How are 401k plans divided in Connecticut divorce?

Going through a divorce is overwhelming, and when you start thinking about dividing assets like a 401k, it can feel even more complicated. You’ve work...

Need help with your divorce? We can help you untangle everything.

Get Started Today

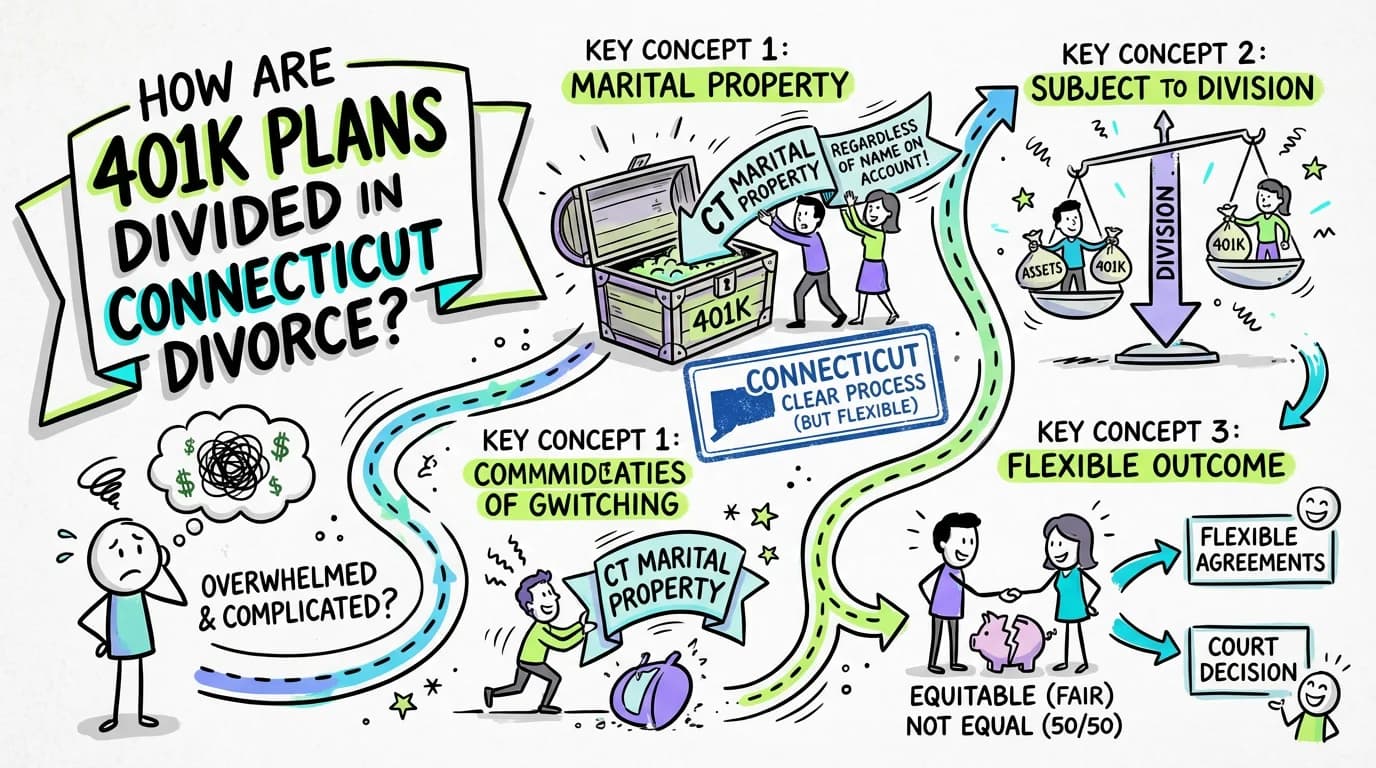

Going through a divorce is overwhelming, and when you start thinking about dividing assets like a 401k, it can feel even more complicated. You’ve worked hard to save for retirement, and it’s natural to worry about what will happen to those funds. The good news is that Connecticut has a clear, though flexible, process for handling this.

In short, your 401k is considered marital property, regardless of whose name is on the account. This means it is subject to division in a divorce. However, "division" in Connecticut doesn't automatically mean a 50/50 split. Instead, the court aims for what is fair and equitable based on your family's specific circumstances. The key to actually making the transfer happen is a special court order that protects you from taxes and penalties.

This article will walk you through exactly how the process of a 401k divorce in Connecticut works, from understanding the law to the practical steps you’ll need to take.

Understanding the Legal Foundation: Your 401k as Marital Property

First, it’s important to understand a core concept in Connecticut divorce law. Connecticut is an "all-property" state. This means that when a couple divorces, the court has the authority to divide nearly any asset owned by either spouse, no matter when or how it was acquired.

