How are credit card debts handled in Connecticut divorce?

Facing a divorce is overwhelming enough without the added stress of untangling your finances. One of the most common questions we hear is about debt, ...

Need help with your divorce? We can help you untangle everything.

Get Started Today

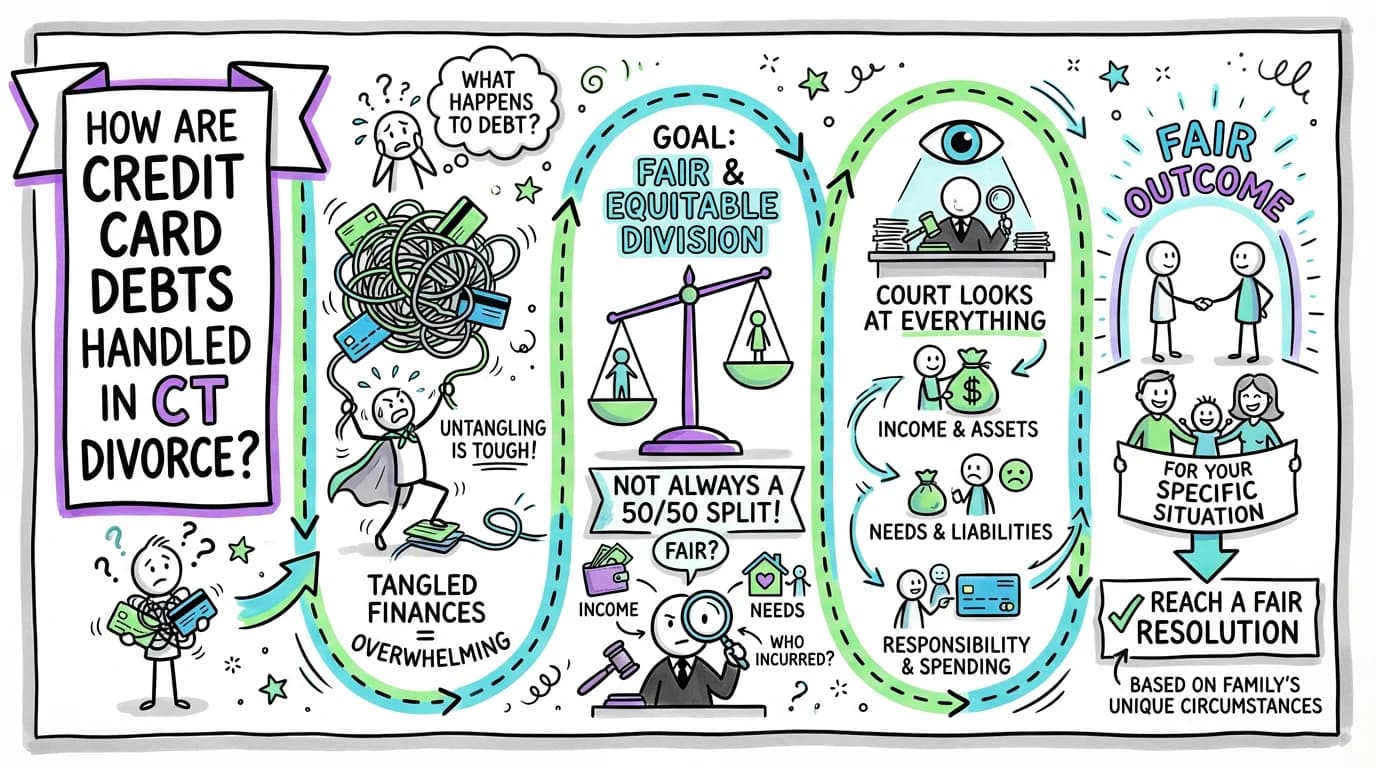

Facing a divorce is overwhelming enough without the added stress of untangling your finances. One of the most common questions we hear is about debt, specifically, "What happens to our credit card bills?" In Connecticut, the short answer is that credit card debt, like assets, is divided fairly and equitably between you and your spouse. This doesn't always mean a 50/50 split.

