What happens to retirement accounts in Connecticut divorce?

Facing a divorce is overwhelming, and worrying about your financial future, especially your hard-earned retirement savings, only adds to the stress. I...

Need help with your divorce? We can help you untangle everything.

Get Started Today

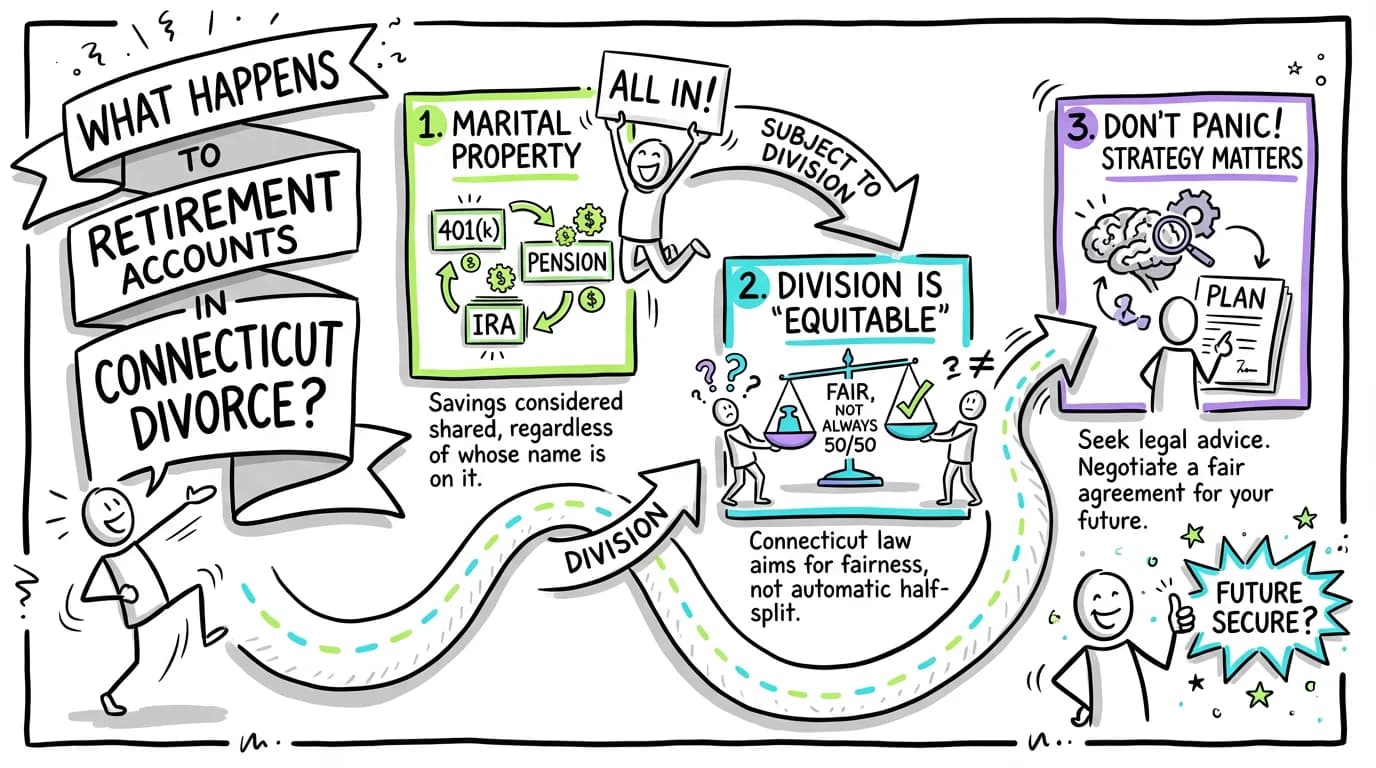

Facing a divorce is overwhelming, and worrying about your financial future, especially your hard-earned retirement savings, only adds to the stress. If you're wondering what happens to your 401(k), pension, or IRA, you're not alone. The simple answer is that in Connecticut, retirement accounts are considered marital property and are subject to division, regardless of whose name is on the account.

But don't panic. This doesn't automatically mean you'll lose half of your savings. Connecticut law requires a fair and equitable division, not necessarily an equal one. Understanding how the process works for retirement accounts in divorce in Connecticut can empower you to protect your financial future and navigate this challenging time with more confidence.

This article will walk you through exactly how Connecticut courts handle retirement assets, from the legal principles to the practical steps involved, so you can understand your rights and what to expect.

