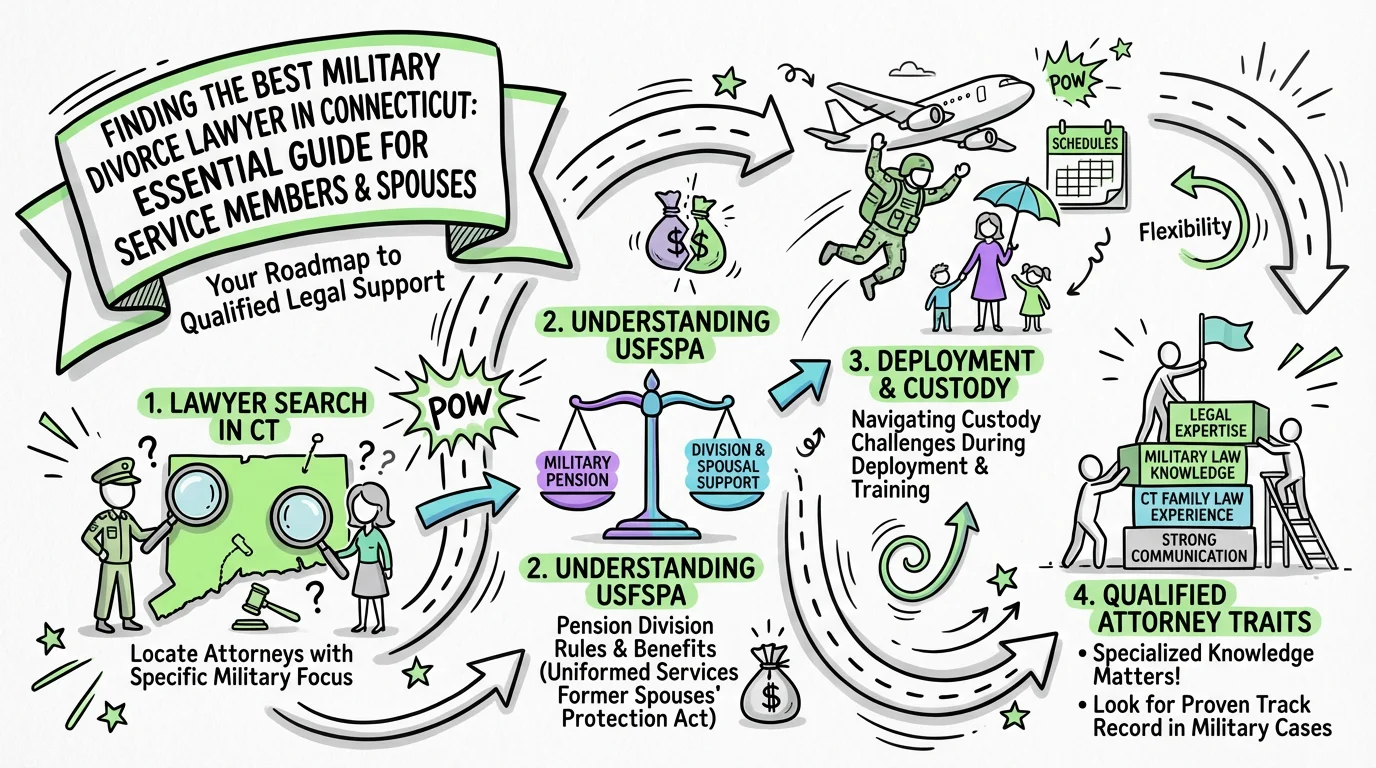

Finding the Best Military Divorce Lawyer in Connecticut: Essential Guide for Service Members and Spouses

Find the best military divorce lawyer in Connecticut. Learn about USFSPA, pension division, deployment custody rules, and what makes an attorney qualified for military divorce cases.

The best military divorce lawyer in Connecticut is one who combines deep knowledge of Connecticut family law with expertise in federal military regulations, including the Uniformed Services Former Spouses' Protection Act (USFSPA), Servicemembers Civil Relief Act (SCRA), and military pension division rules. Look for attorneys who regularly handle military divorces, understand the 10/10 rule for direct pension payments, and can navigate complex issues like deployment custody modifications and TRICARE eligibility—not just any family law attorney will have this specialized knowledge.