The law that governs this, Connecticut General Statutes (C.G.S.) § 46b-81(a), states that the court "may assign to either spouse all or any part of the estate of the other spouse." This includes assets you might think of as solely "yours," like a 401k account held through your employer. It doesn't matter if your spouse never contributed a dime to it; it's still on the table for division.

This broad power gives the court the flexibility to create a financial outcome that is fair to both parties, considering the entire financial picture of the marriage.

Connecticut's Rule: What "Equitable Distribution" Really Means

You’ll hear the term equitable distribution a lot during a Connecticut divorce. It’s the guiding principle for dividing all marital property, including retirement accounts.

Equitable does not mean equal. While a 50/50 split of a 401k is common, especially in long-term marriages, it is not guaranteed. "Equitable" means what the court determines is fair under all the circumstances.

To decide what's fair, the court must consider a list of factors outlined in C.G.S. § 46b-81(c). These include:

- The length of the marriage

- The causes for the divorce

- The age and health of each spouse

- Each spouse's occupation, income, and sources of income

- Vocational skills, education, and employability

- The estate, liabilities, and needs of each party

- The opportunity for each spouse to acquire future assets and income

- The contribution of each spouse to the acquisition, preservation, or appreciation in value of the assets, including the contributions of a homemaker.

The court weighs all these factors to decide on a percentage split for the 401k and other assets. For example, a spouse who was a homemaker for 20 years and has limited earning capacity might receive a larger share of the assets to ensure their future financial stability.

The Step-by-Step Process for Dividing a 401k in Connecticut

Navigating a 401k divorce in Connecticut involves a few distinct steps. Whether you and your spouse reach an agreement or a judge makes the decision, the mechanics are generally the same.

Step 1: Identification and Valuation

You can't divide what you don't know exists. The first step is to identify all retirement accounts held by both spouses. This is done through the financial disclosure process.

Under the Connecticut Practice Book § 25-30, both parties must file a sworn financial statement that lists all assets, including retirement plans. You'll need to provide the most recent statement for your 401k, which shows its value on a specific date. If you suspect your spouse has other accounts, you can use formal discovery tools, like the Mandatory Disclosure and Production rules in Practice Book § 25-32, to get that information.

The "valuation date" (the date used to determine the account's value) is an important point of negotiation. It could be the date the divorce was filed, a date close to the final hearing, or another date the parties agree upon.

Step 2: Negotiation or Litigation

Once all 401ks are identified and valued, you and your spouse have two paths:

- Agreement: The most common and cost-effective path is to negotiate a settlement. You can agree on what percentage of the 401k each person will receive. This agreement becomes part of your overall divorce settlement, which a judge must approve as "fair and equitable" under C.G.S. § 46b-66.

- Litigation: If you cannot agree, the issue will go to a judge. Each side will present arguments about why their proposed division is fair, using the equitable distribution factors from C.G.S. § 46b-81. The judge will then issue a binding order detailing how the 401k will be split.

Step 3: The QDRO - The Most Important Document

This is the most critical technical step in the process. You cannot simply write a check or transfer funds from a 401k like a regular bank account. Doing so would trigger massive taxes and penalties.

To divide a 401k, you need a Qualified Domestic Relations Order (QDRO). A QDRO (pronounced "kwah-dro") is a special court order, separate from your divorce decree, that instructs the 401k plan administrator on how to divide the account. It is required by federal law (ERISA) to recognize the ex-spouse's right to a portion of the retirement benefits.

Why is a QDRO essential?

- It avoids immediate taxes and penalties. A transfer made pursuant to a QDRO is considered a tax-free rollover.

- It's the only way the plan administrator can legally pay benefits to someone other than the employee (you or your spouse).

- It protects both parties. It ensures the receiving spouse gets their correct share and protects the employee spouse from being taxed on the money transferred to their ex.

A QDRO is a highly technical legal document. It must contain specific information required by the 401k plan and federal law. It is strongly recommended that a QDRO specialist or an experienced divorce attorney prepare it. The cost is often split between the spouses.

Step 4: Executing the Transfer

After the QDRO is drafted and approved by both parties, it is signed by a judge. Then, it's sent to the 401k plan administrator for their review and approval. Once the administrator confirms the QDRO meets all legal and plan requirements, they will segregate the funds into a separate account for the receiving spouse (known as the "alternate payee").

The alternate payee then has a few options:

- Rollover: Roll the funds into their own IRA or another qualified retirement plan. This is the most common choice as it preserves the tax-deferred status of the money.

- Cash Out: Take a cash distribution. The money will be subject to ordinary income tax, but the 10% early withdrawal penalty is often waived for QDRO distributions.

Important Considerations for Your 401k Divorce in Connecticut

As you work through the division of retirement assets, keep these key points in mind:

- The "Marital Portion": While Connecticut law allows a judge to divide the entire 401k, it's common to focus on the "marital portion"—the amount that accumulated from the date of marriage to the date of divorce. Contributions made before the marriage (and the growth on those specific funds) may be argued to be separate property. This is a complex calculation and a major point of negotiation.

