Connecticut Alimony Calculator Tools: How Spousal Support Is Determined

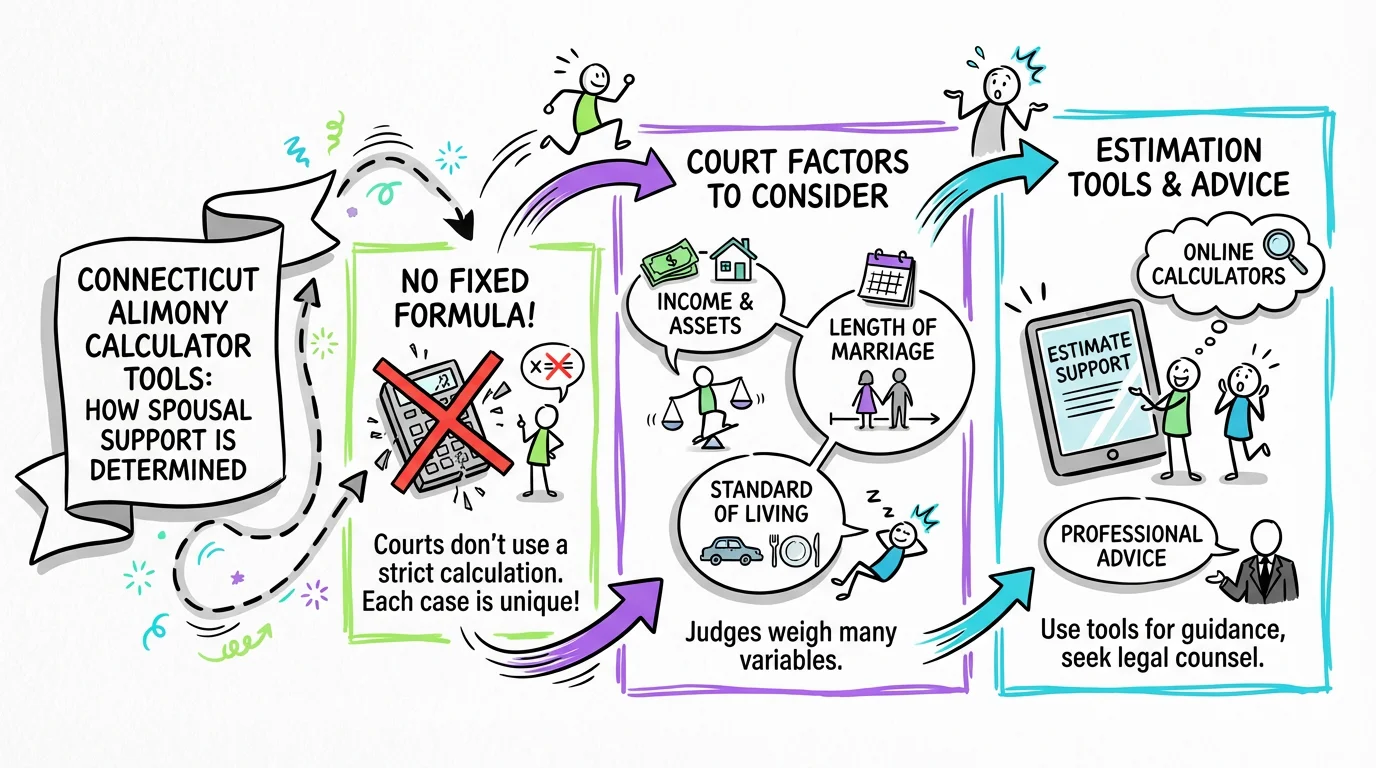

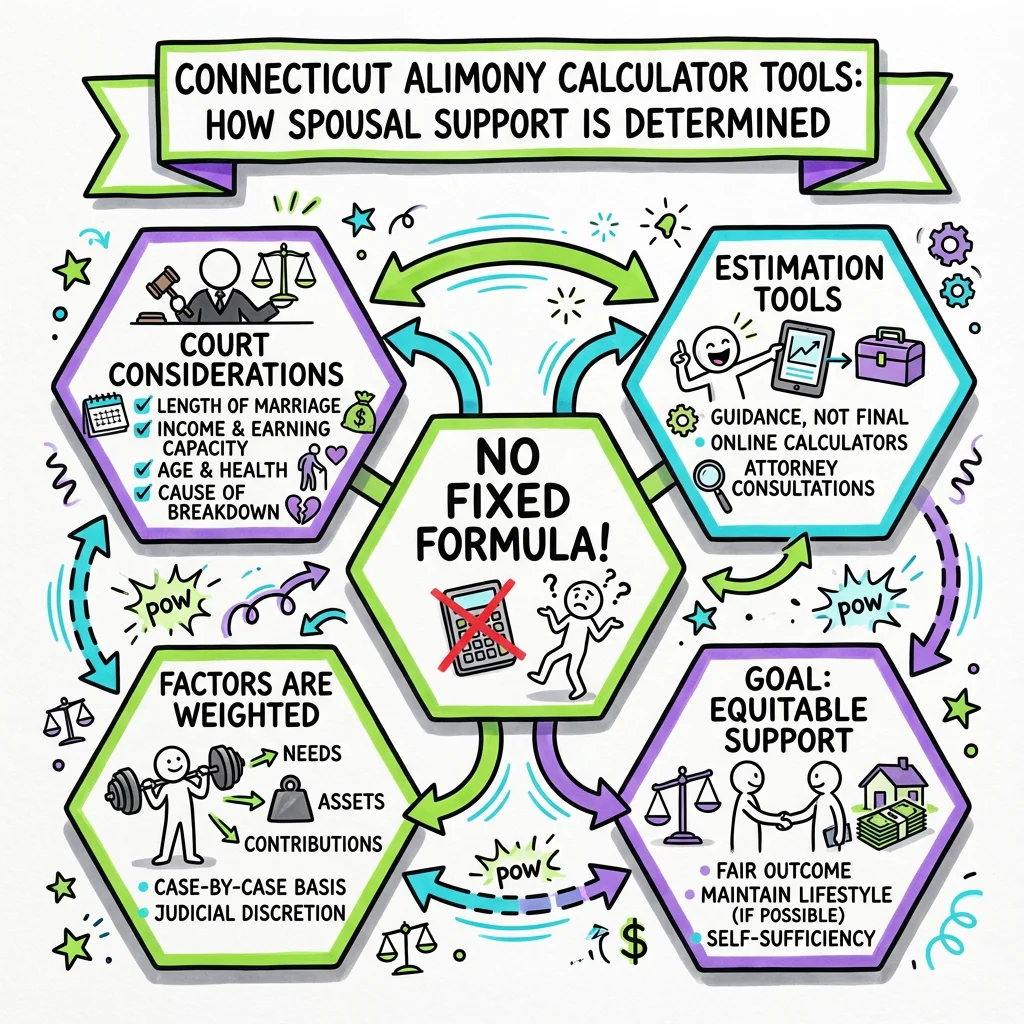

Learn how Connecticut alimony is calculated without a fixed formula. Understand the factors courts consider and tools to estimate spousal support payments.

Connecticut does not use a fixed alimony formula or official state calculator to determine spousal support amounts. Unlike child support, which follows specific guidelines, alimony in Connecticut is determined by judges who weigh multiple statutory factors on a case-by-case basis. This means that while online "alimony calculators" can provide rough estimates, they cannot accurately predict what a Connecticut court will actually award because every marriage and financial situation is unique.

Why Connecticut Doesn't Have an Official Alimony Calculator

The absence of a standardized alimony formula in Connecticut is intentional. Under C.G.S. § 46b-82, the court has broad discretion to order either spouse to pay alimony based on a comprehensive evaluation of the marriage and both parties' circumstances. This approach allows judges to craft fair outcomes that account for the complexities of individual situations—something a simple mathematical formula cannot accomplish.

For stay-at-home spouses who have been out of the workforce, this discretionary system can actually work in your favor. A judge can consider the full impact of your contribution to the marriage, the sacrifices you made for your family, and the realistic challenges you'll face re-entering the job market. These nuanced considerations would be impossible to capture in a one-size-fits-all calculator.