Why Military Divorce Requires Specialized Legal Expertise

Military divorce in Connecticut isn't simply a family law matter—it's a complex intersection of state divorce law and federal military regulations. Connecticut courts apply state statutes like C.G.S. § 46b-81 for property division and C.G.S. § 46b-82 for alimony, but these must be applied within the framework of federal laws that govern military benefits, pension division, and service member protections. An attorney without military divorce experience may miss critical issues that could cost you tens of thousands of dollars in benefits or create custody arrangements that don't account for military realities. For additional clarity on how Connecticut law applies to your unique military divorce situation, Untangle's AI legal guidance can provide instant answers based on Connecticut statutes and case law.

The financial stakes in military divorce are particularly high. Military pensions represent substantial assets—often the largest marital asset after decades of service—and the rules for dividing them are uniquely complex. Connecticut case law has specifically addressed how military pensions must be treated. In Dinunzio v. Dinunzio, the Connecticut Appellate Court held that the trial court erred by treating a military pension as income rather than property subject to equitable distribution, fundamentally changing how the financial orders should have been calculated. This distinction between income and divisible property can mean the difference between receiving a share of the pension itself versus merely having it considered in alimony calculations.

Beyond pensions, military divorces involve TRICARE health coverage, survivor benefit plans (SBP), commissary and exchange privileges, and BAH (Basic Allowance for Housing) calculations—all of which require specific legal knowledge. The right attorney will know how to protect these benefits or ensure you receive your fair share of them.

Key Qualifications to Look for in a Connecticut Military Divorce Attorney

Experience with Military Pension Division

The division of military retirement benefits follows rules established by the USFSPA, which allows state courts to treat disposable military retired pay as marital property. However, for the Defense Finance and Accounting Service (DFAS) to make direct payments to a former spouse, specific requirements must be met—including the "10/10 rule" requiring 10 years of marriage overlapping with 10 years of creditable military service. Your attorney must understand how to draft a Military Pension Division Order (also called a COAP or Court Order Acceptable for Processing) that DFAS will actually accept.

Connecticut courts have consistently addressed pension division issues. In Wald v. Cortland-Wald, the court approved an agreement where the service member agreed to transfer twelve months of G.I. Bill benefits to the spouse as part of the dissolution settlement—demonstrating that Connecticut courts will enforce creative benefit-sharing arrangements when properly presented. An experienced military divorce attorney knows which benefits can be divided or transferred and which cannot.

When evaluating attorneys, ask specifically how many military pension division orders they've drafted and whether they've had orders rejected by DFAS. A rejected order can delay your receipt of benefits by months and require expensive corrections. Tools like Untangle's complete asset inventory can help you organize the financial documentation needed to value military pensions accurately.

Understanding of Deployment and Custody Issues

Connecticut has specific statutory protections for deploying service members regarding custody and visitation. Under C.G.S. § 46b-56e, "armed forces" includes all branches plus National Guard members performing duty under Title 32 of the United States Code. This statute recognizes that deployment creates unique custody challenges and provides a framework for addressing them.

The statute allows service members facing deployment to petition for temporary modification of custody arrangements without that deployment being held against them in future custody decisions. This is crucial protection—without an attorney who understands this, a deploying parent might fear that military service will be used to permanently alter custody arrangements. Connecticut Practice Book Rule § 25-56d also addresses relocation issues, requiring the relocating parent to prove the move serves a legitimate purpose and is reasonable—military PCS orders generally qualify as legitimate purposes.

Your attorney should also understand how to build flexibility into parenting plans that account for military realities: irregular schedules, potential deployment, PCS moves, and the use of family care plans. Untangle's parenting plan builder can help military families maintain communication and schedule coordination across deployments and duty station changes.

Knowledge of the Servicemembers Civil Relief Act (SCRA)

The SCRA provides important protections for active-duty service members in legal proceedings, including divorce. It allows service members to request a stay (delay) of court proceedings if military duty materially affects their ability to appear. An attorney representing either spouse needs to understand these protections—service members need to know their rights, and non-military spouses need to understand potential delays and how to work within the SCRA framework.

Obtaining a stay is not automatic; the service member must request it and provide a letter from their commanding officer stating that military duty prevents their appearance and that leave is not currently authorized. The initial stay lasts for at least 90 days, giving the service member time to find counsel or arrange leave. However, the SCRA is not a permanent shield against divorce proceedings. Connecticut courts balance these protections with the spouse's right to resolve legal matters, meaning an indefinite delay is rarely granted.

Beyond procedural delays, the SCRA affects financial matters, such as capping interest rates on certain pre-service debts and providing protection against default judgments. If a service member fails to respond to a divorce petition because of their service, the court cannot simply enter a default judgment without first appointing an attorney to represent the absent member's interests. A knowledgeable military divorce lawyer ensures these procedural safeguards are strictly followed to prevent judgments from being overturned later.

