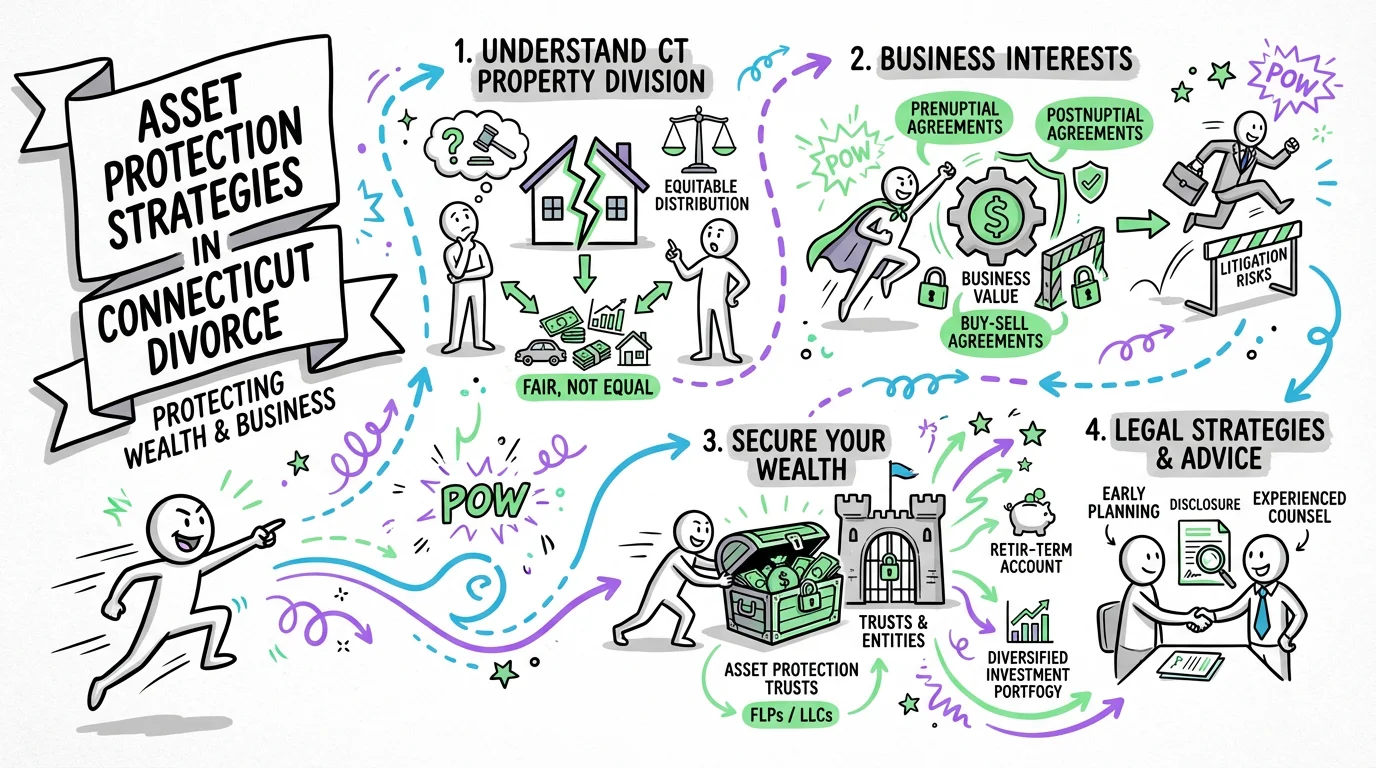

Asset Protection Strategies in Connecticut Divorce | Protecting Wealth & Business

Learn legal asset protection strategies for Connecticut divorce. Understand how CT courts divide property, protect business interests, and secure your wealth.

Connecticut is an "all property" equitable distribution state, meaning courts can divide any asset owned by either spouse—regardless of when or how it was acquired—making proactive asset protection critical for high-net-worth individuals. Under C.G.S. § 46b-81, the court may "assign to either spouse all or any part of the estate of the other spouse," including premarital assets, inheritances, and business interests. However, strategic planning before and during divorce proceedings can help protect your wealth through legitimate legal means such as enforcing prenuptial agreements, demonstrating separate property tracing, utilizing trusts properly, and ensuring accurate business valuations.

