Do I have to pay child support if I have joint custody in Connecticut?

This is one of the most common questions we hear from parents navigating a divorce or separation, and it’s rooted in a completely understandable assum...

Need help with your divorce? We can help you untangle everything.

Get Started Today

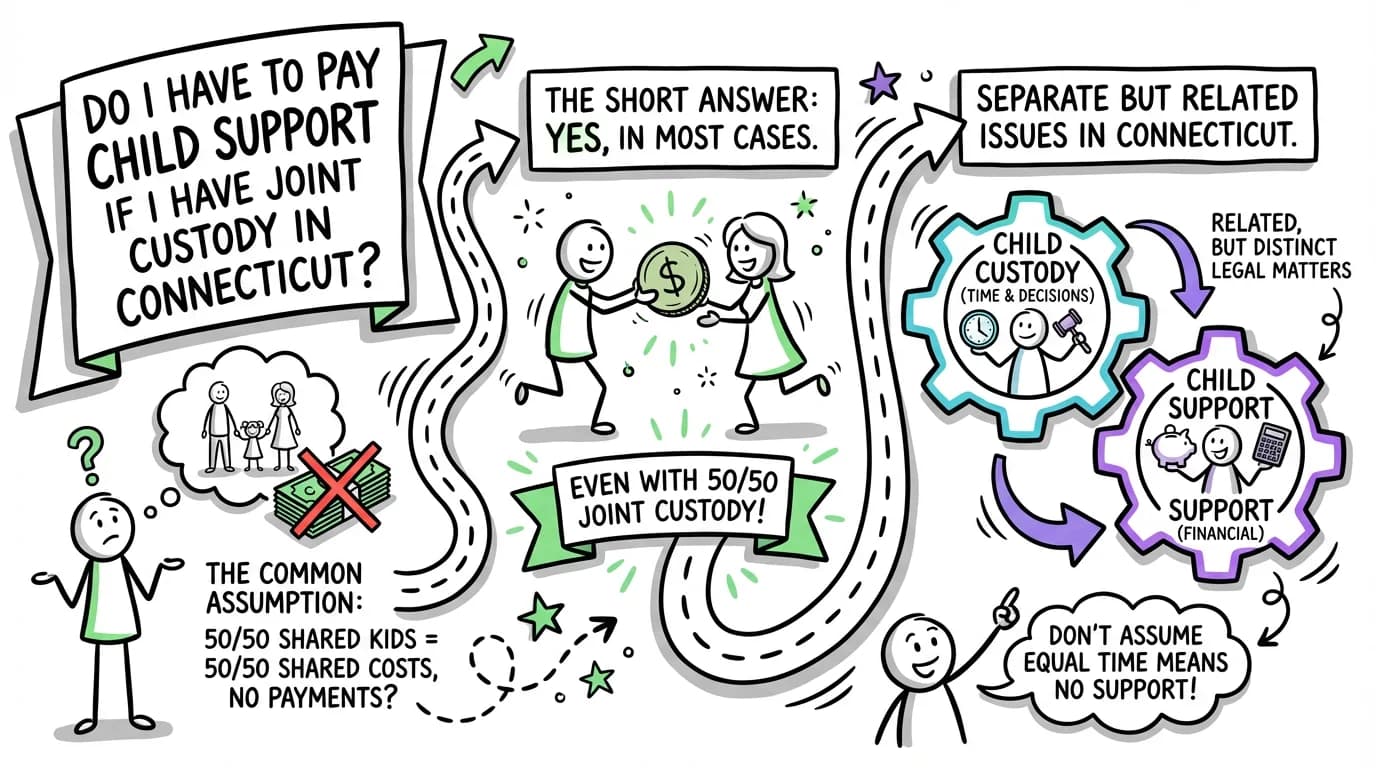

This is one of the most common questions we hear from parents navigating a divorce or separation, and it’s rooted in a completely understandable assumption: if we share the kids equally, shouldn't we share the costs equally, with no money changing hands? The short answer, however, is that in most cases, one parent will still pay child support to the other, even with a 50/50 joint custody arrangement.

In Connecticut, child custody and child support are two separate but related issues. While your parenting schedule is a major factor in the calculation, it’s not the only one. The state’s primary goal is to ensure that children enjoy a similar standard of living in both households and that their financial needs are consistently met. This often means that the higher-earning parent provides financial support to the lower-earning parent, regardless of the time-sharing schedule.

Navigating the rules around joint custody child support in Connecticut can feel confusing, but it doesn’t have to be. This guide will walk you through how it all works, what the law says, and what you can expect as you create a stable financial future for your children.

Understanding the Legal Foundation: Custody vs. Support

Before diving into the numbers, it’s crucial to understand how Connecticut law defines these key concepts. They are not interchangeable, and the court looks at them through different lenses.

What is "Joint Custody" in Connecticut?