Connecticut Residency Requirements for Military Divorce

Military families often face unique residency challenges due to frequent relocations. Under C.G.S. § 46b-44, Connecticut requires that one party has established residence in the state before filing for dissolution. For military families, "residence" and "domicile" questions can become complicated when service members are stationed in Connecticut but maintain legal residence elsewhere, or vice versa.

Connecticut courts will exercise jurisdiction if either spouse is a bona fide Connecticut resident, regardless of where the military member is stationed. This means a non-military spouse who has remained in Connecticut while the service member deployed or was reassigned can file for divorce in Connecticut courts. Conversely, if the service member claims Connecticut as their legal residence (as shown on their Leave and Earnings Statement), they may be able to file in Connecticut even if currently stationed elsewhere.

Understanding these jurisdictional rules matters because where you file can affect which state's laws govern property division and support—different states treat military pensions and benefits differently. A qualified military divorce attorney will evaluate your specific situation to determine whether Connecticut is the most advantageous forum for your case.

Financial Considerations Unique to Military Divorce

| Military Benefit | How It's Treated in CT Divorce | Key Considerations |

|---|---|---|

| Military Pension | Divisible marital property | Requires proper COAP; 10/10 rule for direct pay |

| Survivor Benefit Plan (SBP) | Court can order coverage | Must elect within 1 year of divorce |

| TRICARE Health Coverage | 20/20/20 or 20/20/15 rules apply | Eligibility based on marriage/service overlap |

| G.I. Bill Benefits | Can be negotiated in settlement | As shown in Wald v. Cortland-Wald |

| BAH (Housing Allowance) | Affects support calculations | Based on custody arrangements and dependency status |

| TSP (Thrift Savings Plan) | Divisible as retirement account | Requires separate COAP for division |

| VA Disability Pay | Generally not divisible | But may be considered for support |

Valuing and Dividing Military Pensions

The military pension is often the most valuable asset in a military divorce, yet it's also one of the most misunderstood. Under Connecticut's equitable distribution principles outlined in C.G.S. § 46b-81, courts consider multiple factors when assigning property, including the length of the marriage, causes for dissolution, age, health, occupation, employability, and the opportunity for future acquisition of assets.

For military pensions, the portion earned during the marriage is typically considered marital property. The most common division method is the "time rule" or "coverture fraction," which calculates the marital share based on the years of marriage during military service divided by total years of service. However, Connecticut courts have flexibility to deviate from strict formulas based on equitable considerations.

Accurate financial disclosure is essential for pension valuation. Connecticut Practice Book Rule § 25-30 requires sworn financial statements showing income, expenses, assets, and liabilities. Rule § 25-32 mandates automatic exchange of financial documents including tax returns and pay stubs. For military divorces, this includes Leave and Earnings Statements (LES) and retirement point statements for reserve members. Untangle's financial affidavit generation can help you compile and track all required military financial documentation efficiently.

Support Calculations with Military Income

Child support and alimony calculations in military divorce must account for the full picture of military compensation. Under C.G.S. § 46b-84, both parents must maintain minor children according to their respective abilities. For service members, "ability" includes not just base pay but also BAH, BAS (Basic Allowance for Subsistence), and special pays.

Connecticut courts applying C.G.S. § 46b-82 for alimony consider factors including the length of marriage, causes of dissolution, age, health, station, occupation, employability, and each spouse's needs and means. For military spouses who sacrificed career advancement to support frequent moves, this factor weighs heavily in determining both the amount and duration of alimony awards.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Steps to Find and Evaluate Military Divorce Attorneys in Connecticut

-

Search for specific military divorce experience - Look for attorneys who explicitly advertise military divorce expertise, not just general family law. Check their website for articles about USFSPA, military pension division, or deployment custody issues.

-

Verify their knowledge in initial consultations - Ask specific questions: How many military pension division orders have you drafted? Have you had any rejected by DFAS? How do you handle deployment custody modifications under C.G.S. § 46b-56e?

-

Check references from military clients - Ask for references from past military divorce clients. Their experiences will reveal whether the attorney truly understands military-specific issues.

-

Confirm they understand both sides - Whether you're the service member or the military spouse, your attorney should understand both perspectives. The best military divorce attorneys often represent both service members and civilian spouses at different times.

-

Evaluate their support resources - Military divorces involve complex paperwork. Ask how the attorney manages document organization and client communication, especially important if one party is deployed or stationed away from Connecticut.

-

Discuss realistic timelines - Military divorces can take longer due to SCRA protections, deployment schedules, and the complexity of military pension orders. Your attorney should set realistic expectations.