Understanding Connecticut's All-Property Division System

Unlike many states that distinguish between "marital" and "separate" property, Connecticut courts have broad discretion to divide everything you own. This means your premarital savings, inheritance from your grandmother, or the business you built before marriage are all potentially subject to division. The court considers multiple statutory factors when dividing assets, including the length of the marriage, the cause of the dissolution, each party's age and health, occupation, employability, and the opportunity for future acquisition of assets.

This expansive authority doesn't mean equal division is automatic. Connecticut uses "equitable" distribution, meaning the court aims for a fair outcome—not necessarily a 50/50 split. Courts routinely award a larger share to one spouse based on contributions to the marriage, economic circumstances, and other factors. For high-asset individuals, this creates both risk and opportunity: while your separate assets may be touched, skilled advocacy can demonstrate why certain assets should remain primarily with you.

The practical impact of this system is significant. If you're entering divorce with substantial wealth, you need to understand that simply keeping assets in your name offers no protection. Instead, protection comes from proper documentation, legitimate trust structures, accurate valuations, and strategic negotiation. Tools like Untangle's Complete asset inventory can help you organize and document your holdings comprehensively from the start.

Automatic Orders: What You Cannot Do Once Divorce Begins

The moment a divorce complaint is served in Connecticut, automatic court orders immediately restrict both spouses' ability to move, hide, or dissipate assets. Under Practice Book Rule § 25-5, neither party may sell, transfer, encumber, conceal, assign, remove, or dispose of any property without written consent of the other party or court permission. These orders remain in effect throughout the entire divorce process.

Specifically, the automatic orders prohibit changing beneficiaries on life insurance policies, retirement accounts, or other assets. You cannot cancel, modify, or let lapse any existing insurance coverage. You're forbidden from incurring unreasonable debts or using marital funds for anything other than reasonable living expenses, attorney's fees, or court costs. Violating these orders can result in contempt findings, sanctions, and adverse inferences when the court divides property.

For high-asset individuals, this means any asset protection strategies must be implemented well before divorce proceedings begin—or be done with full transparency and court approval during proceedings. Attempting to hide assets or transfer wealth once litigation starts will backfire severely. Courts have forensic tools and discovery mechanisms to uncover hidden transfers, and the consequences include losing credibility with the judge who will ultimately decide your case.

Legitimate Pre-Divorce Asset Protection Strategies

Prenuptial and Postnuptial Agreements

The most effective asset protection happens before marriage through a properly drafted prenuptial agreement. These agreements can designate specific assets as separate property, waive alimony rights, and establish formulas for property division. Connecticut courts generally enforce prenuptial agreements if they were entered voluntarily, with full financial disclosure, and aren't unconscionable at the time of enforcement.

Postnuptial agreements—created during the marriage—can also provide protection, though courts scrutinize them more carefully given the existing fiduciary relationship between spouses. For maximum enforceability, both prenuptial and postnuptial agreements should include complete financial schedules, independent legal counsel for each party, and reasonable terms that don't leave one spouse destitute.

If you have an existing agreement, now is the time to review it with counsel. Even well-drafted agreements can be challenged on grounds of fraud, duress, or changed circumstances. Understanding the strength of your agreement helps inform your overall divorce strategy.

Trust Structures and Their Limitations

Many high-net-worth individuals believe placing assets in trusts automatically protects them from divorce division. The reality is more nuanced. In the landmark case of Netter v. Netter, the Connecticut Appellate Court addressed whether trust assets could be included in the marital estate. The court held that a spendthrift trust created by the defendant's father prior to marriage could be considered part of the marital estate subject to distribution, depending on the beneficiary's actual access to and control over trust funds.

The key factors courts examine include: whether you created the trust yourself (self-settled trusts offer virtually no protection), whether you can revoke or modify the trust, your practical access to distributions, and whether the trust was created specifically to avoid marital obligations. Third-party irrevocable trusts with independent trustees and genuine spendthrift provisions offer the strongest protection, but even these aren't guaranteed to be excluded from consideration.

For business owners, properly structured trusts holding company stock can provide some protection while also serving legitimate estate planning and liability purposes. However, these structures must be established well before divorce is contemplated, with genuine non-divorce purposes, and must not be funded with marital assets without proper consideration.