That said, the lack of predictability can feel unsettling when you're trying to plan your financial future. Understanding exactly what factors judges consider and gathering comprehensive documentation of your situation becomes even more important when there's no formula to fall back on. While there's no official formula, tools like Untangle's Alimony Calculator can offer a data-driven estimate based on Connecticut's statutory factors, helping you navigate this unpredictability and plan your financial future.

The Statutory Factors Courts Must Consider

Connecticut law requires judges to consider specific factors when determining alimony awards. Under C.G.S. § 46b-82, these factors help ensure that decisions are fair and based on the actual circumstances of each marriage:

| Factor Category | What Courts Examine |

|---|---|

| Length of Marriage | Longer marriages typically result in longer alimony duration |

| Causes of Dissolution | Fault grounds may influence awards in some cases |

| Age and Health | Physical and emotional condition of each spouse |

| Station in Life | The lifestyle established during the marriage |

| Occupation and Employability | Current job skills and realistic earning capacity |

| Estate and Needs | Each party's property, assets, and financial requirements |

| Vocational Skills | Education, training, and time needed to become self-supporting |

| Homemaker Contribution | Value of services as a homemaker and support of spouse's career |

The court also examines the award's impact on any children's best interests and may consider other relevant factors. As demonstrated in Walker v. Walker, courts must articulate their consideration of these statutory factors when making financial orders, providing appellate courts with a basis for review.

