What happens to gifts and inheritance in Connecticut divorce?

If you’ve received a significant gift or inheritance during your marriage, it’s natural to worry about what might happen to it in a divorce. Many peop...

Need help with your divorce? We can help you untangle everything.

Get Started Today

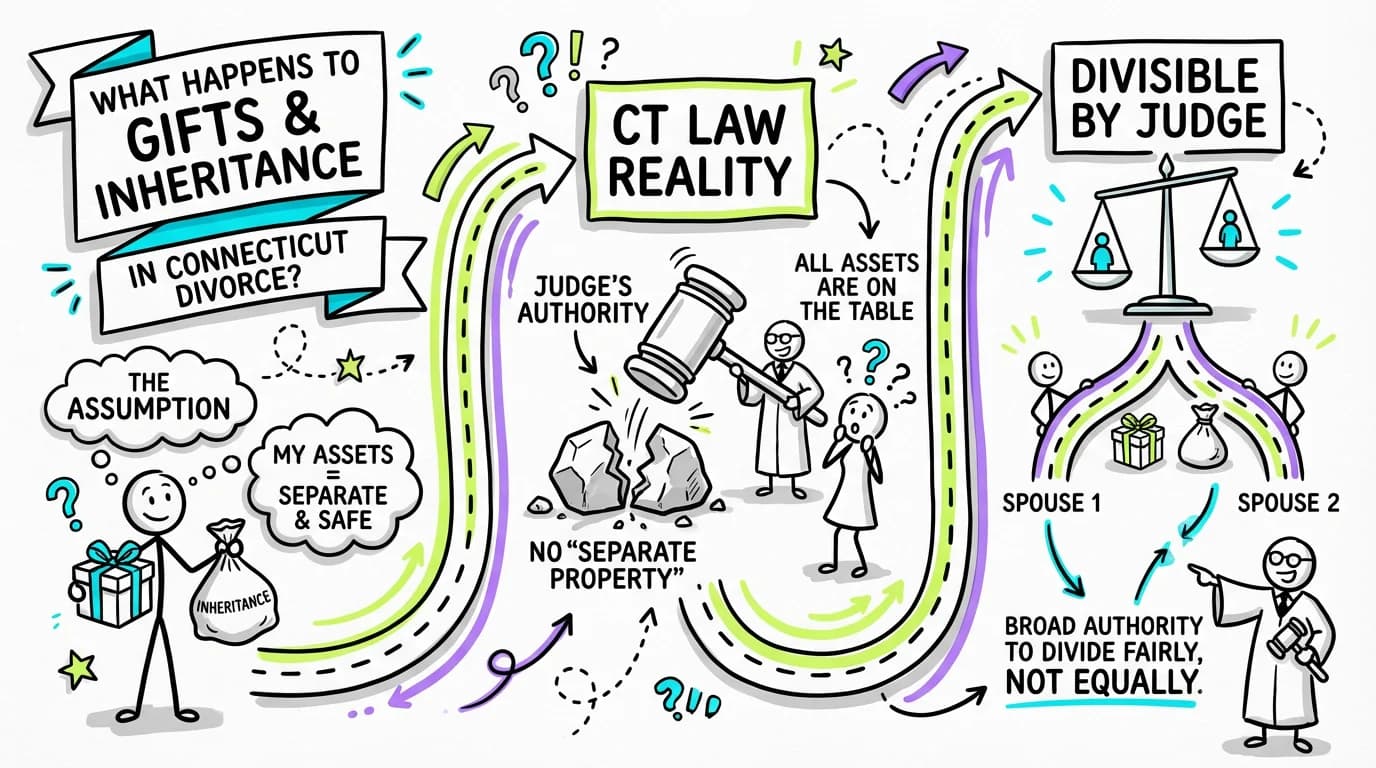

If you’ve received a significant gift or inheritance during your marriage, it’s natural to worry about what might happen to it in a divorce. Many people assume these assets are automatically yours to keep, separate from everything else. In Connecticut, however, the answer is more complex. While you might feel these assets are personally yours, the law gives judges broad authority to divide them.