When people say "joint custody," they are often talking about sharing parenting time equally. However, Connecticut law is more specific. According to the law, joint custody is an order that awards legal custody to both parents, provides for joint decision-making, and ensures the child has "continuing contact with both parents" (C.G.S. § 46b-56a).

There are two types of custody:

- Legal Custody: This is the right and responsibility to make major decisions for your child regarding their health, education, and religious upbringing. Connecticut courts have a presumption that joint legal custody is in the child's best interest when parents agree to it (C.G.S. § 46b-56a(b)).

- Physical Custody: This refers to where the child lives. A parenting plan outlines the schedule of the child's physical residence throughout the year. You can have joint legal custody while one parent has primary physical custody, or you can have both joint legal and joint physical custody, where the child spends significant time, often close to 50/50, with each parent.

What is the Purpose of Child Support?

Child support is not a payment to your ex-spouse; it is a payment for the benefit of your child. The law is clear that both parents have a legal duty to support their children. Connecticut General Statute § 46b-84(a) states that parents "shall maintain the child according to their respective abilities, if the child is in need of maintenance."

The court's entire framework for making decisions about children, whether for custody or support, is guided by the "best interests of the child" standard (C.G.S. § 46b-56(c)). This means ensuring the child's needs are met and they are financially supported by both parents in a way that is predictable and consistent.

How Connecticut Calculates Child Support with Joint Custody

Connecticut uses a specific formula to determine child support, known as the Child Support Guidelines. This formula is the starting point for nearly every case. It is based on an "Income Shares Model," which presumes that a child should receive the same proportion of parental income as they would have if the parents lived together.

Even when you have a shared physical custody arrangement, the guidelines are still the foundation of the calculation. Here’s how the process generally works.

Step 1: Disclosing Your Finances

The entire process begins with honesty and transparency. Both parents are required to complete and exchange a sworn financial statement (Judicial Branch Form JD-FM-006-SHORT or JD-FM-006-LONG). This is a mandatory step under the court's rules (Practice Book § 25-30). This document details your income from all sources, your weekly expenses, your assets (like bank accounts and real estate), and your liabilities (like credit card debt and loans).

It is critically important to be thorough and accurate on your financial statement, as the court will rely on this information to calculate support.

Step 2: Calculating Each Parent's Net Weekly Income

The guidelines worksheet starts with each parent's gross weekly income and then deducts things like federal and state income taxes, Social Security/Medicare taxes, and mandatory health insurance premiums to arrive at a "net weekly income."

Step 3: Using the Child Support Guidelines Worksheet

Once both parents' net weekly incomes are determined, they are added together to get a "combined net weekly income." This combined figure is then applied to a chart in the guidelines to find the basic child support obligation for the number of children you have.

For example, if Parent A has a net weekly income of $1,000 and Parent B has a net weekly income of $1,500, their combined net weekly income is $2,500. The guidelines chart would show a specific dollar amount that a family with that income is presumed to spend on their children each week.

Step 4: The Shared Physical Custody Formula

This is the key step for parents with joint physical custody. The Connecticut Child Support Guidelines include a specific worksheet for shared physical custody situations. This is typically used when each parent has the children for a time period that is "substantially more than the typical noncustodial parenting plan," which is often interpreted as close to a 50/50 split of overnights.

Here’s a simplified look at how the shared custody calculation works:

- Basic Obligation: The court first determines the basic child support obligation from the guidelines chart based on the parents' combined income.

- Prorated Shares: This basic obligation is then multiplied by 1.5 to account for the increased costs of maintaining two separate households for the children.

- Individual Obligations: Each parent's share of this new, higher obligation is calculated based on their percentage of the combined net income.

- Offsetting Payments: The court then determines what each parent would pay to the other. The parent with the lower obligation's amount is subtracted from the parent with the higher obligation's amount. The difference is the amount the higher-earning parent pays to the lower-earning parent.

The logic is to equalize the resources available for the child in each home. Even if you have your child exactly 50% of the time, if you earn significantly more than the other parent, you will almost certainly have a child support obligation. This ensures the child's needs are met consistently, regardless of which home they are in.

Step 5: Deviating from the Guidelines

The guideline amount is presumed to be the correct amount of child support. However, a judge can order a different amount if they find that applying the guidelines would be "inequitable or inappropriate" in a particular case (C.G.S. § 46b-86(a)). The court must make a specific finding on the record explaining why it is deviating.

Common reasons for deviation include:

- Extraordinary expenses for the child's care (e.g., special education or medical needs).

- Other substantial financial resources available to a parent.

- Extraordinary parental expenses (e.g., significant work-related travel).

- The coordination of total family support.

Important Considerations for Joint Custody and Child Support

Beyond the basic calculation, there are several practical points to keep in mind when dealing with joint custody child support in Connecticut.

Parenting Time and Child Support are Enforced Separately

It's a common point of frustration, but it's vital to remember that these are separate court orders.

- A parent cannot legally withhold court-ordered parenting time because the other parent is behind on child support payments.

- A parent cannot legally stop paying child support because the other parent is not following the parenting plan.