Understanding the Legal Foundation: Equitable Distribution in Connecticut

To understand how retirement funds are handled, you first need to know two key things about Connecticut divorce law: it's an "all-property" state and it follows the rule of "equitable distribution."

Connecticut is an "All-Property" State

Unlike some states that only divide assets acquired during the marriage, Connecticut courts have the authority to divide all property owned by either spouse. This includes assets you owned before the marriage, gifts, and inheritances.

According to Connecticut General Statutes (C.G.S.) § 46b-81(a), "the Superior Court may assign to either spouse all or any part of the estate of the other spouse." This means that your 401(k) you started ten years before you got married, your spouse's pension, and any IRAs are all on the table for division.

Equitable Distribution, Not 50/50

"Equitable" means fair, not necessarily equal. The court's goal is to arrive at a property division that is fair and just under all the circumstances. A 50/50 split is possible, but it's not automatic.

The court looks at a specific set of factors to decide what's equitable. C.G.S. § 46b-81(c) requires the court to consider:

- The length of the marriage

- The causes for the divorce

- The age, health, and station of each spouse

- Each person's occupation, income, and sources of income

- Earning capacity, vocational skills, education, and employability

- The estate, liabilities, and needs of each party

- The opportunity for each to acquire future assets and income

- The contribution of each spouse to the acquisition, preservation, or appreciation in value of the assets

The court weighs these factors to decide how to divide all property, including retirement accounts. For example, in a long-term marriage where one spouse stayed home to raise children, a judge might award that spouse a larger portion of the retirement assets to ensure their financial security.

The Step-by-Step Process for Dividing Retirement Accounts in a Connecticut Divorce

Dividing retirement assets involves a specific, careful process to ensure it's done correctly and without triggering unnecessary taxes or penalties.

Step 1: Identify and Disclose All Accounts

The first step is full transparency. Both you and your spouse must identify and disclose all assets, including every retirement account. This is done on a sworn financial statement (Form JD-FM-6), which is one of the most important documents in a divorce.

Under the Connecticut Practice Book § 25-30, parties are required to file these detailed financial statements with the court. Furthermore, Practice Book § 25-32 mandates the automatic exchange of financial documents, including retirement account statements from the last two years. Intentionally hiding an account is illegal and can lead to severe penalties.

Step 2: Value the Retirement Accounts

Once identified, each account must be valued. The method depends on the type of account:

- Defined Contribution Plans (401(k)s, 403(b)s, IRAs): These are the easiest to value. The value is simply the account balance on a given day. You and your spouse will need to agree on a valuation date (e.g., the date of filing, the date of separation, or the date of divorce).

- Defined Benefit Plans (Pensions): These are more complex. A pension doesn't have a simple account balance; it's a promise of a future stream of monthly payments at retirement. To determine its current value, you often need to hire an expert, like an actuary, to perform a valuation.

Step 3: Negotiate an Agreement or Go to Trial

Armed with a full list and valuation of all retirement assets, you and your spouse can negotiate a settlement. You might agree to:

- Divide a specific account, with one spouse receiving a percentage or a flat dollar amount.

- Have one spouse keep their entire retirement account in exchange for giving the other spouse a different asset of similar value (like equity in the house). This is called an "offset."

If you can't agree, a judge will decide how the retirement accounts in your Connecticut divorce will be divided after a trial, based on the legal factors in C.G.S. § 46b-81.

Step 4: Use a QDRO to Transfer the Funds

This is the most critical technical step. You can't just write a check from your 401(k) to your ex-spouse. Doing so would count as an early withdrawal, triggering income taxes and a 10% penalty.

To divide most employer-sponsored retirement plans (like 401(k)s and pensions) legally and without penalty, you need a special court order called a Qualified Domestic Relations Order (QDRO).

A QDRO (pronounced "kwah-dro") is a legal document, separate from your divorce decree, that instructs the retirement plan administrator to create a separate account for your ex-spouse and transfer their awarded share. Once the funds are in their own retirement account, they can manage them as they see fit, including rolling them over into an IRA.

Important Note: IRAs do not require a QDRO. They are divided using a "transfer incident to divorce," which is a simpler process handled by the financial institution holding the IRA.

Important Considerations for Retirement Accounts in Divorce in Connecticut

As you navigate the division of retirement assets, keep these practical points in mind.

The "Marital Portion"

While Connecticut is an "all-property" state, the court pays close attention to the contribution of each of the parties in the acquisition, preservation or appreciation in value of their respective estates (C.G.S. § 46b-81(c)).