The court's goal is to reach a fair outcome based on your family's specific situation. It will look at everything—who incurred the debt, what it was for, and each spouse's ability to pay it back. Understanding this process is the first step toward taking control of your financial future and moving forward with confidence.

This guide will walk you through exactly how credit card debts are handled in a Connecticut divorce, from the laws that guide the judges to the practical steps you can take to protect yourself.

Understanding the Legal Foundation: Equitable Distribution

Connecticut is an “equitable distribution” state. This is a legal principle that governs how all marital property is divided in a divorce. The key word here is equitable, which means fair, not necessarily equal. This principle applies to both your assets (like your house and savings) and your liabilities (like mortgages, car loans, and credit card debt).

The guiding law for this process is Connecticut General Statutes (C.G.S.) § 46b-81. This statute gives the court the authority to "assign to either spouse all or any part of the estate of the other spouse." While the law talks about the "estate," courts have consistently interpreted this to include both assets and debts. Therefore, any debt acquired during the marriage is subject to equitable distribution.

This means that even if a credit card is only in one spouse's name, the debt on that card can be divided between both spouses if the court finds it fair to do so. The name on the account is just one piece of the puzzle; the court is more interested in the big picture of your family's finances.

Connecticut Law Requirements: The Factors a Judge Considers

When a judge decides how to handle credit card debt in a divorce in Connecticut, they don't just flip a coin. They are required by law to consider a specific set of factors to ensure the division is fair. These factors, found in C.G.S. § 46b-81(c), give the court a complete picture of your marriage and financial situation.

The court will carefully weigh:

- Length of the marriage: In shorter marriages, the court might be more inclined to return each party to their pre-marital financial state. In longer marriages, finances are seen as more intertwined.

- Causes for the divorce: If one spouse's behavior, such as a gambling problem or reckless spending on an affair, led to significant credit card debt, the court can assign that debt primarily to them.

- Age and health: A spouse with health issues or who is nearing retirement age may have less ability to take on debt.

- Station, occupation, and income: The court looks at each person's job, social standing, and current income.

- Earning capacity and employability: A spouse with a high-paying job or the potential to earn much more in the future may be assigned a larger share of the debt. This includes looking at education, vocational skills, and overall employability.

- Estate, liabilities, and needs of each party: The court balances the total assets and debts of each person, along with their reasonable monthly needs.

- Opportunity for future acquisition of assets: This is similar to earning capacity but also considers potential inheritances or other future financial gains.

- Contribution of each party: The court considers each spouse's contribution to acquiring, preserving, or increasing the value of the marital estate. This includes non-monetary contributions, like being a stay-at-home parent.

How these factors apply to your credit card debt is unique to your case. For example, if one spouse used a credit card to pay for a degree that increased their earning capacity, the court might assign that debt to them. Conversely, if debt was incurred for family vacations, groceries, and children's expenses, it's almost certain to be considered a joint responsibility, and the court will divide it based on each spouse's ability to pay.

The Step-by-Step Process for Dividing Credit Card Debt

Navigating a credit card debt divorce in Connecticut involves a clear, structured process. Whether you and your spouse reach an agreement or a judge makes the final decision, these are the essential steps.

Step 1: Identification and Full Disclosure

The entire divorce process hinges on honesty and transparency. Both you and your spouse are legally required to disclose all your assets and liabilities. This is done on a sworn financial statement (sometimes called a financial affidavit), a form mandated by the Connecticut Practice Book § 25-30.

On this form, you must list:

- Every credit card account you have.

- Whether the account is in your name, your spouse's name, or held jointly.

- The outstanding balance on each card as of a specific date.

- The minimum monthly payment.