- Outstanding 401k Loans: If there is a loan against the 401k, it reduces the account's net value. The loan must be accounted for in the divorce agreement. Usually, the employee spouse remains responsible for repaying it.

- Vesting Schedules: If the employee spouse is not fully "vested" in their 401k (meaning they don't have a right to all the employer contributions yet), only the vested portion can be divided.

- Automatic Court Orders: From the moment a divorce is filed in Connecticut, automatic orders go into effect (Practice Book § 25-5). These orders prohibit either spouse from "selling, transferring, encumbering, concealing, assigning, removing or in any way disposing of" assets without the other's consent or a court order. This prevents one spouse from draining a 401k before it can be fairly divided.

- Offsetting with Other Assets: You don't have to split the 401k. You can agree to an "offset," where one spouse keeps their entire 401k in exchange for giving the other spouse an asset of equivalent value, such as a larger share of the home equity or another investment account. This can be a great solution but requires careful financial analysis to ensure the trade is truly fair.

Frequently Asked Questions About 401k Division in CT Divorce

Is the entire 401k divided, or just the part earned during the marriage?

Under Connecticut law (C.G.S. § 46b-81), a judge has the authority to divide the entire account. However, in practice, it is very common for negotiations and court decisions to focus on dividing only the "marital share"—the value that accrued between the date of marriage and the date of divorce. Proving the pre-marital value and its growth requires careful documentation.

What is a QDRO and why do I need one for my 401k divorce in Connecticut?

A QDRO, or Qualified Domestic Relations Order, is a special court order that is legally required to divide most employer-sponsored retirement plans, including 401ks. It tells your plan administrator how to pay a portion of your benefits to your former spouse. Without a valid QDRO, the transfer is not possible or could result in significant taxes and penalties.

Can I get my share of the 401k in cash right away?

Yes. The spouse receiving the funds via a QDRO generally has the option to take a cash distribution. While this distribution is subject to ordinary income tax, the 10% early withdrawal penalty is typically waived. However, rolling the funds into your own IRA is usually recommended to continue the tax-deferred growth for your retirement.

Who pays for the QDRO to be prepared?

The cost of preparing the QDRO is a negotiable part of your divorce settlement. Often, the parties agree to split the fee, which can range from a few hundred to a couple of thousand dollars, depending on the complexity.

What happens if my spouse takes money from the 401k before the divorce is final?

This is prohibited by Connecticut's automatic court orders (Practice Book § 25-5), which take effect upon filing for divorce. These orders forbid either party from dissipating assets. If your spouse violates this order, they can be held in contempt of court, which can result in fines, being ordered to pay your attorney's fees, or other sanctions.

How long does the QDRO process take after the divorce is final?

The timeline can vary significantly. After the judge signs the QDRO, it must be sent to the 401k plan administrator for approval. This review can take anywhere from a few weeks to several months. Once approved, the administrator will process the division of funds. Patience is key during this administrative phase.

Does it matter that my name isn't on the 401k account?

No. In Connecticut, a 401k earned during the marriage is considered marital property, regardless of whose name is on the account or who made the contributions. The court will consider it part of the marital estate to be divided equitably.

Can my spouse and I just agree to not split the 401k at all?

Absolutely. You can agree that one spouse will keep their entire 401k, typically in exchange for the other spouse receiving other assets of comparable value (like the house or a brokerage account). As long as the overall settlement agreement is found to be "fair and equitable" by the court (C.G.S. § 46b-66), your agreement will likely be approved.

Getting the Right Help

Dividing retirement assets is one of the most financially significant parts of a divorce. The rules are complex, and a mistake can have long-lasting consequences for your financial future.

It is crucial to work with a qualified Connecticut divorce attorney who understands the nuances of a 401k divorce in Connecticut. They can help you negotiate a fair settlement and ensure all legal documents, especially the QDRO, are prepared correctly. You may also benefit from consulting with a financial advisor or a Certified Divorce Financial Analyst (CDFA) to understand the long-term impact of your settlement options.

Conclusion

Thinking about your 401k in a Connecticut divorce can be stressful, but the process is manageable with the right knowledge and support. Remember these key takeaways:

- Your 401k is marital property subject to equitable distribution.

- "Equitable" means fair, not necessarily a 50/50 split.

- A Qualified Domestic Relations Order (QDRO) is absolutely essential to transfer the funds correctly and avoid tax penalties.

- You have options, including negotiating an offset with other assets instead of splitting the account.

By understanding your rights and the legal process, you can approach this part of your divorce with more confidence and work toward a resolution that protects your financial future.

Legal Citations

- • C.G.S. § 25-30 View Source

- • C.G.S. § 25-32 View Source

- • C.G.S. § 25-5 View Source

- • C.G.S. § 46b-66 (Review of Final Agreement) View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source