Protecting Business Interests in Connecticut Divorce

Business ownership presents unique challenges in high-asset divorce. Whether you own a professional practice, a family business, or equity in a startup, your business will likely be subject to valuation and potential division. The good news is that courts rarely order forced sales of operating businesses; instead, they typically assign the business to the operating spouse with an offset to the other spouse from other marital assets.

Business Valuation Considerations

Accurate business valuation is critical for protection. Courts may use various methods including asset-based approaches, income approaches (capitalizing earnings or discounted cash flow), or market approaches comparing to similar business sales. The valuation method chosen can dramatically affect the outcome—sometimes by millions of dollars for substantial enterprises.

Key valuation concepts that can protect business owners include:

- Personal goodwill vs. enterprise goodwill: In professional practices, value attributed to the owner's personal reputation and relationships may be treated differently than institutional goodwill

- Minority and marketability discounts: Partial ownership interests are often worth less than their pro-rata share

- Key person dependency: Businesses heavily dependent on one individual may warrant valuation adjustments

- Normalization adjustments: Owner compensation, perks, and related-party transactions require careful analysis

Working with a qualified business valuation expert—ideally a CVA (Certified Valuation Analyst) or ABV (Accredited in Business Valuation)—is essential. The expert you hire will significantly impact the valuation methodology and conclusions presented to the court.

Operational Protections

Beyond valuation, several operational strategies can help protect your business:

- Maintain clear records separating business and personal finances

- Document your spouse's non-involvement in business operations if applicable

- Review any buy-sell agreements that may affect transferability

- Consider the timing of major business decisions relative to divorce proceedings

- Protect confidential information while complying with discovery obligations

Tools like Untangle's Smart bank statement analysis can help you maintain the detailed financial records necessary to support your business valuation position and demonstrate the separation between personal and business assets.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

The Discovery Process: Mandatory Financial Disclosure

Connecticut's discovery rules require extensive financial disclosure that leaves little room for hidden assets. Under Practice Book Rule § 25-32, parties must automatically exchange within 60 days: three years of tax returns including K-1s, W-2s and 1099s, current pay stubs, 24 months of statements for all financial accounts, documentation for retirement accounts and life insurance, real estate documentation, business financial statements, and loan applications from the past three years.

| Document Type | Time Period Required | Purpose |

|---|---|---|

| Federal & State Tax Returns | Last 3 years | Income verification, asset identification |

| Bank/Investment Statements | Last 24 months | Asset tracing, spending patterns |

| Business Financial Statements | Last 3 years (if applicable) | Business valuation support |

| Retirement Account Statements | Current | Asset identification |

| Loan Applications | Last 3 years | Sworn financial representations |

This disclosure requirement cuts both ways. You'll need to produce extensive documentation, but you'll also receive the same from your spouse. The loan application requirement is particularly significant—statements made to lenders about income and assets can be compared to current claims in divorce, exposing inconsistencies.

To navigate this extensive disclosure, Untangle's Financial affidavit generation feature can streamline the process of compiling and preparing your mandatory financial forms. For high-asset individuals, organizing this documentation early is crucial.

Prejudgment Remedies: Protecting Against Asset Dissipation

If you're concerned your spouse may dissipate assets, Connecticut law provides powerful protective mechanisms. Under C.G.S. § 46b-80, you can access prejudgment remedies including attachments, garnishments, and lis pendens (notice of pending litigation) on real property. These remedies secure assets while the divorce is pending, preventing your spouse from selling property or depleting accounts.

A lis pendens, filed with the town clerk where real property is located, puts potential buyers on notice that the property is subject to litigation. This effectively prevents sale without court involvement. Prejudgment attachments can freeze bank accounts or other assets. However, these remedies require court approval and a showing of probable cause that you'll succeed in obtaining a judgment.

The automatic orders under Practice Book Rule § 25-5 provide initial protection, but they rely on voluntary compliance. If your spouse violates automatic orders, you'll need to return to court for enforcement. Having documented the marital estate thoroughly—including account balances at the time of separation—is essential for proving dissipation later.

