divorce process itself. Under C.G.S. § 46b-83, the court can award alimony and support from the date you file your application with the Superior Court. This ensures you don't have to wait until the final divorce decree to receive financial assistance.

To request pendente lite support, you'll file a motion accompanied by a sworn affidavit detailing your financial situation. The court will evaluate both parties' financial circumstances and award temporary support to help maintain household stability during litigation. This support can cover living expenses, housing costs, and other necessities while your divorce is pending.

The automatic court orders that take effect when divorce papers are served (Practice Book Rule § 25-5) also provide important protections. These orders prohibit both parties from selling, transferring, encumbering, or disposing of marital assets without written consent or court permission. This means your spouse cannot drain bank accounts, sell property, or hide assets while your divorce is pending—giving you time to assess the full marital estate.

How Connecticut Courts Calculate Alimony

When determining alimony awards, Connecticut courts apply the factors outlined in C.G.S. § 46b-82. For a stay-at-home spouse, several of these factors work in your favor: the length of the marriage, your station and needs, your occupation (or lack thereof due to family responsibilities), your vocational skills and employability, and the time and expense necessary to acquire education or training for appropriate employment.

The statute specifically directs courts to consider whether one spouse contributed to the education, training, or increased earning capacity of the other. If you supported your spouse through graduate school, professional licensing, or career advancement while foregoing your own opportunities, the court will account for this. Additionally, if you interrupted your education or career for childcare or homemaking duties, this weighs heavily in alimony calculations.

| Alimony Factor | How It Affects Stay-at-Home Spouses |

|---|---|

| Length of marriage | Longer marriages typically mean longer or larger alimony awards |

| Age and health | Older spouses or those with health issues may receive more support |

| Occupation and employability | Years out of workforce justify rehabilitative support |

| Vocational skills | Outdated skills may require retraining period |

| Career interruption | Sacrificing career growth for family is heavily weighted |

| Contribution to spouse's career | Supporting spouse's advancement increases your claim |

The case of Marshall v. Marshall illustrates how Connecticut courts handle situations where one spouse has been out of the workforce. In that case, the court assessed the defendant's "earning capacity" based on past employment history, recognizing that actual current income doesn't always reflect true financial potential—a principle that applies to both the higher-earning and lower-earning spouse. Understanding how these factors might apply to your specific situation can be complex. An Alimony calculator can help you estimate potential awards based on Connecticut's guidelines and your circumstances.

Getting Your Attorney's Fees Paid

One of the biggest concerns for financially dependent spouses is affording legal representation. Connecticut addresses this through C.G.S. § 46b-62, which allows courts to order your spouse to pay your reasonable attorney's fees based on your respective financial abilities. This provision exists specifically to level the playing field when one spouse controls the marital finances.

To request attorney's fees, you'll need to demonstrate the disparity in financial resources between you and your spouse. Courts consider the same factors used for alimony determinations, including both parties' financial abilities and needs. If your spouse has substantially greater income or access to liquid assets, the court may order them to pay all or part of your legal fees—including fees for temporary motions and the final divorce proceedings.

This protection is essential because it prevents a wealthier spouse from using financial pressure to force an unfair settlement. You have the right to competent legal representation regardless of whether you personally have funds to pay for it. When exploring your options, understanding potential legal costs is important.

Completing Your Financial Affidavit

Every divorce in Connecticut requires both parties to file sworn financial statements detailing income, expenses, assets, and liabilities. Under Practice Book Rule § 25-30, you must file this document at least five business days before any hearing on alimony, support, or counsel fees. For parties with net income under $75,000 and total assets under $75,000, you'll use the Short Form Financial Affidavit (Form JD-FM-006).

Even if you have no income, completing this form accurately is crucial. You'll need to document all household expenses—housing, utilities, food, transportation, healthcare, children's needs, and personal expenses. This information directly impacts support calculations. Be thorough and realistic; underestimating expenses could result in inadequate support awards. Automated Financial affidavit generation can streamline this process, helping you ensure all necessary details are included.

The mandatory disclosure requirements under Practice Book Rule § 25-32 require your spouse to provide extensive financial documentation within 60 days of your request, including:

- Federal and state tax returns for the last three years

- All W-2, 1099, and K-1 forms for the last three years

- Current pay stubs and the last pay stub from the prior year

- Bank statements for all accounts over the past 24 months

- Investment and retirement account statements

- Life insurance policy information

This discovery process ensures you gain full visibility into marital finances, even if your spouse has controlled all financial matters during the marriage. Organizing and analyzing these disclosures as you receive them is crucial.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Creating Your Post-Divorce Financial Plan

Successfully navigating divorce as a financially dependent spouse requires planning beyond just the divorce settlement. Consider these key areas:

- Immediate Needs Assessment: Calculate your minimum monthly expenses for housing, food, transportation, healthcare, and childcare. This becomes the baseline for pendente lite support requests and helps you understand what settlement terms you can accept.

- Career Reentry Planning: If you've been out of the workforce, assess what skills you need to update or acquire. Connecticut courts can award "rehabilitative alimony" specifically designed to support you while obtaining education or training. Document the time and expense needed for appropriate employment—this information strengthens your alimony case.

- Healthcare Transition: If you're currently covered under your spouse's employer-provided health insurance, you'll need to plan for COBRA coverage or marketplace insurance. Under federal law, you can continue coverage through COBRA for up to 36 months after divorce, though you'll be responsible for the full premium cost. Factor this expense into your support calculations.

