What is separate property in Connecticut divorce?

If you’re facing a divorce in Connecticut, one of the most common and stressful questions is, "What happens to my property?" You might have heard frie...

Need help with your divorce? We can help you untangle everything.

Get Started Today

If you’re facing a divorce in Connecticut, one of the most common and stressful questions is, "What happens to my property?" You might have heard friends in other states talk about "separate property" versus "marital property." Perhaps you have an inheritance from a grandparent or a retirement account you started long before your wedding. It feels like it should be yours alone, right?

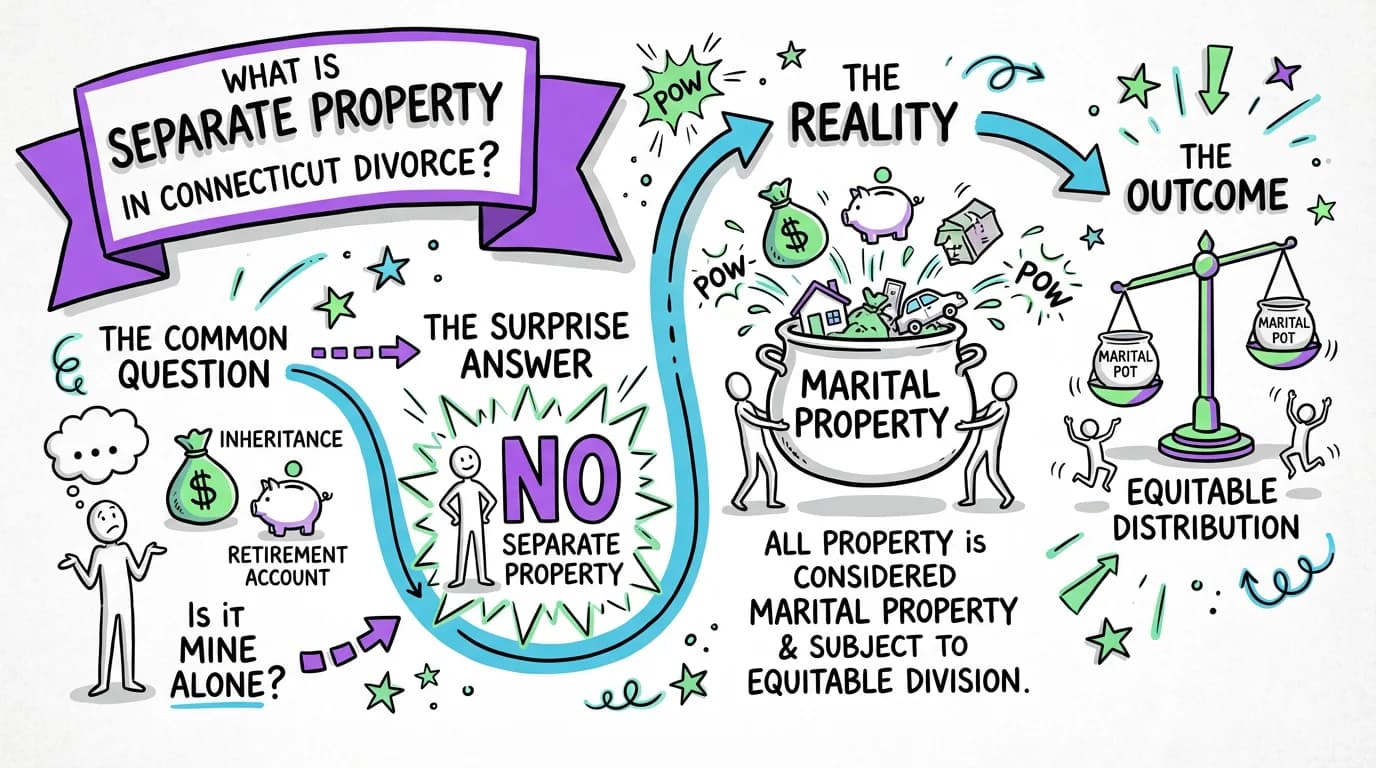

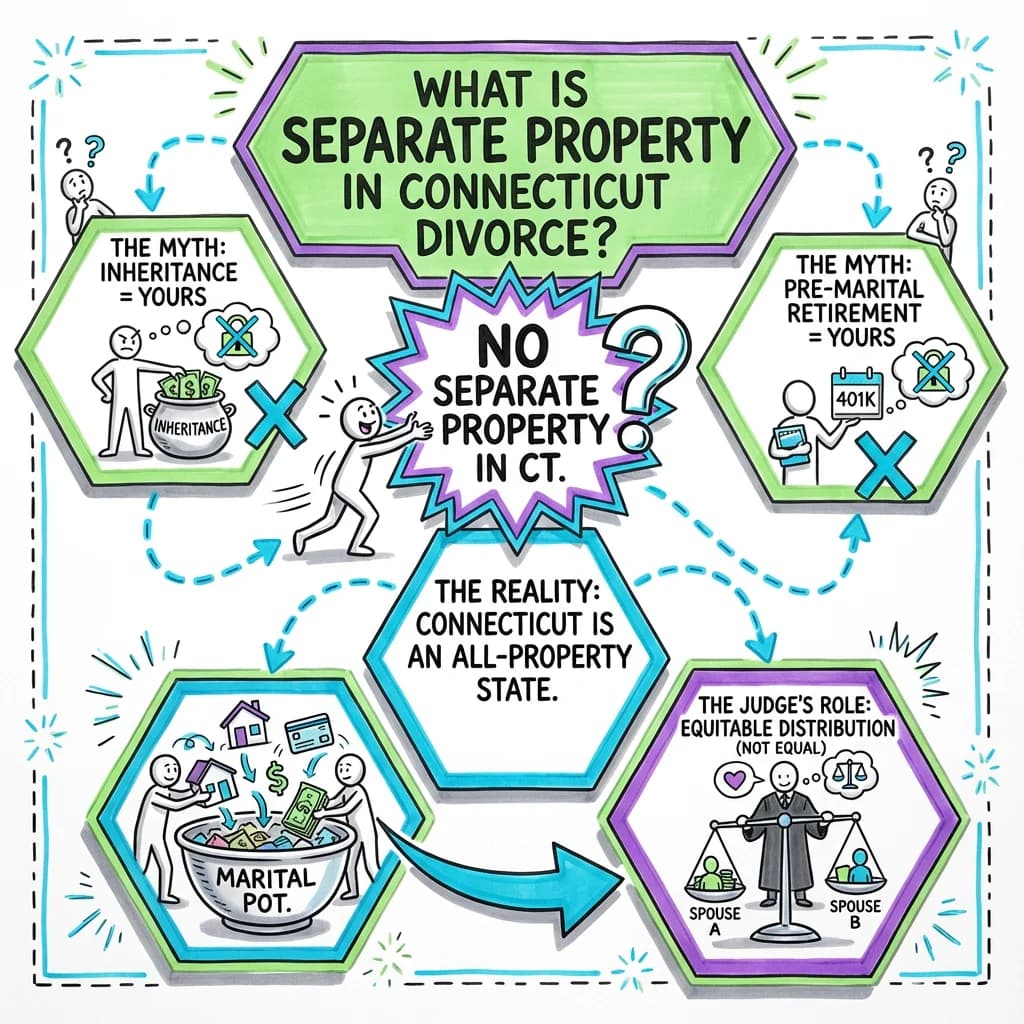

Here’s the straightforward answer that often surprises people: Connecticut law does not recognize the concept of "separate property." Instead, Connecticut is what’s known as an all-property state. This means that when a marriage is dissolved, the court has the authority to divide all assets and debts owned by either spouse, regardless of when or how they were acquired. This includes property you owned before the marriage, gifts you received from your family, and even inheritances meant just for you.

While this might sound alarming, don't panic. Just because the court can divide an asset doesn't mean it will divide it 50/50. The law gives judges a set of specific factors to consider to reach a fair and equitable outcome. Understanding these factors is the key to protecting assets you believe should rightfully remain yours. This guide will walk you through how Connecticut handles property division, what the "all-property" rule really means for you, and what steps you can take to advocate for a fair result.

Understanding the Legal Foundation: Connecticut's "All-Property" Model

The entire framework for dividing assets in a Connecticut divorce comes from a single, powerful statute. Connecticut General Statutes (C.G.S.) § 46b-81 is the law that governs the assignment of property.

The most critical part of this law states: "At the time of entering a decree annulling or dissolving a marriage...the Superior Court may assign to either spouse all or any part of the estate of the other spouse" (C.G.S. § 46b-81(a)).

Let's break down what this legal language means in plain English:

- "The estate of the other spouse": This is an incredibly broad term. It includes everything you own and everything your spouse owns, individually or jointly. It doesn’t matter if the asset is in your name, your spouse’s name, or both names.

