Divorce Rights for Stay-at-Home Moms in Connecticut: Complete Legal Guide

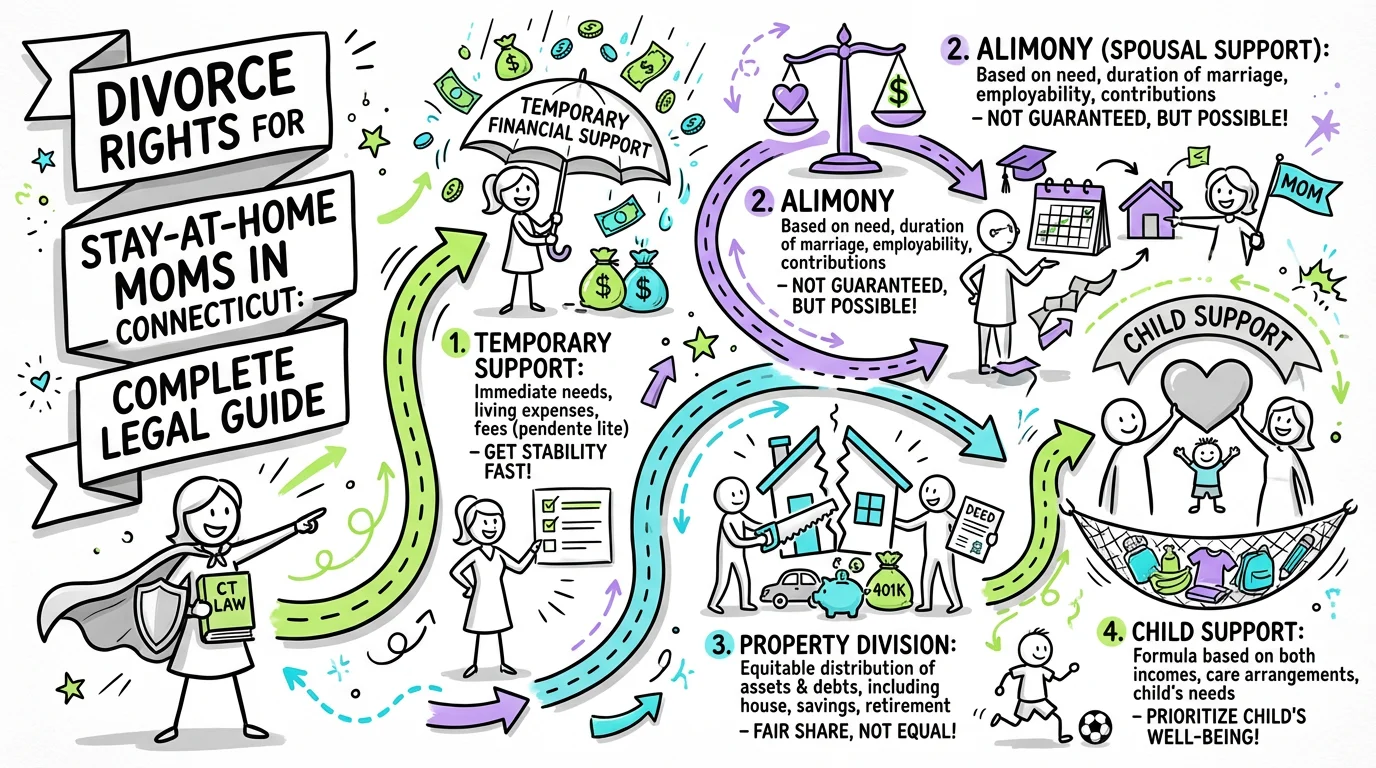

Learn your legal rights as a stay-at-home mom divorcing in Connecticut, including alimony, property division, child support, and temporary financial support options.

Stay-at-home mothers in Connecticut have substantial legal protections during divorce, including rights to alimony (spousal support), an equitable share of marital property, child support, and temporary financial assistance while the divorce is pending. Connecticut law explicitly recognizes the economic value of homemaking and child-rearing contributions, meaning courts consider your non-monetary contributions to the marriage when dividing assets and determining support. You are not at a disadvantage simply because you didn't earn a paycheck—the law is designed to ensure financial fairness regardless of which spouse worked outside the home.

Understanding Your Financial Rights in Connecticut Divorce

Connecticut operates under an "equitable distribution" model, which means marital property is divided fairly—though not necessarily equally—based on numerous factors. Under C.G.S. § 46b-81, the court considers each spouse's contribution to the acquisition, preservation, or appreciation of marital assets, including "services as a homemaker." This statutory language is crucial for stay-at-home moms because it means the years you spent raising children, managing the household, and supporting your spouse's career are legally recognized as contributions deserving compensation.

The court also examines the length of the marriage, the causes of the breakdown, each spouse's age and health, occupation, employability, and future earning capacity. For long-term marriages where one spouse sacrificed career development to support the family, Connecticut courts often award a greater share of assets or longer-term alimony to help that spouse transition to financial independence. Your role in enabling your spouse to build wealth while you maintained the home and raised children is a factor that works in your favor.