- Building Credit History: If all credit accounts have been in your spouse's name, you'll need to establish independent credit. Consider requesting that a portion of your settlement include being added to existing accounts temporarily or receiving funds specifically to secure your own credit.

Steps to Protect Yourself Financially

-

Gather financial documents immediately: Before filing, copy all bank statements, tax returns, investment account statements, property deeds, and vehicle titles you can access. Store copies somewhere safe outside the marital home.

-

Open individual accounts: Even before filing, you can open a bank account in your name only. This provides a place for support payments and begins establishing your independent financial identity.

-

Document your contributions: Create a detailed record of your homemaking, childcare, and other non-monetary contributions to the marriage. Note any career sacrifices you made to support your spouse's advancement.

-

Request pendente lite support promptly: Don't wait to file for temporary support. The sooner you file, the sooner you can receive financial assistance during the divorce process.

-

Understand the full marital estate: Use the mandatory disclosure process to gain complete visibility into all marital assets and debts. Using a Complete asset inventory tool can help you organize and analyze this information systematically.

-

Consider your housing options: Evaluate whether staying in the marital home makes financial sense long-term, or whether selling and dividing proceeds better serves your needs.

-

Plan for child-related expenses: If you have children, understand how child support will be calculated using Connecticut's Child Support Guidelines. The guidelines consider both parents' income—or imputed income if a parent is voluntarily unemployed.

Child Support Considerations for Stay-at-Home Parents

Connecticut's Child Support Guidelines use a specific formula based on both parents' net income. As the stay-at-home parent, you may have concerns about how having no income affects calculations. Generally, if you've been the primary caregiver and your lack of income reflects that family role, courts typically don't impute income to you—meaning they won't calculate support as if you were earning money you're not actually making.

However, under Section 46b-215a-5c(b)(1), courts can consider a parent's "earning capacity" if they are voluntarily unemployed or underemployed. As a stay-at-home parent, your situation is usually viewed differently than someone who simply chooses not to work—your lack of income was a mutual family decision. Document the history of your family's childcare arrangements to support this position.

The child support calculation also considers which parent provides health insurance coverage for the children and the cost of work-related childcare. If you'll need childcare to enter the workforce, these expenses are factored into the support calculation through the Child Support Guidelines Worksheet (Form CCSG-001).

Modification of Support Orders

Life circumstances change, and Connecticut law recognizes this through C.G.S. § 46b-86. Unless your divorce decree specifically prohibits modification, you can return to court to request changes to alimony or support orders upon showing a "substantial change in circumstances." This is important for stay-at-home spouses because:

- If your efforts to become employable take longer than anticipated, you may seek extended support

- If your former spouse's income increases significantly, you may request additional support

- If circumstances change unexpectedly (illness, job loss, children's needs), the court can adjust orders

This flexibility provides a safety net as you transition to financial independence. You're not locked into orders that become unworkable—the court retains jurisdiction to modify support as life evolves.

When to Seek Professional Help

While Connecticut allows self-representation in divorce, financially dependent spouses facing complex situations should strongly consider professional legal assistance. You should consult with an attorney if:

- Your spouse has significant assets or complex income (business ownership, investments, stock options)

- There are questions about hidden assets or financial dishonesty

- Your spouse has hired an attorney and you're negotiating alone

- You've experienced financial abuse or control during the marriage

- You're unsure whether proposed settlement terms are fair

Remember, C.G.S. § 46b-62 may entitle you to have your spouse pay your attorney's fees. A consultation can help you understand your rights and whether professional representation is warranted. Many Connecticut family law attorneys offer initial consultations to assess your situation.

For cases with limited complexity, a Personalized task dashboard can help you understand the process, organize your financial information, and prepare documents—potentially reducing the attorney time (and cost) needed if you do retain legal help. The platform's financial analysis tools are particularly valuable for stay-at-home spouses working to understand their complete financial picture for the first time.

Frequently Asked Questions

How do I prepare for divorce as a stay-at-home spouse in Connecticut?

Start by gathering all financial documents, understanding your household expenses, opening individual bank accounts and credit cards in your name, and consulting with a Connecticut divorce attorney about your rights to temporary support and equitable property division.

Can I get temporary spousal support during my Connecticut divorce if I have no income?

Yes, Connecticut law allows you to request alimony pendente lite (temporary support) under C.G.S. § 46b-83, which provides financial assistance during the divorce proceedings until a final order is issued.

How do I build credit after divorce if I have no income in CT?

You can build credit by opening a secured credit card, becoming an authorized user on a trusted person's account, applying for a credit-builder loan, or using any alimony or child support payments to establish payment history.

What should be on my divorce financial checklist if I don't have a job?

Your checklist should include gathering tax returns, bank statements, retirement account statements, mortgage documents, credit card statements, monthly expense records, and documentation of your contributions as a homemaker to support your case for equitable distribution.

Are there emergency funds available for divorcing spouses with no income in Connecticut?

Connecticut offers resources including court-ordered temporary support, legal aid organizations, and community assistance programs, plus courts can order your spouse to pay your attorney's fees if you lack the financial means to participate fairly in the divorce process.

Legal Citations

- • Practice Book Rule § 25-5 - Automatic Orders upon Service of Complaint View Source

- • Practice Book Rule § 25-30 - Statements To Be Filed View Source

- • Practice Book Rule § 25-32 - Mandatory Disclosure and Production View Source

- • Marshall v. Marshall, 224 Conn. App. 45 View Source

- • Short Form Financial Affidavit (Form JD-FM-006) View Source

- • Child Support Guidelines Worksheet (Form CCSG-001) View Source