For a stay-at-home spouse, the "homemaker contribution" and "vocational skills" factors are particularly significant. Courts recognize that managing a household, raising children, and supporting a spouse's career has substantial economic value—even though it didn't generate a paycheck. Understanding the financial impact of these contributions is crucial. Tools like Untangle's Alimony Calculator can help you model how these and other factors might influence a judge's decision regarding spousal support.

How to Estimate Your Potential Alimony

While no calculator can definitively predict your alimony award, you can develop a reasonable estimate by systematically analyzing your situation. Start by completing a thorough financial inventory that captures both your current needs and the marital standard of living.

Step 1: Document the Marital Lifestyle

Create a detailed record of your family's expenses during the marriage. This includes housing costs, utilities, groceries, transportation, healthcare, childcare, education expenses, entertainment, vacations, and any other regular expenditures. Connecticut courts aim to help both spouses maintain a lifestyle reasonably comparable to what they enjoyed during the marriage, so this documentation is crucial. Be as granular as possible, as vague estimates are less persuasive than documented spending patterns.

Step 2: Calculate Your Income Gap

Determine the difference between your current or potential earning capacity and your spouse's income. If you've been out of the workforce, research realistic salary ranges for positions you could obtain with your current skills and education. Be honest about the time and training you might need to become self-supporting—this directly affects both the amount and duration of potential alimony. You should also factor in the costs associated with returning to work, such as childcare or commuting, which can offset your projected income.

Step 3: Complete Financial Affidavits

Connecticut requires both parties to file sworn financial statements before any hearing involving alimony. The Financial Affidavit Short Form (JD-FM-006) is used when neither party's gross annual income exceeds $75,000 and total net assets are less than $75,000. Completing this form thoroughly helps you understand your own financial picture and provides the court with the information needed to make fair decisions.

Untangle's Financial Affidavit Generation tool can help you gather and organize the financial records you'll need for these affidavits, including tax returns, bank statements, and pay stubs that must be exchanged under Practice Book Rule § 25-32.

Types of Alimony Available in Connecticut

Connecticut courts can award different types of alimony depending on your circumstances:

-

Temporary (Pendente Lite) Alimony: Support paid during the divorce proceedings, authorized under C.G.S. § 46b-83. This can be awarded shortly after filing to help the financially dependent spouse manage while the case is pending.

-

Rehabilitative Alimony: Time-limited support designed to help you become self-supporting through education, training, or career development. This is common when a spouse needs to update skills or re-enter the workforce.

-

Permanent Alimony: Ongoing support with no set end date, typically reserved for long-term marriages where one spouse cannot reasonably become self-supporting due to age, health, or other factors.

-

Lump-Sum Alimony: A one-time payment instead of periodic payments, sometimes used when both parties prefer a clean break or when there are concerns about future compliance.

The type of alimony you receive significantly impacts your financial planning. As shown in Fronsaglia v. Fronsaglia, courts have considerable discretion in structuring these awards, including how they interact with property division. The court upheld financial orders even when one party claimed they were disproportionate, emphasizing the trial court's broad discretion in balancing all factors.

Try our free CT alimony calculator

Get an instant estimate based on Connecticut's statutory factors. No signup required.

Practical Steps for Stay-at-Home Spouses

As someone who has been financially dependent during your marriage, taking proactive steps now can strengthen your position and help you feel more secure about your future:

-

Open individual bank accounts - If you don't already have accounts in your name only, establish them now. Automatic orders under Practice Book Rule § 25-5 prevent either party from hiding or dissipating assets once divorce proceedings begin.

-

Gather financial documents - Collect copies of tax returns, bank statements, investment accounts, retirement accounts, and mortgage documents. You'll need these for mandatory disclosure requirements.

-

Track your contributions - Document the value you've provided as a homemaker, including childcare, household management, support for your spouse's career, and any career sacrifices you made for the family.

-

Research your earning potential - Look into realistic job opportunities, additional training or education you might need, and typical salaries for positions you could pursue.

-

Create a post-divorce budget - Estimate your monthly expenses for housing, utilities, food, healthcare, transportation, and other necessities. This helps demonstrate your actual need for support.

