What is considered marital property in Connecticut?

Going through a divorce is one of life’s most challenging experiences, and worrying about how your property will be divided only adds to the stress. I...

Need help with your divorce? We can help you untangle everything.

Get Started Today

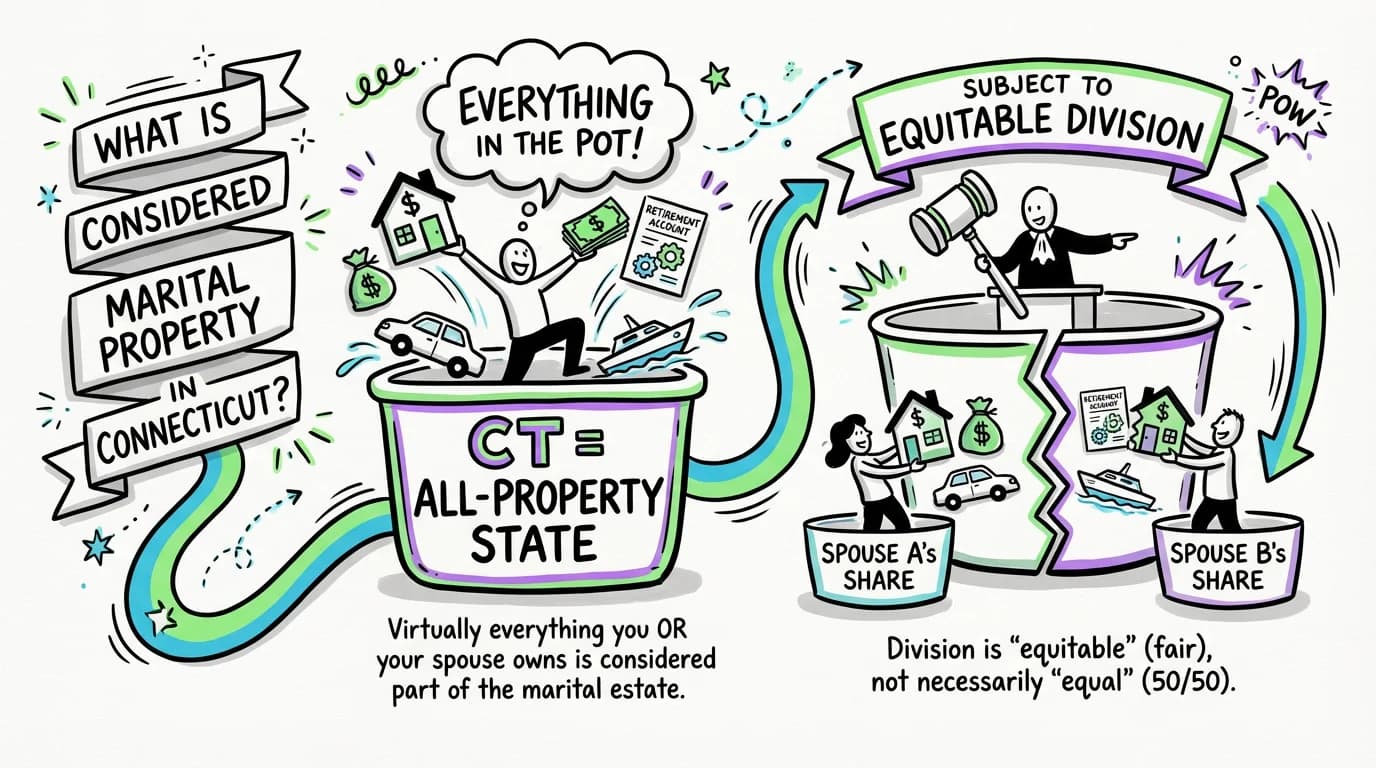

Going through a divorce is one of life’s most challenging experiences, and worrying about how your property will be divided only adds to the stress. If you’re asking, "What is considered marital property in Connecticut?" you're taking a critical first step toward understanding your financial future. The simple answer is that Connecticut is what’s known as an all-property state. This means that virtually everything you or your spouse owns can be considered part of the marital estate and is subject to division by the court.

Unlike some other states, Connecticut doesn't have a rigid definition of "separate property" that is automatically protected. Instead, the law gives judges broad discretion to divide all assets and debts in a way that is fair and equitable, regardless of whose name is on the title or when the asset was acquired.

This guide will walk you through exactly what this means for you. We'll break down the laws that govern property division in a Connecticut divorce, explain what factors a judge considers, and provide clear, actionable information to help you navigate this complex process with confidence.

