Can I keep my house after divorce in Connecticut?

For many people going through a divorce, the question of what happens to the family home is one of the most stressful and emotional parts of the proce...

Need help with your divorce? We can help you untangle everything.

Get Started Today

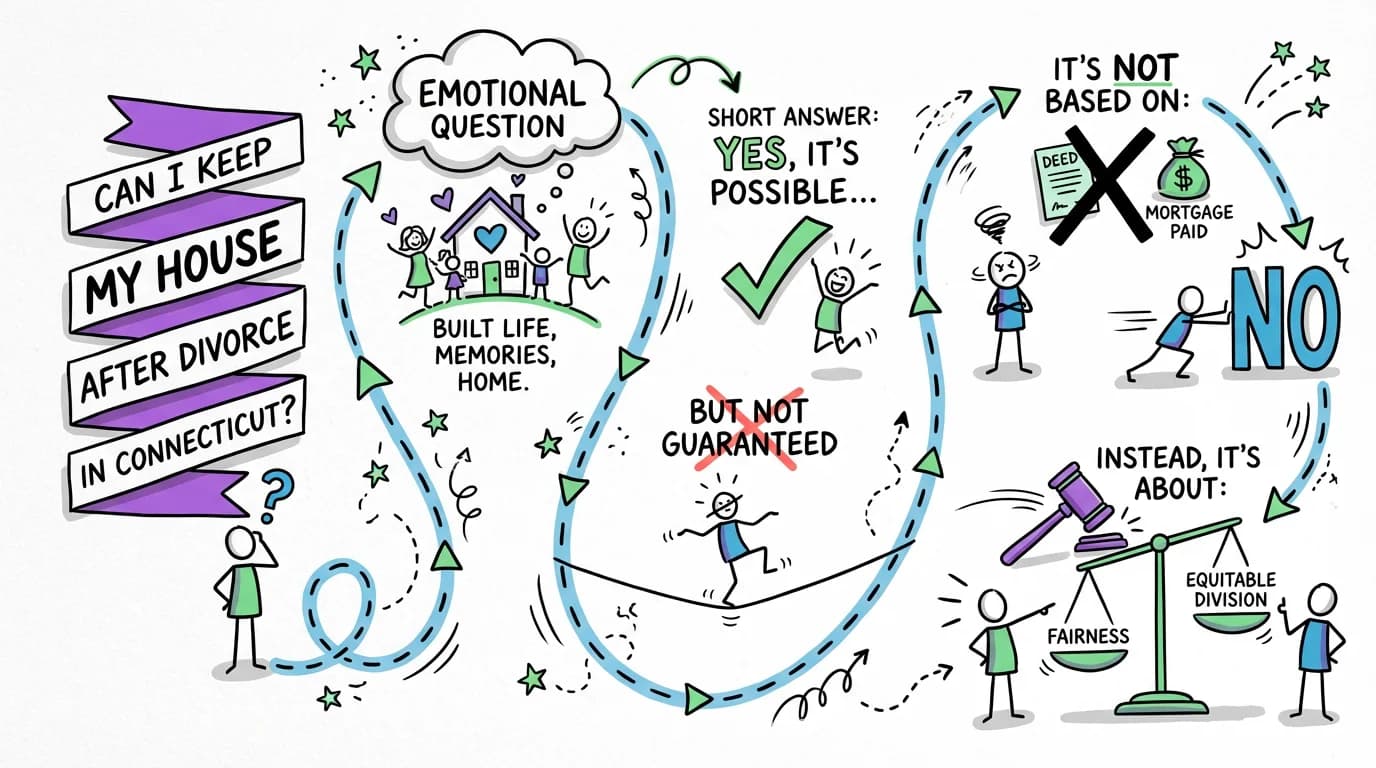

For many people going through a divorce, the question of what happens to the family home is one of the most stressful and emotional parts of the process. It's more than just a building; it's where you've built a life, raised children, and made countless memories. So, can you keep your house after a divorce in Connecticut? The short answer is yes, it is possible. However, it is not guaranteed.

In Connecticut, the decision isn't based on whose name is on the deed or who paid the mortgage. Instead, it's about what the court considers fair and equitable for both you and your spouse. Whether you can keep the house depends on a variety of factors, including your financial situation, your spouse's needs, and what is best for your children. This article will walk you through how Connecticut law addresses the marital home in a divorce, the options available to you, and the key factors a judge will consider.