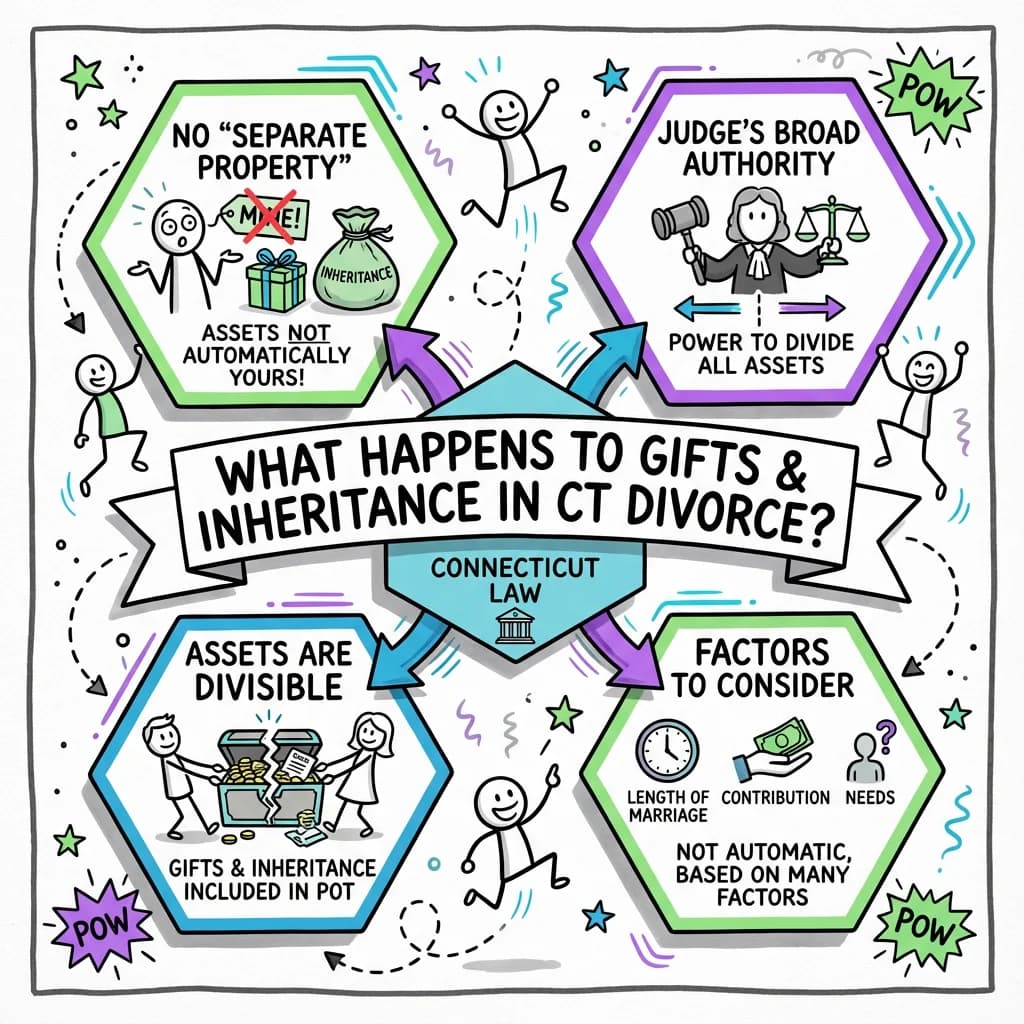

The simple truth is that in Connecticut, there is no such thing as legally "separate property" that is automatically off-limits in a divorce. Instead, Connecticut is an all-property state. This means that virtually everything owned by either you or your spouse—including assets received as gifts or through inheritance—is considered part of the marital estate and is subject to division by the court.

But don't panic. Just because a gift or inheritance is on the table doesn't mean your spouse will automatically get half. The court looks at many factors to decide what is fair and equitable. This article will walk you through how the law works, what factors a judge considers, and what you can do to present your case regarding gifts and inheritance in a Connecticut divorce.

Understanding the Legal Foundation: Connecticut's "All-Property" System

To understand what happens to gifts and inheritances, you first need to grasp Connecticut's fundamental approach to property division. Unlike some states that distinguish between "marital property" (acquired during the marriage) and "separate property" (acquired before marriage, or as a gift/inheritance), Connecticut does not make this distinction.

The guiding law is Connecticut General Statutes (C.G.S.) § 46b-81(a), which states:

"At the time of entering a decree annulling or dissolving a marriage or for legal separation... the Superior Court may assign to either spouse all or any part of the estate of the other spouse."