-

Consider temporary support - Under C.G.S. § 46b-83, you can request alimony pendente lite early in the divorce process to maintain stability while your case proceeds.

Using Untangle's document generation tools can help you organize this information systematically, ensuring you don't overlook important details that could affect your alimony outcome.

Understanding Alimony Modification

Alimony orders in Connecticut are not necessarily permanent. Under C.G.S. § 46b-86, either party can request modification of alimony based on a substantial change in circumstances—unless the original divorce decree specifically precludes modification.

| Circumstances That May Support Modification | Effect on Alimony |

|---|---|

| Recipient's significant income increase | May reduce or terminate support |

| Payer's job loss or disability | May reduce support amount |

| Recipient's cohabitation or remarriage | Often terminates or reduces support |

| Payer's substantial income increase | May support request for higher support |

| Recipient completing education/training | May affect rehabilitative alimony duration |

Understanding modification rules is important for both negotiating your initial agreement and planning your financial future. If you agree to make alimony non-modifiable, you gain certainty but lose flexibility to adapt if circumstances change dramatically.

Practice Book Rule § 25-26 also requires that if the party seeking modification is behind on payments, the court must first determine whether the arrearage is contemptuous and may require payment of arrears before modifying current orders.

Negotiating Alimony in Settlement Agreements

Most Connecticut divorces settle without a trial, meaning alimony is often negotiated between the parties rather than decided by a judge. Under C.G.S. § 46b-66, the court must review any agreement to ensure it's fair and reflects the financial resources and actual needs of both parties.

Approaching alimony negotiation with thorough preparation gives you significant advantages. When you understand your financial needs, can document your contributions to the marriage, and have realistic expectations about your earning potential, you're in a much stronger position to advocate for fair support.

Consider whether you want to trade alimony for a larger share of marital property. This approach provides immediate assets rather than relying on future payments, which can be particularly appealing if you have concerns about your spouse's reliability or employment stability. However, property division and alimony have different tax implications that should be carefully evaluated.

Untangle's Spouse Financial Comparison tool can help you compare different scenarios and understand how various combinations of alimony and property division might affect your long-term financial security.

When to Seek Professional Help

While online tools and resources can help you understand alimony basics and organize your financial information, certain situations require professional guidance. Consider consulting with an attorney if:

- Your marriage was long-term (15+ years) and involves substantial assets

- There are complex business interests or professional practices to value

- You suspect your spouse is hiding assets or income

- Domestic violence has been a factor in your marriage

- Your spouse has already hired an attorney

Financial advisors and divorce financial analysts can also be valuable resources for understanding how different alimony scenarios would affect your long-term financial security. They can help you model various outcomes and make informed decisions during negotiations.

For stay-at-home spouses facing an uncertain financial future, the investment in professional guidance often pays for itself through better outcomes. Even if you're pursuing an uncontested divorce, a consultation with an attorney can ensure you understand your rights and aren't leaving money on the table.

Frequently Asked Questions

How is alimony calculated in Connecticut without a formula?

Connecticut judges determine alimony by weighing statutory factors under C.G.S. § 46b-82, including length of marriage, each spouse's income and earning capacity, age, health, and contributions to the marriage, rather than using a mathematical formula.

Are online alimony calculators accurate for CT divorces?

Online alimony calculators can only provide rough estimates because Connecticut courts have broad discretion to determine spousal support on a case-by-case basis, meaning actual awards may differ significantly from calculator results.

What factors affect how much alimony I'll receive in Connecticut?

Connecticut courts consider factors including the length of your marriage, both spouses' income and earning capacity, age, health, education, vocational skills, contributions as a homemaker, and the standard of living established during the marriage.

How long does alimony last after divorce in CT?

Alimony duration in Connecticut varies based on the type awarded—temporary alimony ends when the divorce is finalized, rehabilitative alimony lasts until the recipient becomes self-supporting, and permanent alimony may continue indefinitely for long-term marriages.

What is the difference between temporary and permanent alimony in Connecticut?

Temporary alimony (pendente lite) provides financial support during the divorce proceedings and ends at finalization, while permanent alimony is awarded in the final divorce decree and may continue for years or indefinitely depending on the circumstances.

Legal Citations

- • Walker v. Walker, 222 Conn. App. 192 View Source

- • Fronsaglia v. Fronsaglia View Source

- • Practice Book Rule § 25-5 - Automatic Orders View Source

- • Practice Book Rule § 25-26 - Modification of Custody, Alimony or Support View Source

- • Practice Book Rule § 25-32 - Mandatory Disclosure and Production View Source

- • Financial Affidavit Short Form (JD-FM-006) View Source