Understanding "Equitable Distribution" in Connecticut

Connecticut is what's known as an "equitable distribution" state. This is a legal concept that guides how all marital property, including the family home, is divided. It's crucial to understand that "equitable" does not mean "equal." It means fair. The court's goal is to arrive at a property division that is fair and just under all the circumstances.

According to Connecticut law, when a marriage is dissolved, the Superior Court "may assign to either spouse all or any part of the estate of the other spouse" (C.G.S. § 46b-81(a)). This means that all assets owned by either you or your spouse are on the table for division, regardless of how they are titled. Even if the house was a gift to you, inherited by you, or owned by you before the marriage, it is still considered part of the marital estate that a judge can divide.

This "all-property" approach gives Connecticut judges significant discretion. They look at the entire financial picture of the marriage to decide how to split assets and debts, including who gets to keep the house after a divorce in Connecticut.

How Connecticut Law Decides Who Gets the House

When deciding how to divide property, including the family home, a Connecticut judge must consider a specific list of factors. These factors are outlined in the law to ensure the final decision is fair. According to C.G.S. § 46b-81(c), the court must consider:

- The length of the marriage: A spouse in a 25-year marriage may have a stronger claim to the house than a spouse in a 2-year marriage.

- The causes for the divorce: While Connecticut is a no-fault state, a judge can consider fault (like adultery or abuse) when dividing property, especially if that behavior impacted the family's finances.

- The age and health of each spouse: The court will look at each person's physical and mental health.

- Each spouse's station, occupation, and sources of income: This includes current jobs and what each person earns.

- Vocational skills, education, and employability: The court assesses each person's ability to earn a living in the future.

- The estate, liabilities, and needs of each party: This is a complete look at your financial picture—what you own, what you owe, and what you'll need to live on after the divorce.

- The opportunity for each spouse to acquire future assets and income: A younger spouse with a high earning potential may be viewed differently than an older spouse who is nearing retirement.

- The contribution of each spouse to the acquisition, preservation, or appreciation in value of the property: This is a critical factor. It includes not only financial contributions but also non-financial ones, like managing the household, caring for children, and supporting the other spouse's career. The law explicitly recognizes the value of a homemaker's contributions.

The judge weighs all these factors together. There is no magic formula. This is why the outcome of who gets to keep the house after a divorce in Connecticut can vary so much from one case to another.

The Process: 3 Common Scenarios for the Marital Home

When it comes to the house, there are generally three paths you and your spouse can take. The best option depends entirely on your unique circumstances, especially your finances and whether you have children.

1. One Spouse Buys Out the Other

This is a very common solution for couples who want to keep the house after a divorce in Connecticut, especially if there are children involved. In a buyout, one spouse keeps the house and pays the other spouse their share of the home's equity.

- How it works: First, you determine the home's fair market value (usually through a professional appraisal). Then, you subtract the outstanding mortgage balance to find the total equity. For example, if your home is worth $500,000 and you owe $300,000, you have $200,000 in equity. If you agree to a 50/50 split, the spouse keeping the house would need to pay the other spouse $100,000.

- The Challenge: The spouse keeping the home must typically refinance the mortgage into their name alone. This means they must qualify for the new loan based on their individual income and credit. This can be difficult, as you are moving from a two-income household to a one-income household.

2. Selling the House and Splitting the Proceeds

If a buyout isn't financially feasible or neither party wants to keep the house, selling it is often the cleanest option. A judge can order the sale of the property under C.G.S. § 46b-81(a) if the parties cannot agree.

- How it works: You put the house on the market, sell it, pay off the mortgage and any closing costs, and then divide the remaining profit.

- The Division: Remember, "equitable" doesn't mean 50/50. The proceeds might be split 60/40, 70/30, or in another proportion based on the factors the court considers. The division of the proceeds is part of the overall financial settlement.

3. Co-Owning the House for a Period of Time

In some cases, particularly when minor children are involved, a judge might allow one parent to remain in the home with the children for a specific period. This is often called "deferred sale" or "exclusive use."

- How it works: The divorce decree will state that the house will not be sold until a future "triggering event," such as the youngest child graduating from high school, the resident spouse remarrying, or a specific date. During this time, one spouse has exclusive use of the home.

- The Details are Key: This arrangement requires a very detailed agreement. Who pays the mortgage? Who is responsible for repairs and maintenance? How will property taxes and insurance be handled? What happens if the resident spouse wants to move? All these questions must be answered in your divorce agreement to avoid future conflicts.