Understanding Marital Property in Connecticut: The "All-Property" Approach

The most important thing to understand about marital property in Connecticut is that the term itself is a bit of a misnomer. The legal foundation for dividing assets comes from Connecticut General Statutes (C.G.S.) § 46b-81. This law doesn't talk about "marital" versus "separate" property. Instead, it gives the court the power to divide the entire "estate" of both parties.

Specifically, the law states that at the time of a divorce, "the Superior Court may assign to either spouse all or any part of the estate of the other spouse" (C.G.S. § 46b-81(a)).

What does this mean in plain English?

- Title Doesn't Matter: It doesn't matter if the house is only in your name, the car is in your spouse's name, or a bank account is held individually. The court can reassign ownership of any asset.

- Timing Doesn't Automatically Protect Assets: Property you owned before the marriage is not automatically yours to keep. It is included in the marital estate and is subject to division.

- Gifts and Inheritances Are Included: Even assets you received as a personal gift or an inheritance during the marriage are considered part of the total estate that the court can divide.

This "all-property" approach gives Connecticut courts significant flexibility. The goal isn't to simply cut everything down the middle. The goal is equitable distribution, which means a division that is fair under all the circumstances. "Equitable" does not always mean "equal."

Connecticut Law Requirements: How Is Property Actually Divided?

Since everything is on the table, how does a judge decide who gets what? The court doesn't just make a random decision. It is required by law to consider a specific set of factors to reach a fair outcome.

According to C.G.S. § 46b-81(c), the court must consider:

- Length of the Marriage: A short-term marriage might see a division closer to restoring each party to their pre-marital financial position, while a long-term marriage often results in a more integrated division of assets.

- Causes for the Divorce: While Connecticut is a "no-fault" state for filing, the court can consider a spouse's behavior if it led to the breakdown of the marriage. For example, if one spouse spent significant assets on an affair, the court might award a larger share of the remaining property to the other spouse.

- Age and Health: The court looks at the physical and mental health of both spouses, as this can impact their ability to earn income and support themselves in the future.

- Station and Occupation: This refers to the lifestyle the couple enjoyed during the marriage and their respective professions.

- Amount and Sources of Income: The court examines all sources of income for both parties, including salary, bonuses, investments, and other earnings.

- Earning Capacity and Employability: This includes a review of each person's vocational skills, education, and overall ability to earn a living. A spouse who has been out of the workforce for a long time may have a lower earning capacity, which the court will consider.

- Estate, Liabilities, and Needs: The court takes a complete inventory of all assets and debts and assesses the current and future financial needs of each spouse.

- Opportunity for Future Acquisition of Assets: The court considers each spouse's potential to acquire new assets and income after the divorce.

- Contribution of Each Spouse: This is a critical factor. The court looks at each person's role in the "acquisition, preservation or appreciation in value of their respective estates." This explicitly includes the contributions of a homemaker. The law recognizes that managing a household and raising children is a valuable contribution that helps build the marital estate.

The court weighs all these factors together to arrive at a final property division order. There is no set formula, which is why the outcome can vary significantly from case to case.

Common Examples of Assets and Debts Divided in a Connecticut Divorce

The "estate" that can be divided is incredibly broad. It includes nearly everything of value you or your spouse owns, as well as any debts you've accumulated.

Common Assets:

- Real Estate: The family home, vacation properties, rental properties, and undeveloped land.

- Bank Accounts: Checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs).

- Retirement Accounts: 401(k)s, 403(b)s, pensions, IRAs, and other retirement plans. The portion earned during the marriage is typically divided using a special court order.

- Investments: Stocks, bonds, mutual funds, and brokerage accounts.

- Business Interests: Ownership in a family business, professional practice, or other company.

- Vehicles: Cars, trucks, motorcycles, boats, and RVs.

- Personal Property: Furniture, artwork, jewelry, electronics, and collectibles.

- Life Insurance: The cash value of any whole life insurance policies.

- Inheritances and Gifts: Money or property inherited by or gifted to one spouse.

Common Debts:

- Mortgages on any real estate.

- Credit Card Debt.

- Car Loans.

- Student Loans.

- Personal Loans.

- Tax Debt.

Important Considerations for Property Division

Understanding the law is the first step. Now, let's look at some practical considerations that can significantly impact your divorce.

The Financial Statement is Your Foundation

In every Connecticut divorce, both parties are required to complete and exchange a sworn financial statement (Practice Book § 25-30). This document is the single most important piece of paperwork in your case. It provides a complete snapshot of your income, expenses, assets, and debts.

Be thorough and completely honest on your financial statement. Hiding assets or misrepresenting your financial situation can lead to severe penalties from the court, including being ordered to pay your spouse's attorney's fees or having the judge rule against you on financial matters.

Reaching an Agreement vs. Going to Trial

You and your spouse do not have to let a judge decide how to divide your property. You have the power to negotiate and create your own settlement agreement. In fact, the vast majority of Connecticut divorces are settled out of court.

