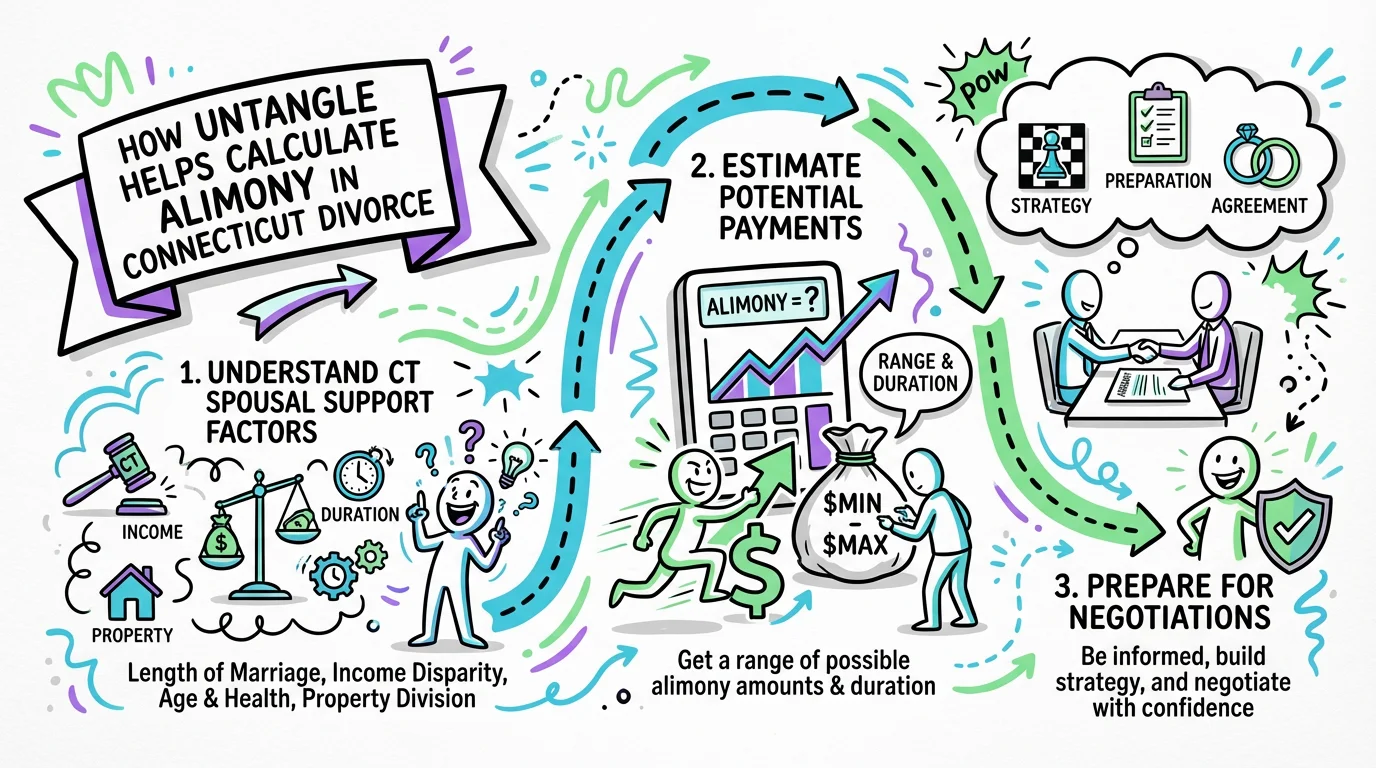

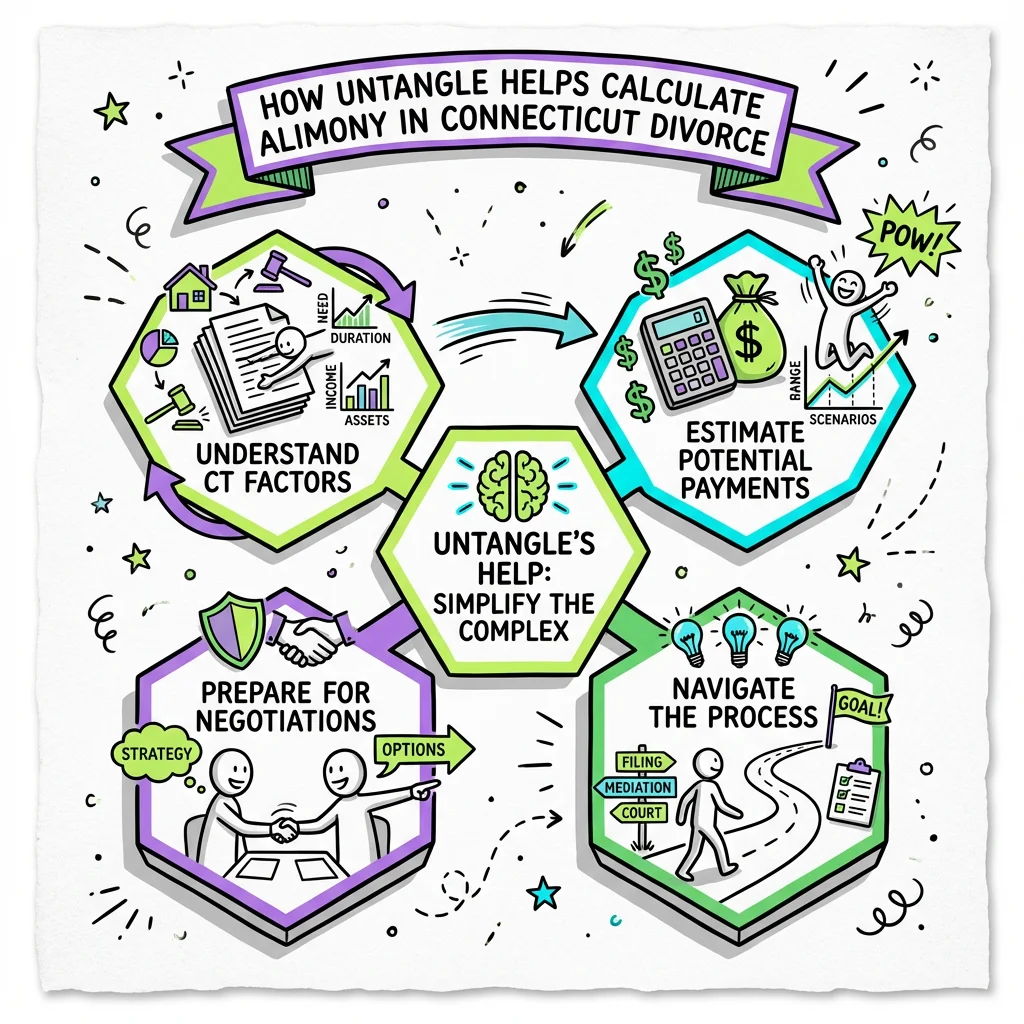

How Untangle Helps Calculate Alimony in Connecticut Divorce

Learn how Untangle helps calculate alimony in Connecticut divorce cases. Understand CT spousal support factors, estimate potential payments, and prepare for negotiations.

Yes, Untangle's alimony calculator helps you estimate potential spousal support payments in Connecticut by analyzing the statutory factors courts consider when awarding alimony. While Connecticut judges have broad discretion and no fixed formula exists for calculating alimony, Untangle provides data-driven estimates based on income disparity, marriage length, and other factors outlined in C.G.S. § 46b-82—giving you a realistic starting point for understanding what you might receive (or owe) as you navigate your divorce.

Understanding Connecticut Alimony: Why Calculations Are Complex

Connecticut differs from many states because it does not use a mathematical formula to determine alimony awards. Instead, under C.G.S. § 46b-82, judges evaluate a comprehensive list of factors to decide both the amount and duration of spousal support. This discretionary approach means two seemingly similar cases can result in very different outcomes depending on the specific circumstances and the judge assigned to your case.