This single sentence is incredibly powerful. It means that the court has the authority to divide any asset, regardless of when it was acquired or whose name is on the title. Your inheritance, a gift from your parents, or even property you owned before the marriage are all part of the "estate" that the court can divide.

So, if everything is on the table, how does the court decide who gets what? The decision isn't arbitrary. The same statute provides a list of factors the judge must consider to reach a fair and equitable outcome.

How Connecticut Law Determines the Division of Assets

When deciding how to handle gifts and inheritance in a Connecticut divorce, a judge won't just flip a coin. They are required by law to weigh a series of factors outlined in C.G.S. § 46b-81(c). Understanding these factors is crucial because your attorney will build your case around them.

The court must consider:

- The length of the marriage

- The causes for the divorce (e.g., adultery, desertion, etc., though most cases are "no-fault")

- The age, health, station, and occupation of each spouse

- The amount and sources of income for each spouse

- Vocational skills, education, and employability

- The estate, liabilities, and needs of each party

- The opportunity for each spouse to acquire capital assets and income in the future

- The contribution of each spouse to the "acquisition, preservation or appreciation in value of their respective estates."

This last point is often the most important when discussing gifts and inheritances. The court will look closely at how each party contributed to the assets. For an inheritance, the non-recipient spouse might argue they contributed to its "preservation" by managing the household, allowing the inheriting spouse to focus on managing the funds, or by contributing to joint expenses that the inheritance would have otherwise covered.

The Critical Role of "Commingling"

While not a formal legal term found in the statutes, commingling is a practical concept that has a huge impact on how gifts and inheritances are treated in a Connecticut divorce. Commingling means mixing assets that were originally from a gift or inheritance with joint marital funds or property.

The more an asset is commingled, the harder it becomes to argue that it should be treated as belonging solely to the recipient. It starts to look and feel like any other marital asset.

Here are some common examples:

-

Clear Example of Not Commingling: You inherit $100,000 from your grandmother. You open a new bank account solely in your name, deposit the check, and never add any marital funds to it or use it for joint expenses. You only use it for your personal needs. In this scenario, it's much easier to argue that this asset should be returned to you before the remaining marital property is divided.

-

Clear Example of Commingling: You inherit that same $100,000. You deposit it into the joint checking account you share with your spouse. Over the next few years, you use that money to pay for family vacations, contribute to your children's college funds, and pay off the mortgage on the marital home. In this case, the inheritance has been completely mixed with marital finances. It would be very difficult to "unscramble the egg" and claim the full $100,000 as yours alone. The court is highly likely to treat the remaining value as a joint marital asset.

-

A Gray Area: You use your inherited funds to make a down payment on the marital home, which is titled in both your names. While the source of the down payment is traceable to your inheritance, the home itself is a joint asset that both of you contributed to (through mortgage payments, upkeep, etc.). The court will consider your initial contribution but will also look at the contributions of your spouse to the home's preservation and appreciation in value.

The key takeaway is that if you want to increase the chances of keeping a gift or inheritance separate, you must treat it as separate from day one.

Important Considerations and Practical Advice

When dealing with a gifts inheritance divorce in Connecticut, several other factors can influence the outcome.

Timing of the Gift or Inheritance

When you received the asset matters. An inheritance received one year into a 20-year marriage that was used for the family's benefit will be viewed very differently from an inheritance received one month before your spouse filed for divorce. In the latter case, a judge may be more inclined to assign that asset entirely to you, as your spouse had little to no involvement with it.

The Giver's Intent

The court may consider the intent of the person who gave the gift. Was it a wedding gift addressed to both of you? Or was it a birthday gift from your parent, made out only to you? While not the deciding factor, clear evidence of the giver's intent can be persuasive. A letter accompanying the gift, for example, could be valuable evidence.

Documentation and Tracing

The burden of proof is on the person claiming an asset is a gift or inheritance that should be treated differently. You must be able to trace the asset from its origin to its current form. This requires meticulous record-keeping. Be prepared to provide:

- Probate court documents or a will showing the inheritance.

- Bank statements showing the initial deposit.

- Account statements showing that the funds were kept separate and not commingled.

- Deeds or titles if the asset was real estate or a vehicle.

Without a clear paper trail, it becomes your word against your spouse's, which is a weak position in court.

Prenuptial and Postnuptial Agreements

A valid prenuptial or postnuptial agreement is one of the most effective ways to protect gifts and inheritances. As noted in the Connecticut Practice Book § 25-2A, parties can ask the court to enforce these agreements. A well-drafted agreement can explicitly state that any gifts or inheritances received by either party will remain their sole and separate property, not subject to division in a divorce.