Cost Comparison: Military Divorce Options in Connecticut

| Approach | Typical Cost Range | Best For | Limitations |

|---|---|---|---|

| Full Representation by Military Divorce Specialist | $10,000 - $30,000+ | Complex cases, contested issues, high-ranking service members | Most expensive option |

| Limited Scope Representation | $3,000 - $10,000 | Specific issues like pension orders | May not cover all needs |

| Mediation with Military-Knowledgeable Mediator | $2,000 - $6,000 | Cooperative couples, simpler cases | Requires mutual agreement |

| Collaborative Divorce | $5,000 - $15,000 | Couples committed to settlement | Must start over if fails |

| DIY with Attorney Consultation | $500 - $3,000 | Very simple cases, no pensions | High risk of costly errors |

The cost of a military divorce attorney in Connecticut varies significantly based on case complexity. However, the specialized nature of military divorce often justifies higher legal fees—mistakes in pension division orders or failure to preserve TRICARE eligibility can cost far more than the attorney fees saved by using a less experienced lawyer.

When to Seek Specialized Military Divorce Help

You should strongly consider hiring a military divorce specialist if any of these apply to your situation:

- Either spouse has 10+ years of military service - Significant pension benefits are at stake that require proper division orders.

- You're approaching the 20-year marriage mark - The 20/20/20 rule for TRICARE eligibility makes timing and documentation critical.

- Deployment is imminent or ongoing - C.G.S. § 46b-56e protections and practical custody arrangements require careful navigation.

- There are disputes about base pay vs. allowances - Properly characterizing military compensation affects support calculations significantly.

- You need to relocate due to PCS orders - Connecticut's relocation rules under Practice Book Rule § 25-56d interact with military orders in complex ways.

Even if you're considering handling some aspects of your divorce yourself, consulting with a military divorce specialist for the pension division order alone can prevent costly errors. Resources like Untangle's personalized task dashboard can help you organize documentation and understand the process, but complex military benefits typically require professional legal guidance to protect your rights fully.

Protecting Your Rights Throughout the Process

Throughout your Connecticut military divorce, maintaining organized records is essential. The automatic orders under Practice Book Rule § 25-5 apply immediately upon service of the divorce complaint, restricting both parties from removing children from Connecticut without consent, dissipating assets, or changing insurance coverage. These orders protect both parties while the divorce proceeds.

For military families, compliance with automatic orders can be complicated by service obligations. A good military divorce attorney will help you understand how to comply with both court orders and military requirements. They'll also ensure that financial affidavits properly account for all military compensation and benefits, and that any settlement agreement or court order includes properly drafted military pension division language that DFAS will accept.

Whether you're beginning to research your options or ready to move forward, understanding the unique aspects of military divorce in Connecticut is the first step toward protecting your interests and your family's future.

Frequently Asked Questions

How much does a military divorce lawyer cost in Connecticut?

Military divorce attorneys in Connecticut typically charge between $300-$500 per hour, with total costs ranging from $5,000 to $20,000+ depending on case complexity and whether pension division or custody disputes are involved.

Can I get free legal help for military divorce in Connecticut?

Yes, active-duty service members can access free legal assistance through JAG offices at nearby military installations, and many Connecticut military divorce attorneys offer free initial consultations to discuss your case.

What is the 10/10 rule for military divorce in Connecticut?

The 10/10 rule allows a former military spouse to receive their share of the military pension directly from DFAS if the marriage overlapped with at least 10 years of creditable military service.

Does a military spouse lose TRICARE benefits after divorce in Connecticut?

A former military spouse may retain full TRICARE benefits under the 20/20/20 rule if the marriage lasted at least 20 years, overlapped with 20 years of military service, but loses eligibility if these thresholds aren't met.

How does deployment affect child custody in a Connecticut military divorce?

Connecticut courts can modify custody arrangements to accommodate deployment schedules, and a skilled military divorce attorney can help create flexible parenting plans that protect both the service member's rights and the children's best interests.

Legal Citations

- • Dinunzio v. Dinunzio, 182 A.3d 706 (Conn. App. Ct.) View Source

- • Wald v. Cortland-Wald, 226 Conn. App. 752 View Source

- • Connecticut Practice Book Rule § 25-56d - Relocation of parent with minor child View Source

- • Connecticut Practice Book Rule § 25-30 - Statements To Be Filed View Source

- • Connecticut Practice Book Rule § 25-32 - Mandatory Disclosure and Production View Source

- • Connecticut Practice Book Rule § 25-5 - Automatic Orders upon Service of Complaint View Source