- "All or any part": This gives the judge complete discretion. The court can give you an asset that was in your spouse’s name, give your spouse an asset that was in your name, or order an asset sold and the proceeds divided.

This approach is called equitable distribution. "Equitable" means fair, which is not always the same as "equal." Unlike community property states where marital assets are often split 50/50, a Connecticut judge’s goal is to find a division that is fair under all the circumstances of your specific case. The concept of separate property in a Connecticut divorce is therefore not a legal rule, but rather an argument you make to the court about why a particular distribution would be equitable.

Connecticut Law Requirements: The Factors a Judge Must Consider

So, if everything is on the table, how does a judge decide what’s fair? The law doesn't leave it to guesswork. C.G.S. § 46b-81(c) provides a specific list of factors the court must consider when dividing property. This list is your roadmap to understanding how a judge will view your assets.

A court will look at:

- Length of the Marriage: A pre-marital asset in a two-year marriage is treated very differently than in a 25-year marriage.

- Causes for the Divorce: While Connecticut is a "no-fault" state, the court can consider fault (like adultery or abuse) when dividing assets, especially if one spouse's actions wasted marital funds.

- Age and Health: The court considers each person's physical and mental health and how it impacts their ability to earn a living in the future.

- Station and Occupation: This refers to the lifestyle the couple enjoyed and their respective professions.

- Amount and Sources of Income: The court looks at what each person earns now from all sources (salary, investments, etc.).

- Earning Capacity, Vocational Skills, Education, and Employability: This is about future potential. A spouse who stayed home to raise children may have a lower current earning capacity that the court will consider.

- Estate, Liabilities, and Needs of Each Party: The court balances the total assets against the total debts and considers what each person will need to be self-sufficient after the divorce.

- Opportunity for Future Acquisition of Capital Assets and Income: This looks at each person's ability to acquire assets and earn income in the years to come.

- Contribution of Each Party: This is arguably the most important factor when discussing assets that feel "separate." The statute says the court shall consider "the contribution of each of the parties in the acquisition, preservation or appreciation in value of their respective estates."

This "contribution" factor is where you can argue that an asset should be awarded primarily to you. For example, if you received an inheritance and kept it in a separate account that your spouse never touched, your attorney would argue that your spouse did not contribute to its "acquisition, preservation or appreciation," and therefore it would be equitable for you to keep it.

How "Separate" Assets are Actually Handled in a Connecticut Divorce

Since there's no automatic protection for what you might consider separate property in a Connecticut divorce, the outcome depends on the specific facts and how they align with the statutory factors. Here’s a practical look at how common types of "separate" assets are typically handled.

Property Owned Before Marriage

You owned a condo before you got married. Is it now marital property? Yes, legally it is part of the marital estate and subject to division. However, the court will absolutely consider that you brought it into the marriage.

- In a short-term marriage, it's very likely the court would award the condo (or its pre-marital value) back to you.

- In a long-term marriage, the lines blur. If marital funds were used to pay the mortgage, make improvements, or pay taxes, your spouse has a strong claim that they contributed to its "preservation or appreciation." The increase in value during the marriage is often seen as a marital asset to be divided.

Inheritances and Gifts Received During the Marriage

This is a major point of confusion. An inheritance or a significant gift from your parents feels deeply personal. Under Connecticut law, however, it is part of the marital estate. The key to keeping it is proving a lack of contribution from your spouse and avoiding commingling.

Commingling is the act of mixing funds that were once separate with joint or marital funds.

- Example of NOT commingling: Your aunt leaves you $100,000. You open a new investment account in your name only, deposit the check there, and never use it for household expenses. You have a strong argument that this asset should be yours.

- Example of commingling: You deposit that same $100,000 inheritance into your joint checking account. You then use that money to pay for a family vacation, a new car, and everyday bills. You have now commingled the funds, making it nearly impossible to trace and treat as separate. By using it for the family's benefit, you've effectively turned it into a marital asset.

The Power of a Prenuptial or Postnuptial Agreement

The only surefire way to legally define and protect separate property in a Connecticut divorce is with a valid prenuptial or postnuptial agreement. These contracts allow you and your spouse to opt out of the "all-property" rules and define for yourselves what will be considered separate and what will be marital.

According to the Connecticut Practice Book § 25-2A, if you have such an agreement, you must specifically ask the court to enforce it in your divorce filings. These agreements are powerful tools for asset protection, but they must be drafted and executed correctly to be enforceable.