If one parent violates an order, the correct course of action is to file a Motion for Contempt with the court (Practice Book § 25-27), not to take matters into your own hands.

What Child Support Covers

Child support is intended to cover a child's basic needs, including housing, food, and clothing. The guidelines also account for health insurance premiums and unreimbursed medical expenses. The court will issue specific orders about which parent is responsible for providing health insurance and how out-of-pocket costs (like co-pays and deductibles) will be divided, which is often in proportion to the parents' incomes.

Expenses for things like extracurricular activities, private school tuition, or summer camps are typically not included in the basic child support calculation but can be addressed in your divorce agreement or by court order.

Modifying a Child Support Order

Life changes, and so can child support orders. An order can be modified if either parent can prove a substantial change in circumstances has occurred since the last order was entered (C.G.S. § 46b-86).

Examples of a substantial change in circumstances include:

- A significant increase or decrease in either parent's income (e.g., a promotion or a job loss).

- A change in the parenting schedule that significantly alters the time the child spends with each parent.

- A change in the child's needs (e.g., a new medical diagnosis).

- The child turning 18 and graduating from high school.

A modification is not automatic. One of the parents must file a motion with the court to formally request a change to the existing order.

Frequently Asked Questions about Joint Custody Child Support in Connecticut

1. Does a 50/50 parenting schedule automatically mean no child support is paid?

No. This is the most common misconception. Because child support is calculated based on both parents' incomes, the higher-earning parent will almost always pay some amount of support to the lower-earning parent to ensure the child's standard of living is consistent between the two homes.

2. Can my ex and I just agree to waive child support?

While you and the other parent can agree on a child support amount, you cannot simply waive it without court approval. Any agreement concerning child support must be submitted to the court. A judge will review it to ensure it is "fair and equitable under all the circumstances" and in the child's best interest (C.G.S. § 46b-66). If the court feels the agreement doesn't adequately provide for the child, it can reject the agreement and make its own orders.

3. How does health insurance factor into the calculation?

The cost of health insurance premiums for the child is factored directly into the guidelines worksheet. The parent who pays for the insurance receives a credit in the calculation. The court will also issue orders regarding how unreimbursed medical, dental, and vision expenses will be divided between the parents (C.G.S. § 46b-84(f)).

4. What happens if my income changes after the child support order is made?

If your income changes significantly (either up or down), you can file a Motion for Modification with the court. You will need to provide an updated financial statement and prove that the change in circumstances is substantial. The court will then run a new guidelines calculation to determine the new support amount.

5. Can child support be ordered for college expenses in Connecticut?

Yes, under certain circumstances. Connecticut law allows courts to issue an "educational support order" for a child to attend college or a vocational program (C.G.S. § 46b-56c). This is a separate order from regular child support. The court will only enter such an order if it finds it is "more likely than not that the parents would have provided support to the child for higher education... if the family were intact." These orders can continue until the child reaches the age of 23.

6. What forms do I need to figure out child support?

The two primary forms are the Financial Affidavit (JD-FM-006) and the Child Support and Arrearage Guidelines Worksheet (JD-FM-006). If you have a shared parenting plan, you will use the specific worksheet designed for that calculation. These forms are available on the Connecticut Judicial Branch website.

Getting the Help You Need

Figuring out joint custody child support in Connecticut involves complex calculations and strict legal standards. While the state provides forms and guidelines, applying them to your unique situation can be challenging, especially when emotions are running high.

Working with an experienced Connecticut family law attorney can help ensure your financial disclosures are accurate, the support calculation is done correctly, and your child's best interests are protected. An attorney can also help you negotiate a fair settlement with your co-parent or advocate for you in court if an agreement can't be reached. Mediation is another valuable tool that can help parents work together to create a parenting plan and resolve financial issues outside of court (C.G.S. § 46b-53a).

Conclusion

The key takeaway is that joint custody does not automatically eliminate the need for child support in Connecticut. The law focuses on the parents' respective incomes and the child's right to be supported financially by both of them. The shared physical custody formula in the Child Support Guidelines is designed to balance the costs of raising a child across two households, but it will almost always result in a payment from the higher-earning parent to the lower-earning parent. By understanding the process and providing accurate financial information, you can help ensure a fair outcome that provides the stability and security your child deserves.

Legal Citations

- • C.G.S. § 25-27 View Source

- • C.G.S. § 25-30 View Source

- • C.G.S. § 46b-53a (Mediation Program) View Source

- • C.G.S. § 46b-56a (Joint Custody) View Source

- • C.G.S. § 46b-56 (Orders re Custody and Support of Children) View Source

- • C.G.S. § 46b-56c (Educational Support Orders) View Source

- • C.G.S. § 46b-66 (Review of Final Agreement) View Source

- • C.G.S. § 46b-84 (Parents' Obligation for Child Support) View Source

- • C.G.S. § 46b-86 (Modification of Alimony or Support Orders) View Source