For stay-at-home spouses, this uncertainty can feel overwhelming. After years of contributing to your family through unpaid labor—managing the household, raising children, supporting your spouse's career—you may be unsure how courts will value your contributions or what financial support you can reasonably expect. The lack of a clear formula makes planning for your post-divorce life exceptionally challenging.

This is exactly where Untangle becomes invaluable. Rather than leaving you guessing, Untangle's alimony calculator analyzes the factors Connecticut courts actually consider and helps you understand the range of possible outcomes. You can model different scenarios—what if you get a job within six months? What if your spouse's bonus changes?—to prepare for negotiations with realistic expectations rather than anxiety-inducing uncertainty.

The Statutory Factors Untangle Analyzes

Connecticut law requires courts to consider specific factors when determining alimony. Under C.G.S. § 46b-82, these include the length of the marriage, the causes for dissolution, the age, health, and station of each party, their occupation, amount and sources of income, vocational skills, employability, and the estate and needs of each party. The statute also considers the desirability of the custodial parent securing employment.

Marriage Length and Its Impact on Support Duration

The duration of your marriage significantly influences both the amount and length of alimony you might receive. Generally, marriages lasting less than ten years may result in rehabilitative alimony—time-limited support designed to help you gain skills and become self-sufficient. Marriages of fifteen years or longer often result in longer-term or even permanent alimony, particularly when one spouse sacrificed career development for the family.

Untangle helps you understand where your marriage falls on this spectrum. By entering your marriage length along with other relevant factors, you can see how duration typically affects awards in Connecticut courts. For a stay-at-home spouse after a twenty-year marriage, this analysis might reveal that courts often award support lasting 50-70% of the marriage length—giving you concrete numbers to work with during settlement discussions.

Income Disparity and Earning Capacity

Perhaps the most critical factor in alimony calculations is the income difference between spouses. Courts look at both current income and future earning capacity—your ability to earn money based on your education, skills, and work history. For someone who left the workforce to raise children or support a spouse's career, earning capacity may be significantly lower than if you had continued working throughout the marriage.

Untangle's calculator considers not just current income but also your potential earning capacity and how long it might take you to become financially independent. If you haven't worked in fifteen years, the tool can help estimate realistic timelines for reentering the workforce and what income you might earn—factors that directly influence how much support you may need and for how long.

How Untangle's Alimony Calculator Works

Using Untangle's alimony estimation tools is straightforward, even if you're not financially sophisticated. You'll input basic information about both spouses' incomes, the length of your marriage, your employment history, and other relevant factors. The tool then generates estimates based on how Connecticut courts typically handle similar situations.

What You'll Need to Get Started

Before using the calculator, gather your financial information. Connecticut Practice Book Rule § 25-30 requires both parties to file sworn financial statements showing income, expenses, assets, and liabilities. This same information powers Untangle's calculations:

- Current gross income for both spouses (salary, bonuses, investment income)

- Length of marriage

- Employment history and any gaps

- Education and vocational training

- Health considerations affecting employability

- Current monthly expenses

- Whether you have minor children

The more accurate your input, the more useful your estimates will be. If you're unsure about your spouse's exact income, Untangle can help you work with estimates and refine them as you obtain documentation through the mandatory disclosure process required under Practice Book Rule § 25-32. Tools like Untangle's income source tracking can help you compile all necessary financial data, making sure you have a complete picture.

Understanding Your Results

Untangle provides a range of potential outcomes rather than a single number—because that's how Connecticut alimony actually works. You might see that based on your circumstances, monthly alimony could range from $2,500 to $4,000 for a duration of 8-12 years. This range reflects the discretion judges have and helps you set realistic expectations.