If you reach an agreement, you will submit it to the court for approval. A judge will review it to ensure it is "fair and equitable under all the circumstances" (C.G.S. § 46b-66). As long as the agreement is fair and both parties entered into it knowingly and voluntarily, the court will almost always approve it and make it a legally binding order.

The Connection Between Property Division and Alimony

Property division and alimony are closely related. The court considers the property award when deciding whether to order alimony, and for how much and how long (C.G.S. § 46b-82). For example, if one spouse receives a significant, income-producing asset in the property settlement, their need for alimony may be reduced or eliminated. Conversely, a spouse who receives fewer assets might be awarded more alimony.

Frequently Asked Questions About Marital Property in Connecticut

Here are answers to some of the most common questions people have about dividing assets in a Connecticut divorce.

1. Is an inheritance considered marital property in Connecticut?

Yes. In Connecticut, an inheritance received by one spouse before or during the marriage is part of the total marital estate that a judge can divide. However, the court will consider that it was an inheritance when applying the factors in C.G.S. § 46b-81. The spouse who received the inheritance may be awarded a larger share of it, but it is not automatically protected.

2. What about property I owned before the marriage? Is that separate?

No, pre-marital property is not automatically considered separate in Connecticut. Just like an inheritance, any asset you brought into the marriage becomes part of the pot of assets subject to equitable distribution. The court will consider that you owned it before the marriage, but it still has the authority to award some or all of it to your spouse if it deems it equitable to do so.

3. Do we have to sell the family home?

Not necessarily, but it is a common outcome. The main options for the family home are:

- Sell the house and divide the proceeds.

- One spouse buys out the other's equity and keeps the house.

- The parents continue to co-own the house for a set period, often until the youngest child finishes high school.

The best solution depends on your financial situation, whether you have children, and your ability to agree.

4. How are debts divided in a Connecticut divorce?

Debts are treated just like assets. They are part of the marital estate and are divided equitably between the spouses. The court will look at who incurred the debt, for what purpose, and each party's ability to pay it off when deciding how to assign responsibility.

5. What happens to my 401(k) or pension?

Retirement accounts are considered property and are subject to division. Typically, the portion of the account that was earned during the marriage is divided. This is often done using a special court order called a Qualified Domestic Relations Order (QDRO), which allows the funds to be transferred from one spouse to the other without tax penalties.

6. Does it matter whose name is on the title or account?

No. As explained in C.G.S. § 46b-81, the court has the authority to assign property from one spouse's estate to the other, regardless of whose name is on the legal title. This is a core principle of Connecticut's "all-property" system.

7. Is Connecticut a community property state?

No. Community property states generally consider assets acquired during the marriage to be owned 50/50 by both spouses, while assets owned before marriage are separate. Connecticut is an "equitable distribution" or "all-property" state, where the focus is on a fair division of all assets based on a long list of factors, not a simple 50/50 split.

8. What is a financial statement and why is it so important?

A financial statement is a sworn court form where you must list all of your income, expenses, assets (like bank accounts, real estate, retirement) and liabilities (like mortgages and credit card debt). It is required by court rule (Practice Book § 25-30) and serves as the factual basis for all financial negotiations and court orders regarding property division, alimony, and child support.

Getting Help: Navigating Property Division

Dividing a lifetime of accumulated assets is legally and emotionally complex. The best thing you can do is be prepared. Start by gathering all of your financial documents, including tax returns, pay stubs, bank statements, retirement account statements, and loan documents.

Working with experienced professionals can make a world of difference. A knowledgeable Connecticut divorce attorney can help you understand your rights, protect your interests, and negotiate a fair settlement. A financial advisor or a divorce mediator can also provide valuable guidance and support.

This article is for informational purposes only and does not constitute legal advice. The laws regarding divorce and property division are complex and you should consult with a qualified attorney for advice regarding your individual situation.

Conclusion

The key takeaway about marital property in Connecticut is that the state uses a broad, all-encompassing approach. There is no "separate property" that is automatically off-limits. From the house you bought together to an inheritance received by one spouse, everything is part of the marital estate.

The court's mission is to achieve equitable distribution—a division that is fair, not necessarily equal. To do this, a judge will carefully weigh the many factors laid out in C.G.S. § 46b-81, including the length of your marriage, your respective financial situations, and your contributions to the family. By understanding this framework, you can better prepare for the road ahead and work toward a resolution that allows you to move forward with financial security.

Legal Citations

- • C.G.S. § 25-30 View Source

- • C.G.S. § 46b-66 (Review of Final Agreement) View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source

- • C.G.S. § 46b-82 (Alimony) View Source