It is critical to be thorough and accurate. Hiding debt (or assets) can lead to serious penalties from the court and can damage your credibility, potentially resulting in a less favorable outcome for you.

Step 2: Characterizing the Debt

Next, you and your attorneys (or the court) will look at the nature of the debt. While Connecticut doesn't have rigid categories like "marital" and "separate" property, the timing and purpose of the debt are extremely important.

- Debt Incurred During the Marriage: Debt accumulated from the date of marriage to the date of separation is generally considered a shared responsibility, especially if it was for family purposes (e.g., home repairs, kids' activities, daily living expenses).

- Debt Incurred Before the Marriage: Debt you brought into the marriage usually remains your own responsibility, but it must still be disclosed as it affects your overall financial picture.

- Debt Incurred After Separation: This is where things can get tricky. Connecticut's Automatic Orders (Practice Book § 25-5) go into effect the moment a divorce is filed. These orders prohibit either spouse from taking on "unreasonable debts." If your spouse goes on a spending spree after you've separated, you can argue that they should be solely responsible for that new debt. However, debt for necessary living expenses or attorney's fees is typically viewed differently.

Step 3: Negotiation and Settlement

Most divorce cases in Connecticut are settled out of court. This is your opportunity to work with your spouse to create a fair plan for handling your credit card debt. You might agree to:

- Assign specific cards to each person to pay off.

- Use a marital asset, like a savings account, to pay off all the cards.

- Sell an asset and use the proceeds to clear the debt.

- Have one spouse take on more debt in exchange for keeping a valuable asset, like the marital home.

Any agreement you reach will be written into your settlement agreement. A judge will review it to ensure it is "fair and equitable under all the circumstances" as required by C.G.S. § 46b-66 before making it a final court order.

Step 4: Court Intervention

If you cannot agree, a judge will make the decision for you. After hearing testimony and reviewing your financial statements and other evidence, the judge will apply the factors in C.G.S. § 46b-81 and issue a final divorce decree that explicitly states who is responsible for paying each specific debt.

Important Considerations and Practical Advice

The court's order is legally binding between you and your ex-spouse, but it does not change your contract with the credit card company. This is one of the most misunderstood aspects of handling debt in a divorce.

Joint Accounts: A Critical Warning

If your name is on a joint credit card account, the creditor can legally pursue you for the entire balance, regardless of what your divorce decree says. If your ex-spouse is ordered to pay a joint credit card and fails to do so, the credit card company can still come after you, report the late payments on your credit report, and even sue you.

What to do:

- Close Joint Accounts: As soon as possible, contact your creditors and ask to close all joint accounts to new charges. This prevents either party from adding to the debt.

- Transfer Balances: If possible, try to have the spouse responsible for the debt transfer the balance to a new card in their name only. Creditors may not allow this without the new cardholder qualifying on their own.

- Pay it Off: The safest option is to pay off and close all joint accounts using marital assets before the divorce is finalized.

What if My Ex-Spouse Doesn't Pay?

If your ex-spouse was ordered to pay a debt (whether joint or in their name) and they stop paying, your first step is to protect your own credit if it's a joint account. You may need to make the payments yourself to avoid damage to your credit score.

Your legal remedy is to file a Motion for Contempt with the family court. Under C.G.S. § 46b-87, if the court finds your ex-spouse is in contempt of the divorce decree, it can order them to pay, reimburse you for any payments you made, and even award you attorney's fees for having to bring the motion.

Frequently Asked Questions about Credit Card Debt and Divorce

Here are answers to some of the most common questions about handling credit card debt in a divorce in Connecticut.

1. What if my spouse ran up secret credit card debt without my knowledge?

Full disclosure is mandatory. If you discover hidden debt during the divorce process, bring it to the court's attention immediately. The court will consider the "causes for the dissolution" and the purpose of the spending. If the debt was for non-marital purposes, like an affair or a secret hobby, the judge has the discretion to assign that entire debt to your spouse.