The tool also shows you how changing various factors affects the outcome. What happens if you find part-time work? How does the estimate change if your spouse receives a promotion? This scenario modeling helps you prepare for negotiations and understand what trade-offs might make sense for your situation.

Types of Alimony You Might Receive

Connecticut courts can award different types of alimony depending on your circumstances, and understanding these categories helps you use Untangle more effectively.

| Type | Purpose | Duration | Typical Situations |

|---|---|---|---|

| Rehabilitative | Help you become self-supporting | Limited (usually 3-7 years) | Shorter marriages, younger spouses |

| Permanent | Ongoing support | Until death, remarriage, or modification | Long marriages, health issues, limited earning capacity |

| Lump Sum | One-time payment | N/A | Property settlement alternatives |

| Pendente Lite | Support during divorce | Until final decree | Immediate financial needs |

Pendente Lite Support: Getting Help Now

If you need financial support while your divorce is pending, you can request alimony pendente lite under C.G.S. § 46b-83. This temporary support begins from the date you file your application and continues until your divorce is finalized. Untangle can help you understand what temporary support might look like and prepare the financial documentation needed to support your request.

For stay-at-home spouses with no independent income, pendente lite support is often essential. It provides immediate financial stability while you work through the longer divorce process—covering necessities like housing, utilities, and food so you're not financially pressured into accepting an unfair settlement.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Preparing Your Financial Documentation

Accurate alimony calculations—whether by Untangle, your attorney, or the court—depend on complete financial information. Connecticut requires extensive disclosure through the Financial Affidavit (Form JD-FM-006), and gathering this information early gives you a significant advantage.

Creating Your Financial Picture

Untangle's financial affidavit generation tool helps you compile and organize the documents you'll need:

- Income documentation: Pay stubs, W-2s, tax returns for the past three years, 1099s for any freelance or investment income

- Expense tracking: Monthly bills, credit card statements, receipts for regular expenses

- Asset inventory: Bank statements, retirement account statements, property valuations

- Debt overview: Mortgage statements, car loans, credit card balances, student loans

This documentation serves double duty: it feeds into Untangle's calculations for more accurate estimates and prepares you for the mandatory disclosure requirements under Practice Book Rule § 25-32, which requires parties to exchange tax returns, pay stubs, and financial account statements. Having these documents organized in one secure place prevents last-minute scrambling when court deadlines approach.

The Financial Affidavit Connection

Connecticut's Financial Affidavit Long Form requires detailed information about your income, expenses, assets, and liabilities. This sworn statement becomes critical evidence in alimony determinations. By using Untangle to organize your finances, you're simultaneously preparing this required court document and getting clearer estimates of potential support—an efficient approach that saves time and reduces stress.

It is important to remember that this affidavit is a sworn document, meaning errors or omissions can have serious legal consequences. Judges rely heavily on the integrity of this financial snapshot when making alimony rulings. Using Untangle's systematic approach to gathering and categorizing your data helps ensure that your affidavit is both complete and accurate, reducing the risk of credibility issues in court.

Factors That Can Modify Alimony Later

Understanding that alimony can be modified helps you plan realistically for your future. Under C.G.S. § 46b-86, either party can request modification of alimony orders upon showing a "substantial change in circumstances." This means your initial award isn't necessarily permanent.

Common circumstances that might lead to modification include:

- Significant income changes for either party

- Recipient spouse's cohabitation with a new partner

- Retirement of the paying spouse

- Health changes affecting earning capacity

- Recipient spouse completing education or job training

Courts in cases like Ross v. Ross and Fogel v. Fogel have addressed how changes in income and employment affect alimony modification requests. Knowing that modification is possible can help you negotiate initial terms more strategically—perhaps accepting lower payments for longer duration, or vice versa.

Untangle helps you think through these long-term considerations by modeling different scenarios. What does your financial picture look like if alimony ends in five years versus ten? What if you receive more monthly but for a shorter period? These projections help you make informed decisions during settlement negotiations.