Strategic Approaches to Property Division Negotiation

While courts have broad authority to divide assets, most high-asset divorces settle through negotiation. Strategic negotiation can achieve better outcomes than litigation, particularly when complex assets, privacy concerns, or ongoing business relationships are involved.

Tax-Efficient Division Strategies

Not all assets are created equal from a tax perspective. A retirement account worth $1 million has very different after-tax value than $1 million in cash or appreciated stock. Sophisticated negotiation considers:

- Pre-tax vs. post-tax assets: Traditional IRAs and 401(k)s will be taxed on withdrawal

- Capital gains implications: Appreciated property carries embedded tax liability

- Basis step-up opportunities: Some assets may benefit from holding until estate transfer

- Alimony and support coordination: Under C.G.S. § 46b-82, courts can consider tax implications

The Child Support Guidelines at Section 46b-215a-5c(b)(5) explicitly recognize "coordination of total family support" as grounds for deviation, allowing consideration of "division of assets and liabilities," "provision of alimony," and "tax planning considerations." This creates opportunity for creative settlements that minimize overall tax burden while achieving equitable results.

Trading Assets Strategically

High-asset divorces often involve trading assets to achieve goals beyond simple dollar value. You might accept less liquid assets in exchange for keeping your business intact. You might trade retirement assets for real property to achieve specific lifestyle objectives. Consider not just current value but:

- Liquidity needs and timeline

- Management burden and expertise required

- Future appreciation potential

- Emotional attachment and practical utility

- Privacy and ongoing entanglements with your spouse

When to Engage Professional Help

Asset protection in Connecticut divorce requires a team approach. Beyond a skilled family law attorney, high-asset individuals often benefit from:

- Forensic accountants: To trace assets, analyze business finances, and identify hidden funds

- Business valuation experts: CVAs or ABVs with experience in your industry

- Financial advisors: For modeling post-divorce scenarios and tax implications

- Trust and estate attorneys: If significant trust interests or estate planning issues exist

The complexity of your situation determines the team you need. A straightforward high-income W-2 earner with investment accounts needs different expertise than a business owner with multiple entities, trusts, and international assets.

Starting your preparation early—ideally before filing—gives you maximum strategic advantage. Untangle's Case details management and Debt and liability tracking tools can help you compile, categorize, and analyze financial documents before formal discovery begins, giving you a complete picture of the marital estate and identifying potential issues before they become problems. The platform helps you document assets, model scenarios, and maintain the detailed records that will support your position throughout the divorce process.

Remember: legitimate asset protection is about proper documentation, accurate valuation, strategic negotiation, and understanding the law—not hiding assets or gaming the system. Connecticut courts have seen every scheme imaginable, and attempted deception almost always backfires. Your best protection is thorough preparation, skilled professionals, and honest advocacy for a fair outcome.

Frequently Asked Questions

Can I protect assets before filing for divorce in Connecticut?

Yes, you can legally protect assets before filing by establishing prenuptial or postnuptial agreements, properly funding trusts, maintaining separate property documentation, and working with a divorce attorney to develop a strategic protection plan.

What assets are protected from divorce division in CT?

In Connecticut's "all property" equitable distribution system, no assets are automatically protected from division, but courts may award a larger share of premarital assets, inheritances, or business interests to the original owner based on statutory factors like marriage length and each spouse's contributions.

Is a prenuptial or postnuptial agreement better for asset protection?

Prenuptial agreements are generally stronger because they're signed before marriage when there's less pressure, but postnuptial agreements can still provide significant asset protection if properly drafted and both parties have independent legal counsel.

Is it too late to protect assets after separation in Connecticut?

While options become more limited after separation, you can still protect assets through accurate business valuations, separate property tracing to document premarital ownership, and strategic legal advocacy to demonstrate why certain assets should remain primarily with you.

How does Connecticut divide inherited assets in a divorce?

Connecticut courts can divide inherited assets as part of their broad equitable distribution authority under C.G.S. § 46b-81, but judges often consider the source of the inheritance and whether it was kept separate when determining a fair division.

Legal Citations

- • Practice Book Rule § 25-5 - Automatic Orders upon Service of Complaint View Source

- • Practice Book Rule § 25-32 - Mandatory Disclosure and Production View Source

- • Netter v. Netter, 235 Conn. App. 774 View Source