2. Am I responsible for debt on a card that's only in my spouse's name?

To the credit card company, you are not responsible. They can only pursue the person whose name is on the account. However, in the context of the divorce, the family court can order you to contribute to or pay off that debt as part of the overall equitable distribution of assets and liabilities. This is common if the debt was incurred for family benefit.

3. What happens to credit card debt incurred after we separated?

The Automatic Orders (Practice Book § 25-5) that apply upon filing for divorce prevent either party from incurring unreasonable new debt. If your spouse racks up charges for a lavish vacation after separation, you have a strong argument that they should be solely responsible. However, if they use a card to pay for groceries, rent, or other necessities because you are no longer contributing to household expenses, the court may see that as a shared responsibility.

4. Can I close our joint credit card accounts during the divorce?

Yes, and it is often a very wise move. Closing the account to new purchases prevents the balance from growing. You are still both responsible for the existing balance, but it freezes the amount you need to deal with in the divorce. It's a good idea to notify your spouse in writing that you are doing this.

5. What if my ex-spouse files for bankruptcy on the debt they were ordered to pay?

This is a complicated situation. If the debt was in your ex-spouse's name only, their bankruptcy will not affect you. However, if it was a joint debt, their bankruptcy filing does not eliminate your obligation to the creditor. The credit card company will likely turn to you for the full payment. You may need to return to family court to seek a modification of alimony or other financial orders to compensate for the fact that you are now burdened with this debt.

6. How can I prove what the credit card debt was used for?

Credit card statements are your best evidence. During the discovery phase of your divorce, you can request statements for all accounts. Review them carefully and highlight charges that were clearly not for family purposes. If you need more detail, you may need to subpoena records from the merchants themselves.

7. Does it matter who made the payments on the card during the marriage?

It can be a factor, but it's often less important than the purpose of the debt. In most marriages, income is pooled to pay bills, so the fact that payments came from one spouse's bank account doesn't necessarily mean they are solely responsible for the debt. The court views it as marital funds paying a marital debt.

Getting Help with Your Connecticut Divorce

Dividing debt is a complex part of any divorce. The stakes are high, and a misstep can affect your financial health for years to come.

- Consult a Connecticut Divorce Attorney: An experienced family law attorney can provide advice tailored to your specific situation, help you negotiate a fair settlement, and protect your rights in court.

- Consider Mediation: For couples who can communicate effectively, mediation can be a less adversarial and more cost-effective way to resolve financial issues. A neutral mediator can help you and your spouse create a mutually acceptable plan for your debts (C.G.S. § 46b-53a).

- Work with a Financial Professional: A Certified Divorce Financial Analyst (CDFA) can work alongside your attorney to analyze the long-term financial impact of different settlement options, helping you make informed decisions.

Conclusion: Taking Control of Your Financial Future

The way credit card debt is handled in a Connecticut divorce is guided by the principle of fairness. The court has broad authority to divide liabilities equitably based on a wide range of factors unique to your marriage.

Remember the key takeaways:

- Full Disclosure is Mandatory: Be honest and thorough on your financial statement.

- Equitable Means Fair, Not Equal: The division of debt will be based on what is fair for your specific circumstances.

- Protect Your Credit: Take proactive steps like closing joint accounts to prevent further debt from accumulating.

- The Decree is Between You and Your Ex: It does not alter your agreement with creditors.

Navigating the financial complexities of divorce is challenging, but you don't have to do it alone. By understanding the law and seeking professional guidance, you can work toward a fair resolution that allows you to begin your next chapter on solid financial footing.

Legal Citations

- • C.G.S. § 25-30 View Source

- • C.G.S. § 25-5 View Source

- • C.G.S. § 46b-53a (Mediation Program) View Source

- • C.G.S. § 46b-66 (Review of Final Agreement) View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source

- • C.G.S. § 46b-87 (Contempt of Orders) View Source