Moving from Estimates to Negotiations

Once you understand your likely alimony range through Untangle's calculator, you're better positioned to negotiate effectively. Knowledge is power in divorce negotiations, and having data-driven expectations prevents you from being pressured into accepting too little—or making unrealistic demands that stall productive discussions.

Using Your Estimates Strategically

Your Untangle estimates give you a foundation for settlement discussions. If the calculator suggests a range of $3,000-$4,500 monthly for 10-15 years, you have concrete numbers to discuss rather than vague hopes or fears. You can negotiate within that range based on other factors in your divorce—perhaps accepting the lower end of support in exchange for more favorable property division, or pushing for the higher end if you'll be the primary custodial parent.

It is also often possible to trade monthly alimony for a lump sum payout or a larger share of retirement assets. This can be particularly advantageous if you prefer a clean financial break or are concerned about your spouse's future ability to pay. Using your estimates, you can calculate the present value of the alimony stream to ensure any trade-off you accept is mathematically fair.

When Professional Help Becomes Essential

While Untangle provides valuable estimates and financial organization, certain situations require professional legal guidance. If your spouse owns a business with complex income structures, if there are concerns about hidden assets, or if your case involves allegations of fault that might affect the divorce outcome, consulting with a Connecticut family law attorney ensures your interests are fully protected.

Untangle complements attorney representation rather than replacing it. Many users find that arriving at their first attorney consultation with organized finances and preliminary alimony estimates makes that meeting more productive—and potentially reduces billable hours spent gathering basic information.

Taking Control of Your Financial Future

For stay-at-home spouses facing divorce, uncertainty about financial support can be paralyzing. Untangle's case management tools transform that uncertainty into actionable information. By understanding what Connecticut law says about alimony, seeing estimates based on your actual circumstances, and organizing your financial documentation, you move from a position of vulnerability to one of informed confidence.

The divorce process is never easy, especially when you've been financially dependent on your spouse. But you don't have to navigate it blindly. With tools like Untangle's alimony calculator, you can understand what support you might expect, prepare compelling documentation for court, and enter negotiations knowing your worth. That knowledge doesn't just help you secure fair alimony—it helps you start building the independent future you deserve.

Frequently Asked Questions

How accurate is Untangle's alimony calculator for Connecticut divorces?

Untangle provides data-driven estimates based on the statutory factors in C.G.S. § 46b-82, but since Connecticut judges have broad discretion and use no fixed formula, results should be used as a realistic starting point rather than a guaranteed prediction.

What factors does Untangle use to estimate spousal support in CT?

Untangle analyzes income disparity, marriage length, and other factors outlined in Connecticut's alimony statute (C.G.S. § 46b-82) to calculate potential spousal support amounts.

Can I model different alimony scenarios using Untangle?

Yes, Untangle allows you to model different scenarios—such as getting a new job or changes in your spouse's income—to help you prepare for negotiations with realistic expectations.

Is there a free alimony calculator for Connecticut divorces?

Untangle offers an alimony calculator that helps estimate potential spousal support payments in Connecticut, though you should check their website for current pricing and available features.

Why is calculating alimony in Connecticut so complicated?

Unlike many states, Connecticut does not use a mathematical formula for alimony—instead, judges have broad discretion to evaluate factors like income, marriage length, and contributions to the marriage on a case-by-case basis.

Legal Citations

- • C.G.S. § 46b-82 (Alimony) View Source

- • C.G.S. § 46b-83 (Alimony pendente lite) View Source

- • C.G.S. § 46b-86 (Modification of alimony orders) View Source

- • Connecticut Practice Book Rule § 25-30 (Statements To Be Filed) View Source

- • Connecticut Practice Book Rule § 25-32 (Mandatory Disclosure and Production) View Source

- • Ross v. Ross, 200 Conn. App. 720 View Source

- • Fogel v. Fogel, 212 Conn. App. 784 View Source

- • Connecticut Financial Affidavit Long Form (JD-FM-006) View Source