Important Considerations and Practical Advice

Navigating the division of property requires careful preparation and a clear understanding of your obligations.

- Full Financial Disclosure is Mandatory: You must list every single asset on your sworn financial statement, which you are required to file with the court (Practice Book § 25-30). This includes pre-marital accounts, inheritances, and gifts. Attempting to hide an asset is a serious offense that can lead to severe penalties from the court.

- Documentation is Your Best Friend: To support your argument that an asset should be treated as "separate," you need proof. Gather bank statements from before the marriage, copies of inheritance checks, letters from the executor of an estate, and any documents that trace the asset from its source to its current location.

- Negotiation is Powerful: The vast majority of divorces in Connecticut are settled by agreement, not by a judge's ruling after a trial. In negotiations, you and your spouse can agree to treat certain assets as separate, even though the law says they are divisible. A skilled attorney can help you negotiate a settlement that honors the unique history of your assets.

Frequently Asked Questions about Separate Property in Connecticut

Here are answers to some of the most common questions people have about this topic.

1. Is my inheritance considered separate property in a Connecticut divorce?

No, it is not automatically considered separate property. It is part of the marital estate and subject to division. However, the court will consider that it was an inheritance (a contribution solely from you) and will look at whether you kept it separate or commingled it with marital funds when deciding how to divide it equitably.

2. What if I owned my house before I got married?

The house is part of the marital estate. The court will consider its pre-marital value, the length of the marriage, and how much marital money (from either spouse's income) was used to pay the mortgage, taxes, and upkeep. The appreciation in value during the marriage is very likely to be considered a marital asset.

3. Is a gift from my parents during the marriage part of the marital estate?

Yes. Like an inheritance, a gift to one spouse is legally part of the divisible marital estate. Its ultimate disposition will depend on the factors in C.G.S. § 46b-81, especially whether it was kept separate or used for the benefit of the family.

4. What does "commingling" mean and why is it so important?

Commingling means mixing separate funds with marital funds to the point they can no longer be distinguished. For example, depositing inheritance money into a joint bank account used for household bills is commingling. It weakens your argument that the asset should be treated as separate because it shows an intent to use the money for the marriage.

5. Can a prenuptial agreement protect my separate property in Connecticut?

Absolutely. A properly drafted and executed prenuptial (or postnuptial) agreement is the most effective way to legally designate certain assets as separate and ensure they are not subject to division in a divorce.

6. Does it matter who is at fault for the divorce when dividing property?

Yes, it can. "The causes for the...dissolution of the marriage" is one of the factors the court must consider (C.G.S. § 46b-81(c)). If one spouse's behavior (like having an affair and spending marital money on it) led to the breakdown and wasted assets, the court can award a larger share of the remaining property to the other spouse.

7. What happens to the debt I had before the marriage?

Just like assets, pre-marital debts are part of the total financial picture the court considers. The court has the authority to assign a pre-marital debt to either party as part of an overall equitable distribution of the estate.

8. Do I have to disclose my "separate" assets on my financial affidavit?

Yes, 100%. You are required by law to disclose all assets and debts, regardless of how or when you acquired them. Failure to do so can result in serious sanctions from the court, including potentially having the entire divorce judgment reopened for fraud.

Getting Help

The concept of an "all-property" state can be unsettling, and the process of dividing a lifetime of assets is emotionally and logistically complex. You don't have to figure this out alone. The best step you can take is to consult with an experienced Connecticut divorce attorney. They can analyze your specific situation, explain how a court is likely to view your assets based on the statutory factors, and help you build the strongest possible case for a fair and equitable outcome, whether through negotiation or in court.

Disclaimer: This article provides general information about Connecticut divorce law and is not intended as legal advice. Every case is unique, and you should consult with a qualified attorney for advice regarding your individual situation.

Conclusion

The key takeaway regarding separate property in a Connecticut divorce is that while the legal term doesn't exist, the principle behind it is very much alive in the courtroom. Connecticut's "all-property" system gives judges broad authority, but it also requires them to look closely at the entire history of the marriage and the finances. The source of an asset, the contributions of each spouse, and the overall fairness of the situation are paramount. By understanding the factors in C.G.S. § 46b-81 and preparing a well-documented case, you can effectively advocate for a property division that respects your contributions and secures your financial future.

Legal Citations

- • C.G.S. § 25-2 View Source

- • C.G.S. § 25-30 View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source