Future Inheritances

What about an inheritance you expect to receive in the future? Generally, a potential inheritance is considered speculative and is not divisible property. The court cannot divide an asset you don't yet have.

However, C.G.S. § 46b-81(c) allows the court to consider "the opportunity of each for future acquisition of capital assets and income." If an inheritance is not just a possibility but a near certainty—for example, a parent has passed away and their estate is in probate—a judge may consider this future influx of cash when deciding on a fair division of the current marital assets or in determining alimony.

Frequently Asked Questions about Gifts and Inheritance in a Connecticut Divorce

Here are answers to some of the most common questions people have about this complex topic.

1. Is my inheritance automatically protected in a Connecticut divorce?

No. This is the most common misconception. Connecticut is an "all-property" state, meaning your inheritance is part of the marital estate and is subject to division by the court. The court will decide on a fair division based on the specific facts of your case and the factors listed in C.G.S. § 46b-81.

2. What if I kept my inheritance in a separate bank account?

Keeping an inheritance in a separate account, solely in your name, is the single best step you can take to protect it. This prevents "commingling" and makes it much easier to argue that your spouse did not contribute to its acquisition, preservation, or appreciation. While it's still legally on the table, a judge is far more likely to assign the asset back to you.

3. Does it matter if the gift was from my spouse's parents?

It can. The court will look at the intent of the giver. If your spouse's parents gave a large cash gift with a card that said, "To our wonderful son and daughter-in-law, for a down payment on your future home," that looks like a gift to the marriage. If they gave a gift only to their child for their birthday, it's easier to argue it was intended for that individual.

4. Can a prenuptial agreement protect my inheritance?

Absolutely. A properly executed prenuptial or postnuptial agreement can define what happens to gifts and inheritances, overriding Connecticut's default "all-property" rules. This is the most reliable way to ensure these assets remain yours.

5. What about gifts we received together, like wedding gifts?

Gifts given to both of you, such as wedding gifts, are almost always considered joint marital property and will be divided equitably along with all other marital assets.

6. My parent is elderly and I expect to inherit soon. Will that be part of my divorce?

A potential, speculative inheritance is not a current asset and cannot be divided. However, the court can consider your "opportunity for future acquisition of capital assets" (C.G.S. § 46b-81(c)) when dividing the property you do have now. If the inheritance is certain and imminent, it may have a greater influence on the judge's decision.

7. What happens if I used my inheritance to pay for our home?

This is a classic example of commingling. By investing your inheritance into a jointly titled marital home, you have converted it into a marital asset. The court will recognize your initial contribution from the inheritance as one factor, but the house itself will be subject to equitable division, considering all the contributions (financial and otherwise) made by both spouses during the marriage.

8. How do I prove an asset was a gift or inheritance?

Through documentation. You will need to provide evidence like a copy of the will, trust documents, probate records, gift letters, and bank statements that trace the money from the original source into your possession.

Getting Help: Why You Need an Experienced Attorney

Navigating the complexities of gifts inheritance divorce Connecticut requires skilled legal guidance. The outcome is highly dependent on the specific facts of your case and how those facts are presented to the court.

An experienced Connecticut divorce attorney can help you:

- Gather and organize the necessary financial documents to trace your assets.

- Build a strong argument based on the statutory factors in C.G.S. § 46b-81.

- Negotiate a settlement with your spouse that fairly accounts for the gift or inheritance.

- Ensure you comply with all court rules, including the mandatory filing of a sworn financial statement (Practice Book § 25-30).

Attempting to handle this on your own, especially when significant assets are at stake, can lead to a financially devastating outcome.

Conclusion

While it can be unsettling to learn that your personal gifts and inheritance are subject to division in a Connecticut divorce, remember that "subject to division" does not mean "automatically split 50/50." The law provides a framework for a judge to make a fair and equitable decision.

The key takeaways are clear: Connecticut is an all-property state, the court has broad discretion, and your actions—especially whether you commingle the assets—play a huge role. By understanding the law, keeping meticulous records, and seeking professional legal advice, you can position yourself for the most favorable outcome possible and protect the assets that are most important to you.

Legal Citations

- • C.G.S. § 25-2 View Source

- • C.G.S. § 25-30 View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source