Important Considerations and Practical Advice

Deciding whether to fight to keep the house involves more than just emotion. Here are some practical things to think about:

- Can You Truly Afford It? The mortgage is just the beginning. You also have to account for property taxes, homeowner's insurance, utilities, and routine maintenance and repairs, which can be substantial. Before you decide you want to keep the house, create a detailed post-divorce budget to see if it's realistic.

- The Mortgage is a Separate Contract: Your divorce decree can state that your ex-spouse is no longer responsible for the mortgage, but that does not remove their name from the loan. The mortgage is a contract with your lender. If your name is on it, the lender can still come after you for payment if the person living in the house defaults. The only way to remove a name is through a refinance or a loan assumption approved by the lender.

- Automatic Orders: As soon as a divorce is filed in Connecticut, automatic orders go into effect for both parties (Practice Book § 25-5). These orders prevent either spouse from selling, transferring, or borrowing against the house without the other's consent or a court order. They also require both parties to continue paying for things like the mortgage and insurance to preserve the asset during the divorce process.

- Financial Disclosures are Mandatory: To make a fair decision, the court needs a complete picture of your finances. Both you and your spouse will be required to file a sworn financial statement with the court (Practice Book § 25-30). This document details your income, expenses, assets (including the house), and debts. Being thorough and honest on this form is critical.

Frequently Asked Questions About Keeping the House

Q: What if I owned the house before we got married?

In Connecticut, it doesn't matter. The house is still considered marital property subject to division under C.G.S. § 46b-81. However, the court will consider the "contribution of each of the parties in the acquisition, preservation or appreciation" of the asset. This means the judge will take into account that you brought the house into the marriage, which could result in you receiving a larger share of its value, but it does not guarantee you will get to keep it outright.

Q: Does it matter whose name is on the deed or mortgage?

No. Connecticut is an "all-property" state. The court can divide any asset owned by either party, regardless of whose name is on the title.

Q: Can my spouse force me to sell the house during the divorce?

Your spouse cannot force you to sell on their own, but they can ask the court to order a sale. If a judge determines that selling the house is the most equitable way to divide the asset, they have the authority to order it sold (C.G.S. § 46b-81(a)).

Q: Can I get exclusive use of the house while the divorce is pending?

Yes. You can file a motion asking the court for "exclusive use of the family home...pendente lite" (meaning, while the case is pending) under C.G.S. § 46b-83. A judge will grant this if they find it is "just and equitable." This is often done to provide stability for children during the divorce process.

Q: How is the buyout amount for the house calculated?

The basic formula is: (Fair Market Value of the Home) - (Outstanding Mortgage Balance) = Total Equity. The buyout amount is the share of that equity your spouse is entitled to receive, which is determined through negotiation or by a court order. It may or may not be 50%.

Q: What if my spouse was at fault for the divorce? Does that mean I get the house?

Not necessarily. While the "causes for the...dissolution" is a factor the court considers (C.G.S. § 46b-81(c)), it is just one of many. Fault typically only has a significant impact on property division if the misconduct was egregious or had a direct financial impact on the marriage (for example, if a spouse spent marital savings on an affair).

Q: What if we can't agree on the value of our home?

If you and your spouse can't agree on a value, you can each hire your own licensed appraiser. If the values are different, you can try to negotiate a middle ground. If you still can't agree, you will both present your appraisals to the judge, who will then decide the value of the home for the purpose of the divorce.

Getting the Help You Need

The question of whether you can keep your house after a divorce in Connecticut is complex, with significant emotional and financial implications. The decision involves a careful application of state law to your family's specific circumstances. Because so much is at stake, navigating this process without professional guidance is risky.

An experienced Connecticut divorce attorney can help you understand your rights, evaluate your options, and advocate for a fair outcome that protects your interests. They can help you negotiate a buyout, structure a deferred sale agreement, or argue your case before a judge. A financial advisor can also be an invaluable resource, helping you create a realistic post-divorce budget to determine if keeping the house is a financially sound decision for your future.

Conclusion

Keeping your house after a divorce in Connecticut is possible, but it requires careful planning and a realistic assessment of your financial situation. The law provides a framework for a fair division, but the outcome is never certain. By understanding the principles of equitable distribution, the factors a judge considers, and the practical options available, you can approach this difficult decision with more clarity and confidence. Remember to seek professional legal and financial advice to help you make the best choice for you and your family's future.

Legal Citations

- • C.G.S. § 25-30 View Source

- • C.G.S. § 25-5 View Source

- • C.G.S. § 46b-81 (Assignment of Property) View Source

- • C.G.S. § 46b-83 (Alimony and Support Pendente Lite) View Source