It's important to understand that Connecticut courts can divide all property owned by either spouse, regardless of whose name is on the title. This means retirement accounts, investment portfolios, real estate, and business interests accumulated during the marriage may all be subject to division. Tools like Untangle's Complete asset inventory can help you organize and track all marital property to ensure nothing is overlooked during this critical process.

Alimony Rights for Stay-at-Home Spouses

Alimony, also called spousal support, is specifically designed to address situations where one spouse has been financially dependent during the marriage. Under C.G.S. § 46b-82, Connecticut courts consider numerous factors when awarding alimony, including the length of marriage, causes of dissolution, each party's age, health, station, occupation, amount and sources of income, earning capacity, vocational skills, and "the contribution of each of the parties in the acquisition, preservation or appreciation of their respective estates."

For stay-at-home mothers, several alimony factors work strongly in your favor. Courts specifically consider "the award of the family home or other residential dwelling unit" to the custodial parent and examine each spouse's "opportunity for future acquisition of capital assets and income." If you've been out of the workforce for years, the court recognizes that your earning capacity may be significantly lower than your spouse's and that you may need time and resources to become self-supporting.

The case of Oudheusden v. Oudheusden illustrates how Connecticut courts protect financially dependent spouses. In that case, the court awarded the wife $18,000 per month in alimony that was not modifiable in duration or amount, recognizing her contributions to a long-term marriage and her need for ongoing support. While every case is different, this demonstrates that substantial alimony awards are available when circumstances warrant them. Using Untangle's Alimony calculator can help you understand what level of support might be appropriate for your situation based on Connecticut guidelines.

Pendente Lite Support: Financial Help During Divorce

One of the most important protections for stay-at-home moms is the right to pendente lite support—temporary financial assistance that begins while your divorce is still pending. Under C.G.S. § 46b-83, the court can award alimony and support "from the date of the filing of an application therefor." This means you don't have to wait months or years for your divorce to finalize before receiving financial help.

Pendente lite orders can include spousal support, child support, exclusive use of the family home, and attorney's fees. These temporary orders recognize that financial emergencies can't wait for final judgments. If your spouse controls all the family finances, you can file a motion requesting immediate relief, and the court will hold a hearing to address your urgent needs.

Practice Book Rule § 25-24 establishes the procedure for filing these motions, stating that "any appropriate party may move pendente lite... for alimony, child support, custody, visitation... counsel fees, maintenance of the family, or other equitable relief." This is a powerful tool for stay-at-home parents who might otherwise be left without resources during what can be a lengthy divorce process. Working with Untangle's Automatic document generation can help you prepare the necessary paperwork to request this vital support.

Automatic Court Orders That Protect You

When a divorce is filed in Connecticut, automatic court orders immediately go into effect to protect both spouses and any children. Under Practice Book Rule § 25-5, these orders prevent either party from making major financial moves without court approval. Neither spouse can sell, transfer, or dispose of marital assets; cancel insurance policies covering the other spouse or children; or incur unreasonable debts that would burden the other party.

For stay-at-home moms, these automatic orders provide crucial protection against a working spouse who might try to hide assets, drain bank accounts, or cancel health insurance during the divorce process. The orders remain in effect until modified or terminated by the court, ensuring stability during an uncertain time.

These protections mean that even if your name isn't on accounts or titles, your spouse cannot unilaterally dispose of marital property. If you suspect your spouse is violating these orders, you can bring the matter to the court's attention and request enforcement. The Notice of Automatic Court Orders form (JD-FM-158) outlines these protections and must be served with the divorce complaint.

Child Support and Custody Considerations

Connecticut uses the Income Shares Model for calculating child support, which means child support is based on both parents' combined income. According to the Child Support Guidelines Preamble, "the child should receive the same proportion of parental income as he or she would have received if the parents lived together." This approach ensures children maintain their standard of living even after divorce.

Under C.G.S. § 46b-84, both parents are obligated to maintain their children "according to their respective abilities." For stay-at-home moms with little or no income, this typically means the working spouse will pay child support. The guidelines also allow courts to deviate from standard calculations based on "substantial assets" or "the parent's earning capacity" when appropriate.

Custody arrangements significantly impact support calculations. Stay-at-home mothers are often awarded primary physical custody, particularly for young children, given their established role as primary caregiver. If you're concerned about understanding how custody arrangements affect your financial situation, the Child Support Worksheet (CCSG-001) can help you estimate potential support amounts.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

The Financial Affidavit: Your Most Important Document

The Financial Affidavit is the cornerstone of your divorce case. Practice Book Rule § 25-30 requires each party to file a sworn statement showing "current income, expenses, assets, and liabilities" at least five business days before any hearing on alimony or support. For stay-at-home moms, completing this form accurately is essential to demonstrating your financial needs and your spouse's ability to pay.