This means that for an account started before the marriage, the court will often focus on dividing the portion that grew during the marriage. This "marital portion" is calculated by determining the account's value on the date of marriage and subtracting it from the value on the date of divorce, plus any growth on the pre-marital portion. For pensions, a formula called the "coverture fraction" is often used to determine the marital share.

Survivor Benefits for Pensions

If you are the non-employee spouse receiving a share of a pension, it is crucial that the QDRO addresses survivor benefits. Without this provision, your pension payments could stop if your ex-spouse dies before you. Make sure this is part of your negotiation.

Tax Consequences are Key

The entire purpose of a QDRO or a transfer incident to divorce is to avoid negative tax consequences. A properly executed transfer is not a taxable event. The receiving spouse will only pay taxes on the money when they withdraw it during their own retirement, just like any other retirement account.

Frequently Asked Questions about Retirement Accounts and Divorce

Here are answers to some of the most common questions people have about retirement accounts in a Connecticut divorce.

1. Is my 401(k) that I started before the marriage considered marital property?

Yes. In Connecticut, because it is an "all-property" state, any asset owned by either spouse is considered marital property and is subject to division (C.G.S. § 46b-81). However, the court will consider that you owned it before the marriage as one of the many factors in deciding what a fair and equitable division is.

2. How is a pension divided in a Connecticut divorce?

Pensions are typically divided in one of two ways:

- Present Value Offset: An expert calculates the pension's current cash value. The employee spouse keeps the pension, and the other spouse receives other marital assets (like cash or home equity) of equivalent value.

- Deferred Distribution: The non-employee spouse receives a percentage of the pension payments when the employee spouse retires. This is accomplished using a QDRO.

3. What is a QDRO and do I really need one?

A QDRO is a court order that tells a retirement plan how to pay a portion of the benefits to a non-employee spouse. You absolutely need one to divide most employer-sponsored plans like 401(k)s, 403(b)s, and pensions. You do not need one for IRAs.

4. Will I lose half of my retirement savings in my divorce?

Not necessarily. Connecticut courts aim for an "equitable" (fair) split, not an "equal" one. The final division depends on the many factors listed in C.G.S. § 46b-81, such as the length of the marriage and each spouse's financial situation.

5. Can my spouse and I agree not to divide our retirement accounts?

Yes. You can agree to an arrangement where each person keeps their own retirement accounts, especially if you can offset the value with other assets. For example, one spouse might keep their full 401(k) while the other keeps the marital home. As long as the court finds the overall settlement agreement to be "fair and equitable," it will likely be approved (C.G.S. § 46b-66).

6. What happens if my spouse tries to hide a retirement account?

Failing to disclose assets on a sworn financial statement is a serious offense. If a hidden account is discovered later, you can ask the court to reopen the divorce judgment on grounds of fraud. The judge can then re-divide the assets and may penalize the spouse who hid the account.

7. How much does it cost to get a QDRO?

Preparing a QDRO is a specialized task. While some divorce attorneys do them, many refer the work to a QDRO specialist. The cost can range from several hundred to a few thousand dollars, depending on the complexity of the plan. The cost is typically split between the spouses.

8. Can I get my share of my ex-spouse's retirement account in cash?

When you receive funds via a QDRO, you generally have two options. You can (1) roll the money over into your own IRA, which defers all taxes, or (2) take a cash distribution. If you choose cash, the money will be subject to ordinary income tax, but the 10% early withdrawal penalty is often waived if the distribution is made directly from the QDRO. It's crucial to discuss the tax implications with a financial advisor before making this choice.

Getting the Right Help

The rules surrounding the division of retirement accounts in a Connecticut divorce are complex. The stakes are high, and a mistake can have a lasting impact on your financial security for decades to come.

It is highly recommended that you work with an experienced Connecticut divorce attorney who can protect your rights and guide you through the process. For cases with significant or complex retirement assets, consulting with a Certified Divorce Financial Analyst (CDFA) can also provide invaluable clarity and help you achieve a truly fair outcome.

Conclusion

Your retirement savings represent years of hard work and planning for the future. While Connecticut law treats these funds as marital property, it also provides a structured and fair process for their division. By understanding the principles of equitable distribution, the importance of full financial disclosure, and the critical role of a QDRO, you can better advocate for your financial well-being. Remember, the goal is not to leave one person with nothing, but to divide the marital estate in a way that is fair and allows both you and your former spouse to move forward and build secure, independent futures.

Legal Citations

- • C.G.S. § 25-30 View Source

- • C.G.S. § 25-32 View Source

- • C.G.S. § 46b-66 (Review of Final Agreement) View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source