The Financial Affidavit Long Form (JD-FM-006) requires detailed information about your weekly expenses, monthly bills, assets, and debts. Even if you haven't managed the family finances, you'll need to gather information about all accounts, properties, and obligations. Under Practice Book Rule § 25-32, your spouse is required to provide tax returns, pay stubs, bank statements, and other financial documents within 60 days of a request.

Don't underestimate your expenses. Include everything from groceries and utilities to children's activities, medical costs, and clothing. Courts use this information to determine appropriate support levels, so being thorough is essential. Untangle's Financial affidavit generation feature can streamline this process, helping you compile and organize all necessary financial information thoroughly so nothing is missed.

Steps to Protect Your Rights as a Stay-at-Home Mom

- Gather financial documents immediately. Collect copies of tax returns, bank statements, investment account statements, retirement account information, mortgage documents, and any other financial records you can access. Do this before filing for divorce if possible.

- Understand all marital assets and debts. Make a comprehensive list of everything you own and owe as a couple, including property, vehicles, retirement accounts, credit cards, and loans. Connecticut can divide property held in either spouse's name.

- Calculate your actual monthly expenses. Track every expense for your household and children over several months to establish an accurate baseline for support requests.

- File for pendente lite support promptly. Don't wait to request temporary support—file your motion as soon as your divorce case begins to ensure you have resources during the proceedings.

- Complete your Financial Affidavit thoroughly. This document drives most financial decisions in your case, so invest time in making it accurate and comprehensive.

- Document your contributions to the marriage. Keep records of your homemaking, child-rearing, and any support you provided for your spouse's career advancement.

- Explore career training or education options. Courts may award additional support or time for you to gain skills needed for employment. Begin researching options early.

Key Factors Courts Consider for Stay-at-Home Parents

| Factor | How It Helps Stay-at-Home Moms |

|---|---|

| Length of marriage | Longer marriages typically result in longer alimony duration |

| Homemaker contributions | Legally recognized as equivalent to financial contributions |

| Earning capacity disparity | Lower earning potential supports larger/longer alimony awards |

| Age and health | Older spouses may receive more support due to limited employment options |

| Custody of children | Primary custodial parent often receives family home and higher support |

| Standard of living | Courts aim to maintain lifestyle established during marriage |

| Career sacrifices | Time out of workforce to raise children is considered |

When to Get Professional Help

While Connecticut allows divorcing spouses to represent themselves, stay-at-home moms facing complex financial situations should seriously consider legal representation. If your spouse owns businesses, has significant assets, or controls all family finances, an experienced family law attorney can ensure hidden assets are discovered and your rights are fully protected. Courts can even order your spouse to pay your attorney's fees under C.G.S. § 46b-82, which allows awards for "such counsel fees and automatic body execution to secure any order" to ensure equal access to legal representation.

Even if you're considering mediation or a collaborative divorce, consulting with an attorney before signing any agreement protects your interests. What seems fair in the moment may not adequately provide for your long-term financial security. Using Untangle's AI legal guidance can help you understand your options and connect with appropriate professional support for your specific situation.

Frequently Asked Questions

How much alimony can a stay-at-home mom get in Connecticut?

Connecticut courts determine alimony based on factors like marriage length, lifestyle during marriage, earning capacity, and the homemaker's contributions, with no fixed formula or cap on the amount.

Can a stay-at-home mom get half of everything in a CT divorce?

Connecticut uses equitable distribution rather than a 50/50 split, meaning a stay-at-home mom may receive more or less than half depending on factors like marriage length, homemaker contributions, and each spouse's future earning capacity.

Do stay-at-home moms have an advantage in child custody cases in Connecticut?

While Connecticut courts prioritize the child's best interests over either parent's role, being the primary caregiver is a significant factor that often favors stay-at-home mothers in custody determinations.

How do Connecticut courts value a homemaker's contributions in divorce?

Under C.G.S. § 46b-81, Connecticut courts explicitly recognize homemaking and child-rearing as valuable contributions equal to financial contributions when dividing marital property and determining support.

Can I get temporary financial support while my Connecticut divorce is pending?

Yes, stay-at-home moms in Connecticut can request pendente lite orders for temporary spousal support, child support, and payment of household expenses while the divorce case proceeds.

Legal Citations

- • Practice Book Rule § 25-5 (Automatic Orders) View Source

- • Practice Book Rule § 25-24 (Motions) View Source

- • Practice Book Rule § 25-30 (Financial Statements) View Source

- • Practice Book Rule § 25-32 (Mandatory Disclosure) View Source

- • Oudheusden v. Oudheusden, 338 Conn. 761 View Source

- • Financial Affidavit Long Form (JD-FM-006) View Source

- • Notice of Automatic Court Orders (JD-FM-158) View Source

- • Child Support Worksheet (CCSG-001) View Source